With an ambitious target to generate 61% renewable energy (RE) in the Electricity Supply Business Plan (RUPTL) 2025-2034 and President Prabowo’s bold remark on achieving 100% RE by 2035, a rigorous assessment of transition costs and benefits is instrumental in ensuring that Indonesia’s energy transition is not only successful but its outcome truly just and sustainable.

For the energy transition to be just, it should consider all socioeconomic risks and opportunities and address them for affected stakeholders. Concerns over this stem from two main factors: (1) uneven socioeconomic implications of retiring coal power plants, and (2) inequitable distribution of benefits from adopting low-carbon technologies.

As with any sunset industry, workers and communities dependent on revenues that fossil fuel plants generate will require support to shift to new livelihoods. Renewable energy facilities can accommodate this shift by replacing the plants as employers and/or by powering other forms of economic activity. GGGI has estimated that between 2.1 million and 3.7 million new direct jobs can be created in renewables in Indonesia by 2030. Recent analysis from also highlights cases where community-based renewables have fostered local livelihoods in various villages in Eastern Indonesia.

The flexibility of RE projects in terms of size and location, as well as their generally low maintenance costs, can further deliver benefits related to equity. Solar, wind, hydro, and geothermal technologies can be used in either small- or large-scale installations, reducing market entry barriers. They can also be installed in a decentralized manner, either on- or off-grid, enabling use in remote areas. While upfront investment requirements can be relatively high, maintenance costs and total costs of ownership are low, reducing the need for subsidies often required to sustain fossil fuel energy generation.

However, it is not a given that the benefits of shifting to renewable energy will be equitably distributed. If not managed well, the introduction of low-carbon technologies risks having minimal benefits for marginalized groups, deepening existing inequalities that have long characterized the fossil fuel industry, or even creating new ones.

Finance is therefore crucial in delivering energy transition benefits equitably and creating broader economic opportunities. Around USD 97 billion is needed to achieve Indonesia’s 2030 climate targets, as estimated in the Comprehensive Investment and Policy Plan (CIPP) of its Just Energy Transition Partnership (JETP).

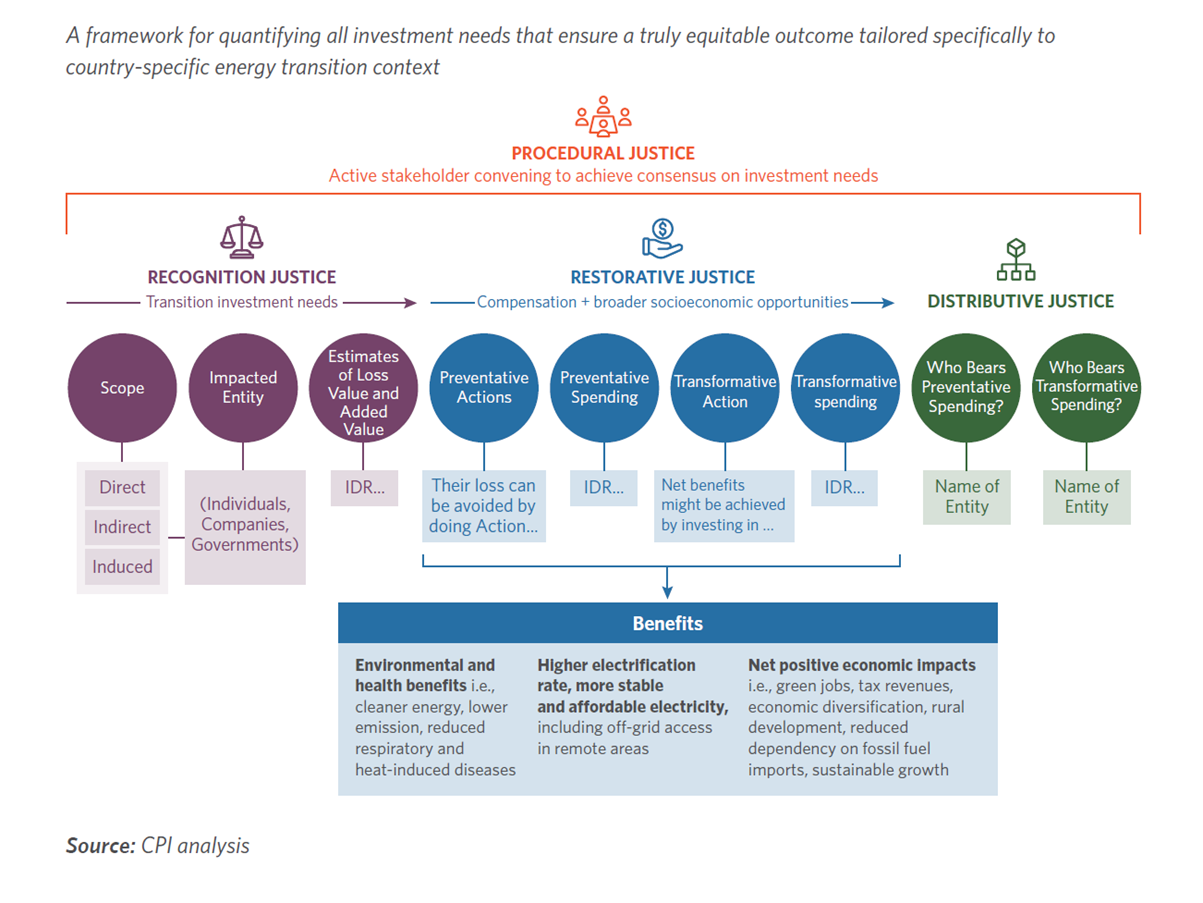

Rooted in the principal justice aspects of an energy transition (recognition justice, restorative justice, distributive justice, and procedural justice), this report lays out a framework for quantifying the investment needs that ensure a truly equitable outcome tailored specifically to Indonesia’s energy transition context, with the planned early retirement of Cirebon 1 coal-fired power plant (CFPP) as a case study.

Figure 1. Case-specific framework for financing Indonesia’s just energy transition

Important information required for policymakers to accurately capture the restorative justice element of an energy transition includes:

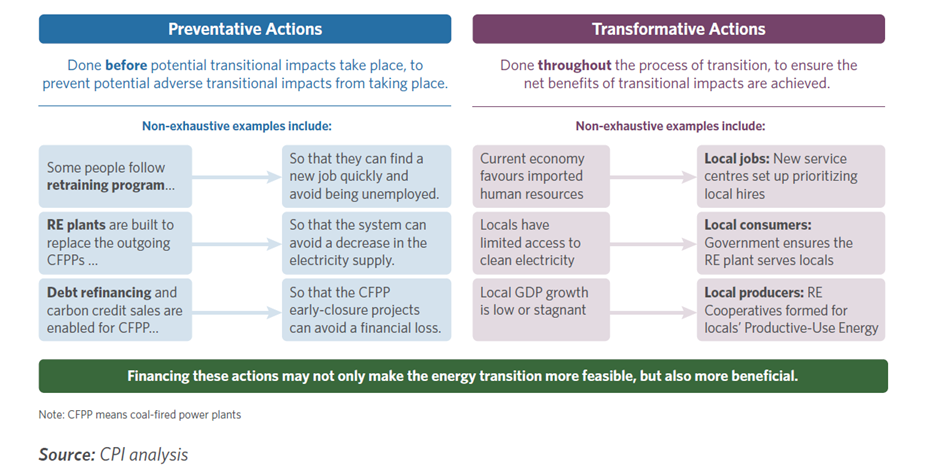

- A list of preventative actions to avoid identified losses to the extent possible (e.g., reskilling programs to prevent workers from losing their jobs, development of RE plants to avoid any decrease in the electricity supply, debt refinancing to avoid significant financial losses from early retirement of coal plants).

- Estimates of preventative spending to support these preventative actions.

- A list of transformative actions done throughout the process of transition to ensure net benefits of transitional impacts are achieved (e.g., green jobs creation, job service centers prioritizing local hires, RE cooperatives to optimize productive use of energy/PUE, diversification of local economies, and other benefits).

- Estimates of transformative spending to fund those transformative actions (e.g., capacity building with seed capital or subsidized loans for local SMEs).

Financing more preventative actions today may translate to spending on fewer transformative actions tomorrow. This relationship is illustrated below:

By applying this framework in key initiatives such as Indonesia’s JETP and Energy Transition Mechanism (ETM), stakeholders at all levels can make informed decisions about just transition Finance, paving the way for a more equitable, sustainable, and prosperous energy future.