Context

India’s energy demand has grown in sync with its rapid development, which has caught steam since liberalization. The country is largely dependent upon fossil fuels (primarily domestic and imported coal) for meeting its energy demands. Compared to other fossil fuels, the availability of coal is higher, accounting for 55% of the country’s energy demand. The availability of this natural resource has led to the creation of power generation infrastructure predominantly primed to absorb and transmit such power to regions where there is no indigenous production of power. Over the past five decades, expansion of coal-based power capacity has enabled India to secure significant energy independence.

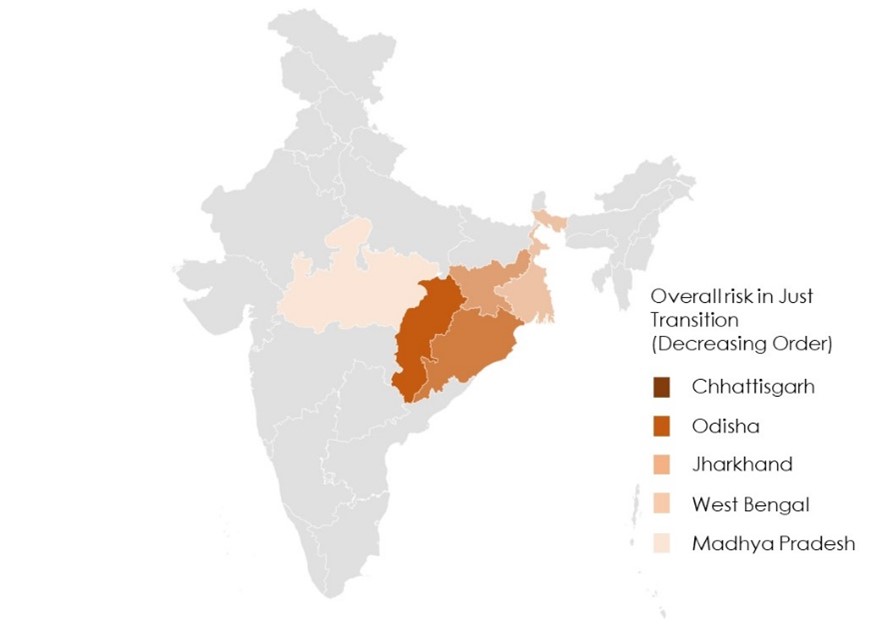

Extraction and mining are concentrated in a few mineral-rich states of India, with 85% of production concentrated in five eastern states: Chhattisgarh, Jharkhand, Madhya Pradesh, Odisha, and West Bengal. Fossil power production has also been generally preferred in these states to cut transportation costs as its cost-effective and efficient to transmit electricity instead of the fuel resource to consumption centers. Coincidentally, these are also the states that are the most economically impoverished, with limited additional economic drivers. As a result, the economy of these states is heavily reliant on fossil fuels for generating revenue, ensuring employment, and financing social programs.

Going forward, India has committed to Net Zero ambitions by 2070 which would require India’s energy mix to shift from fossil fuels to greener sources of energy. This will put the states that are at the forefront of India’s fossil fuel production in a vulnerable position. The energy transition risk will impact them critically in comparison to any other Indian state, leading to wider socioeconomic ramifications. In this scenario, securing a “Just Transition” for these five states is needed to minimize the impacts on all stakeholders associated with the mining and utilization of India’s domestic fossil fuel resources.

This blog presents a primary risk assessment, in the form of a composite index, spotlighting the vulnerabilities of the five states and their inherent dependence on mining and the use of fossil fuels. This blog is structured into three parts: briefly describing the key parameters of the composite vulnerability index, the results of the assessment, and the way forward.

Designing Vulnerability Index

Vulnerability Assessment acts as a steppingstone to identify states facing potential transition risks and thereby help focus efforts on facilitating Just Transition in such states. CPI has undertaken a vulnerability assessment of Indian states on the basis of their standing on multiple parameters indicating the possible implications of the energy transition on the socioeconomic parameters of these states.

In the first step, we used (i) fossil fuel production ranking and (ii) share of fossil power in power production capacity mix as a basis for identifying the transition vulnerability of Indian states. Using this basis, the five states we identified for Vulnerability Assessment are: Chhattisgarh, Jharkhand, Madhya Pradesh, Odisha and West Bengal.

In the second step, these five states were assessed on key parameters and bucketed into five dimensions: fiscal and economic position, physical climate risk, socioeconomic implications, diversification options, and political economy.

| S.No | Bucket | Key Parameters | Rationale |

| 1 | Losses – Fiscal and Economic | Share of cess, royalties, goods and services tax (GST), and other levies coming from fossil fuel mining companies in state’s tax and non-tax revenues | Energy Transition will impact states’ tax and non-tax revenues coming from fossil fuel mining companies. Higher dependency means the state is more vulnerable |

| Revenues from electricity duties and other charges from power generation businesses in the state’s tax and non-tax revenues | Energy Transition will impact revenue generated by states from fossil power plants | ||

| The total value of fossil power plant assets at risk | Energy Transition will impact investments locked in fossil fuel power plants | ||

| 2 | Physical – Vulnerability to Climate Risks | Vulnerability to physical climate risks | States’ vulnerability to events like droughts, floods, and cyclones |

| Disaster Resilience Index (denoting disaster preparedness) | States’ preparedness in tackling physical risks of climate change | ||

| 3 | Socioeconomic – Implications of Energy Transition (Loss to communities) | Total direct employment in fossil fuel mining and the fossil sector as a share of the total population | Transitioning from traditional sources of energy to new sources of energy would directly impact employees. The employees would either need to be reskilled or compensated for job loss which will cost the state exchequer |

| Corporate social responsibility (CSR) funds spent in a state by NTPC and Coal India Limited (CIL) and subsidiaries | Companies working in the power sector value chain make a significant investment in community development, especially in mineral-rich states. This will be impacted in face of the Energy Transition | ||

| 4 | Diversification – Potential Options for States | Current dependence of the state on fossil fuels for power generation | Higher dependence of the state on fossil fuel for power generation will impact energy security in case of an Energy Transition |

| Total renewable energy (RE) potential of state compared to current fossil fuel-based power generation capacity | Higher RE potential will give comfort to the state in transitioning away from fossil fuels | ||

| Contribution of fossil fuel-independent sectors in Gross State Domestic Product (GSDP) (Agriculture, Banking, Services, Manufacturing, Construction) | Higher contribution of the fossil fuel-independent sector in GSDP will lead to a lower impact on state finances | ||

| 5 | Political Economy – Provisions or Governances in the state for Adaptions and Just Transitions. | Good Governance Index (GGI) | GGI measures state capacity to deliver public services. A better GGI score indicates a state’s strength in delivering services required for Just Transition |

| State Finances: Fiscal deficit (FD)/GSDP (8-year average, 2012-2020) | A stronger fiscal position will provide flexibility to states in managing the costs of Just Transition |

Key Findings

The analysis was initiated by collecting relevant data from publicly-available sources for the parameters mentioned in the previous section.

Preliminary analysis shows that, currently, all the states assessed for this study remain vulnerable to the risk of fossil fuel being transitioned away in the future; most of them are concentrated in the eastern part of the country.

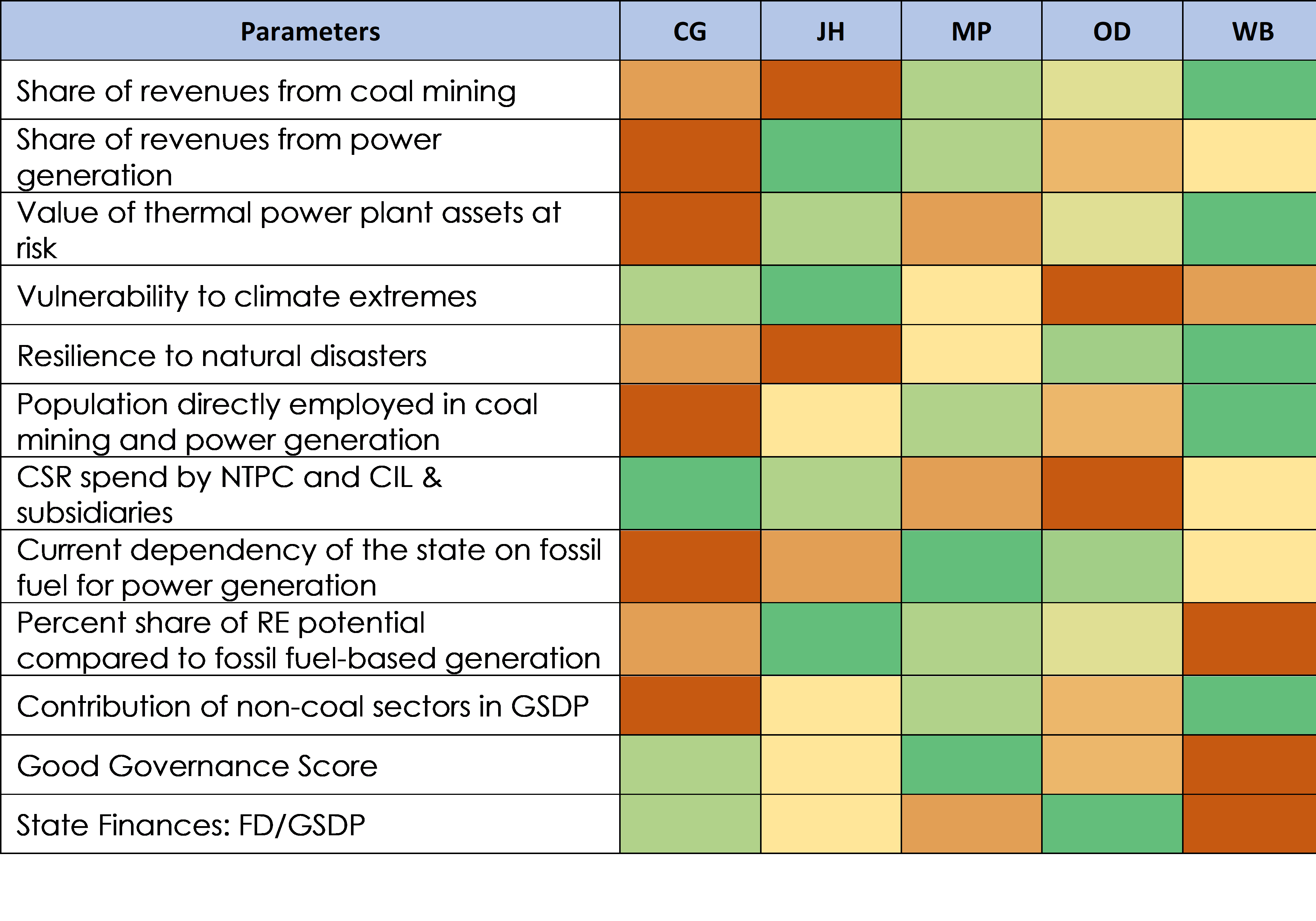

The table below captures standing of assessed states on each parameter.

CG – Chhattisgarh, JH – Jharkhand, MP- Madhya Pradesh, OD – Odisha – West Bengal

CG – Chhattisgarh, JH – Jharkhand, MP- Madhya Pradesh, OD – Odisha – West BengalChhattisgarh – Chhattisgarh emerges as the most vulnerable state with a significant share of its revenue coming from mining fossil fuel and fossil power generating capacities. Even though it is one of the least vulnerable states to physical climate risks, it has very limited resilience to natural disasters. It also has the maximum proportion of the population directly employed in fossil fuel mining. It has substantial fossil power capacity and lower than required RE potential to replace it which impacts the future energy security of the state.

Odisha – Odisha is the second most vulnerable state on the list. Being a coastal state, it is highly vulnerable to physical climate risk. It also corners the highest CSR spend from public sector undertakings (PSUs) in fossil power generation and fossil fuel mining vis-à-vis other states. The state does have a significant RE potential and is in a position to replace its existing fossil plants without impacting energy security.

Jharkhand – Jharkhand is heavily dependent upon fossil fuel mining for its state revenue with more than a quarter of its revenue coming from fossil fuel mining alone. The state does have RE potential to replace its existing fossil power plants however the ability of state finances to support the same is limited as state finances are stretched with an average fiscal deficit on the higher side compared to other states.

West Bengal – West Bengal is in a better position compared to other states with a more diversified economy having lower dependence on fossil fuel for revenue. However, the state has significant fossil power capacity and lower than required replaceable RE potential, thereby risking its energy security in case of transition. The state finances to are stretched with the fiscal deficit being the highest among all assessed states.

Madhya Pradesh – Madhya Pradesh commands a better position amongst all assessed states with less dependence on fossil fuels for revenue. However, the state does have significant investments in fossil power capacity translating into significant investment risk arising from the phase-down of these plants.

Way Forward

This analysis is a step towards initiating a conversation about enabling Just Transition pathways. The energy transition could result in losses of tax and non-tax revenue from the fossil fuel-dependent sectors and could also put an additional burden on states to accommodate the workers and communities affected by this transition in the form of job loss compensations and reskilling costs. This could result in a sharp decline of public funds available for other socio-economic and developmental priorities.

Therefore, to cope with this unforeseen financial pressure, states would require alternate sources of finance, which may be in the form of transition assistance finance (TAF). TAF could be delivered to stakeholders through fiscal policies, the use of existing – or the designing of new – financial, de-risking mechanisms that tap into international and domestic development finance and most notably carbon finance.

With this vision, CPI is working towards designing a Just Transition Finance Facility (JTFF). This JTFF would be a multi-stakeholder effort that would mobilize development finance for the delivery of transition-related assistance to vulnerable states.

To ensure effective delivery to the right stakeholders, the next part of this assessment would be an in-depth, state-wise analysis of vulnerability, a cross-sectoral assessment of the need for transition assistance finance for the impacted states, and development of financing mechanisms to unlock flows of international and domestic development and carbon finance to address transition impacts.

(Call to action: This will require input from multiple stakeholders, so the authors encourage feedback. To learn more about CPI’s Just Transition program, including our work specific to the India power sector, please contact anup.samal@cpiglobal.org, tariq.Habib@cpiglobal.org and saarthak.khurana@cpiglobal.org)