The financial system lies at the heart of a sustainable future, particularly in the wake of the COVID-19 pandemic. Financial actors, including governments, central banks and financial supervisors, development finance institutions, commercial banks, asset owners, asset managers, and insurers, must work together to create a financial ecosystem that accurately prices risk and rewards sustainability, thus supporting the move towards a sustainable, net zero future. As economies move from relief to recovery, extensive evidence suggests that meeting the Sustainable Development Goals and Paris Agreement objectives could bring widespread economic, health, and employment benefits, improve economic and financial stability, and reduce inequality.

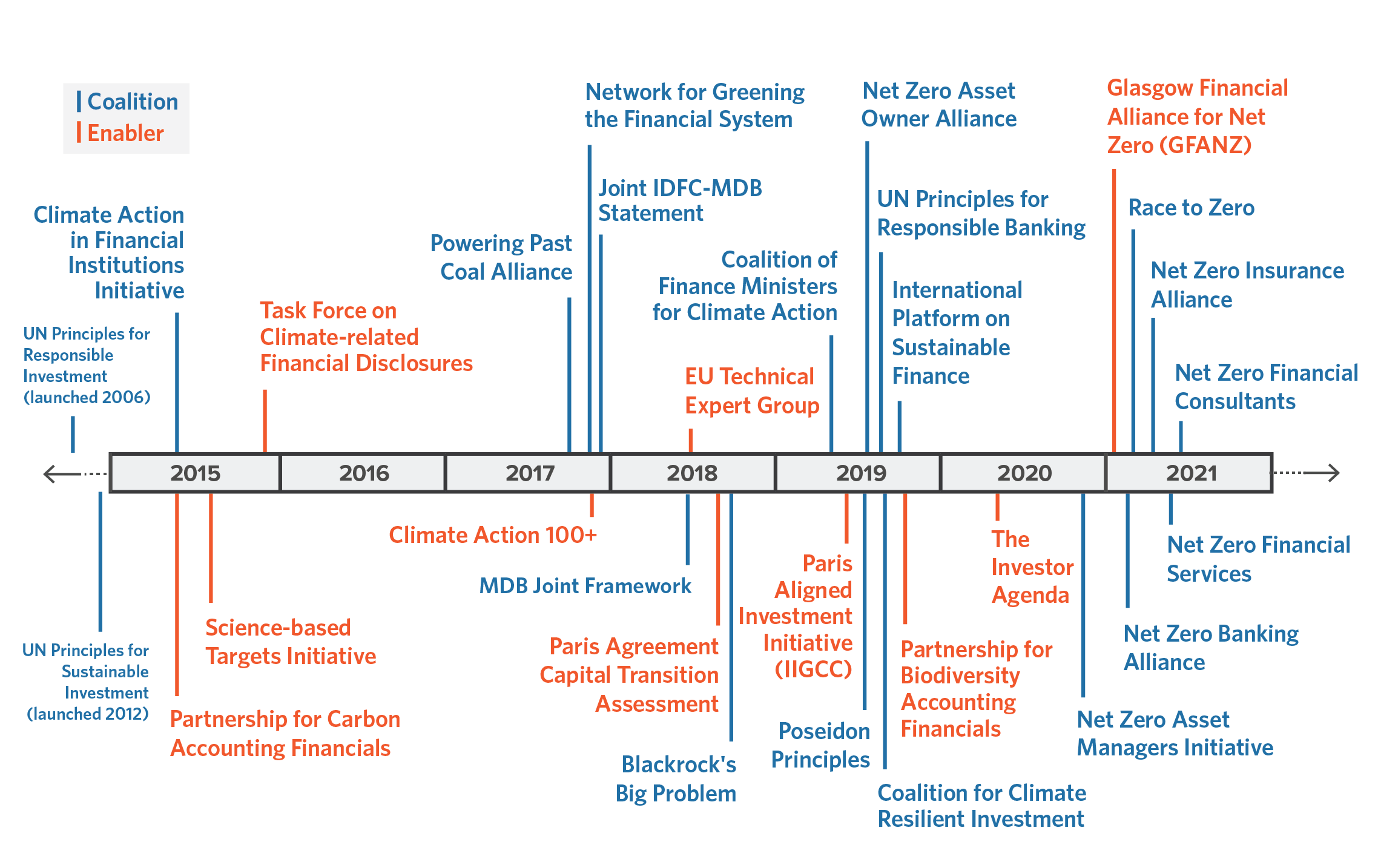

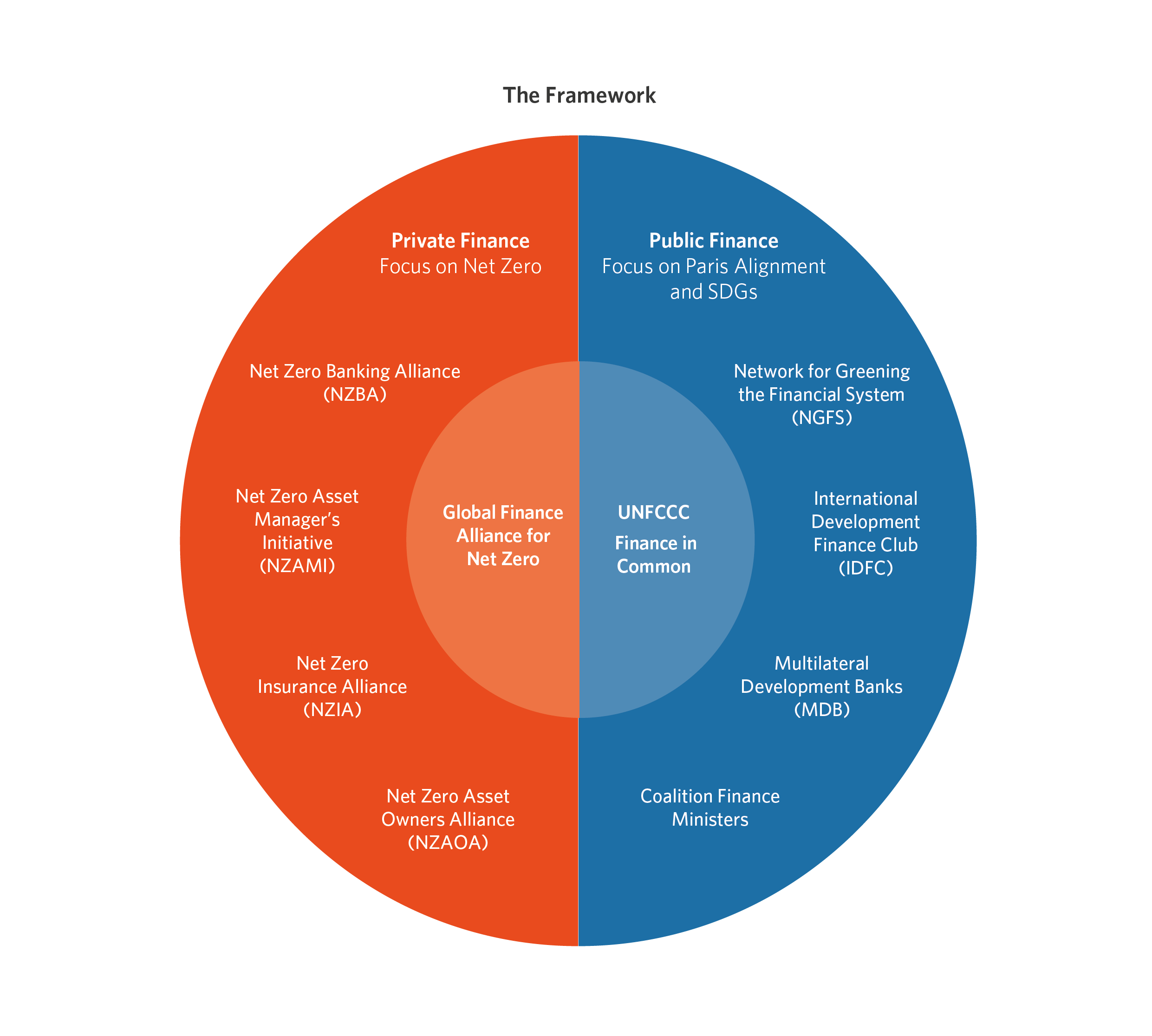

Financial actors have formed coalitions to promote sustainable finance (Figure 1), with many reaffirming commitments in the wake of COVID-19. These include public sector coalitions, such as the Coalition of Finance Ministers, the Network for Greening the Financial System (for central banks), the group of Multilateral Development Banks, and the International Development Finance Club, and private sector coalitions such as the Net Zero Asset Owners Alliance, the Net Zero Asset Managers Initiative, the Net Zero Banking Alliance, the Net Zero Insurance Alliance, the Net Zero Investment Consultants Initiative, and the Net Zero Financial Service Providers Alliance.

However, while many initiatives make commitments to align finance with the Paris Agreement and Sustainable Development Goals, important questions remain:

- How do we assess the integrity of commitments and track progress towards meeting them?

Increasing integrity and accountability can be positively reinforcing. Yet despite an accelerating pace of sustainability and net-zero pronouncements by a range of actors, there is no universally accepted framework of what robust commitments should include and against which to measure progress. There is also currently no organization that is tracking the progress of the financial system overall, nor analyzing the impact, separately or in aggregate, of the commitments. Similarly, the many institutions that have not made commitments are also not routinely identified and tracked. - How to coordinate across public and private financial actors to achieve systems-level results?

While the Glasgow Financial Alliance for Net Zero (GFANZ) initiative aims to be an overarching coalition umbrella for the private sector, there is currently no international forum that allows for the regular exchange of ideas and knowledge between the public and private sectors towards meaningful ambition. - How to incorporate commitments and ambition on intersecting social and environmental issues that affect our ability to reach climate change goals?

Addressing climate adaptation, biodiversity and nature, pollution, just transition, and the needs of developing countries will reinforce climate change goals, but to date no framework has brought together these issues.

This Framework for Sustainable Finance Integrity (“Framework”) therefore seeks to provide a universal set of sustainability guardrails across the financial system, to: encourage ambition to deliver meaningful sustainability and net zero results; contribute to a clear pathway for more coordinated action; create metrics against which to track progress; and reinforce the multiplier effect these actions will have on the real economy. This document describes the actions necessary across the financial system to deliver results and compares them to an analysis of the current leading practices on climate action. The document has been developed based on a rigorous, technical assessment of existing initiatives and the scientific literature.

The Framework is the first guide to define necessary action across the public and private financial sectors, providing a universal set of sustainability guardrails across the financial system.

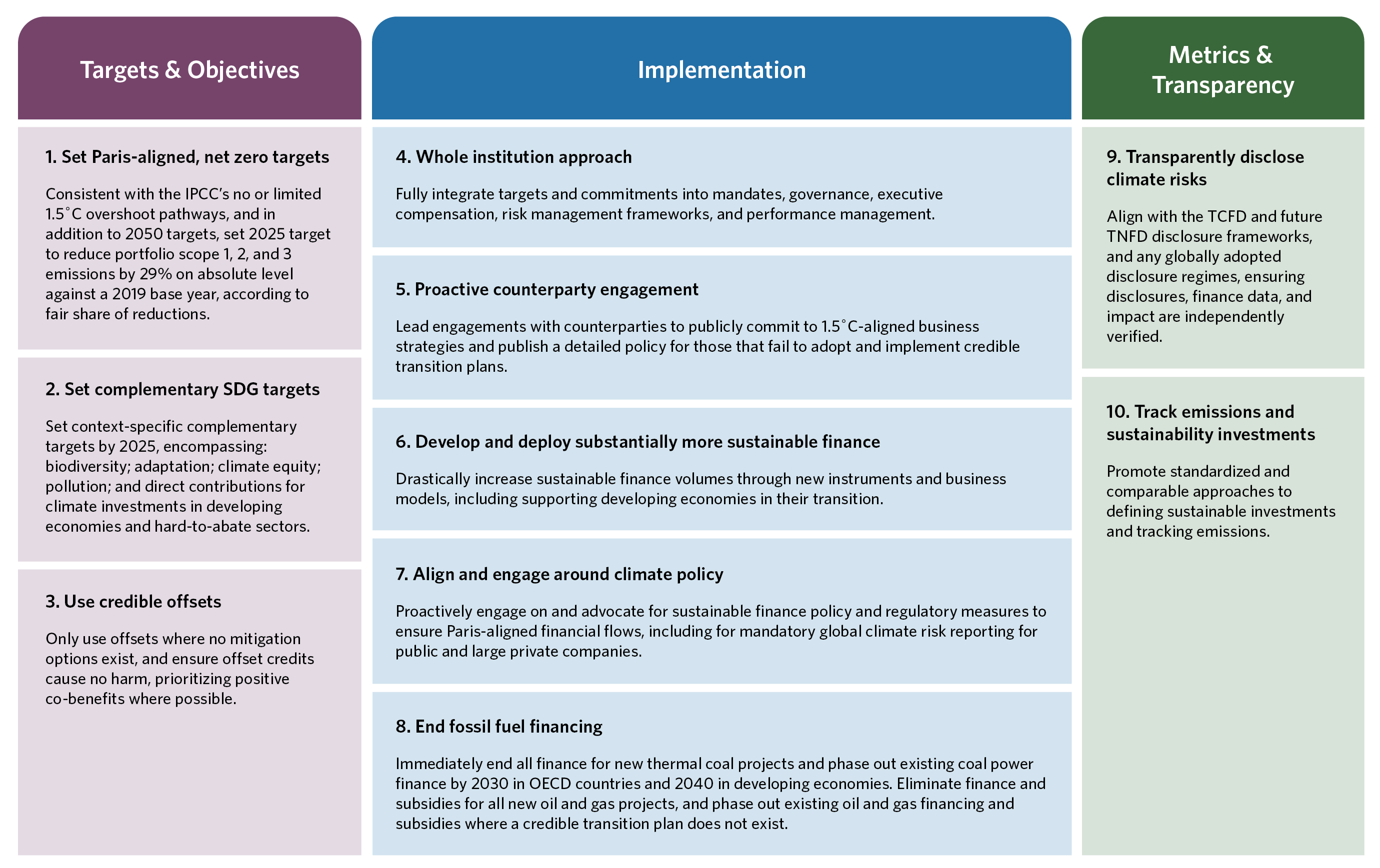

The Necessary Action metrics (Figure 3) have been developed to reflect scientific analysis. These metrics were developed through a review of current literature on climate science, net zero trajectories, and analysis undertaken by sectoral experts. As a result, the metrics are aligned with the level of ambition necessary to meet global climate and sustainability targets.

The metrics are defined in three categories:

- Targets and objectives: This category includes targets that financial sector actors set at the strategic level of institutions, encompassing targets that align with the Paris Agreement and Sustainable Development Goals, and/or reaching net zero emissions for both new investments and overall portfolios. It also covers more specific targets that would illustrate interim progress and help drive action in the near-term: for example, interim emissions targets, climate finance, and developing economy investment targets. While most financial sector targets to date have focused on climate mitigation, targets for pollution, adaptation and resilience finance, biodiversity conservation, and just transition are also considered in this category.

- Implementation: This category covers the measures that an institution would take to achieve its targets. It includes approaches to mainstream sustainability in its governance and operations, for example via mandates and strategies, decision-making processes and tools, investment products, performance management, and risk management. It includes actions taken on shareholder, client, and policy engagement, as well as the phase out of fossil fuel finance and implementation and scaling of new sustainable business models.

- Metrics and transparency: This category covers the development and adoption of metrics to track and report on performance both internally within the organization as well as externally, for example via climate- and nature-related disclosures, and to use that data to improve performance over time.

The full report also provides a detailed analysis of current coalition commitments. Each coalition has been assessed against the necessary action metrics, and observed to be either aligned with necessary action, making progress towards necessary action, partially aligned with necessary action, or not aligned with necessary action.

As coalitions and institutions continue to increase ambition in sustainable finance the analysis will continue to evolve. Through the report, the Framework not only provides a set of sustainability guardrails for financial institutions’ pledges but also serves as a tool to assess the comprehensiveness and ambition of these pledges. The report describes the actions necessary across the financial system to deliver results and highlights the gap between these necessary action metrics and current leading practices. This analysis has been developed based on a rigorous, technical assessment of existing initiatives and scientific literature.

CPI invites other organizations to contribute to this initiative to reinforce the importance of integrity in sustainable finance.