CPI’s 2021 Global Landscape of Climate Finance (the Landscape) tracked USD 46 billion in adaptation finance in 2019/2020, an increase of 53% from the USD 30 billion in 2017/2018. While this increase reflects a broader positive trend across public actors recognizing the importance and urgency of implementing climate-resilient development, adaptation finance continues to account for only a minor share of total global climate finance flows (averaging USD 632 billion in 2019/2020).

As in previous iterations of the Landscape, almost all tracked adaptation finance in 2019/2020 was funded by public actors (98%), with multilateral DFIs accounting for the largest share therein (35%), closely followed by national DFIs (34%). The USD 1 billion of tracked private adaptation finance was provided by corporations and institutional investors.

The absence of significant private funding stems both from widely acknowledged difficulties involved with tracking private adaptation finance (Richmond et al., 2020), as well as distinct, and now long-term, limits to private sector engagement in the adaptation space. This blog dives deeper into the reasons underlying the private adaptation finance gap, synthesizing potential policy levers that could help unlock and mobilize private capital to prepare for, or respond to, the physical impacts of climate change.

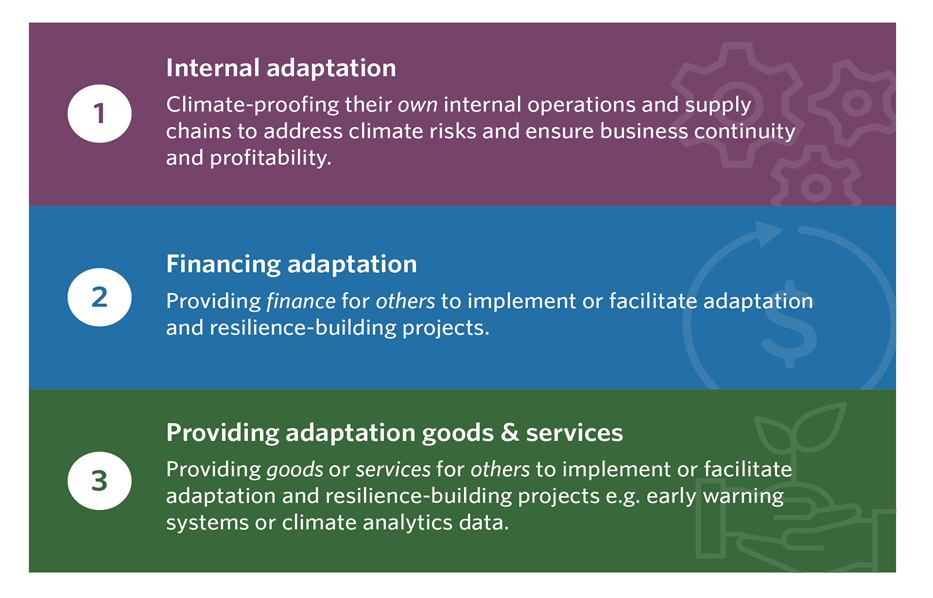

Acknowledging that the “private sector” is not a homogenous group but instead encompasses various actors, from large international corporations down to micro, small and medium-sized enterprises (MSMEs), broadly speaking actors can play one (or multiple) of three key roles in relation to adaptation.

Three Roles for the Private Sector

Though these roles are not mutually exclusive, the scope for private participation is likely dependent upon the particular actor: larger corporations have greater potential to straddle more than one role (adelphi, 2019), however, it has been observed that MSMEs, which form the bedrock of developing countries’ economies, may be as likely to function in a mixture of Role (1) and (3), provided targeted support and incubator programs are in place (Trabacchi et al., 2020). Nonetheless, all private actors, big or small, encounter certain barriers that inhibit them from engaging with these opportunities:

Barrier (1) Actors suffer from information asymmetries and knowledge gaps, thereby reducing the incentive and/or ability to invest in adaptation: this barrier concerns a lack of, or limited understanding about, climate risk and vulnerability data, as well as uncertainty on where private investment is needed most and the measures that are currently available to address climate risks.

Barrier (2) Private actors are unable to (fully) capture the environmental and social benefits that result from their investment. This is a classic case of market failure, largely stemming from the public good nature of (some) adaptation projects; for example, coastal protection in response to sea level rise. From a private sector perspective, the problem is perceived or genuinely low market rates of return on adaptation projects, generating unfavorable risk-return profiles that stifle investment.

Barrier (3) The adaptation issue suffers from what has been termed the tragedy of the horizon (Carney, 2015): private actors operate around short or mid-term horizons, whereas many adaptation projects are inherently long term, the benefits of which may not be realized for many years into the future, conditional upon uncertain climate outcomes. As such, it is difficult to make the business case for potentially large up-front costs today set against relatively long payback times in an uncertain future.

Despite these very real barriers, the WBG (2021) concludes it is “mission possible” to unlock private sector investment in adaptation and resilience, provided a well-crafted enabling environment is in place:

Barrier (1) calls for public or, in line with Role (3), other private actors to make localized climate risk and vulnerability data available and indeed accessible, coupling context-specific problems with cost-effective solutions.

Barrier (2) calls for public actors to strengthen financial incentives for private actors to invest in adaptation: there is a rich financial toolkit – tax breaks or benefits, risk guarantees, credit enhancement, grants and concessional loans – that can compensate private actors for the (non-market) positive externalities they generate, helping to create a pipeline of bankable adaptation projects that are suitably and adequately “de-risked” (WBG & GFDRR, 2021).

Barrier (3) is arguably trickier to tackle than the other two and requires a suite of different actions geared towards changing values or the narrative that currently surrounds adaptation. Much of the literature indicates that long-term planning on the part of governments is essential: identifying, prioritizing, and costing adaptation investment needs across sectors and geographies while nurturing public-private dialogue to determine who can and should do what, and where and how it can be done (WBG & GFDRR, 2021). Ultimately, public actors must help to make the business case for adaptation, explaining and emphasizing the opportunities for adaptation (Roles 1-3) in language that is relevant and accessible to actors whose perspective is profit & loss, revenues & market share. Initiatives like the Global Innovation Lab for Climate Finance can, further help to identify, develop, and support new innovative financial instruments and business models.

Finally, changing – or better informing – narratives to dislodge the notion that adaptation means costs without benefits is of utmost importance if we are to unlock the very real but currently constrained potential of private actors to finance and facilitate both their own and others’ adaptation to climate change.

References

Climate Policy Initiative, 2021. Global Landscape of Climate Finance. Available at: https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2021/

adelphi, 2019. The roles of the private sector in climate change adaptation – an introduction. Available at: https://www.adelphi.de/en/publication/roles-private-sector-climate-change-adaptation-introduction

Carney, Mark, 2015. Breaking the tragedy of the horizon – climate change and financial stability. Available at: https://www.bankofengland.co.uk/speech/2015/breaking-the-tragedy-of-the-horizon-climate-change-and-financial-stability

Richmond, Morgan, Meattle, Chavi, Micale, Valerio, Oliver, Padraig and Padmanabhi, Rajashree, 2020. A Snapshot of Global Adaptation Investment and Tracking Methods. Available at: https://climatepolicyinitiative.org/wp-content/uploads/2020/04/A-Snapshot-of-Global-Adaptation-Investment-and-Tracking-Methods-April-2020.pdf

Trabacchi, Chiara, Koh, Jay, Shi, Serena and Guelig, Tara, 2020. Adaptation SME Accelerator Project. Adaptation Solutions Taxonomy July 2020. Available at: https://lightsmithgp.com/wp-content/uploads/2020/09/asap-adaptation-solutions-taxonomy_july-28-2020_final.pdf

World Bank Group (WBG) and Global Facility for Disaster Reduction and Recovery (GFDRR), 2021. Enabling Private Investment in Climate Adaptation & Resilience. Current Status, Barriers to Investment and Blueprint for Action. Available at: https://openknowledge.worldbank.org/bitstream/handle/10986/35203/Enabling-Private-Investment-in-Climate-Adaptation-and-Resilience-Current-Status-Barriers-to-Investment-and-Blueprint-for-Action.pdf?sequence=5&isAllowed=y

World Bank Group (WBG), 2021. Unlocking Private Investment in Climate Adaptation and Resilience. Available at: https://www.worldbank.org/en/news/feature/2021/03/04/unlocking-private-investment-in-climate-adaptation-and-resilience