Climate change threatens catastrophic consequences, especially for the world’s poorest. Recognizing this threat, the 2015 adoption of both the Paris Agreement and the UN Sustainable Development Goals signaled unprecedented global political will for action on climate change. While limiting global temperature rise to 2 degrees Celsius, as targeted by the Paris Agreement, will avoid the most disastrous of these consequences, achieving this goal will require trillions of dollars of new investment in low-carbon climate-resilient drivers of economic growth.

Based on IFC estimates, developing countries alone will need $1.5 trillion in climate investment annually through 2030. Therefore, recognizing the importance of private investment to meeting the climate challenge, in 2013 the German, U.K., and U.S. governments met to consider ways to coordinate their public capital towards more effectively mobilizing private investment. Out of this meeting, the Lab was born, with a mission to identify, develop, and launch innovative and transformative climate finance solutions to drive billions of dollars to the low-carbon, climate-resilient economy.

We are proud to announce that the Lab reached a huge milestone last week – the 26 ideas and companies that have been selected, developed, and endorsed by the Lab since its launch in 2014 have now mobilized over $1 billion in sustainable investment.

In the last four years, the Lab has grown into a robust public-private partnership of over 60 expert Lab member institutions, and has spanned four programs – the Global Lab, India Lab, Brasil Lab, and the Fire Awards. It is supported by nine funders: the German Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety (BMUB), the UK Department for Business, Energy & Industrial Strategy (BEIS), the U.S. Department of State, the Netherlands Ministry for Foreign Affairs, Bloomberg Philanthropies, the David and Lucile Packard Foundation, Oak Foundation, the Rockefeller Foundation, and Shakti Sustainable Energy Foundation. The Lab has been endorsed by the governments of the G7, India, and Brazil, and was recently named in the “Top 11 Best Bets” out of nearly 2,000 submissions to the Macarthur Foundation’s 100&Change competition.

The solutions developed and endorsed by the Lab are tackling some of the most persistent barriers to sustainable investment, and bringing finance for sustainable development into the regions and sectors that need it most.

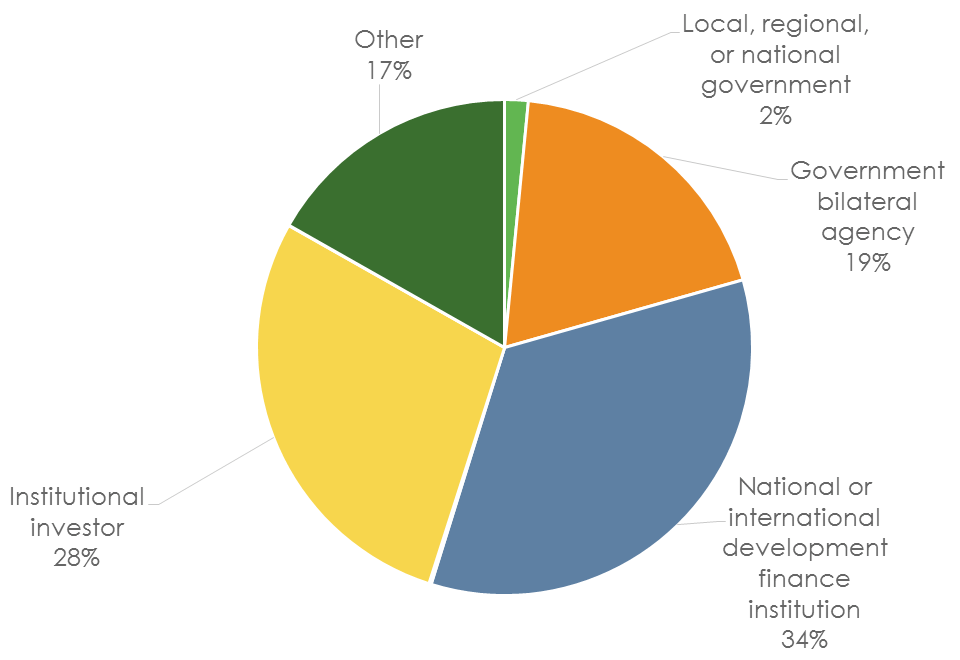

Public and private investors in Lab instruments

Take for example Energy Savings Insurance (ESI), which this week helped the Lab cross the $1 billion line with the announcement of support from the Green Climate Fund to expand the already successful model into Paraguay and Argentina. ESI started as a seed of an idea at the Inter-American Development Bank (IDB), a Lab Member, who was interested in addressing barriers to energy efficiency investments in Latin America. Energy efficiency upgrades can save money for small- and medium-sized businesses (SMEs) in developing countries while reducing greenhouse gas emissions. However, the sector is starved of investment as both SMEs and local banks often lack the expertise and confidence to invest in capital intensive energy efficiency measures. Energy Savings Insurance guarantees the financial performance of energy efficiency savings projects, paying out if the projected value of energy savings is not met. The product is currently launched in seven countries in Latin America, with two more on the way with the latest support from the GCF, IDB, Agencia Financiera de Desarrollo (AFD) in Paraguay, and Banco de Inversión y Comercio Exterior S.A.(BICE) in Argentina. By 2030, ESI has potential to catalyze over USD $10 billion in energy efficiency investments.

The Water Financing Facility is another idea brought to the Lab as a concept – proposed by the Dutch government as a way to bring crucial private finance into the water sector in developing countries. While water infrastructure is a key aspect of building climate resilience in many regions, it is typically regarded as an unfavorable investment due to high perceptions of risk from investors. To address these risks, the Facility issues investment-grade resilient water bonds to domestic institutional investors to support countries’ national water and climate priorities, building infrastructure that improves access to safe and affordable water both today and into the future while providing consistent returns for investors. Early investments have helped set up the Facility, which is anticipating its first bond issuance this year.

We have identified three key ingredients that have allowed us to get this far. First, the Lab is a collaboration of the public and private sectors. As most ideas at the beginning need support from both public and private actors to get off the ground, access to key stakeholders in both sectors allows for the informed selection of viable ideas; the stress-testing and refinement of these ideas with potential investors and implementing partners, which allows us to address the needs of investors from very early on; and the right network to help take ideas forward and get to market quickly.

Second, the Lab focuses on four key criteria in selecting and endorsing transformative ideas: innovation, actionability, financial sustainability, and catalytic potential. Ideas must address key market barriers in innovative ways. They must have a clear and feasible pathway to implementation identified, and be able to phase out public funding over time. Finally, they must be able to catalyze a larger market for climate solutions.

Third and above all, we focus on mobilizing finance – ideas must be of interest to Lab members in both the public and private sectors and offer concrete opportunities for investment. To date, Lab Members have invested more than $230 million in ideas that have come out of the Lab.

Even as the Lab has been successful thus far, we know there is plenty more to do to turn this first billion into the trillions necessary to shift to the global pathways laid out in the Paris Agreement. As certain sectors, such as renewable energy, become more mainstream, the sustainable investment community must continue pushing to focus on incubating ideas in the most difficult sectors and regions to catalyze new markets. To that end, the Lab’s new 2018 class of instruments focuses on sustainable transit, mini-grids for rural development, and climate resilient land use.

As we move into our next four years, the Lab is looking forward to increasing collaboration in climate finance to drive billions more towards a low-carbon, climate resilient economy.

Climate Policy Initiative serves as Secretariat of the Lab. Our first impact report covering 2014-2017 is available here.