A new financing mechanism developed by CPI/PUC-RIO could boost the role of forests in the global climate agenda.

One month ahead of COP30, the “Forest COP”, Climate Policy Initiative/PUC-RIO (CPI/PUC-RIO) has released a new report with a clear message: tropical forests must be at the center of climate strategies. Researchers propose an unprecedented financing mechanism, the Reversing Deforestation Mechanism (RDM), to drive large-scale forest restoration and transform the role of forests in the climate agenda. The RDM could generate up to US$ 100 billion in annual global revenue for countries with tropical forests.

The report was conducted at the request of COP30 President, Ambassador André Corrêa do Lago, who convened a council of economists to provide insights into the economic dimensions of COP30, including contributions to the ‘Baku to Belém Roadmap to 1.3T’ and to the COP30 Action Agenda.

“Forests are not only vulnerable to climate change, they are indispensable assets in the fight against it. Global efforts to mitigate climate change have been insufficient. Global emissions continue to rise, and even if current NDCs are fully implemented, the planet is still on track for a temperature increase of 2.6°C to 2.8°C. In other words, expanding carbon removal from the atmosphere is becoming an even greater priority, and tropical forests offer one of the most powerful tools available,” explains Juliano Assunção, executive director of CPI/PUC-Rio.

To develop the mechanism, researchers at CPI/PUC-RIO examined the tropical forests in 91 countries, analyzing deforestation trends, forest cover, and restoration opportunities in each country. Together, these countries hold 1.27 billion hectares of tropical forests and store 593 GtCO2, approximately one-third of the world’s historical emissions.

However, over the past decade, these countries have lost more than 10 million ha per year due to deforestation. According to Assunção, this reveals not only the vulnerability of these areas, but also an unparalleled opportunity: restoring areas deforested since 2001 could recapture up to 49 GtCO₂.

“We must act now to turn tropical forests into lasting climate assets. By delaying action, we risk losing this unique opportunity to ensure climate and ecological stability. Incentives created from consistent financial mechanisms ensure long-term political commitment, enabling forests to provide climate mitigation, biodiversity protection, and sustainable development at a scale that few solutions can match. RDM offers a financial opportunity for large-scale restoration of tropical ecosystems,” Assunção points out.

At a carbon price of US$ 50 per ton, RDM could generate revenue exceeding US$ 5,000 per hectare for more than 170 million hectares of forest. Forests restored under this scheme could remove up to 2 GtCO₂ per year globally in the first years of operation. At a value of US$50 per ton, that represents roughly US$ 100 billion in annual revenue.

In the Amazon, RDM would reverse the fate of the forest. Instead of emitting approximately 16 GtCO₂ over 30 years, the region could capture 18 GtCO₂ through large-scale natural regeneration. At a carbon price of US$ 50 per ton, which is much lower than the current market rate, this would yield about US$ 30 billion annually.

“The Amazon plays a significant role in achieving global climate goals, and climate finance can generate economic opportunities for a region that continues to face development challenges. When paired with carbon capture at a fair price, forest restoration becomes a more profitable land use for vast areas of low-productivity cattle ranching,” says Assunção.

How the mechanism works

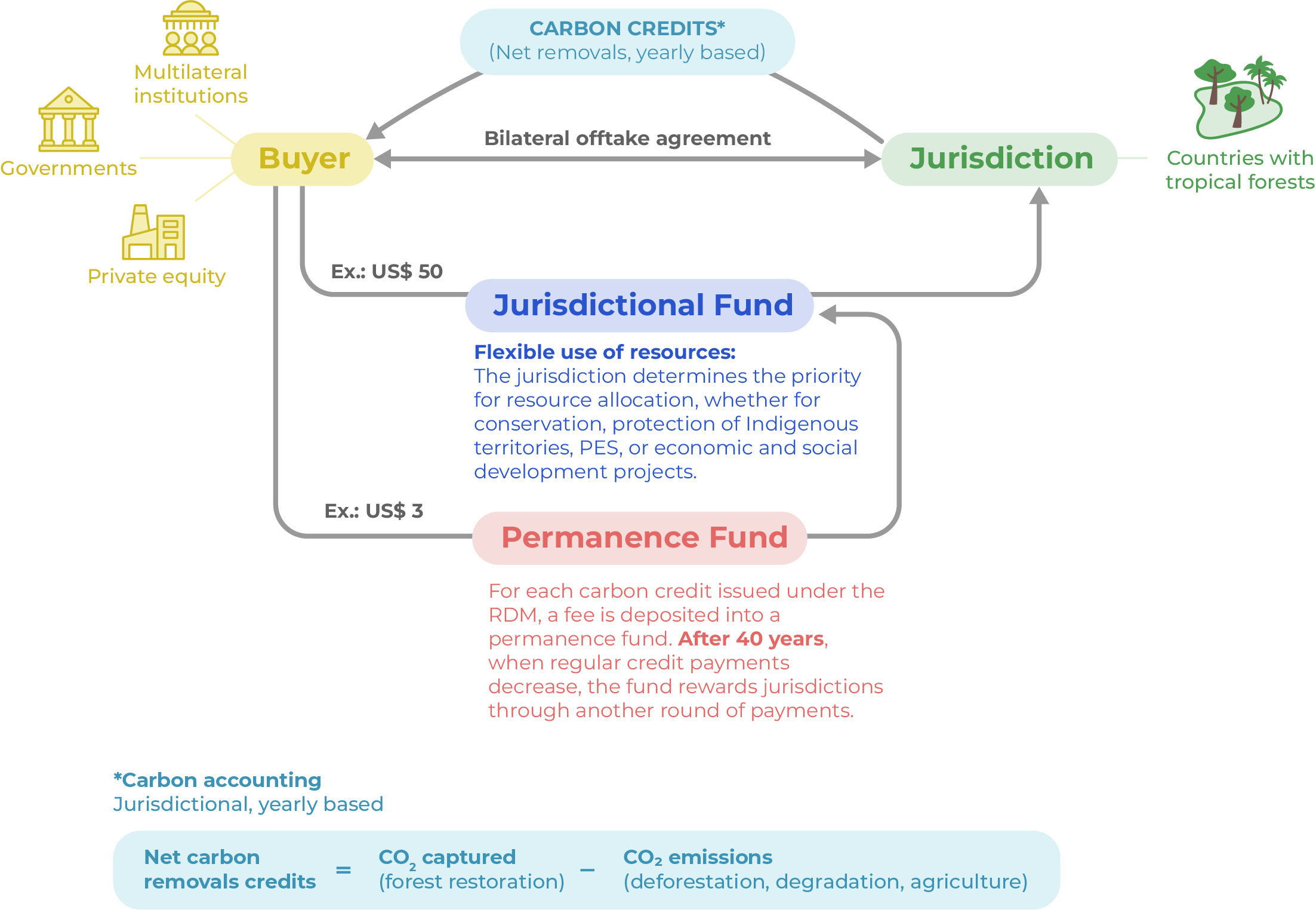

While existing mechanisms, such as jurisdictional REDD+ (JREDD+) and the Tropical Forests Forever Facility (TFFF), focus on halting deforestation and preserving standing forests, RDM addresses the current financing gap for large-scale restoration. The mechanism is designed to reward net carbon removals – that is, the amount of CO2 equivalent captured through forest restoration, subtracting emissions from deforestation, forest degradation, and agricultural activities.

RDM is structured as a bilateral agreement between a buyer (government, multilateral institution, or private institution) and a jurisdiction (a national or subnational government).

The mechanism provides results-based payments. Each year, the amount of carbon captured through restoration would be assessed, and payments would be managed through jurisdictional funds. The fund would be used for the prevention of deforestation and forest degradation, forest protection, and restoration. It would also generate resources available to promote socioeconomic development of affected populations.

RDM Implementation

Source: CPI/PUC-Rio, 2025

“RDM is designed to complement efforts with the JREDD+ and TFFF mechanisms in the fight against climate change. By linking climate finance directly to verified carbon results, RDM offers a scalable, transparent, and efficient pathway to transform tropical forests into high-impact climate assets,” comments Assunção.

Forest Finance Mechanisms: JREDD+, TFFF, and RDM

Source: CPI/PUC-Rio, 2025

Assunção explains that RDM is a fit-for-purpose financial solution that creates financial incentives for large-scale forest restoration, adapted to meet the different realities of tropical forests across the world.

“Tropical forests are one of the most powerful and underutilized tools in the fight against climate change. Large-scale restoration can turn millions of hectares of degraded land into climate assets, but this will only be possible if we mobilize robust, long-term financing. COP30 is an opportunity to consolidate a fit-for-purpose financial architecture, which can mobilize international resources commensurate with the potential of tropical forests on the climate agenda,” concludes Assunção.

Access the full report: bit.ly/Forest-Climate-Nexus

About Climate Policy Initiative

Climate Policy Initiative (CPI) is an organization with international expertise in finance and policy analysis. CPI has seven offices around the world. In Brazil, CPI has a partnership with the Pontifical Catholic University of Rio de Janeiro (PUC-RIO). CPI/PUC-RIO works to improve the effectiveness of public policies and sustainable finance in Brazil through evidence-based analysis and strategic partnerships with members of the government, civil society, the private sector and financial institutions.

For more information, please contact

Camila Calado Lima

camila.lima@cpiglobal.org

+55 86 99966-0560