Africa faces the challenge of providing electricity to 600 million people. Most sub-Saharan Africans without power live in remote areas. Mini-grids, small-scale systems that can operate without being connected to a centralized grid, represent an opportunity to provide clean energy access without the challenges of standard grid electrification. According to the IEA, about 40% of all new electricity connections until 2030 could be delivered economically through mini-grids – requiring installation of 4000 – 8000 mini-grids a year in 25 years.

However, private investment in the mini-grid market is limited. Mini-grid customer demand is difficult to predict and rural customers often lack credit histories. This makes it difficult to assess the revenue-generating potential of a mini-grid project – and therefore its bankability. As a result of this revenue risk barrier, mini-grids are overwhelmingly financed with grants and equity and some limited concessional debt.

GATE aims to increase clean energy access in sub-Saharan Africa, through unlocking private investment for mini-grids. It guarantees a baseline level of revenues to address revenue risk, a key barrier to private sector finance.

INNOVATION

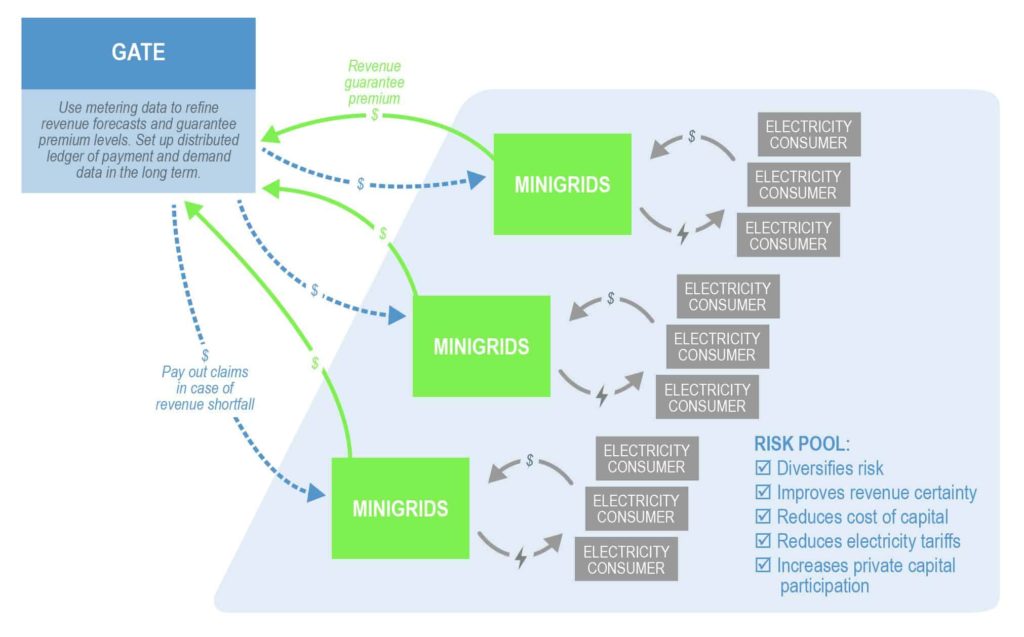

The Green Aggregation Tech Enterprise (GATE) addresses revenue risk, a key obstacle to private investment in and the subsequent scale-up of the mini-grid market. GATE guarantees mini-grids a baseline level of revenues. This baseline revenue guarantee ensures that mini-grids can meet debt obligations in the event of revenue shortfalls.

GATE’s market development support is non-distortive and promotes an efficient risk-reward structure. No other products in this market target the key barrier of revenue risk.

GATE has the potential to unlock private finance and enable the deployment of thousands of mini-grids to deliver energy access to millions of people in sub-Saharan Africa.

IMPACT

GATE transforms mini-grid finances, enabling project debt leverage of 70% and equity returns of 20%. In GATE’s pilot phase (2018 – 2023), GATE will enable 60,000 electricity connections.

GATE targets an enormous market in its pilot markets Kenya, Nigeria and Zambia: by 2023, the market potential in these countries is:

27 million electricity connections for households and businesses, a US$ 5.7 billion market value, and 11.71 million tons CO2 abatement annually

DESIGN

GATE creates a guarantee business that effectively pools mini-grid revenue risk. With GATE, mini-grids pay a premium to gain a guaranteed minimum revenue stream:

• The mini-grid agrees to a periodic revenue threshold with GATE, over a fixed time.

• The mini-grid pays a regular premium to GATE for each period covered.

• In the event that revenue falls below the threshold, GATE pays out the difference.

This means that mini-grids can meet their debt obligations in the event of revenue shortfalls. This can transform the financing of mini-grids: from donor grants to debt finance.

GATE provides its product to a diverse portfolio of mini-grids, across different locations and customer bases to pool the risks that face individual mini-grids. This enables GATE to price these risks more effectively than individual investors. In addition, data that GATE gathers from mini-grid customers enables more accurate risk pricing. This design enables GATE to achieve financial sustainability and deliver attractive returns to private investors.