The expansion of the palm oil industry over the last decades has resulted in deforestation and other land use shifts across Indonesia (K.G. Austin et al., 2017). At the same time, palm oil is touted as a major economic driver and a source of welfare for smallholders. An estimated 40% of Indonesia’s total plantation area is managed by smallholder farmers involved in palm oil production, and this continues to grow as international demand rises[1].

The Berau regency in Eastern Kalimantan is a good example to understand this trend at the community level. A recent study from CPI (Mafira et al, 2019) shows that Berau’s economy is undergoing a shift from extractive industries, particularly coal mining, to agricultural production, with a particular focus on palm oil.

However, this upward trend in palm oil increases the dependence on one main commodity, putting Berau’s economy at risk, as was previously the case with coal (Mafira et al, 2019; Mafira, et al. 2018). It also poses as a conflict to Indonesia’s national and community goals with palm oil plantations potentially increasing deforestation, and consequently causing other harmful environmental impacts.

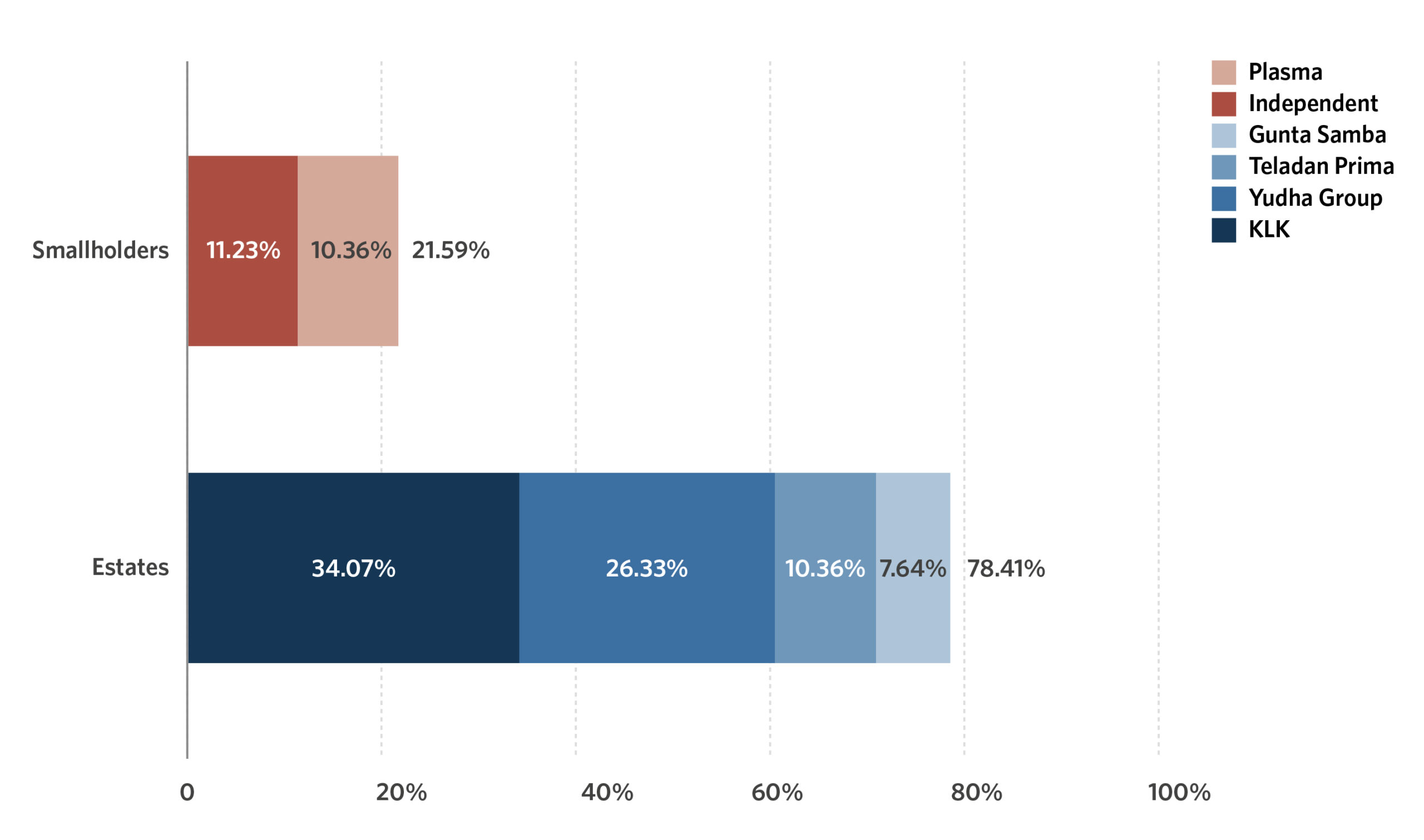

This trend is particularly striking for independent smallholders in Berau. Data shows that 21.23% of total palm oil land in Berau[2] is owned by independent smallholder farmers. While immature trees cover 47% of smallholder land, for private companies that figure is 2%[3]. This contributes to the lack of economic diversification with palm oil edging out other estate crops, leaving Berau exposed to price and demand risks.

Figure ES 1. Independent palm oil smallholders in Berau

In Berau, dependency on single estate crops like palm oil decimate food crops, affect livelihood, and increase food security risks. Moreover, we find that smallholders’ income from palm oil is not as significant as it may seem. Policy change is, therefore, required to improve the wellbeing of smallholders, in harmony with increasing the region’s economic resiliency and environmental protection goals.

This CPI study, produced as part of Project LEOPALD or Low Emissions Oil Palm Development, explores crop diversification opportunities to support independent smallholders in Berau for better long-term outcomes,[4] while outlining options to push Berau towards economic resilience and achieve its sustainability goals. It is replicable across regencies in Indonesia, especially those with similar attributes as Berau.

The key findings are as follows:

1. Palm oil has been a popular livelihood option among independent smallholders in Berau, but is insufficient to cover minimum living costs and creates risks

Berau’s central statistics show that estate crops, including palm oil, coconut, cocoa, pepper, rubber, and coffee, contributes to a major portion of Berau’s economy, and amounts to 84.7% of Berau’s total GDP. Palm oil has become an increasingly popular choice in Berau because it provides a recurring income and has relatively low labor needs. Berau’s central statistics also show that FFB (Fresh Fruit Bunches) production increased by 84% in 2018 YoY, alongside the increase in palm oil plantation area (BPS, 2019)[5].

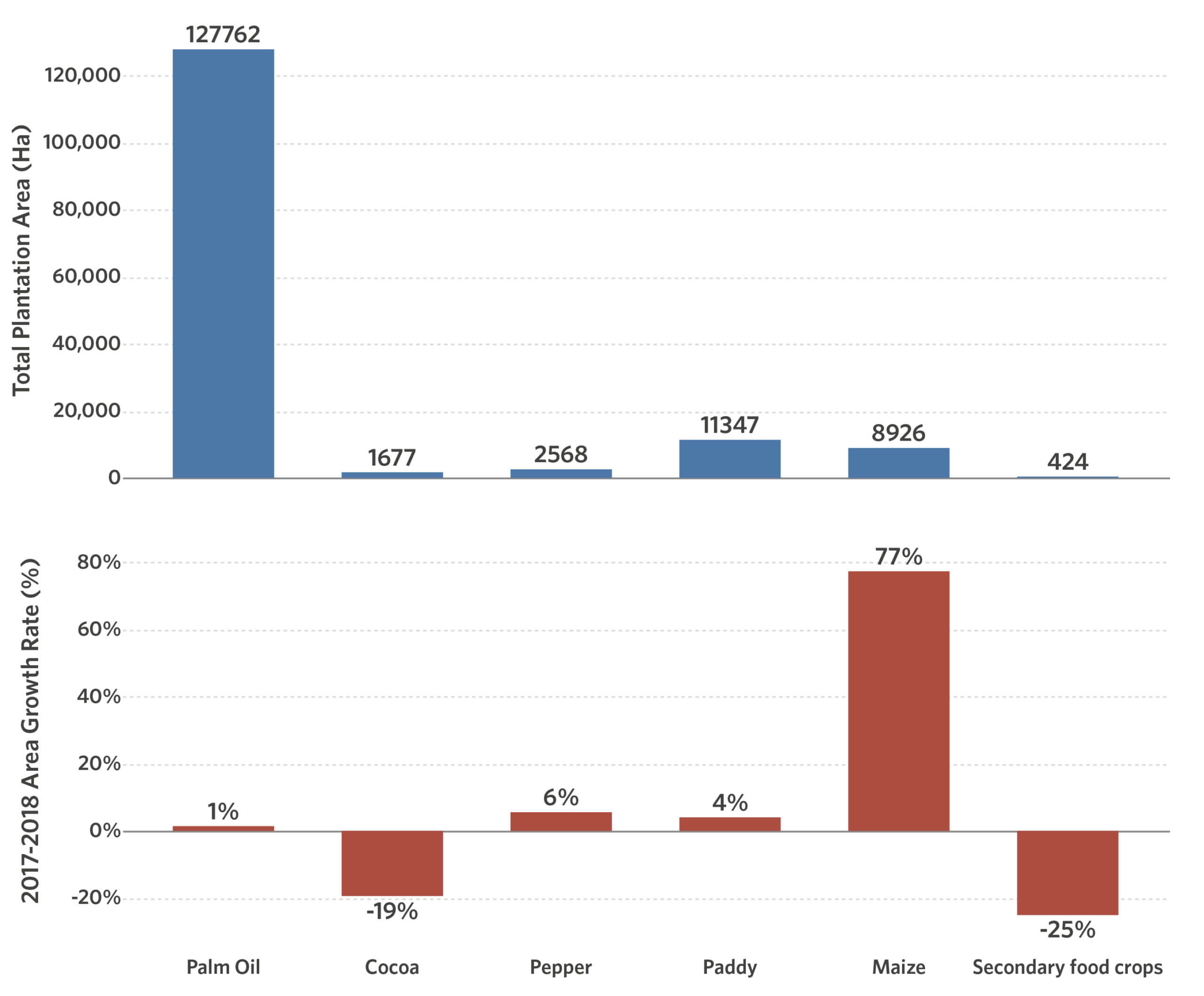

Palm oil is edging out food crops and other state crops such as cocoa and pepper (Mafira et al, 2019). This raises a red flag as Berau, a food secure region with enough staple food such as rice to self-subsist, is transitioning into a region that is increasingly reliant on imports of food crops from other regions for food security (ibid). The following figure illustrates the stark dominance of palm oil plantation area by comparing it with other commodities and food crops in Berau. Certain food crops, especially maize, have significantly increased plantation area and production in 2018, though the scale is much smaller when compared to palm oil.

Figure ES2 . Berau Regency Crops Statistics

Source: Berau Regency Plantation Office, 2019

Nevertheless, palm oil alone is not enough to generate sufficient income growth in Berau. Through survey data and the Monte Carlo approach, we developed a financial model to assess the return on investment from an independent smallholder’s business model. The results indicate that palm oil smallholders in Berau can only generate a return on investment at a level that is far below the region’s minimum wage. On average, the net return on a two-hectare palm oil plot generates 439% lower returns than minimum wage and regency GDP or capita across a span of 25 years, compared with Berau’s minimum living costs.

In addition, palm oil smallholders face several risks that could impact their earning potential. These risks include the selling price volatility on their commodities, and low land productivity due to a range of reasons such as climate risks and a lack of access to capital.

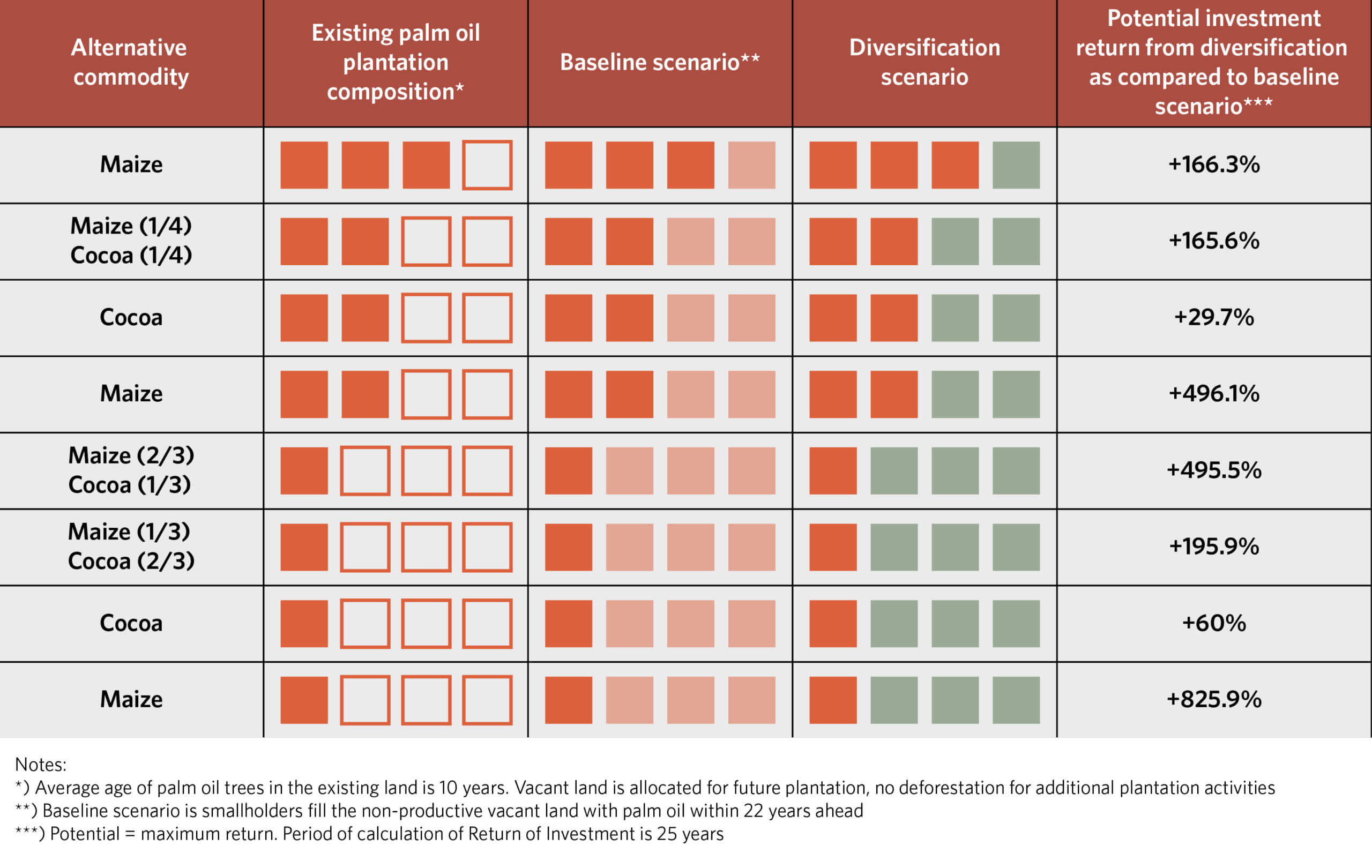

2. Compared to palm oil monocrops, crop diversification can yield up to 800% more revenue for smallholders

Our research on the Berau regency indicates that maize is the most recommended crop to diversify palm oil plantations due to its high-income potential, infrastructure preparedness, and lower knowledge gap. Cocoa is the second most preferred as maize has a higher revenue potential. Diversifying palm oil with maize will generate an income potential of up to 825% more, while cocoa can generate an income potential of up to 495% more than monocropping.

Maize and cocoa can increase smallholders’ income while diversifying the region’s plantation portfolio, which is currently dominated by palm oil.

Berau is designated by the central government of Indonesia as the center for cocoa production, and our model resonates with the government program. To date, there are existing national and subnational policy frameworks supporting Berau’s diversification priorities. These include village priority economic activity programs (Program Unggulan Kawasan Pedesaan – “PRUKADES”) and farmers’ corporation plantation zones (Pengembangan Kawasan Pertanian-Perkebunan Berbasis Korporasi Petani).

Table ES 1. Potential investment return from diversification

This study also explores the range of public financial instruments available to smallholders, such as interest subsidy (Kredit Usaha Rakyat/ KUR), credit guarantee scheme, insurance, and concessional sharia loan. These instruments can be accessed by smallholders looking to diversify their crops.

3. Diversification of crops can potentially absorb the business risks faced by palm oil smallholders, while remaining in line with Berau’s sustainability agenda

Certain policy options have the potential to grow and safeguard smallholders’ incomes, such as expansion, intensification via replanting, and diversification. The expansion option should not be endorsed as it promotes deforestation.

Meanwhile, intensification through replanting requires a high amount of capital and technical knowledge, both of which are currently lacking among independent smallholders. Diversification, which includes planting additional crops that can coexist with palm oil, is therefore the most efficient option, as it does not incur a large amount of capital but promises high returns, and does not require intensive capacity building.

Promoting more diversified plantations can help Berau achieve sustainability while improving economic resiliency. This increases land use effectiveness and reduces smallholders’ sensitivity towards market price volatility, all while providing revenue during the beginning and the end of the palm oil life cycle, or the zero and declining productivity period.

4. For smallholders who own vacant lands specifically allocated for planting, it is less financially risky to start crop diversification when the existing palm oil plantation is at peak productivity (approximately year 10) than to begin during unproductive years

To ensure positive cashflows, diversification is best started during the period where smallholders are generating high cash revenues from their existing palm oil plots, as this is the most bankable period for smallholders to access finance.

Palm oil plantations are known for being challenging to intercrop with other commodities[6]. Intercropping is usually done during the first three to five years before the palm oil trees become productive and the canopy becomes tall and dense, leaving insufficient light for other crops to grow. This study does not discuss intercropping in between palm oil trees in the first years, but does recommend that part of the land is reserved for other crops.

While maintaining positive cashflow is important, this must be done by considering the context of smallholder’s existing lands. Those smallholders that have completely planted their lands with oil palms must wait until their trees are no longer productive, and then diversify by replacing them with alternative crops. Those who have completely planted their lands with oil palms, and whose trees are entering productive age, can begin their diversification efforts after their palm oil trees have reached their lowest productivity.

On the other hand, smallholders who have allocated vacant land for plantations should immediately start utilizing these for alternate crops, rather than continue planting oil palms.

We provide specific simulations of optimal proportions of land and alternative crop types in this study, all of which recommend beginning alternative plant cropping after the existing oil palm trees mature.

Even so, challenges remain for smallholders who do not have proper licenses and supporting documentation such as STDB (Surat Tanda Daftar Budidaya), as they will find it difficult to obtain financing no matter how good their cash flow is.

KEY RECOMMENDATIONS

This study formulates key recommendations for Berau’s government. These recommendations have the potential to be replicated across other regencies in Indonesia that have similar attributes, to encourage crop diversification and use finance as a lever to drive crop diversification by palm oil smallholders.

We recommend the following steps:

- Strengthen the ongoing support for crop diversification through village priority economic activity programs (Program Unggulan Kawasan Pedesaan – “PRUKADES”). This can be accomplished by educating stakeholders about optimal crop mixes, ensuring smallholder ownership of plantation permits such as STDB, and facilitating access to financiers and off-takers.

- Strengthen development plans for farmers’ corporation plantation zones (Pengembangan Kawasan Pertanian-Perkebunan Berbasis Korporasi Petani), by building-in components regarding innovative financing schemes to support farmer crop diversification. It is also necessary to explore opportunities to cooperate with financial institutions, particularly to bring (Kredit Usaha Rakyat/KUR) and agricultural credit guarantee schemes to rural areas, design regency-financed maize insurance subsidies, and enable sharia concessional schemes for diversification financing.

- At the national level, the government can support Berau’s government through national agricultural commodity programs to continue diverse crop prioritization based on geographical or regency-based potential. It is also necessary to engage with financial institutions to bring more agricultural smallholder financing into their portfolios, and enable capacity building on financial instruments and products for cooperative and Micro, Small, and Medium Enterprises (MSMEs) and smallholder actors.

Though in this study we recommend moving away from monocropping, further research is required to investigate the environmental impacts of different types of crops in various geographical conditions. While maize and cocoa provide high economic return compared to palm oil, research shows that these commodities may pose negative environmental impacts

(Ntiamoah and Afrane, 2008; Chew et al., 2013; Konstantas et al., 2018). Hence, concrete steps towards crop diversification would also entail the Government of Berau outlining sound environmental safeguards for these commodities.

[1] The study focuses on independent smallholders who typically own and manage 2-5 Ha plots of plantation land with no buyer contract. They rely on middlemen, have low productivity, and limited access to finance. This study also employs a financial modelling approach with a focus on modelling a smallholders’ 2 Ha plot.

[2] BPS. 2019. “Statistik Daerah Kabupaten Berau.” Badan Pusat Statistik. https://beraukab.bps.go.id/publication/download.html?nrbvfeve=MGU5YTNjOTNjMDc5OWRjNjZmNjA0MTdi&xzmn=aHR0cHM6Ly9iZXJhdWthYi5icHMuZ28uaWQvcHVibGljYXRpb24vMjAxOS8xMi8yNy8wZTlhM2M5M2MwNzk5ZGM2NmY2MDQxN2Ivc3RhdGlzdGlrLWRhZXJhaC1rYWJ1cGF0ZW4tYmVyYXUtMjAxOS5odG1s&twoadfnoarfeauf=MjAyMC0wOC0yNCAwNzo0Mzo0Nw%3D%3D

[3] Slingerland et. al. 2019, Improving Smallholder Inclusivity through Integration of Oil Palm with Crops.

[4] Jong, H (2020). “Indonesia aims for sustainability certification for oil palm smallholders.” Mongabay. https://news.mongabay.com/2020/04/indonesia-aims-for-sustainability-certification-for-oil-palm-smallholders/

[5] Survey data from Menapak (2017)

[6] Tree Crop Estate Statistics of Indonesia 2017- 2019 Palm Oil made by Indonesia Plantation Agency (DJP)