In order to meet rapidly growing electricity demand, the Government of India has set an ambitious target of installing 40 GW of rooftop solar power by 2022. This is a significant increase from the 0.7 GW of installed capacity at the end of March 2016. The Indian rooftop solar power industry has grown steadily in recent years, due to the declining cost of installation and favorable government policies. However, the growth rate remains slower than what will be required to achieve India’s 40 GW rooftop solar target.

There are three key barriers to the growth of rooftop solar power in India: the high upfront costs of installation, low access to debt finance, and perceived performance risk. Commercial and industrial consumers are reluctant to invest the high upfront amount required to install rooftop solar capacity – for instance, the size of a typical rooftop solar installation for commercial and industrial customers is around 150-200 KW, costing more than INR 10 million – especially given that it is a non-core business activity. In addition, banks are reluctant to lend to rooftop solar projects because there are high perceived risks and limited information on the performance and track records of rooftop solar investments. And finally, because rooftop solar power is a relatively new technology in India, many potential customers are concerned with performance risk, a perception that the technology may not perform as expected over its lifetime.

In order to expand the rooftop solar industry in India, there is a need to develop policy solutions, business models, and financing instruments which can address these barriers. One promising solution to manage these barriers is the third party financing model. Globally, the third party financing model for rooftop solar power has been a significant driver of growth in the rooftop solar industry.

Under the third party financing model, consumers buy electricity from a developer, who installs, owns, and operates a rooftop solar plant on the consumer’s property. The developer then sells the power to the consumer under a long-term power purchase agreement at a specified price during the contract term, typically for 15 to 25 years. The success of the third party financing model hinges on the fact that developers are in a better position to manage the financing challenges and performance risk of rooftop solar power – and the model shifts these responsibilities from the consumer to the developer.

Currently in India, the third party financing model supports around 102 MW, or 13%, of total rooftop solar installations. The industry believes that there is potential to increase the total installed capacity under the third party financing model to more than 20 GW by 2022, meaning that this model has the potential to achieve more than half of the government’s 40 GW target.

However, the third party financing model would first need to overcome certain challenges. In order to expand the use of third party financing and support more rooftop solar installations, it is important to understand the driving factors for adoption of the third party financing model and the challenges to its adoption. This report explores the driving factors and challenges to the third party financing model, and proposes a series of recommendations for policy changes and financial instruments which could address these challenges.

Consumers of rooftop solar power are divided into three segments: industrial, commercial, and residential. Rooftop solar power has not expanded much into the residential segment, due to its low profitability and high transaction costs. It will be more feasible for the residential segment by around 2020, when the segment is expected to achieve grid parity, which is when the cost of rooftop solar power becomes equal to grid electricity. Because of this, our analysis of the third party financing model primarily focuses on the industrial and commercial segments, which are more viable in the next three to four years.

Our analysis demonstrates that the third party financing model is financially viable in most states, in presence of current government fiscal incentives, for the commercial and industrial segments. In fact, it is financially viable in the majority of states even without government fiscal incentives, because the majority of states have already achieved grid parity.

The key driver for the adoption of the third party financing model is its ability to remove the high upfront installation costs and perceived performance risk for consumers. In addition, savings in the cost of electricity is another major driver for the third party financing model. However, in order for the model to expand, several challenges to the third party financing model need to be addressed.

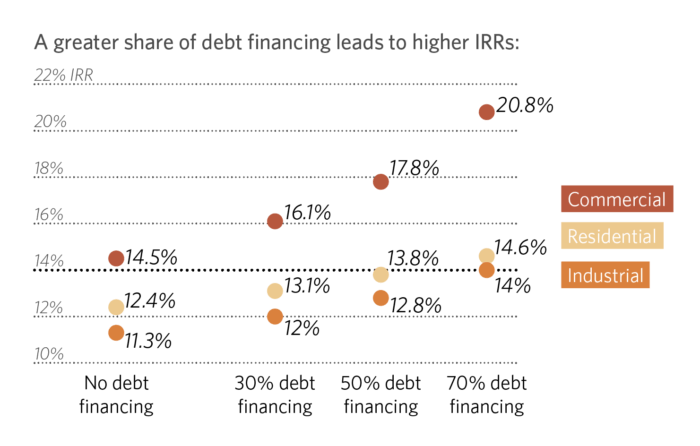

Limited access to debt finance remains the most significant challenge to the third party financing model. Since the rooftop solar sector is new and transaction costs are high (due to smaller projects), banks don’t yet feel comfortable in lending to projects. Due to limited access to debt finance, the third party financing model has been mostly driven by equity finance in India, which has limited potential for scale in the way it is currently used.

Consumer credit risk is the second biggest challenge to the third party financing model. This is caused by several factors, including low availability of credit assessment procedures, low enforceability of agreements, and lengthy and costly legal processes in the case of a dispute or payment default.

Challenges in the implementation of net metering also pose a significant challenge. Net metering policies across the different states are not consistent and vary in terms of process, technology, and assigned responsibilities. In addition, implementation of net metering policy suffers from issues related to the state-level public electricity distribution companies (DISCOMs) who are responsible for implementing net metering. These issues include a lack of appropriate training for DISCOM officials on rooftop solar installation approvals and implementation, delayed approvals from DISCOMs for net metering installations, and lack of proper monitoring of DISCOMs’ implementation performance.

We have developed recommendations for policy changes and financial instruments which could address these challenges. We focus on the top ten most promising policy solutions, as well as three promising financial instruments. Government entities, industry players, financing agencies and other stakeholders will need to work together to implement these recommendations.

The key policy changes that we recommend are:

- First, to increase access to debt finance for rooftop solar, the Ministry of New and Renewable Energy (MNRE) can enable a training system for bankers on how to better assess loan applications for rooftop solar power.

- Second, to reduce consumer credit risk, MNRE and state governments can include DISCOMs as a party to the power purchase agreement between the developer and the consumer. In case a consumer defaults on bill payment, DISCOMs may terminate the consumer’s power supply from the grid, thereby ensuring that the consumer has a strong incentive to pay for the solar power on time. Also, the Ministry of Law and Justice can create local specialized courts to resolve consumer payment disputes, thereby ensuring that any default-related cases will be decided quickly.

- Third, to remove challenges in implementation of net metering, MNRE can offer rooftop solar power a higher Renewable Purchase Obligation (RPO) credit. This would incentivize DISCOMs to fulfill more of their RPO requirement through rooftop solar power, rather than other sources of renewable energy, since they would be able to fulfill more of their requirement by sourcing the same amount of power from rooftop solar power.

The key financial instruments that we recommend are:

- Loans4SME, under development with the India Innovation Lab for Green Finance, is a peer-to-peer lending platform that aims to catalyze debt investments by connecting debt investors directly with creditworthy small and medium enterprises (SMEs) in renewable energy.

- The Rooftop Solar Private Sector Financing Facility another instrument under development with the India Lab, could increase the availability of debt finance for rooftop solar installations. It involves two phases: aggregation of creditworthy solar rooftop projects, which can be funded through a warehouse line of credit, and securitization of the these loans through issuance of green bonds. Through this solution, the aggregate deal size would be large enough and of sufficient credit quality to attract more debt finance, and at a lower cost.

- A Rooftop Solar Investment Trust (RSIT) could also help increase the availability of equity for rooftop solar power in India. The trust would group rooftop installations into bundles of 1 to 5 MW in size, capitalized with a mix of equity and debt. It would then sell bundles of rooftop installations to investors looking for long-term cash flows from the underlying standardized leases.