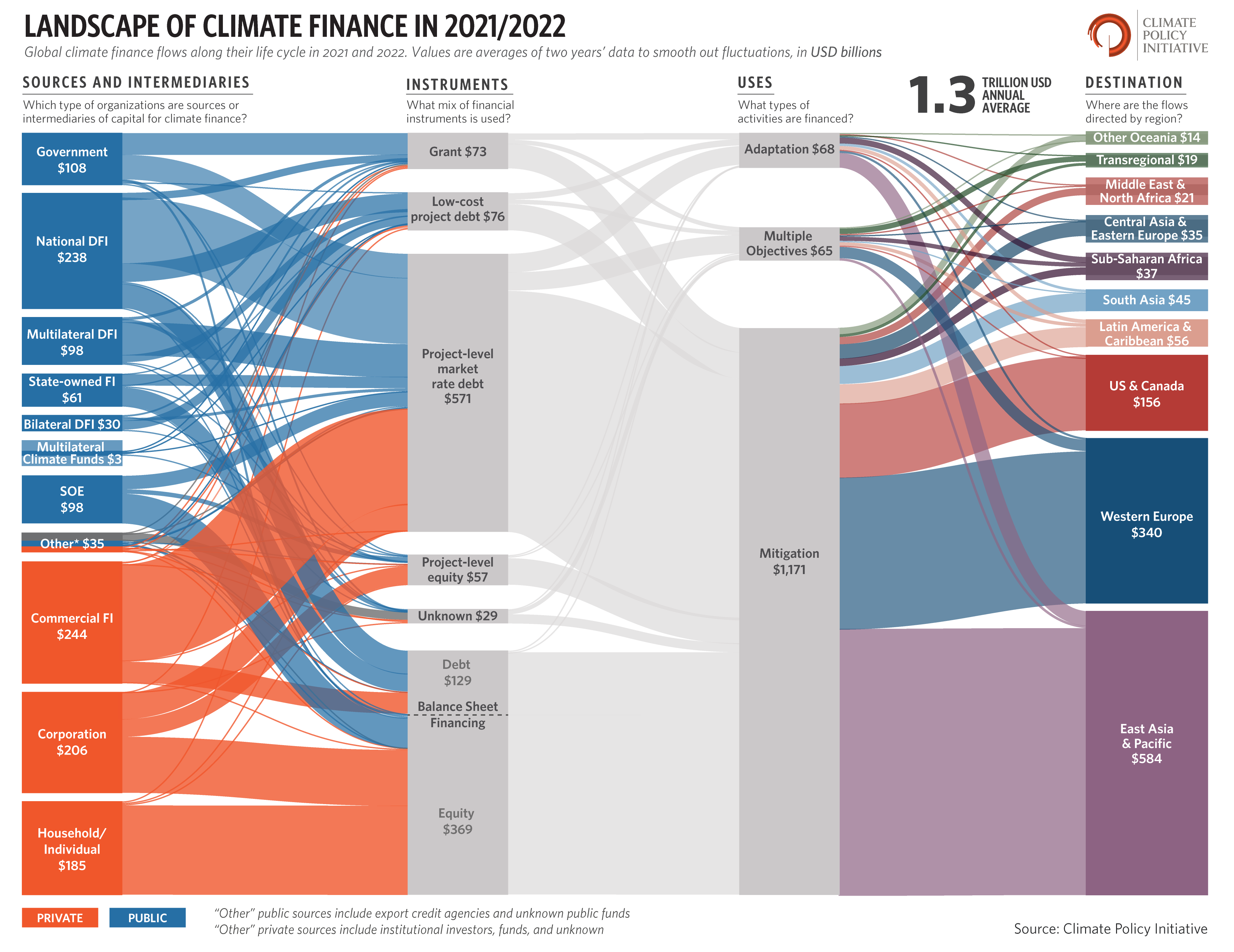

CPI’s Climate Finance Tracking Program provides the most comprehensive data and insights into finance flows supporting climate change mitigation and adaptation outcomes.

With time running out to close the climate investment gap, decision-makers require clear, comprehensive information on climate mitigation and adaptation finance. CPI’s unique analysis covers both public and private finance data, translating it into concise reporting and interactive data visualizations. Our research provides a baseline against which to measure progress towards levels of investment consistent with global climate goals.

Our work aims to provide governments, climate funds, development finance institutions, philanthropies, and private investors with accurate data on the current scale, sources, instruments, and uses of climate finance.

Flows

What is the current state of global climate finance?

Presenting the most comprehensive data available on global climate finance flows, including granular data by source, financial instrument, region, use, and sector.

Needs

How far are we to closing the climate investment gap?

Using both bottom-up and top-down analyses to understand the finance required by region, sector, and type of capital, and examining the roles of public and private investment in closing the climate finance gap.

Impact

What should be prioritized to improve impact and outcomes?

Creating frameworks and assessing historical data to understand the effectiveness and efficiency of climate-aligned and unaligned finance.

Featured Work

Global Landscape of Climate Finance 2024

The most comprehensive assessment of global climate finance flows, drawing on numerous data sources and updated annually since 2012. Our latest edition shows that while annual climate finance reached almost USD 1.5 trillion in 2022, it needs to increase at least fivefold by 2030 to meet the goals of the Paris Agreement and to avoid the worst consequences of climate change.

Read Publication

Ensuring the quality of our work

Data Science

Methodology

Convening and dissemination

Climate Finance by Sector

We use our unique data set and methodological expertise throughout our growing body of sector-specific and thematic work. Our sectoral and thematic areas of analysis include assessing the scale of climate finance, identifying the main actors, and revealing investment gaps. We also highlight opportunities to mobilize finance that address climate goals and create positive economic impacts. Our sectoral climate finance tracking work covers a wide range of topics, including comprehensive analyses of:

- Climate finance for agrifood systems globally

- Financial commitments flowing to energy access in high-impact countries

- Methane abatement finance

CPI has also published innovative methods to better measure finance for climate adaptation.

Climate Finance by Geography

Understanding domestic flows of finance can help governments identify finance gaps, prioritize efforts to better align with climate goals, and unlock the private investment needed for green, resilient development.

Our tracking work supports these efforts by providing robust analyses of how much climate finance is flowing at regional, national, and subnational levels. We also work directly with governments to identify the enabling conditions that can help drive investment to support low-carbon, climate-resilient growth.

Impact and Highlights from CPI’s Climate Finance Tracking Program

Our 2022 Highlights and Impact Report outlines the impact and key milestones achieved by our climate finance tracking program in 2022 and beyond. It also highlights our contribution in advancing data-driven analysis, influencing climate finance policy, and amplifying knowledge.

Read report

Publications

Publicação

Understanding the Quality of Climate Finance

As public resources face growing pressure, understanding not just climate finance flows but also how well they are delivered—is critical. This report offers a framework for assessing the quality of public climate finance, with clear pathways to deliver sustained, transformational change at the project, market, and system levels in EMDEs and beyond.

Publicação

Scaling Up Green Guarantees: Recommendations by the Green Guarantee Group

Despite record growth in global climate investment, the finance gap remains vast, especially in emerging markets and developing economies. Guarantees are among the most effective tools to mobilize private capital for climate action but remain underused. This report by the Green Guarantee Group offers clear, practical recommendations to scale their deployment where they are needed most.

Publicação

Global Landscape of Climate Finance 2025

The Global Landscape of Climate Finance offers the most comprehensive overview of global climate finance flows, providing crucial insights into the resources dedicated to addressing climate change.

Equipe

Please get in touch at adminlondon@cpiglobal.org if you would like to learn more or support our research.

Many climate finance tracking challenges remain. By providing ever more comprehensive and comparable data, CPI will continue to help decision-makers make optimal use of their resources.