The Landscape of Methane Abatement Finance 2023 presents the latest insights on global methane abatement finance covering trends in 2021 and 2022. The findings support enhanced methane abatement ambitions and commitments of public and private actors in line with the objectives of the Global Methane Pledge.

The briefing paper, How to Start Scaling Methane Abatement Finance, outlines opportunities for both public and private entities to scale methane abatement flows across three key areas: 1) International public finance, 2) domestic public finance, and 3) corporate/private sector initiatives.

Another accompanying report, Spotlight: Financing Oil & Gas Methane Abatement in Southeast Asia, presents an overview of methane abatement activities and opportunities in Southeast Asia’s oil and gas industry to demonstrate intervention options in practice.

Why does methane abatement matter?

Methane (CH4) mitigation can yield significant short-term temperature reductions and at significantly lower costs. Methane is a key driver of near-term global warming, with a 20-year warming power more than 80 times greater than that of CO2.

Human-driven methane emissions account for nearly 45% of current net warming, threatening the goals of the Paris Agreement. Methane emissions experienced record growth in 2020 and 2021. Despite the Global Methane Pledge in 2021, they increased by a further 14 parts per billion (ppb) in 2022.

Three sectors account for 95% of human-caused emissions: AFOLU (agriculture, forestry and other land use) (40%); fossil fuels (35%), encompassing coal, oil, and natural gas; and waste (20%), including both solid waste, and wastewater. Swift and targeted abatement in the three sectors have multifold benefits beyond greenhouse gas reduction: prevent premature deaths, crop losses, and labor disruptions, as well as improve industrial safety, livestock, and agriculture practices.

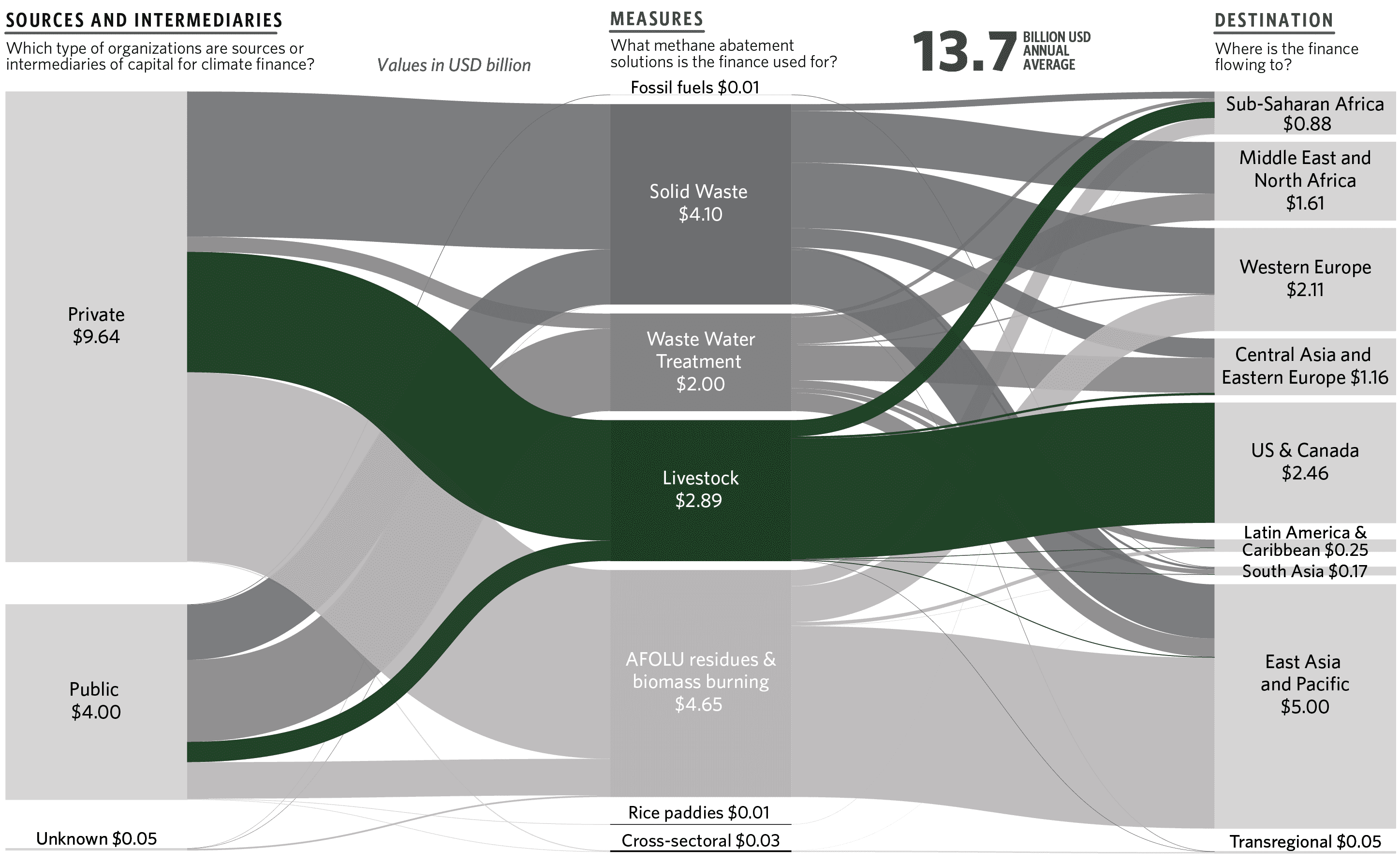

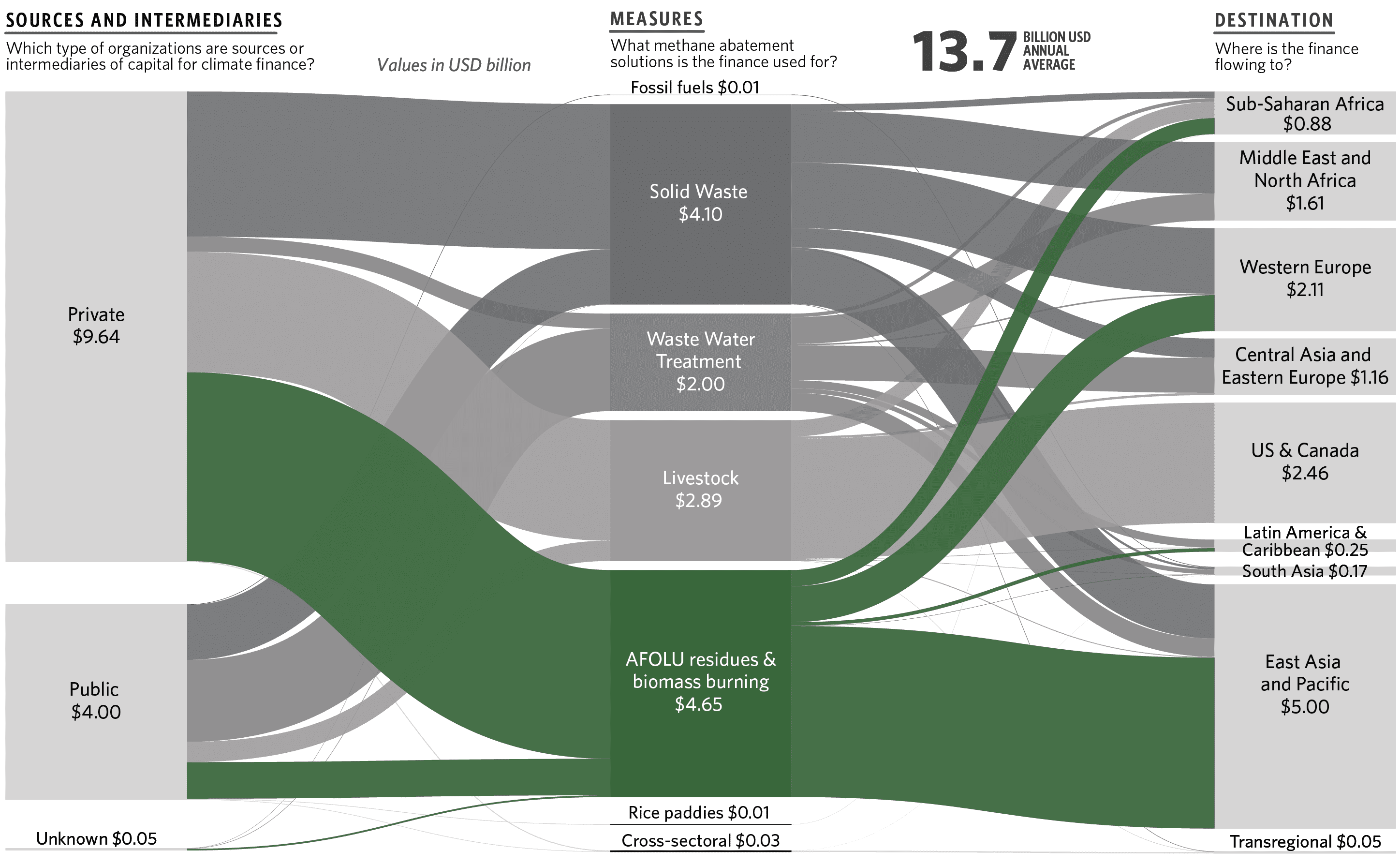

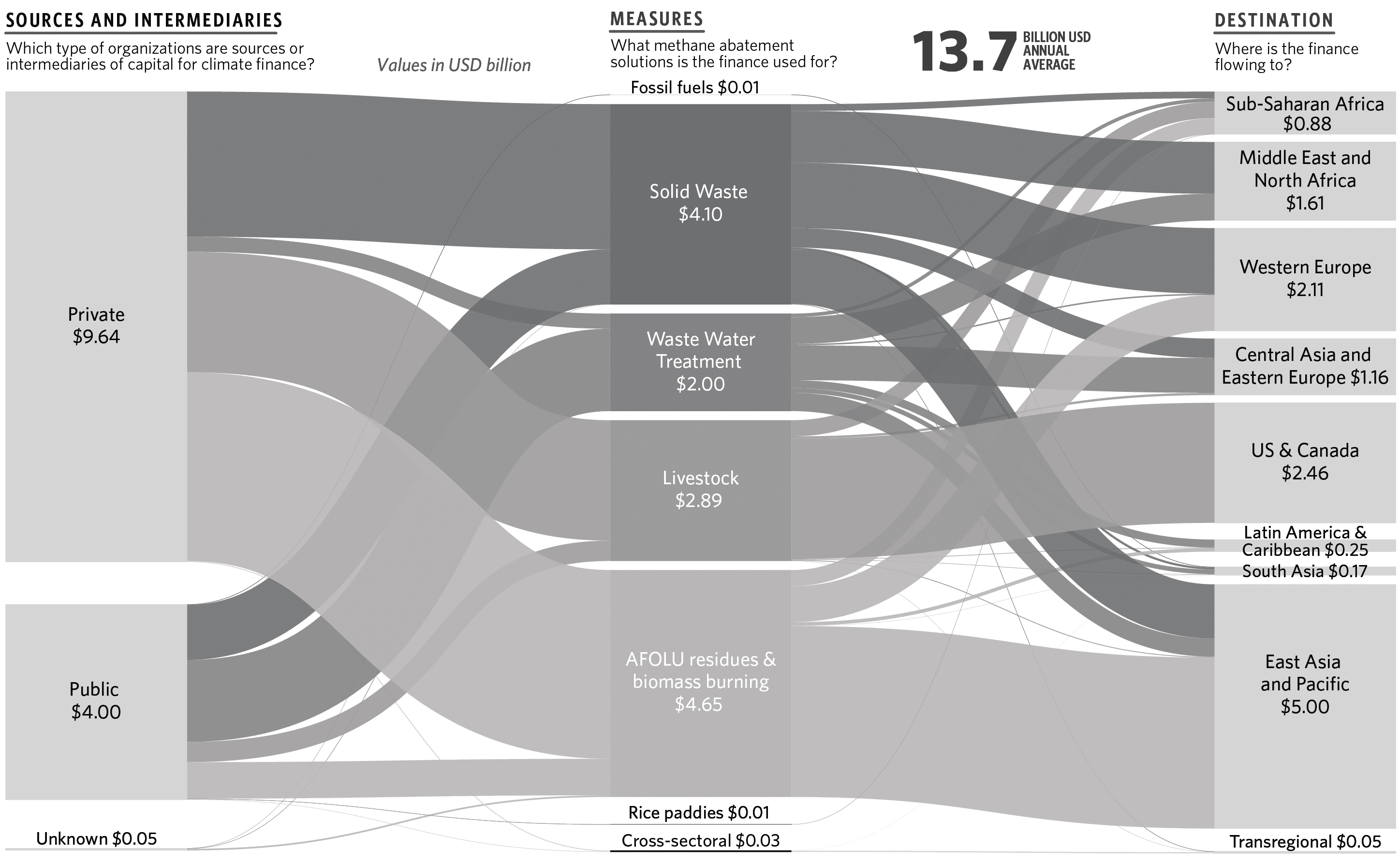

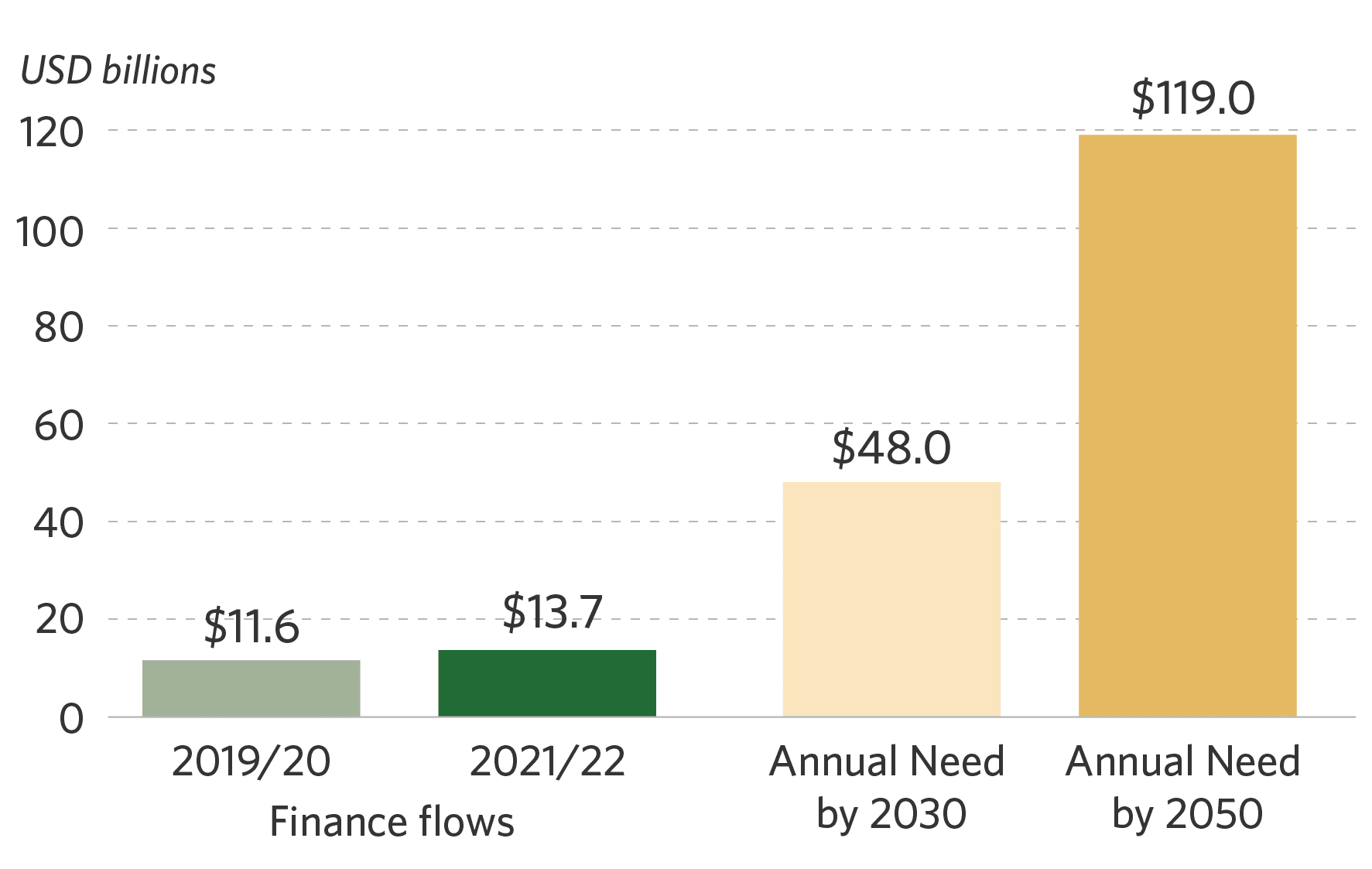

Overview of global targeted methane abatement finance flows and needs in 2021/2022

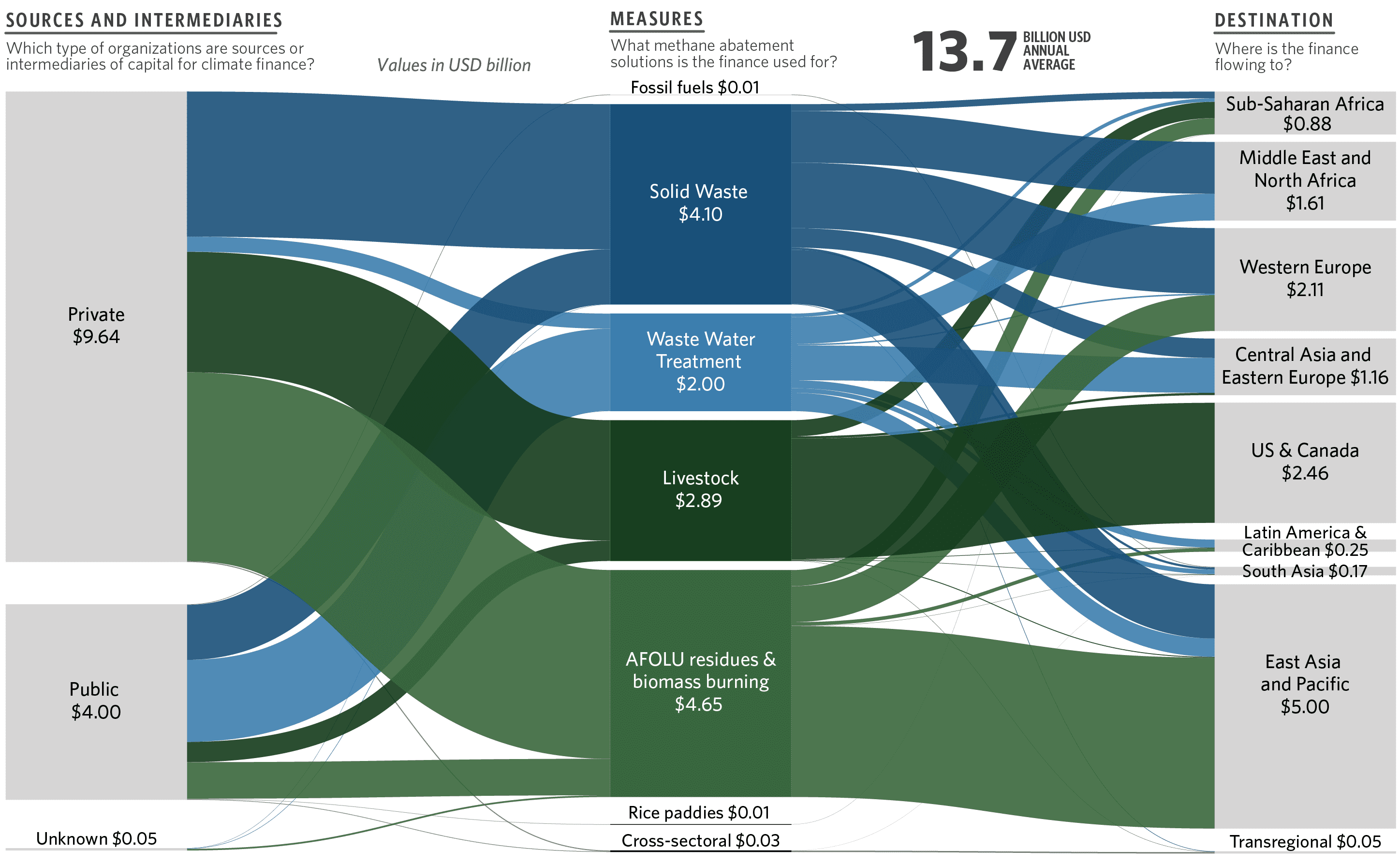

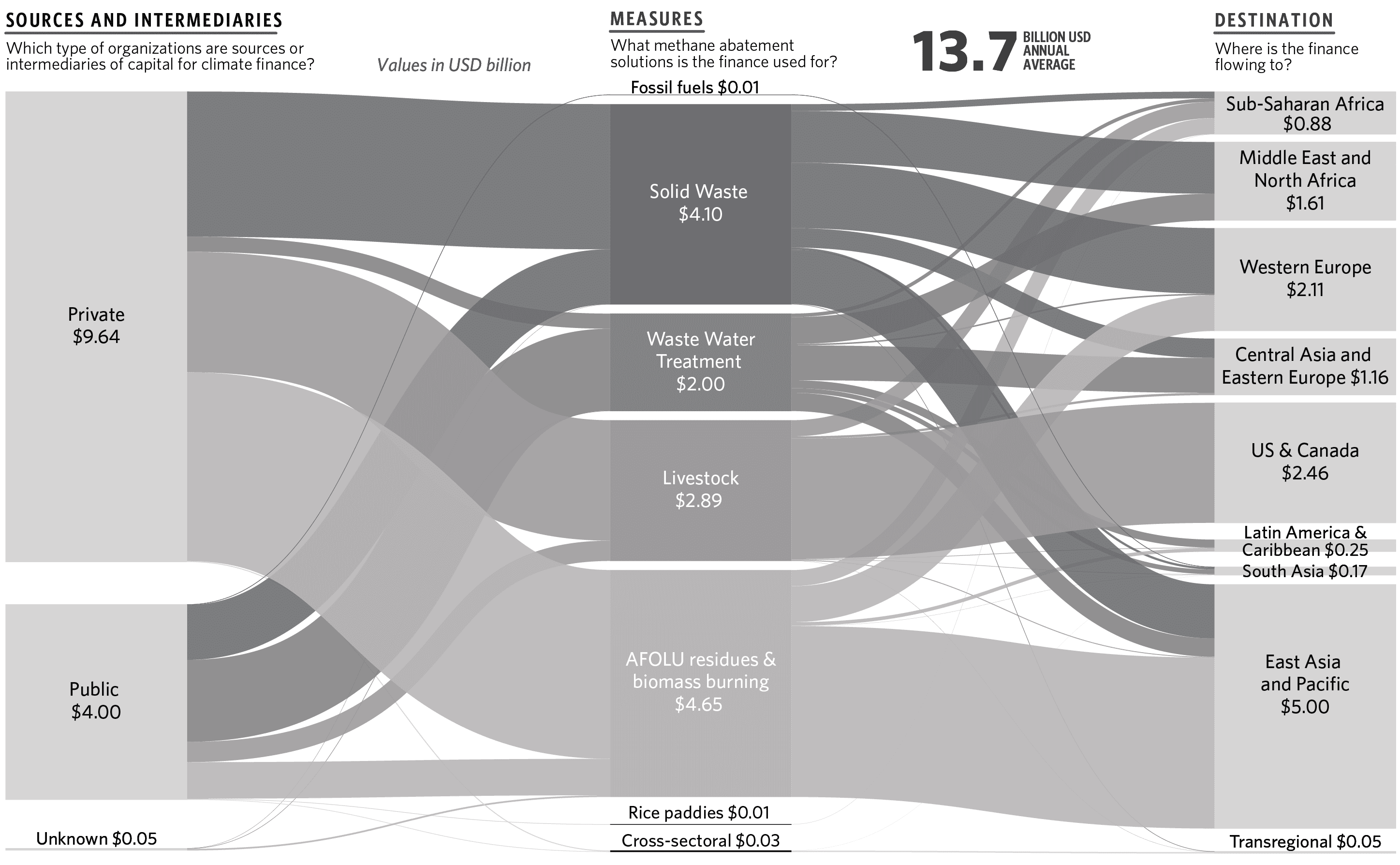

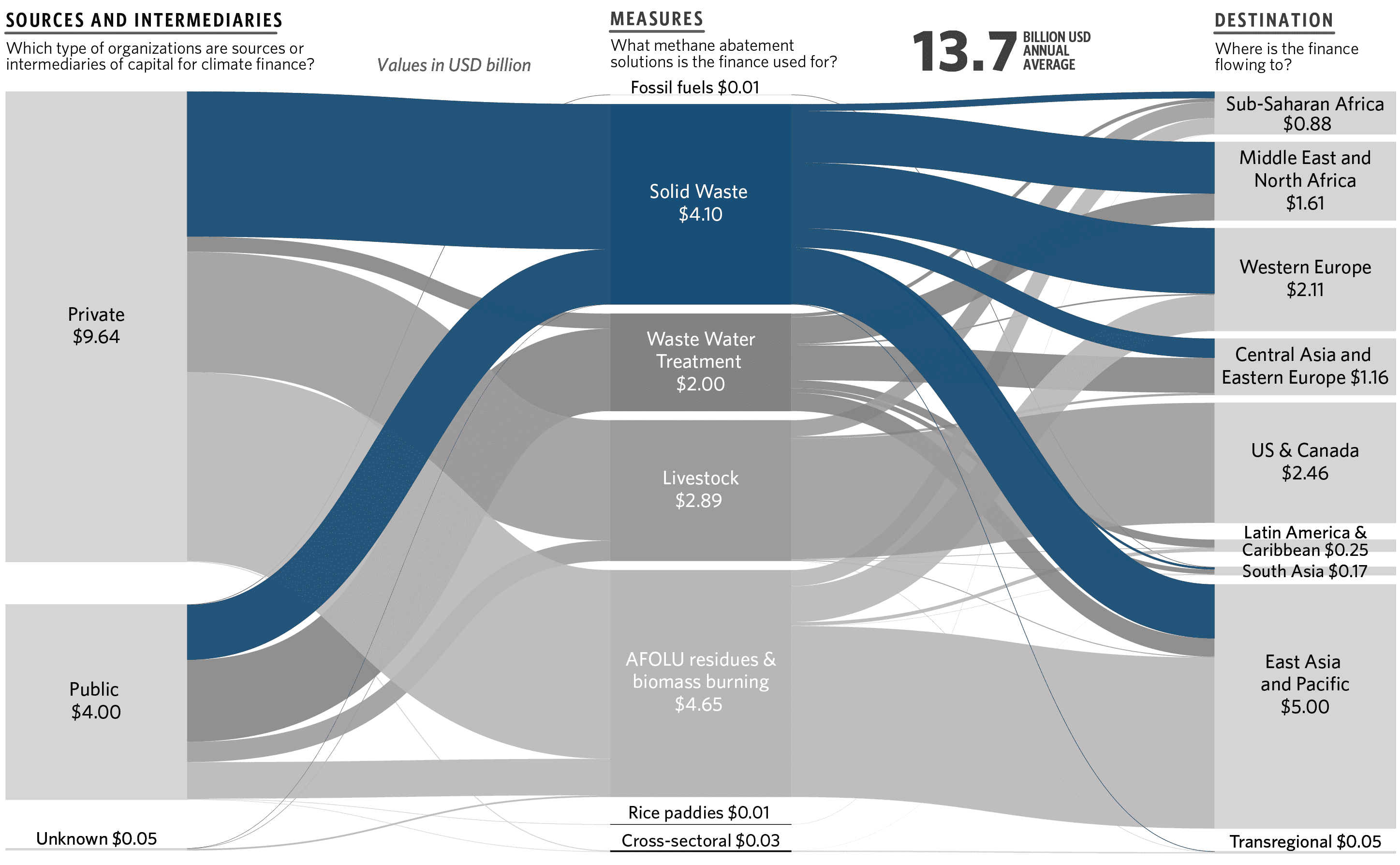

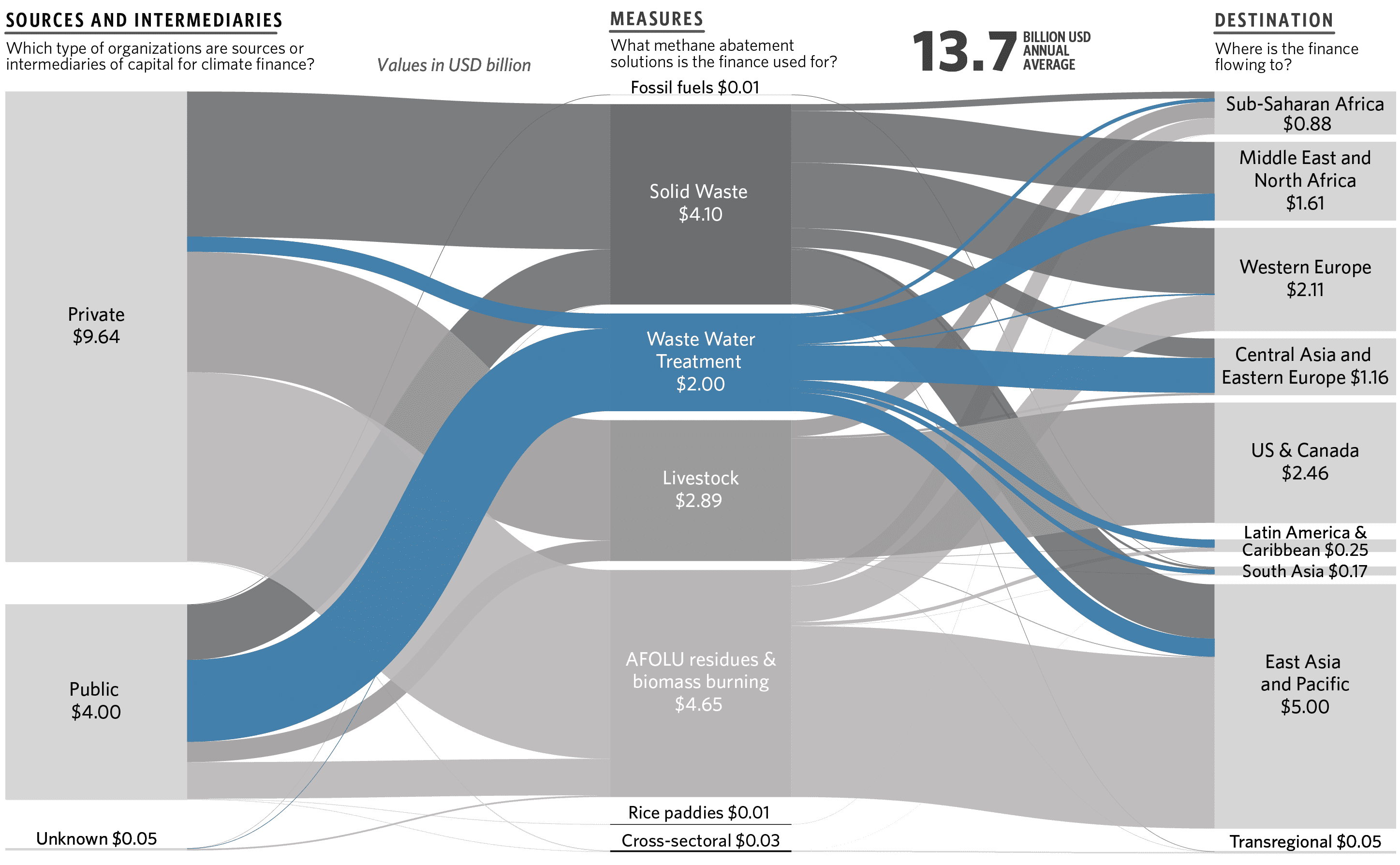

The average annual methane abatement finance flows reached USD 13.7 billion in the years 2021/22, reflecting an 18% increase compared to 2019/20 when it stood at USD 11.6 billion. However, current finance levels remain significantly below the global estimated needs of USD 48 billion annually by 2030. This implies that annual flows must increase substantially by at least 3.5 times by 2030.

Methane abatement finance does not flow proportionately to sectors and regions with the highest abatement potential and emissions sources.

The largest recipient sector of methane abatement finance in 2021/2022 was AFOLU with (USD 7.5 billion), followed by waste (USD 6.1 billion), and fossil fuels (USD 10.6 million):

- While less than 1% of tracked finance goes to fossil fuels, this sector has the highest abatement potential (34 MtCH4 per year), given the cost-effective measures available to tackle methane in oil and gas. Better data would greatly help understanding how finance flows to the sector. Scaling up finance for the fossil sector is essential as it has the largest mitigation potential and is often cost effective.

- AFOLU attracted 55% of flows (USD 7.5bn), driven by sharp rise in manure-to-energy activities. As the largest contributor of anthropogenic emissions, at 147 Mt/year, AFOLU’s annual needs outstrip current flows 2.2-fold.

- The waste sector accounted for 45% of finance (USD 6.1bn), driven mainly by wastewater management and solid-waste to energy investment. This marked a drop of over USD 1 billion from 2019/20 and significantly behind the USD 20.4 billion needed per year until 2030.

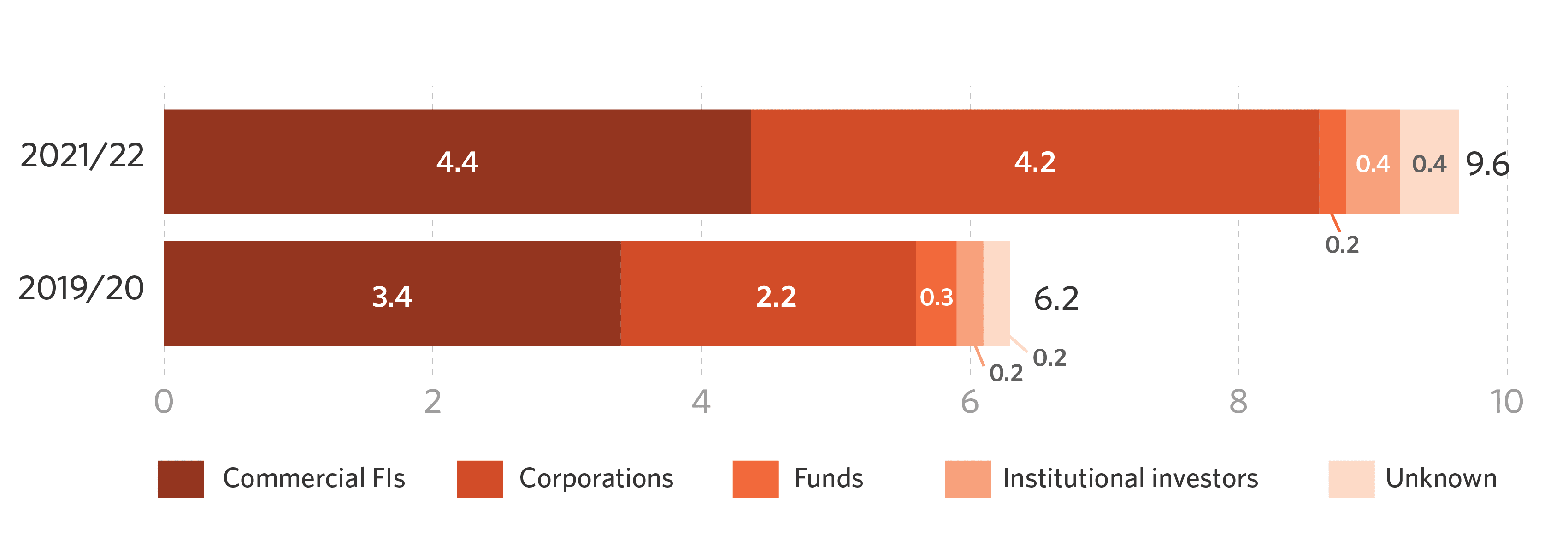

70% of methane abatement finance came from private sources. Corporations represented 44% and commercial financial institutions 45% of private flows, focusing mainly on AFOLU.

Public actors contributed 30% of methane abatement finance. Development finance institutions (DFIs) are a key public sector contributor, accounting for 68% of total methane abatement flows. The largest sectoral recipient of public finance was the waste sector.

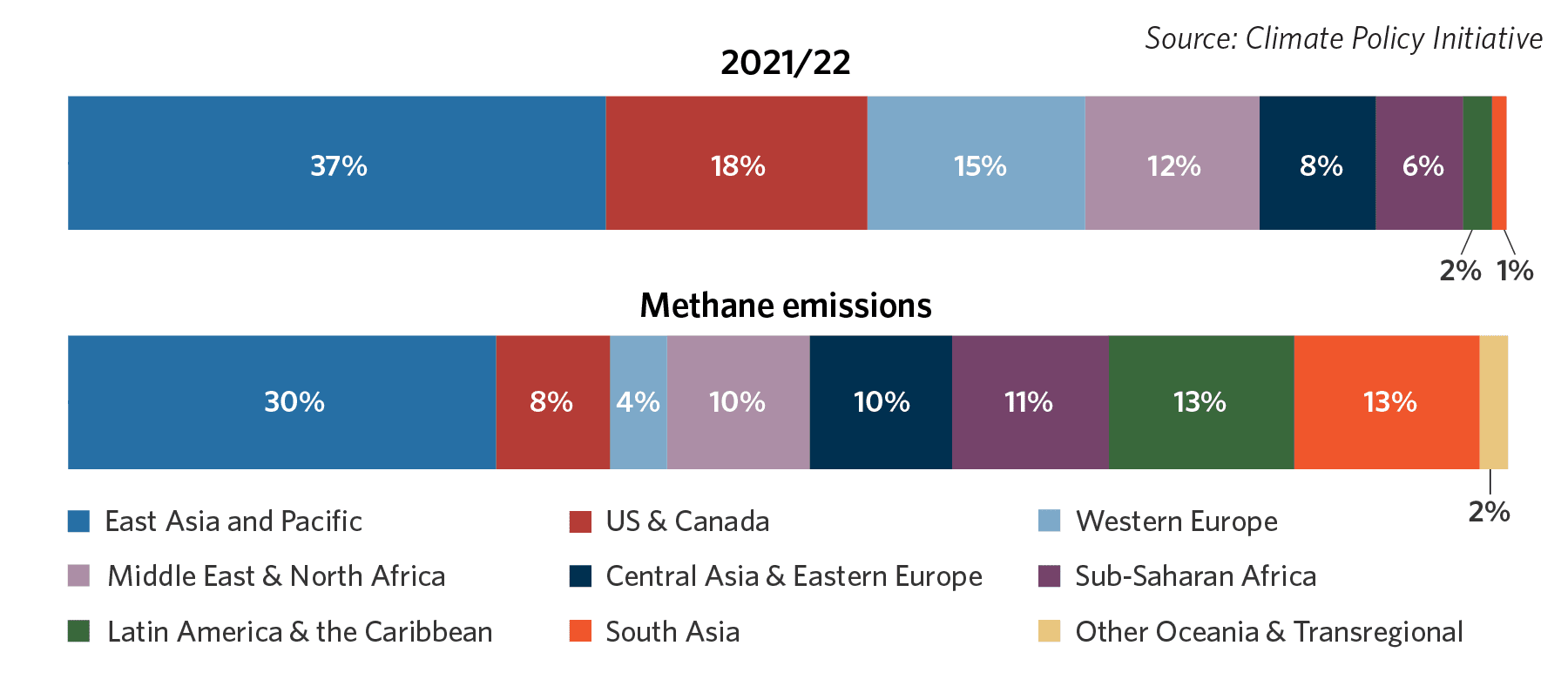

The top three recipient regions of methane abatement finance are East Asia & the Pacific (USD 5bn), the U.S. & Canada (USD 2.5bn), and Western Europe (USD 2.1bn). China, with the largest methane emissions in the world, is pivotal in financing methane abatement.

Latin America and South Asia, responsible for 26% of global methane emissions (13% each), received only 1.8% and 1.3% of global methane finance, respectively. This discrepancy underscores a notable support gap in funding for these regions.

Debt was the predominant financial instrument for methane abatement finance globally, with a share of USD 7.9bn or 57%. Equity contributed with USD 5.5 bn or 40%. This mix is encouraging as it highlights a relative diversity of instruments.

Grants, while only a small share at USD 0.3 bn or 2%, have potential to be the most catalytic instrument type. The effective deployment of scarce grant and concessional resources offers much promise to accelerate methane abatement finance.

How to Scale Methane Abatement Finance?

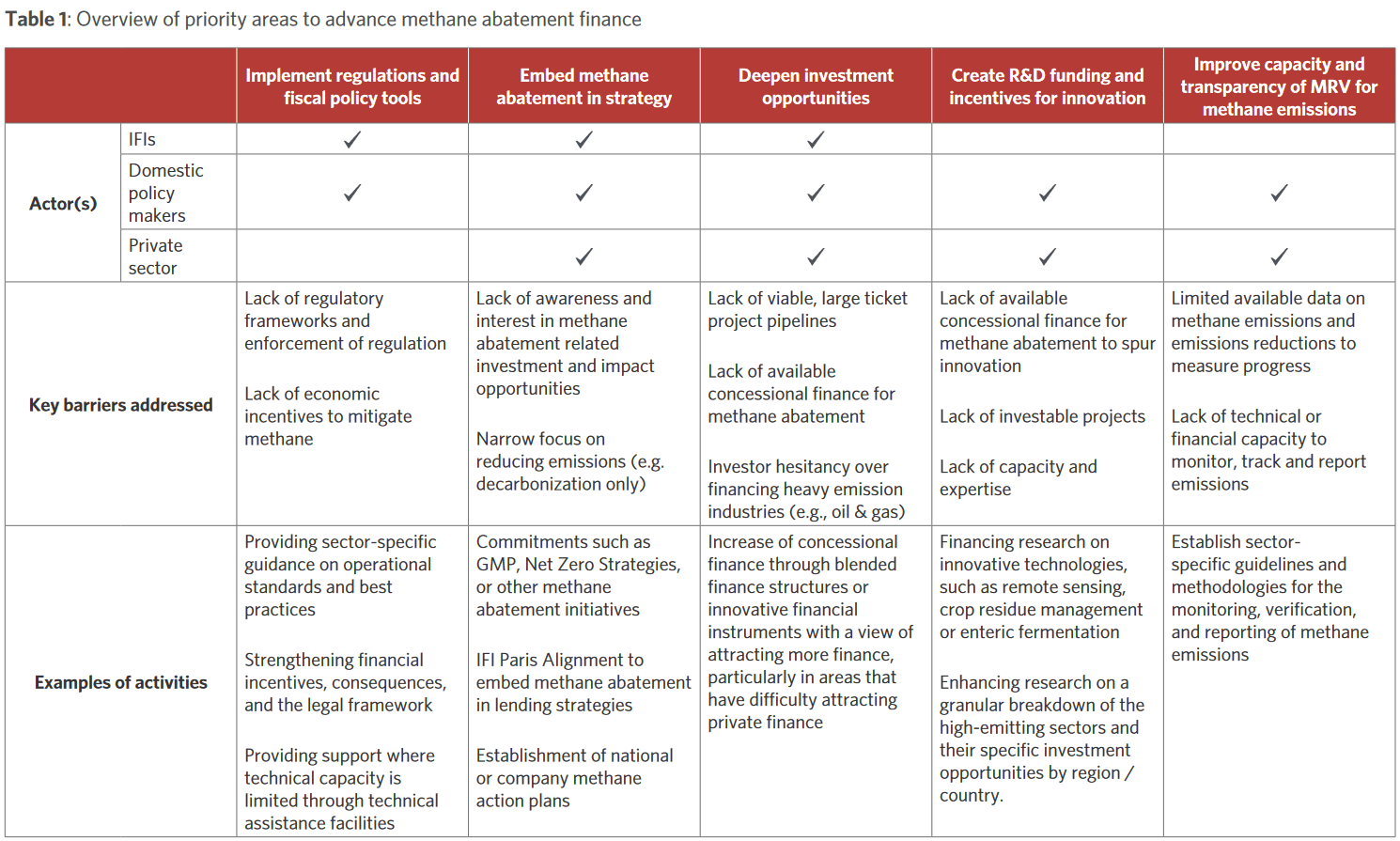

Mitigating methane emissions presents a clear opportunity for policymakers, as well as public and private investors, to take substantial strides in curbing global warming during this decade. Building on the momentum of recent initiatives such as the Global Methane Pledge (GMP) and the associated Methane Finance Sprint, public and private sector decision-makers should seek opportunities to close the methane abatement finance gap. We spotlight five priority areas to enable stakeholders to identify crucial entry points to investment.

Opportunity spotlight: methane abatement finance for oil and gas in Southeast Asia

Governments in Southeast Asia should join the Global Methane Pledge and develop national methane action plans. While methane is included in all countries’ Nationally Determined Contributions, only five have signed the GMP, and none have specific oil and gas methane reduction strategies.

- In fossil fuel-exporting nations like Indonesia, Malaysia, and Brunei, where intentional venting or flaring causes most methane emissions, governments should prohibit non-emergency flaring and address fugitive emissions through operational standards.

- Importer countries like Cambodia or Laos may consider setting methane-related import standards for oil and gas.

- Nations with nationally-owned or partially nationally-owned oil and gas companies, such as Brunei, Vietnam, Malaysia, and Thailand, can utilize expertise within state-owned entities to inform policymaking.

Private actors can implement voluntary methane abatement solutions and collaborate with the public sector. Initiatives like the ASEAN Energy Sector Methane Roundtable and the Methane Leadership Program (MLP) showcase private sector efforts in the region.

International financial institutions should expedite financing for methane abatement in Southeast Asia as part of a just energy transition away from fossil fuels. Programs aimed at reducing methane emissions from oil and gas should prioritize the region, given its projected future growth.