Source: CPI Analysis

* The baseline cost is 12.8%, which is the average annual return of an “A” rated bond.

+ Actual cost reduction depends on the structure of the guarantee

~ We assume the developer avails an interest rate swap for foreign debt

# Based on baseline foreign debt cost of 13%

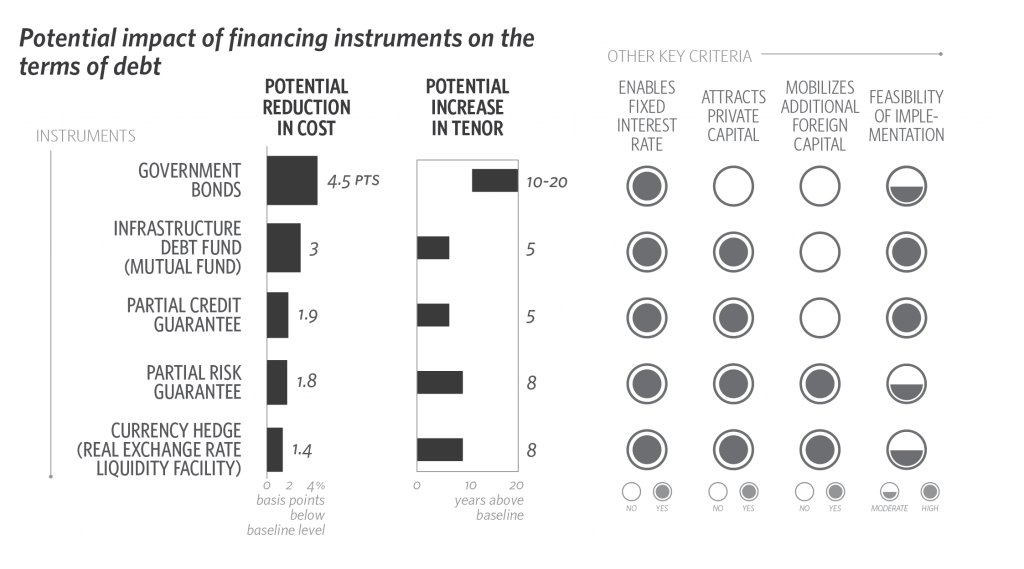

Since each of these instruments represents a different kind of debt, we estimated the reduction in cost of debt for each instrument based on the typical baseline cost applicable for that particular instrument. The potential benefits from each of the instruments are as follows:

- Government bonds: A direct government borrowing and lending program, compared with a typical domestic loan that is available at 12.3% for 10 years, would reduce the cost of debt by up to 4.5 percentage points and increase tenor by up to 10 years, ultimately decreasing the delivered cost of renewable energy by approximately 25%. However, a direct government borrowing and lending program may crowd out private financing if not designed carefully.

- Infrastructure debt funds (mutual funds): An infrastructure debt fund, compared with a typical domestic loan, would reduce the cost of debt by up to 3 percentage points and increase tenor by up to 5 years, which would reduce the delivered cost of renewable energy by approximately 14.5%.

- Partial credit guarantees: Partial credit guarantees reduce the cost of debt by enhancing the credit rating of a project. By using a partial credit guarantee, an A-rated bond at 12.8% can be enhanced to AA, reducing the cost of debt by up to 1.9 percentage points, which when combined with a tenor increase of 5 years compared to domestic debt would reduce the delivered cost of renewable energy by approximately 10.5%.

- Partial risk guarantee: Partial risk guarantees attract foreign funds by mitigating political risks. A partial risk guarantee, for a typical foreign loan at 13% for 10 years, could reduce the cost debt by up to 1.8 percentage points and extend the tenor by up to 10 years, ultimately decreasing the delivered cost of renewable energy by approximately 12.7%.

- Exchange rate liquidity facility: An exchange rate liquidity facility offers a standby lower-cost credit line to mitigate currency depreciation risk for project developers who access foreign loans.A liquidity facility, compared to a typical foreign loan at 13% for 10 years, would reduce the cost of debt by up to 1.4 percentage points and increase the tenor by up to 8 years, which would decrease the delivered cost of renewable energy by approximately 11.2%.

These instruments can potentially help mobilize domestic capital and foreign investment, while improving risk management. Ultimately, the selection of the most appropriate instrument(s) for solving India’s renewable energy financing challenge depends on policy priorities and implementation feasibility. The actual benefit derived from these instruments depends on their design and implementation. The government of India should coordinate with financial institutions and research organizations on the selection, development, and implementation of these financial instruments.

Depending on which instrument mixes seem most relevant to India, we recommend further analysis to examine the instruments in greater detail: for the direct government lending program, on the design of the program to identify checks and balances to limit crowding out private investment; for infrastructure debt funds, on how to increase effectiveness and suitability for renewable energy projects; for credit guarantee on project selection and cost of implementation; for risk guarantee, assessment of guarantee programs already implemented elsewhere in the world; and for exchange rate liquidity facilities, on feasible models for Indian conditions.