Indonesia is the largest economy and energy consumer in Southeast Asia. It accounts for two-fifths of the region’s energy consumption, and its overall energy demand is expected to increase by more than 30% between 2020 and 2025.

Indonesia has committed to 29% unconditional emission reduction by 2030. Yet, the country scores high in terms of energy intensity, meaning, the energy consumed for every unit of activity in Indonesia is high and the country is not being efficient with its use of energy.

Energy efficiency offers clear benefits to Indonesia’s emission reduction and energy resilience goals, as well as overall support for economic and social development strategic objectives (IEA, 2015). Increasing energy efficiency can also fuel economic recovery through job creation and improved competitiveness in the industrial and commercial sectors. These factors, along with the benefit of reduced energy costs, are particularly valuable during this time as the nation battles the aftereffects of the COVID-19 pandemic.

Despite clear benefits, multiple regulations supporting energy conservation, and large opportunities, energy efficiency business models in Indonesia face multiple barriers. These barriers threaten the national target of 17% energy savings by 2025 (from the 2015 baseline) and the 2030 emissions reduction target.

Therefore, in this study we aim to:

- Identify and understand the challenges faced by Energy Service Companies (ESCOs) in Indonesia’s developing energy efficiency market

- Based on market research, suggest improvements to existing energy efficiency business models that are viable and can be scaled up in Indonesia

KEY FINDINGS

We conducted a market survey among key ESCOs, clients, and lenders to understand where the market stands in terms of regulatory, financial, and awareness towards energy efficiency projects. Our key findings are:

- Energy efficiency projects remain unappealing to owners and investors.

Loan officers and risk managers within financial institutions often have no knowledge of energy efficiency technologies and their energy efficiency business models, resulting in perceived high risk on financing aspects. Limited information about the benefits of energy management is the primary reason for the lack of interest by building owners and investors for energy efficiency projects. Owners and facility managers are often unable to access energy consumption benchmarking in buildings and industries, as well as information on impact measurement in energy efficiency projects. This leads to incertitude in risk calculation and investment return. - ESCOs are supposed to play a key role in bridging the gap between clients and

investors but are struggling because of perceived risks.

ESCOs are a key part of energy efficiency business models. They design, provide, and maintain systems to ensure energy cost savings can be used to pay back early capital investment. Hence, prioritizing and addressing the concerns of ESCOs are vital to furthering energy efficiency projects in Indonesia.

In our survey, all ESCOs admitted to a lack of confidence from investors and clients in energy saving projects. This is primarily due to the underperformance of Energy Savings which led to a default in payment, resulting in lack of finance to invest. Based on their experience, they identified three key factors that could establish this trust: 1) initial analysis and audit; 2) more communication about energy saving mechanism and performance with the facility owners; 3) and availability of financing. - The financial risk perceived by both clients and investors is the biggest hurdle in

developing energy-efficient projects.

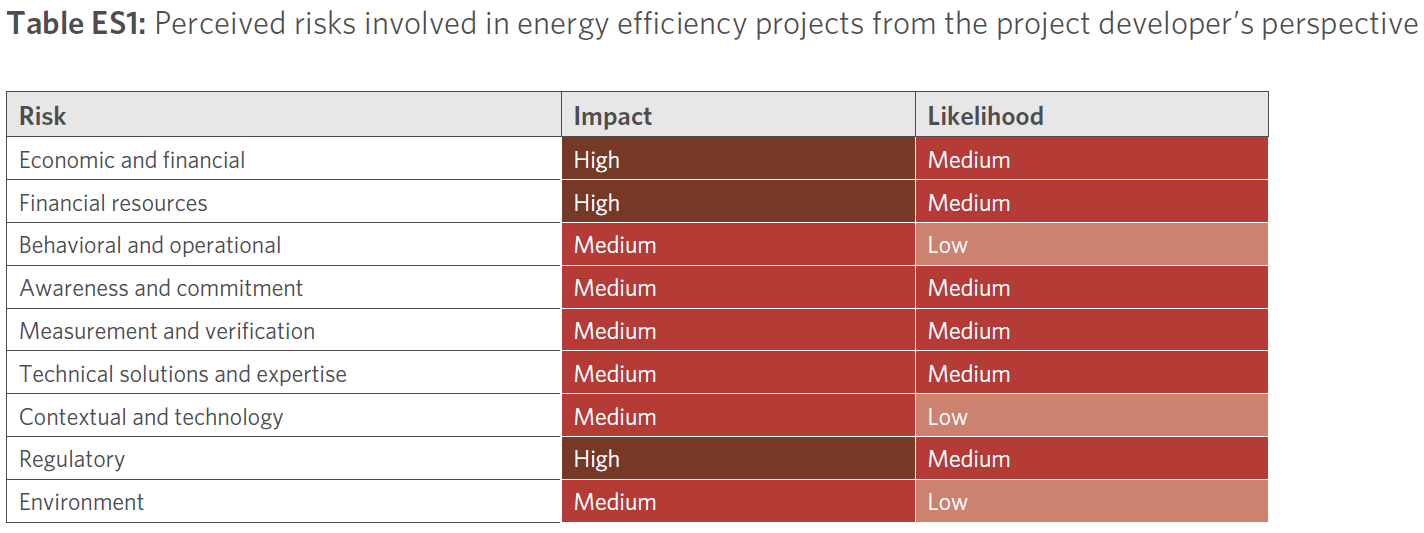

We identified nine perceived risks in the energy efficiency market, listed in Table ES1 below, out of which three stood out in the survey: economic and financial, financial resources, and regulatory. We measured the potential impact of each risk on the market and the likelihood of each of those risks occurring:

- The two traditional energy efficiency business models offered by ESCOs—shared

savings model and guaranteed savings model—have failed to address the business

challenges in Indonesia.

The shared savings model is primarily recommended for developing economies, where clients are usually small and face difficulties in accessing finance from banks. But a common problem across developing economies, including Indonesia is that ESCOs are also usually small and face the same difficulties in accessing finance from banks, thus the shared savings model remains unsuccessful.

The guaranteed savings model puts the ESCO client in a risky position because they assume the debt risk from the bank. Clients’ lack of trust in ESCOs’ capacity and capabilities hampers this business model from being functional in Indonesia. Further, the typical contractual agreements for energy efficiency businesses in Indonesia still do not fully address certain key issues. These issues include the potential disagreements in energy-saving measurements, the opaqueness of the resulting monetary savings, and the lack of financial guarantees in a non-performing situation. Updating standard contractual agreements to address these issues would improve trust between clients and banks.

BUSINESS MODELS

Business models must be improved to accelerate energy efficiency development. We recommend tailored versions of three existing business models that 1) can address the risks identified in Table ES1 including economic and financial risks, and financial resource risks, 2) are being implemented and can be scaled up in Indonesia, but 3) require additional support from Ministry of Energy and Mineral Resources (MEMR) and Financial Services Authority (OJK) to address regulatory risk.

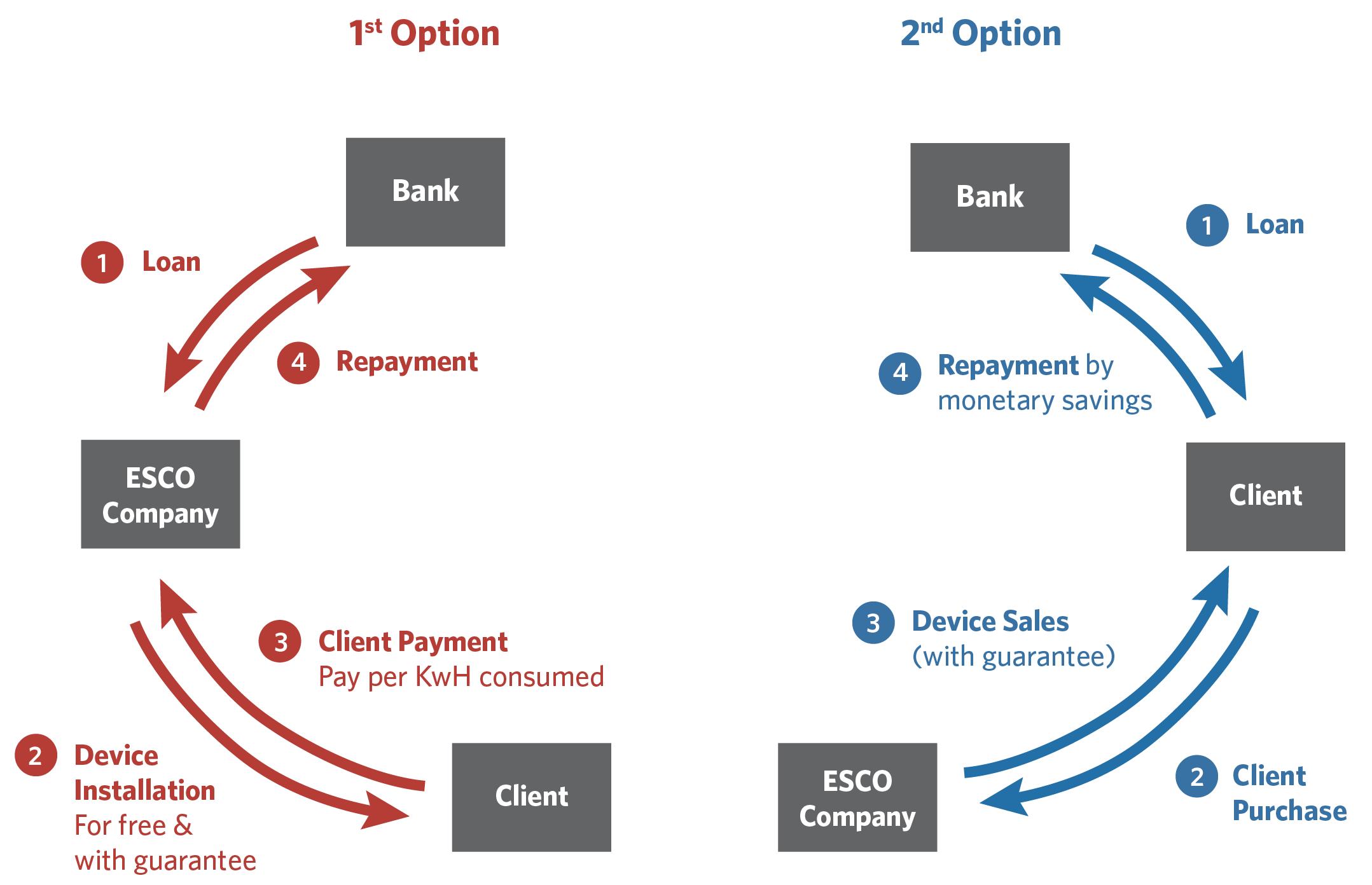

- Service or device business model

This model is expected to lower the perceived high investment cost for clients because it offers flexibility and multiple options that suit their investment preferences, i.e., the subscription service or the purchase option. Further, because ESCO helps install the equipment in both options, the clients face no construction risks. Even in the second option where the client opts for purchasing the device only and are responsible for repaying the bank’s loan, the ESCO would still provide technical guarantee that the device would deliver the promised energy savings or the required output. Thus, it minimizes unknown factors in the detailed risk and return calculation for both the client and the ESCO.

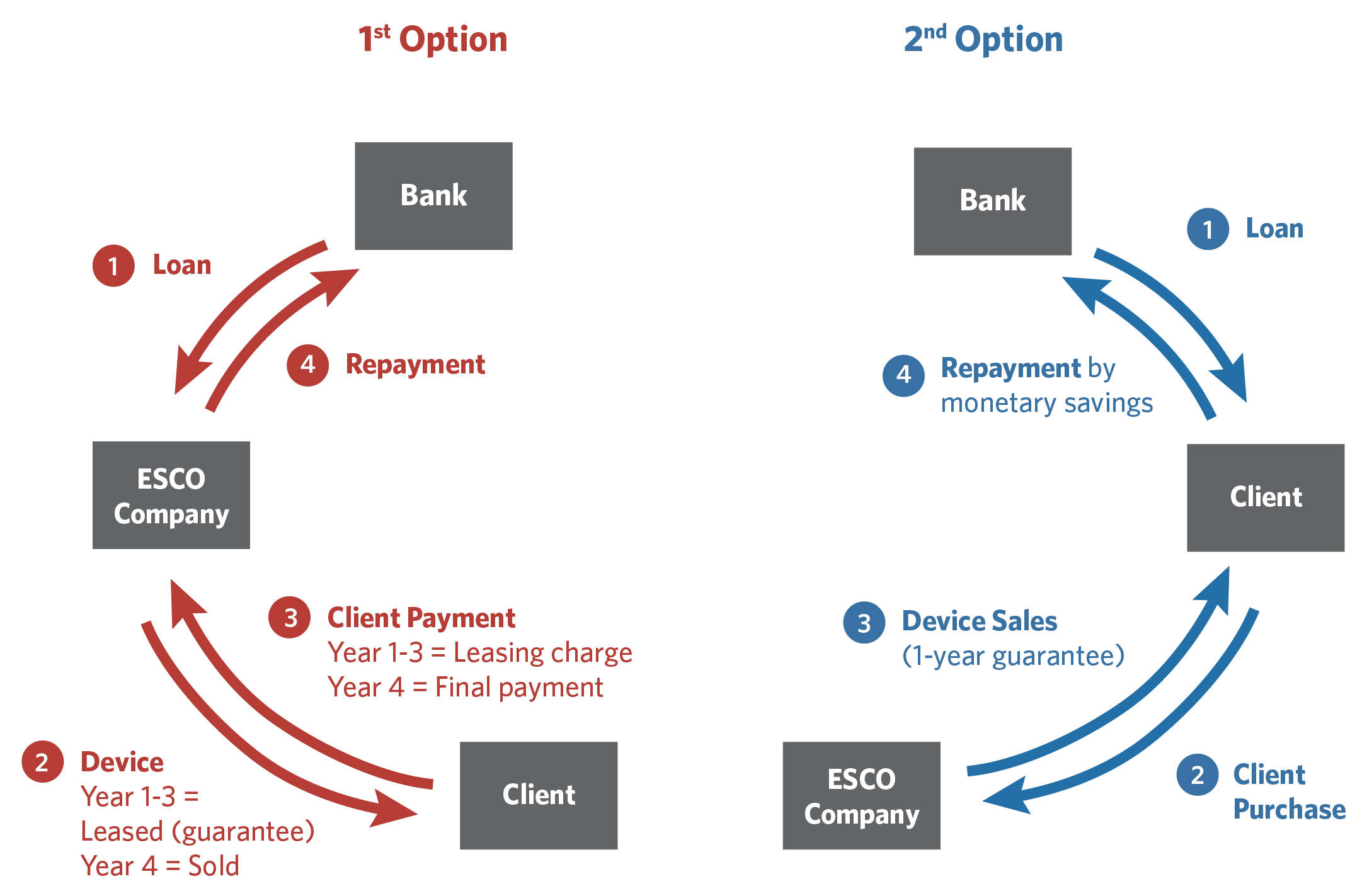

2. Leasing and purchase business model

The bank’s payment default risk is low because the ESCO, as the borrower, will be fully paid by the clients who either buy the device immediately (with a single big payment in the beginning) or continuously pay small amounts within four years (after which the device’s ownership is transferred to client). Additionally, the client, as the borrower, will be backed by ESCO’s guarantee, which is another factor that lowers the risk. This guarantee minimizes the perceived high investment cost from the client’s perspective.

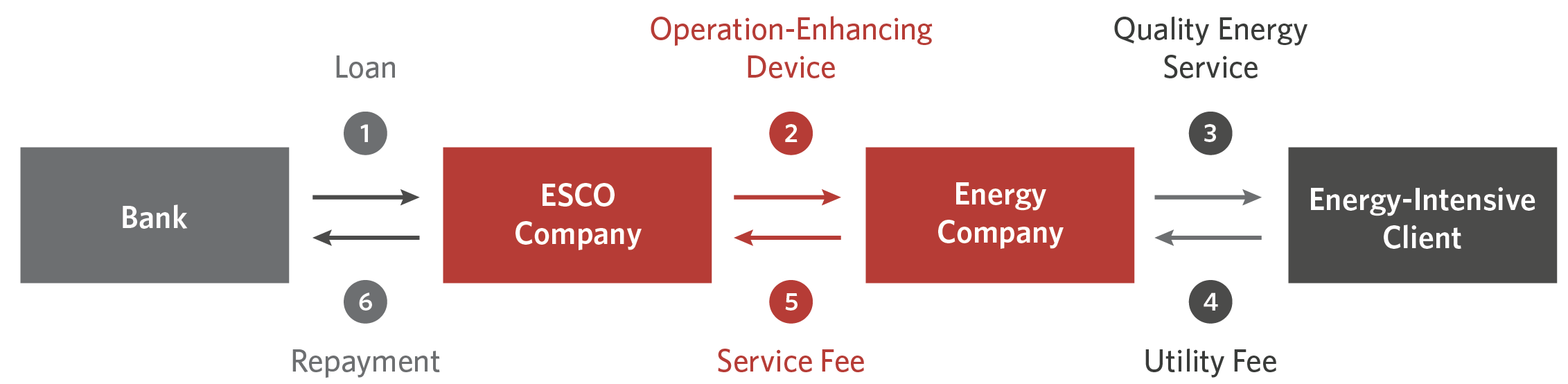

3. Quality energy service business model

Under this model, the client does not install the device and is protected from risks that arise from construction costs. The bank is also relatively safe from the risk of payment defaults. First, this model is applicable to a particular business arrangement, in which the energy providing company would only have deals with certain types of clients (energy-intensive companies – usually big players with a reliable financial background). Second, the collateral in this model is the escrow account that the ESCO has in the bank, to which the energy providing company pays the fee for the service provided by the ESCO.

Although improved business models and contractual agreements offer several advantages to manage challenges in the energy efficiency business, they cannot address regulatory risk, a topic outside the scope of this report. Indonesia needs stable and reliable regulations to grow and support its energy efficiency business landscape.

Other important issues that this study does not include, but must be addressed and need further analysis to accelerate energy efficiency business in Indonesia, include:

- Bank loan interest reduction

- Implementation of incentives or disincentives measures, and

- Market expansion through wider mandatory energy efficiency enforcement or market based mechanism, such as energy savings credits trading.