About

Africa is urbanizing rapidly. Africa’s cities will be home to an additional 950 million people in the next 30 years, yet there is an annual infrastructure funding gap estimated to be between USD 68-108 billion. Decisions made today on how the infrastructure to serve this growth is built will shape the continent’s carbon footprint for decades to come.

Although many emerging economies have supportive regulatory frameworks to encourage private participation in sustainable infrastructure investment, commercial funding is limited, costly, and time-consuming for project developers to obtain.

Existing infrastructure fund managers can serve as important agents of change by developing innovative solutions that help developers obtain institutional-scale financing for early-stage infrastructure projects.

The ACT Fund’s unique blended–currency mechanism addresses high transaction costs and lead times, barriers that have constrained the project pipeline in West Africa, while also shortening and simplifying the project exit process to allow efficient redeployment of capital in further projects.

INNOVATION

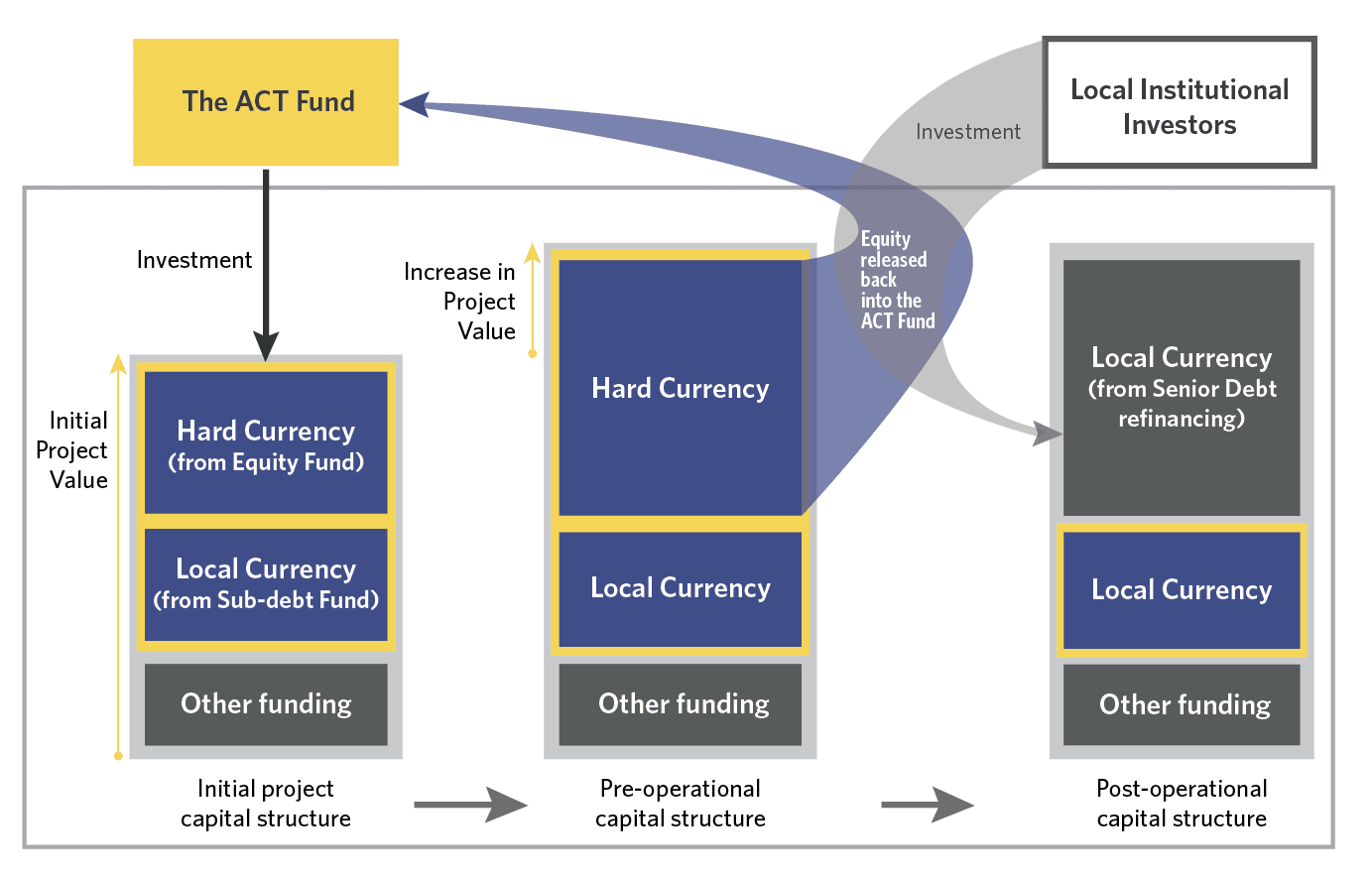

Equity and debt funding for all phases is addressed at project conception, eliminating the typical financing risks and transaction costs that occur at pre-construction financial close. Through local currency debt refinancing, the hard currency equity is released and recycled back into the fund. This improves a single project’s liquidity versus traditional funds, and increases the number of projects that can be initiated with the fund. A project is then therefore capitally structured with local currency which significantly reduces currency risk for both the project and the fund’s investors.

IMPACT

The goal for the ACT Fund is to help bring large-scale, commercial sustainable infrastructure investment into the mainstream, unlocking the local institutional capital that is urgently needed to build a greener, more resilient West Africa. Due to its efficient structure, projects will reach their operational stage more quickly, enabling the fund to mobilize more than four times its initial investment, supporting dozens of energy, mobility, waste, and water projects across West Africa that will reduce the region’s carbon footprint and generate thousands of good jobs.

Once successfully proved in West Africa, the ACT Fund can serve as a blueprint for launching green infrastructure funds that mobilize local capital to support climate-resilient urban development in other emerging economies.

“There is significant untapped local and international capital available for low carbon infrastructure in Africa’s fastest-growing regions if the unique barriers for each investment class can be removed. The Lab allowed us to optimize the financial instrument, strategically plan the pilot and develop the relevant metrics and measurement of climate change mitigation and adaptation”

Tariye Gbadegesin, ARM-Harith

DESIGN

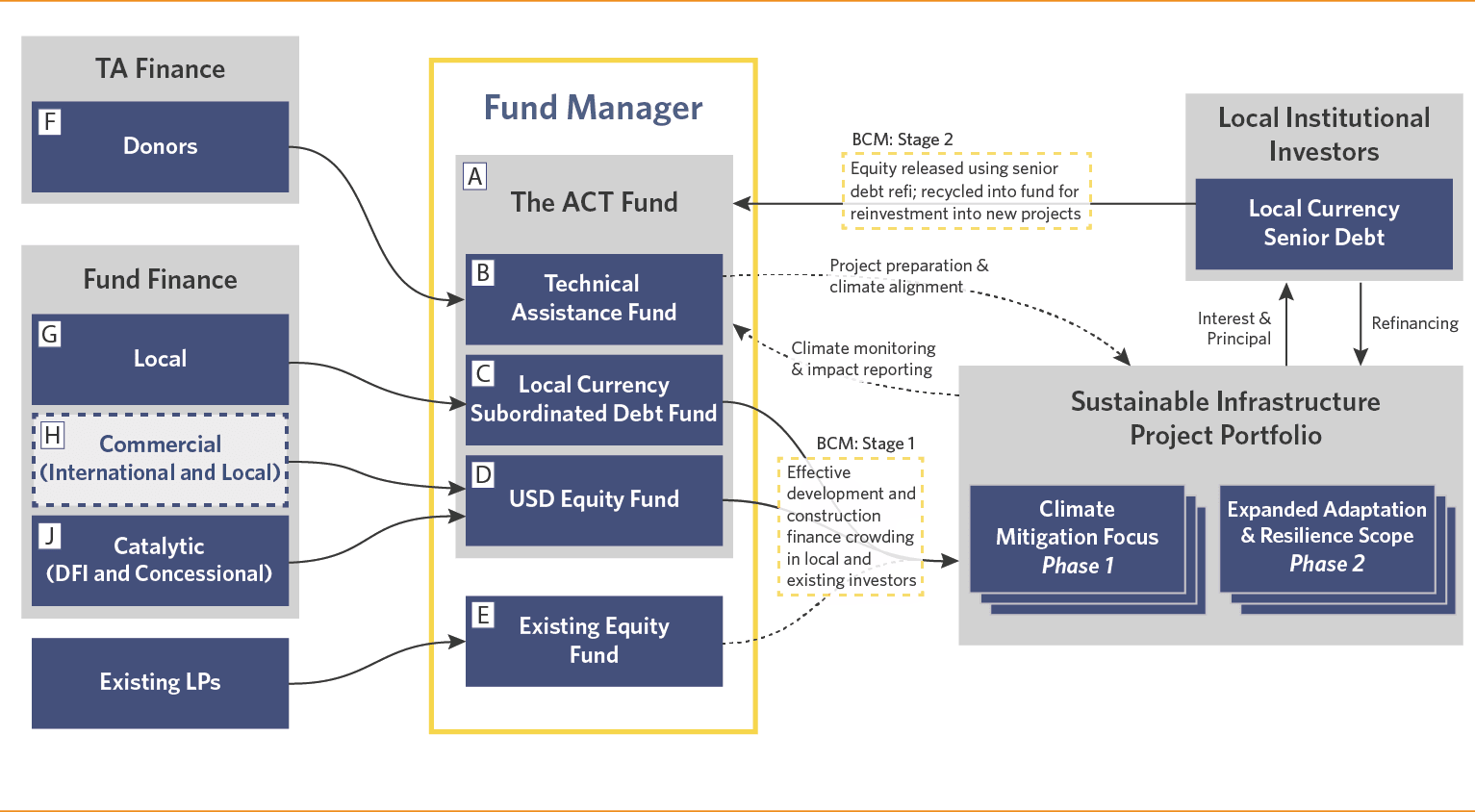

The mechanism operates in two stages. In Stage 1, the fund manager draws down from both the equity funds (D and E) and the local currency subordinated debt fund (C) in tandem to cover the majority of the full development and construction costs of a project and get it to operational phase as efficiently as possible. Stage 2 uses local senior debt to release the majority of the equity invested in a project once it becomes operational, effectively resulting in a locally-financed project in full commercial operation.

The funds unlocked by the equity release will be recycled into the ACT Fund to be redeployed into the next wave of projects, allowing the ACT fund to invest in and exit more projects than in a traditional fund with a longer equity commitment period.

Technical assistance (B) will support project developers to make their projects investment-ready under international sustainable investment guidelines.