This publication is CPI’s analysis of Climate Investor One, an innovative climate finance instrument endorsed by the Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

In recent years, many developing countries have established supportive regulatory frameworks for private investment in renewable energy projects. However, finance for these projects remains a challenge: Projects can fail or face severe delays due to lack of expertise and prolonged negotiations with financiers; because renewable energy projects involve high amounts of capital expenditure, debt costs at construction can have a disproportionate effect on their financial viability; and finally, attracting new investors remains a challenge. Climate Investor One (formerly the Climate Development and Finance Facility) will facilitate early-stage development, construction financing, and refinancing to fast-track renewable energy projects in developing countries.

Climate Investor One, proposed by the Netherlands Development Finance Company FMO, addresses these challenges by combining three innovative investment facilities into one to finance projects in the wind, solar and hydro sectors.

Climate Investor One supports these projects through several stages of a projects’ life to ensure projects get off the ground and attract new investors. It provides technical, environmental and social due diligence support at an early-stage. It then cuts out complex negotiations with multiple providers by financing a large part of construction costs with equity, removing the need for more costly debt finance. Finally, Climate Investor One will unlock new capital through a pooled refinance fund that may be appealing to institutional investors.

In June 2017, Climate Investor One announced first close at USD 412 million, receiving support from the Directorate-General for International Cooperation (DGIS), Ministry of Foreign Affairs of the Netherlands), Atradius Dutch State Business, De Nederlandse Waterschapsbank N.V. (NWB Bank), Aegon Asset Management and FMO – all from the Netherlands – together with global partners from Norway (KLP), South Africa (Sanlam Investments Holdings) & the UK (Royal Borough of Windsor & Maidenhead Pension Fund).

In a pilot, Climate Investor One would finance nine projects to deploy 300 MW of renewable energy capacity and reduce 600ktCO2 emission per year. Due to the combination of the financing facilities, these projects would be built for 7-21% less capital than a typical project, a significant reduction in costs, with clean energy provided at 9-18% lower cost to consumers in developing countries. Climate Investor One will mobilize at least USD 2 billion in new private finance out to 2020, while lowering the cost of clean electricity to consumers in developing countries.

FACILITY DESIGN

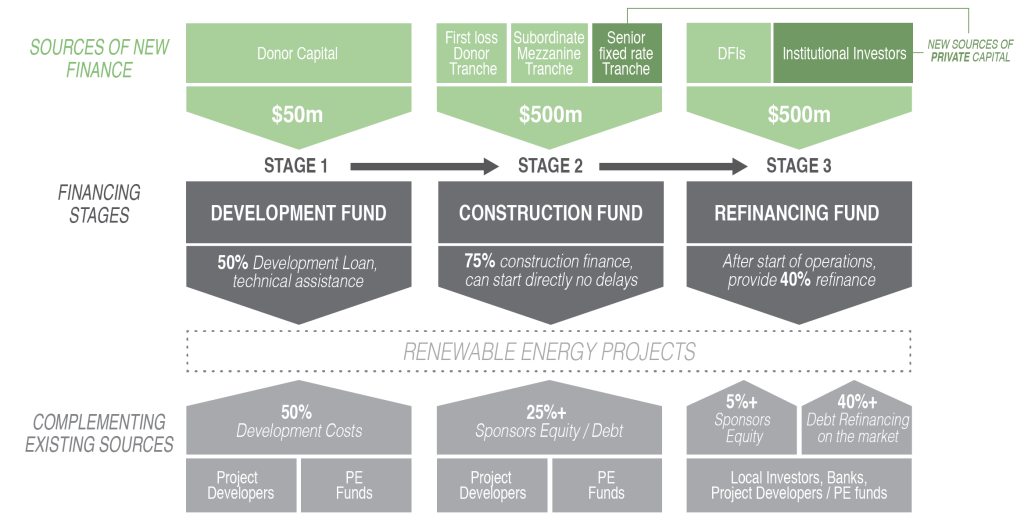

Climate Investor One focuses on financing projects in low and lower middle income countries in the wind, solar, and hydro sectors with an average size of 25-75 MW or USD 80-100m in total investment cost. Climate Investor One consists of three stages:

A Development Fund funded by non-repayable donor contributions would finance up to 50% of development costs for projects by private sector developers. Its specific aim would be to improve projects’ bankability from an early stage, which would include activities that projects often struggle to complete for lack of finance, such as help securing land titles and permits, concluding a power purchase agreement, conducting an environmental and social impact assessment, and reaching financial close by securing 100% of investment costs. The donor capital used to fund this stage would be converted to equity stakes for successful projects that would in turn be bought out by the Construction Finance Facility at commercial rates. In this way, the Development Facility would be an evergreen facility, recycling the returns made from the construction finance facility buy-outs to fund the development of subsequent new projects.

A Construction Fund would provide up to 75% of investment costs on commercial terms to projects. It would be funded by three different tiers representing different risk/return positions: A $100m Tier 1 donor tranche to cover potential losses; a $200m Tier 2 subordinate tranche taken up by DFIs and potentially PE/commercial investors ; and a $200m Tier 3 senior tranche taken up by commercial investors comfortable with construction risks (approx. 13 year 8% notes). Because such a facility would reduce both the complexity and development time with fewer financiers for project developers to negotiate with, it could also reduce the overall cost of financing and project development.

A Re-financing Fund would have right of first refusal on up to 50% of the long-term refinanced debt of derisked projects after they enter commercial operation. The price for re-financing would be set by the other 50% of external investors and local banks. The Refinancing Facility would consist of investors seeking long-term de-risked infrastructure debt, and in this way, attract a new tranche of investors to clean energy in developing countries.