Climate change has far-reaching impacts that are not limited to a particular sector or geography; it impacts the entire financial system. If left unchecked, this impact will be severe. The financial system plays a crucial role in every country’s transition to a sustainable economy – especially in unlocking private investments needed to bridge the gap between supply and demand in green activities.

This transition towards a sustainable economy requires focusing on two primary objectives: 1) increasing green finance, and 2) managing climate-related risks that impact financial risk. However, targeting both these objectives can create a potential dilemma.

In the current scenario, if we try to increase green finance through policy and regulation, it tends to increase overall financial risk, as green loans and assets are currently ‘perceived’ to be of lower credit quality. So, expanding green finance could lead to an overall higher credit risk profile – both at the individual bank/asset manager level and at the macro-prudential level. On the other hand, if we focus on managing financial risks through climate policy and regulation, we may end up reducing green finance flows, because in the current models the ‘perceived’ higher risk of green loans and assets produces a higher cost of capital. Therefore, a balancing act to address this potential dilemma is crucial.

Existing policies and frameworks do not lend themselves to this balancing act. According to a Network for Greening the Financial System (NGFS) study [1], current regulatory and supervisory frameworks do not adequately factor in the climate-related risks impacting financial risk. This is compounded by the fact that current fiscal frameworks are not conducive to green activities, particularly in emerging economies, mainly because green activities are usually new and have limited track records, inconsistent information, and less proven collaterals. Another gap in the existing frameworks is how climate risk is currently addressed in capital markets. While there is a slow but growing appreciation of how climate risk threatens assets, we still do not have adequate risk mitigation options in place. This leads to reduced capital flows toward green investment. In addition, there is heavy reliance on the current credit rating system for loan issuance, which funnels long-term capital without factoring in climate-related risks. Similarly, Environmental, Social, and Governance (ESG) evaluation is gaining popularity in India, however, it is not equipped in its current form to effectively mobilize green finance. Current ESG rating systems suffer from integrity issues as well as the lack of ability to extract the data driving those ratings, in order to focus on the environmental aspects evaluated. [2]

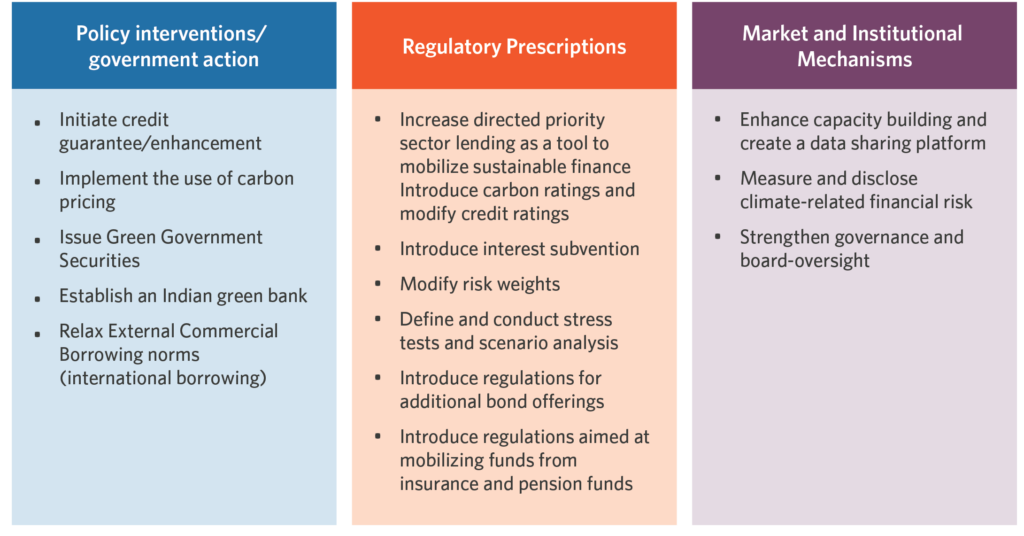

To address these challenges, we have identified the key areas of intervention that would achieve the twin objectives of increasing finance to green activities and managing climate-related financial risk [3]. We look at three key pillars: Policy Interventions, Regulatory Prescriptions, and Market and Institutional Mechanisms. While some of the details of these recommendations are specific to the Indian financial system, the overall guidance applies to many middle-income developing economies. The recommendations under each pillar are presented in Table 1 and details for each are covered in the report.

Figure 1. Regulating Green Finance – Three Key Pillars

Our recommendations aim to increase green finance, manage risks, or do both. They address constraints faced by banks, institutional investors, and capital markets among others. Regulators, policymakers, and central banks will have a pivotal role to play in achieving the twin objectives mentioned, and in coordinating such activities closely.

Achieving both objectives of increased climate flows and better risk management is necessary to reach India’s climate and sustainability goals, and be on track to meet the 1.5-degree pathway. Focusing on one over the other will not suffice.

[1] NGFS (2019). A call for action – Climate change as a source of financial risk: Executive Summary. Available at: https://www.ngfs.net/sites/default/files/medias/documents/ngfs_first_comprehensive_report_-_17042019_0.pdf

[2] SEBI, recognizing the need for standardization, has issued a consultation paper that aims to distinguish ratings factoring in the impact of the environment on companies vis-à-vis the impact of companies on the environment

[3] For the purpose of the report climate risks are referred to as climate-related financial risks