Currency risk is one of the biggest and most persistent barriers to renewable energy and climate investment in developing countries. In countries with underdeveloped capital markets, like the majority of countries in Sub-Saharan Africa, the only viable option is to finance projects in a foreign currency – such as dollar or euro.

The Long-Term Foreign Exchange Risk Management instrument provides the tools to address currency and interest rate risk.

However, a project’s revenues are often in local currency, creating a risk that they will not be enough to pay back foreign debt if the local currency loses value. The long timeframes involved with renewable energy investments mean changes in the value of a currency of 50% or more are not uncommon. This can spell disaster for a project.

About

Currency risk is one of the biggest and most persistent barriers to renewable energy and climate investment in developing countries. In countries with underdeveloped capital markets, like the majority of countries in Sub-Saharan Africa, the only viable option is to finance projects in a foreign currency – such as dollar or euro.The Long-Term Foreign Exchange Risk Management instrument provides the tools to address currency and interest rate risk.

However, a project’s revenues are often in local currency, creating a risk that they will not be enough to pay back foreign debt if the local currency loses value. The long timeframes involved with renewable energy investments mean changes in the value of a currency of 50% or more are not uncommon. This can spell disaster for a project.https://www.youtube.com/embed/DpgB27YLn5Y

An interlinked barrier is interest rate risk. Loans in developing countries are often only available with a floating interesting rate – meaning that debt repayments increase if interest rates rise. Changes in interest rates also affect the value of a currency so these two risks can compound and the uncertainty can discourage investors from pursuing what would otherwise be profitable and important investments.

By enabling companies and investors to lock-in long-term finance in local currencies, the set of tools offered by the Long-Term FX Risk Management instrument can help to make more projects attractive, unlocking new investment in projects that provide clean energy, reduce greenhouse gas emissions and increase climate resilience.

To implement a pilot, USD 250 million is being sought from donor finance sources.

- USD 50 million to partially guarantee a portfolio of local currency loans and cross-currency swaps provided by International Finance Corporation (IFC) to project developers.

- USD 200 million to back a portfolio of cross-currency and interest rate swaps provided by TCX.

This can support USD 1.5 billion of clean investment projects with a potential GHG reductions of 1.7 MtCO2 per year and a cumulative total of 39 MtCO2 over the operational lifetime of the assets.

The TCX investment management company is the implementing partner. TCX recently worked with M-Kopa, a solar electricity systems provider, to connect 500,000 homes in Kenya, Tanzania, and Uganda to solar power. The project adds nearly 500 homes every day. TCX has gained financial support of EUR 30 million from the German Environmental Ministry.

TCX recently worked with M-Kopa, a solar electricity systems provider, to connect 500,000 homes in Kenya, Tanzania, and Uganda to solar power.

Since the instrument addresses such a major investment barrier, its potential impact post-pilot is large. It can be used in different countries and sectors and could also contribute to financial market development in developing countries, unlocking additional investment.

Facility Design

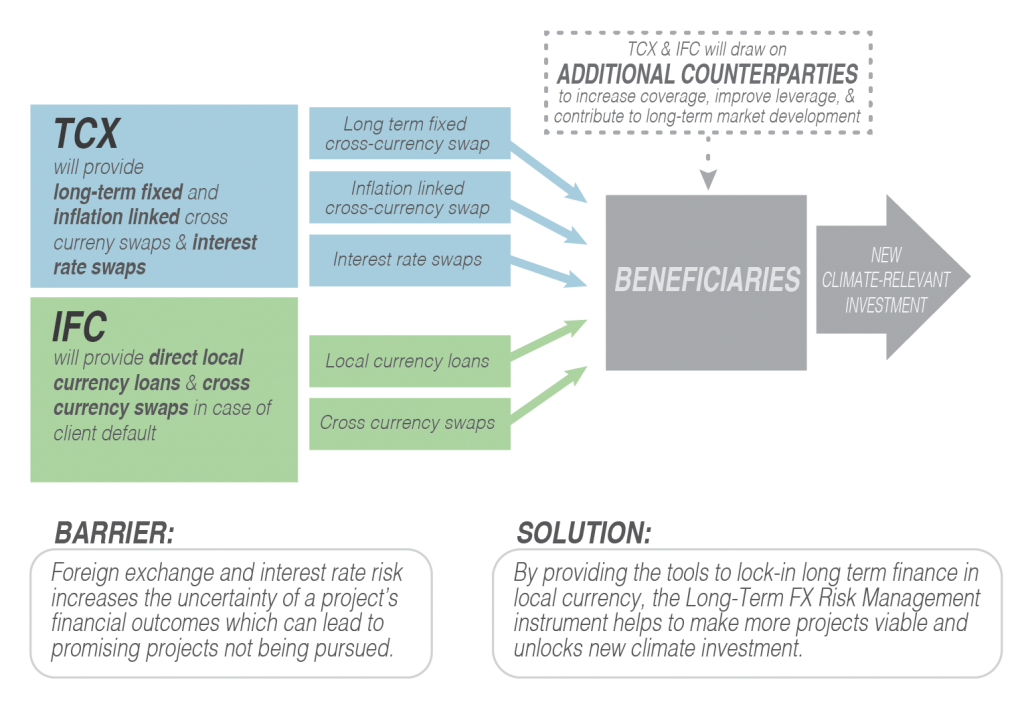

In a pilot, TCX and International Finance Corporation (IFC) would collaborate to develop a pipeline of projects and enter into joint transactions where appropriate. Their roles are complementary and each would fill specific gaps in the market.

Currency risk is one of the biggest and most persistent barriers to renewable energy and climate investment in developing countries. In countries with underdeveloped capital markets, like the majority of countries in Sub-Saharan Africa, the only viable option is to finance projects in a foreign currency – such as dollar or euro.The Long-Term Foreign Exchange Risk Management instrument provides the tools to address currency and interest rate risk.

However, a project’s revenues are often in local currency, creating a risk that they will not be enough to pay back foreign debt if the local currency loses value. The long timeframes involved with renewable energy investments mean changes in the value of a currency of 50% or more are not uncommon. This can spell disaster for a project.https://www.youtube.com/embed/DpgB27YLn5Y

An interlinked barrier is interest rate risk. Loans in developing countries are often only available with a floating interesting rate – meaning that debt repayments increase if interest rates rise. Changes in interest rates also affect the value of a currency so these two risks can compound and the uncertainty can discourage investors from pursuing what would otherwise be profitable and important investments.

By enabling companies and investors to lock-in long-term finance in local currencies, the set of tools offered by the Long-Term FX Risk Management instrument can help to make more projects attractive, unlocking new investment in projects that provide clean energy, reduce greenhouse gas emissions and increase climate resilience.

To implement a pilot, USD 250 million is being sought from donor finance sources.

- USD 50 million to partially guarantee a portfolio of local currency loans and cross-currency swaps provided by International Finance Corporation (IFC) to project developers.

- USD 200 million to back a portfolio of cross-currency and interest rate swaps provided by TCX.

This can support USD 1.5 billion of clean investment projects with a potential GHG reductions of 1.7 MtCO2 per year and a cumulative total of 39 MtCO2 over the operational lifetime of the assets.

The TCX investment management company is the implementing partner. TCX recently worked with M-Kopa, a solar electricity systems provider, to connect 500,000 homes in Kenya, Tanzania, and Uganda to solar power. The project adds nearly 500 homes every day. TCX has gained financial support of EUR 30 million from the German Environmental Ministry.TCX recently worked with M-Kopa, a solar electricity systems provider, to connect 500,000 homes in Kenya, Tanzania, and Uganda to solar power.

Since the instrument addresses such a major investment barrier, its potential impact post-pilot is large. It can be used in different countries and sectors and could also contribute to financial market development in developing countries, unlocking additional investment.

Facility Design

In a pilot, TCX and International Finance Corporation (IFC) would collaborate to develop a pipeline of projects and enter into joint transactions where appropriate. Their roles are complementary and each would fill specific gaps in the market.

TCX would focus on market risk – TCX has been hedging frontier market currencies since 2008. TCX would enter into a transaction to provide long-term fixed and inflation linked cross currency swaps and interest rate swaps to beneficiaries that are undertaking climate-relevant investment.

IFC would solve another key barrier – credit risk. Swap providers, including TCX, cannot take credit risk, which is present because a currency swap involves a stream of payments over time. They might require high collateral – as much as 25% of the value of the hedge up front. This is where IFC can come in. By accepting the credit risk and using their own AAA credit rating to act as the counterparty, they can make a transaction happen. IFC would be an intermediary offering currency swaps to clients and also providing a local currency loan product that combines a USD loan from IFC with a cross currency swap for clients who do not wish to enter into derivatives transactions.