CPI’s 2023 Impact Report

Bridging between climate ambition and action

CPI was purpose-built to create clarity and guidance around complex finance and policy questions with no obvious answers.

We are proud to present CPI’s 2023 Impact Report, showcasing the highlights of our work last year.

Our work is quickly evolving to address new facets of the energy transition and climate change, from adaptation to zero-carbon buildings. CPI saw significant expansion of our sector- and country-specific work in 2023, meeting the growing urgency to create enabling environments and mobilize global finance that will implement climate action at scale.

Download the report

2023 at a Glance

In 2023, CPI grew across all programs, collaborating with over 300 organizations-governments, finance institutions, the private sector, academia, and civil society-on vital climate

Active projects

80+

Publications

300+

Events and speaking engagements

150+

Global team members

50%

Of staff are in emerging economies

95%

Of analytical staff hold advanced degrees

60%

Of senior leadership are women

Our Impact and Reach

CPI’s 2023 work influenced policy, legislation, and finance mobilization at international, national, state, and subnational levels. We continued our active engagement with G20 presidencies, provided sought-after guidance on international finance architecture reform, conducted training on sustainable finance for government and private-sector leaders, and launched new programs to mobilize finance in agriculture, and rural renewable energy.

Image: Financial leaders gather for CPI’s annual San Giorgio Group meeting in Venice, Italy

To address the urgency and complexity of the current climate finance and policy landscape, we need to significantly expand collaboration. CPI’s reputation for solid evidence and objectivity creates an environment of trust that brings together diverse actors committed to taking action.

UN Special Envoy on Financing the 2030 Sustainable Development Agenda

USD 70 tn

Assets Under Management (AUM) of financial sector organizations actively engaged in CPI's work

USD 4.4 bn

mobilized for climate action through CPI-led programs

960,000+

website views

165,000+

social media followers

650+

media mentions

Approach to systems-level change

Since our founding in 2009, CPI has remained grounded in our core principles of helping governments, businesses, and investors to address climate change while seizing opportunities for equitable and sustainable economic development.

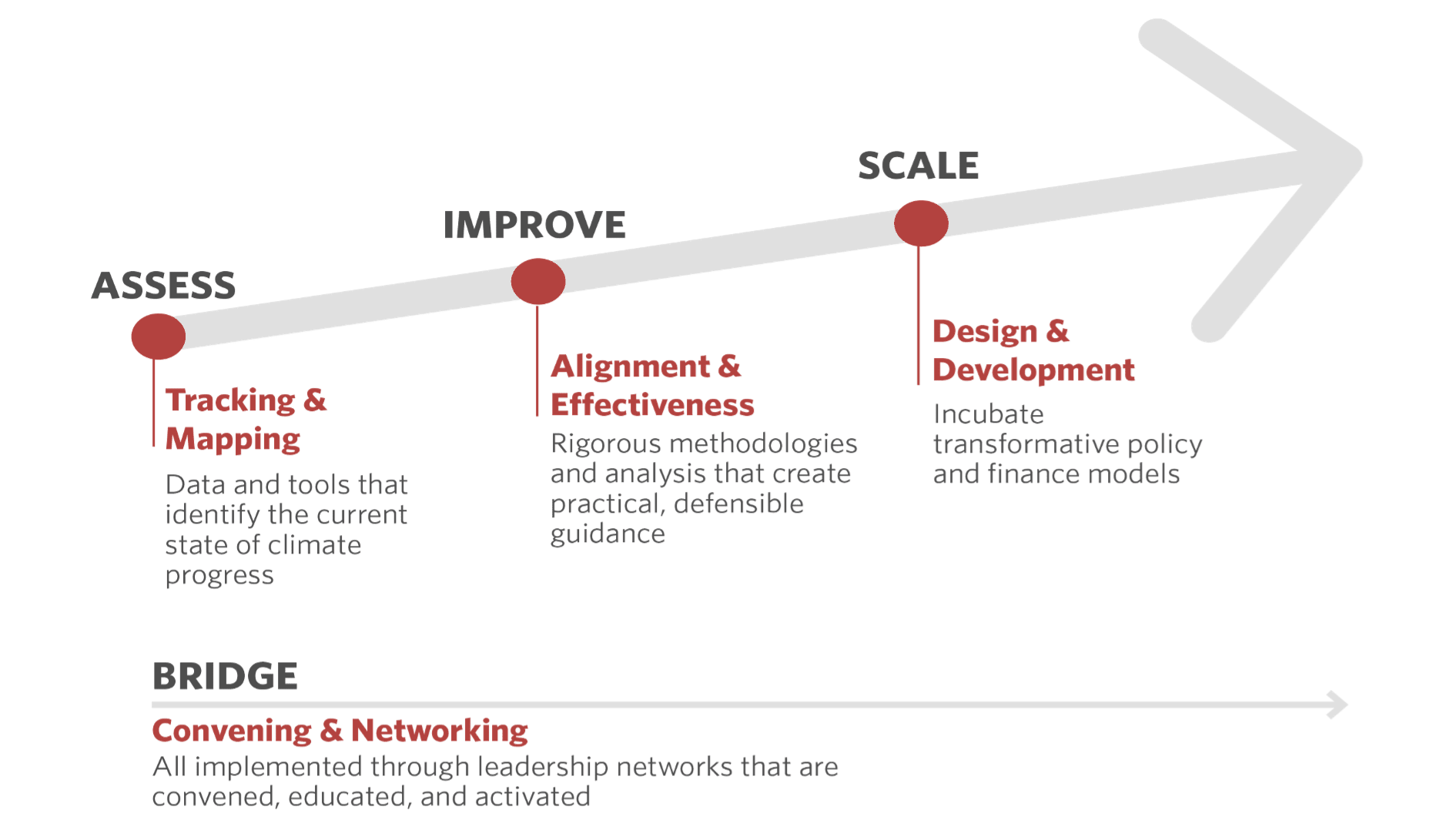

Our strategy of assessing climate action and supporting its scale spans across all CPI programs. In 2023, we increased the scope and sophistication of our four work pillars—“Assess”, “Improve”, “Scale”, and “Bridge”—reflecting our reputation for research rigor, practical guidance, and the ability to break down silos and bring disparate actors together to create systems-level change.

We applied the above framework across the following sectors and agendas in 2023:

- Climate finance tracking

- Climate finance effectiveness

- Climate finance innovation

- Adaptation and resilience

- Cities and infrastructure

- Conservation and AFOLU

- Energy

- Just transition

Our 2023 Impact Report gives an overview of how our work is helping governments, businesses, and investors to bridge between goals and ambition to meaningful and effective action.

Download the full report