Microfinance, which began its journey in India almost 50 years ago, is now an essential part of its socioeconomic ecosystem. Beyond the widespread coverage, its significance lies in the unique nature of its clients – the traditionally unbanked, underserved, and, in today’s context, one of the most climate vulnerable populations. The adverse effects of climate change disproportionately impact the marginalised groups because of their limited resources, low economic resilience, and increased exposure to natural disasters.

A Natural Union

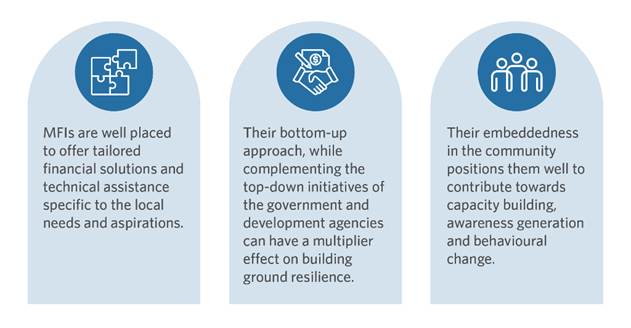

Smallholder farmers face the disastrous impacts of rising temperatures, unpredictable rainfall, and extreme weather events. As per estimates, an overwhelming 80% of India’s marginal farmers face crop yield losses due to climate change, and overall farmers’ income could decline by as much as 15-18% on average[1]. Urban low-income populations facing frequent exposure to heat waves, water stress, and health hazards fare no better. While being disproportionately exposed to environmental risks on the one hand, a part of the MFI clientele, such as micro-entrepreneurs and small traders in activities such as mining, sand harvesting, and charcoal production, are also sometimes forced to participate in relatively polluting activities due to a lack of adequate financial and technical capacity to adopt climate-friendly business practices[2]. It is here that MFIs, with their deep grassroots presence, trusted relationships, and decades-long engagement with low-income households, can play a unique role in driving inclusive, green growth.

And this is not a one-sided trade.

‘Green’ focused microfinance policies can help MFIs reach a broader client base, encourage innovation of climate-smart solutions, and enable them to expand further and penetrate the rural and semi-urban markets they usually operate in[3],[4]. The financial and non-financial services by the MFIs can help clients reduce their vulnerability to climate change, in turn, reducing the credit risk for MFIs. It also offers scope for access to impact-focused funding such as the Incofin Climate-Smart Microfinance Fund (ICMF[5]). The Fund plans to invest USD 550 million over the next five years, benefitting at least 50 MFIs through direct support and capacity building initiatives[6].

The Familiar Trail

Furthermore, it’s not necessarily a new space for the MFIs, neither in India nor abroad. Even if not particularly categorised or publicised as ‘green’, MFIs have been engaged in promoting environmentally friendly practices for a long time. One of the earliest examples that can be cited is that of the Biogas Support Programme (BSP) in Nepal, which involved the network of MFIs for household-level installation of biogas plants[7].

The focus of MFIs on green initiatives has continued to grow since 2008. As per an assessment of around 1,100 MFIs reporting in the 2014 MIX market [8]from India and other geographies, a promising 19% indicated having green microcredit products, 34% reported having environmental risk reduction procedures in place, and 40% claimed to have undertaken environmental awareness-raising activities[9]. MFIs are increasingly playing an active part in both climate risk mitigation and adaptation.

| About | Impact | Role of MFIs | |

| Microfinance for water access [10] | MFIs collaborating with the WaterCredit initiative by Water.org | -Since 2004, the initiative has enabled access to safe WASH facilities to over 31 million people in India | -Microloans for water and sanitation solutions -Expand the outreach of WASH finance to remote areas and underserved communities |

| Democratising clean energy through MFIs [11] | Building on the extensive reach and activity of MFIs in a region, clean energy enterprises engage MFIs to enable communities with access to their products | -Clean energy access to low-income households -Awareness generation and demand creation for clean energy products | -Microloans/ end user financing for buying off-grid RE products -Top-up loans to mitigate the risk of non-repayment and relatively higher transaction costs |

| Beyond (micro) finance [12],[13] | Partnership between the Asian Development Bank ADB and Micro Finance Institutions’ Network MFIN for piloting the launch of the Nat-Cat (Natural Catastrophe) insurance project | -Enrolment target of 0.45 million borrowers –Awareness generation target of approx. 1 million borrowers | -Data analysis by Annapurna Financial Private Limited -Launch through the MFIN network |

These examples are neither universal nor exhaustive but simply indicative of the ever-expanding universe of the MFIs. Since most of the solutions are community-driven, there is a vast potential for MFIs to leverage the Self-Help Group/ Joint Liability Group models to integrate climate-focused interventions into their ongoing programs. Ongoing initiatives such as NABARD’s support for training and capacity building of MFI clients, including SHGs/ SHG Federations, can further boost such interventions.

A drop in the Ocean

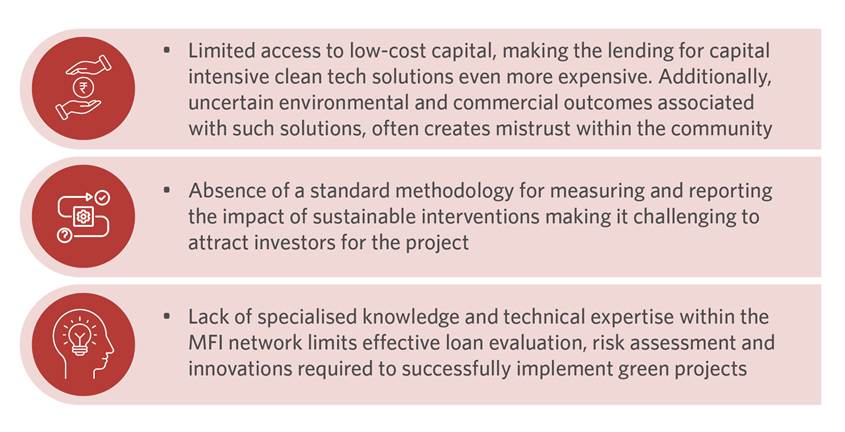

However, despite the positive trends and manifold opportunities, the role of microfinance for climate action presents an under-tapped opportunity. MFIs are yet to develop specific loan products and training to promote environmentally friendly businesses in sectors such as agroforestry and blue economy. Products such as Microinsurance remain vastly underutilised despite their proven potential in building resilience of vulnerable groups. Even for sectors and products explored, there are segregated cases of success (and failure), but not an institutionalised approach to position microfinance as a viable provider of climate finance. Several factors, including those listed below (but not limited to), limit the full potential of microfinance.

Looking Ahead

Despite the challenges, microfinance offers a model for convergence of the social, economic, and environmental ambitions of the Viksit Bharat– one that is too good to ignore. A strategic approach encompassing certain product and process innovations built on the back of coordination and partnerships with key stakeholders, MFIs, government, development institutions, and sustainability-focused businesses is crucial to actualising this vision.

Several such efforts are already underway, with initiatives like the partnership between AGRI3 Fund and HSBC to help MFIs integrate climate-smart lending practices into their portfolio, or Caspian Debt’s recent loan product offering to help MFIs fund climate-adaptive agricultural products[14]. Such strategic collaborations and innovations also pave the way for greater private sector participation in this space. Microfinance also stands to benefit from the policy focus of bringing in a unified taxonomy for climate finance, providing a huge scope for product innovation, strategic collaborations, and development of climate-positive financial solutions by the MFIs.

[1] https://agri3.com/opportunity-analysis-for-indian-mfis-to-support-climate-smart-agriculture/

[2] https://sparkassenstiftung-easternafrica.org/media/detail/role-of-microfinance-institutions-in-green-financing-1039

[3] https://www.gogreenmicrofinance.com/about

[4] https://publications.iadb.org/en/green-microfinance-latin-america-and-caribbean-analysis-opportunities

[5] https://incofin.com/wp-content/uploads/Incofin-COP29-November-11-Climate-resilience-event.pdf

[6] https://incofin.com/enabling-climate-resilience-through-financial-inclusion/

[7] https://www.iese.edu/media/research/pdfs/OP-0301-E

[8] MIX is the premier source for objective, qualified and relevant microfinance performance data and analysis. Committed to strengthening financial inclusion and the microfinance sector by promoting transparency, MIX provides performance information on microfinance institutions (MFIs), funders, networks and service providers dedicated to serving the financial sector needs for low-income clients.

[9] https://publications.iadb.org/en/green-microfinance-latin-america-and-caribbean-analysis-opportunities

[10] https://water.org/our-impact/where-we-work/india/

[11] https://www.ceew.in/publications/unlocking-access-finance-decentralised-energy-solutions

[12]https://fwwbindia.org/wp-content/uploads/2024/05/Report-Dialogue-on-Climate-risk-and-adaptations-MFIs-NBFCs-Dialogue-2.pdf

[13] https://fidcindia.org.in/wp-content/uploads/2023/11/MFIN-INDIA-MICROFINANCE-REVIEW-2022-23-09-11-23.pdf

[14] https://agri3.com/opportunity-analysis-for-indian-mfis-to-support-climate-smart-agriculture/