India has topped the charts across the world in bad air quality. A recent study by the World Health Organisation (WHO) shows that 14 out of the 15 most-polluting cities in the world are in India. New Delhi, the capital of India and the second most polluted city in the world, can serve as an apt example to reveal the grave situation where breathing in open air is equivalent to smoking three packs of cigarette in a day. While car exhaust is a major culprit, fossil fuel-based power plants also play a large role in this situation.

Switching from fossil fuel based power plants to clean energy power from sources like wind and solar can play a key role in combating air pollution and climate change. Clean energy, especially distributed solar power, is also critical to solving the issue of energy access to millions of unpowered homes in India.

To address this twin challenge of air pollution and climate change, India has set aggressive targets of 40 GW of rooftop solar by 2022 which would require an investment of ~USD 40 billion in next 4 years. This would be a significant undertaking given that the current rooftop solar capacity installation stands at ~1.8 GW. Moreover, India is likely to install only ~13 GW of rooftop solar by 2022, considering the current rate of annual capacity addition. This is merely 33% of the set target.

Although rooftop solar is increasingly becoming cost-competitive, it still requires investment upfront to buy and install panels. Rooftop solar is approximately 17% and 27% cheaper than the average industrial and commercial tariff respectively. Despite the falling prices, high upfront cost of rooftop solar installation, limited access to debt finance, and perceived performance risk restrict rooftop solar adoption.

Our previous research suggests a third party financing model or the “RESCO” model to help address these barriers. However, the success of this model has been limited as only 360 MW (18%) of the total of 1,800 MW have been installed under the RESCO model. This is mainly due to inadequate availability of debt capital for project developers.

So what’s the solution?

A recent study by Climate Policy Initiative (CPI), Indian Council for Research on International Economic Relations (ICRIER), and Stockholm Environment Institute (SEI), creates a case for municipal entities to promote rooftop solar in India by issuing green bonds in capital markets.

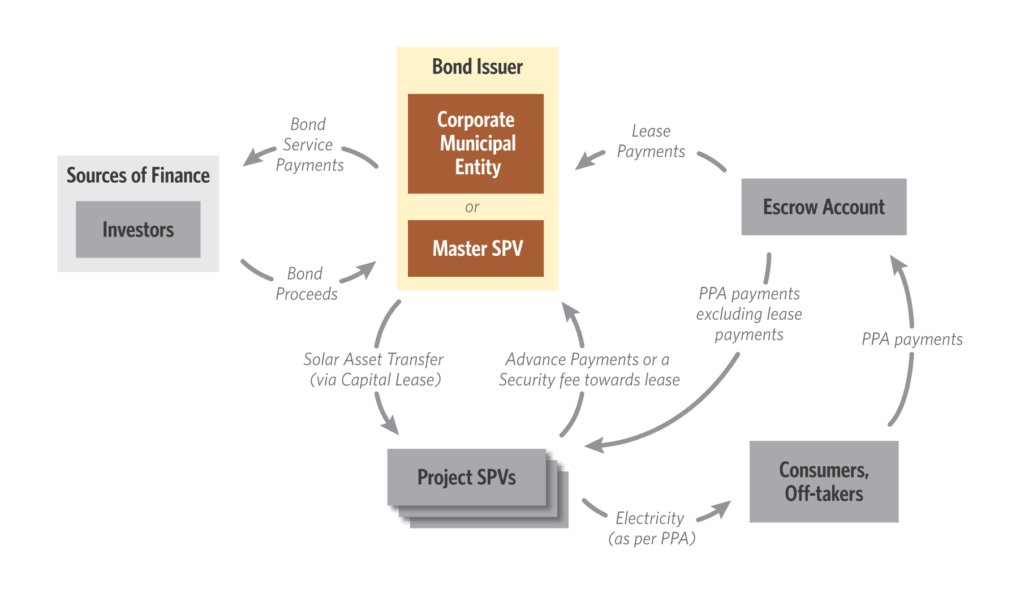

The study proposes a transaction structure wherein a special purpose vehicle (SPV) or a corporate municipal entity (CME) owned by the municipal corporation would raise the green bonds and disburse the proceeds of these bonds to SPVs owned by project developers via capital lease arrangements. In our paper, we also provide a detailed roadmap for municipalities to deploy the proposed model. After the installation and payment is complete for rooftop solar, cash flows would funnel back to the initial capital financiers. The proposed transaction structure is a Public Private Partnership (PPP) approach, similar to the Design-Build-Finance and Operate (DBFO) model with financing activity taken care by a public entity such as Municipal Corporations.

Transaction Structure to raise Municipal Bond for Rooftop Solar Financing

Municipal bonds have already been successfully tried in India for other infrastructure projects that serve the public good. For example, Pune Municipal Corporation recently issued a municipal bond for its water sector. With a 7.5% of coupon over 10 years, the 12 times oversubscribed bond showed significant appetite of investors for investing in such instruments. The solar municipal bond would help reduce costs for rooftop solar power at those same rates, by around 10-14%. This is a large financial savings that will ultimately help the electricity consumers by reducing the cost of already-cheaper solar power further.

In addition to reducing the cost of rooftop solar, municipal bonds also have the potential to mobilize significant untapped investment from new sources such as domestic institutional investors which has a potential of USD 56 billion in the green bond market and reached a total issuance size of USD 156 billion in 2017.

Still, financing rooftop solar via municipal bonds would face some barriers. This includes finding municipalities with credit ratings of A+ or more, reluctance of municipal corporations to issue bonds, lack of municipal mandate to promote electricity generation, high transaction costs, etc. which may hamper the uptake of this mechanism. However, the study points to several fixes like credit enhancement mechanisms, first loss capital, and legislative amendments from the central government that could encourage municipal bond issuance for rooftop solar.

These recommendations, and the others we outline in the CPI-SEI-ICRIER study, are a win win for all – for India, it will help reach its rooftop solar targets. For municipal corporations, it will help build organizational capacity to raise municipal bonds for other projects. And for the very cities struggling with clean air, this innovative but proven model can help residents save money on electricity, something that helps everyone breathe easier.

***

A version of this blog first appeared on Green Growth Knowledge Platform (GGKP), a global network of international organizations and experts that identifies and addresses major knowledge gaps in green growth theory and practice.