As public budgets become increasingly strained—exposing climate finance to shifting priorities—a stronger evidence base is needed to illustrate which climate interventions work, for whom, and what can be scaled or replicated. Many public climate finance providers are now grappling with how to target their limited resources where they are most needed and how to ensure that their finance generates results on the ground. A robust evidence base on the outcomes and holistic impact of climate finance can inform optimal deployment of public climate finance, ensuring funds are used effectively while also strengthening the case for sustained public flows. It is essential to consider what works and for whom from the perspectives of both finance providers and the beneficiaries of finance, catering to their respective and common priorities.

A better understanding of the quality of climate finance is essential to ensure that limited resources are used optimally to catalyze sustained, transformational change—rather than one-off, incremental improvements. While quantity remains at the forefront of global climate finance discussions, given the persistent climate investment gap, less attention has been paid to understanding the quality of that finance at a strategic level. Existing approaches to assessing the quality of climate finance are generally institution-specific and non-standardized – requiring patient and detailed data collection, often at odds with the impetus to disburse finance within short time periods – which inhibits collective action. More and better coordination among public climate finance providers on assessing the quality of their finance can help elucidate collective options for, and guide decision-making on, strategic deployment and optimal sequencing of scarce resources.

To date, climate finance providers and beneficiaries of finance have considered quality from various standpoints, without reaching a shared understanding. In international discussions, quality often refers to the level of concessionality or ease of access to finance (UNFCCC, 2024). Some providers equate quality with the additional finance mobilized by an initial intervention. Quality has also been taken to mean the extent of core climate results (emissions mitigated and beneficiaries reached) on the ground.

This scoping study adopts a broad approach to explore the quality of climate finance in terms of whether flows deliver sustained transformational change at the market and system levels, ultimately leading to low-emission, climate-resilient and equitable economies.

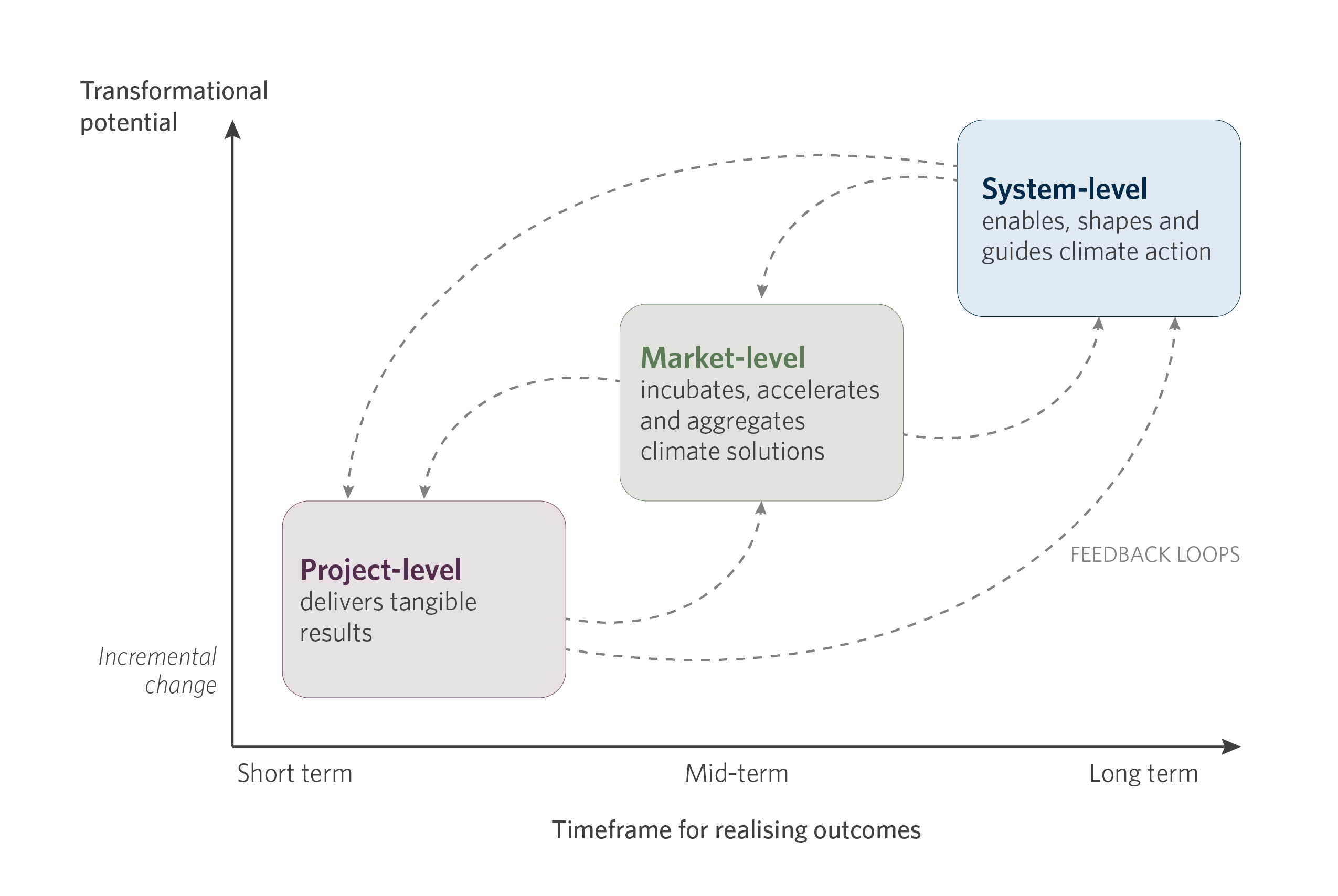

This paper presents a conceptual framework for collectively understanding the quality of climate finance among public climate finance providers, using these actors’ varied work to date as basis from which to build. This framing provides a structured approach – by elucidating three different levels (see ES1) – for understanding climate finance quality, which could, with further development and socialization, inform the appraisal and design of high-quality climate finance projects or programs, catalyzing impact beyond one-off project interventions to influence the broader market and system levels of action. These levels are derived from an extensive review of the literature, as well as stakeholder consultations with key public climate finance providers and encapsulate how climate finance quality may be defined depending on the scope of analysis, the influence sphere and the typical time horizon for realizing outcomes. Ultimately, the goal is to advance the global conversation on the effective use of financial resources by explaining the dimensions through which climate finance quality may be understood.

The project-level represents the smallest unit of intervention and the most tangible level at which to instigate market- and system-level change. Projects aim to achieve direct and measurable results (outputs and outcomes), often tied to a specific location or community, and typically realized in the short to medium term. Climate projects aim to mitigate emissions and/or build climate resilience, which can be achieved through specific outputs. Climate project outputs may yield sector-specific results in addition to core climate results.

The market level examines whether, or to what extent, climate finance induces market-level change by stimulating demand and supply for climate solutions. Changes at this level are relevant beyond direct project beneficiaries—e.g., for supply chain actors—and represent indirect, ripple effects that are harder to attribute to a single project. Market-level transformation often results from the aggregation of various initiatives that cumulatively contribute to market development over the medium to long term, shifting norms and accelerating the uptake of a particular climate solution or climate-positive practices. Key action areas at the market level include addressing market imperfections, demonstrating the effects of climate solutions in a particular geography, incubating and accelerating nascent climate solutions, offering targeted subsidies to grow the market, facilitating technology transfer, mitigating path dependence, and supporting research and development.

Finally, the system-level examination assesses whether, or to what extent, climate finance induces structural shifts toward low-emission, climate-resilient and equitable economies. This entails fundamentally changing political, social, and economic systems (e.g., power, industry, agriculture, or finance) to enable climate action at scale, as well as progressing toward the UN Sustainable Development Goals more broadly (Jaeger et al., 2022). The system-level lens examines how public climate finance can influence, or facilitate, guiding paradigms and values, behaviors and attitudes, policies and regulations, and institutional arrangements, aligning them with low-emission, climate-resilient and equitable growth. This level is relevant for the assessment of whole-of-economy approaches, as well as monitoring progress along country development pathways or toward global climate goals over the long term. While individual interventions may contribute to systems change, attributing progress at this level to specific institutions is challenging because it occurs through a combination and sequence of efforts by various stakeholders over a longer timeframe.

Transformational climate finance is finance that works to deliver positive and sustained change at the market and broader system levels. A climate intervention may only be considered transformational if it works to catalyze market- or system-level changes beyond the individual project or program, over the medium to long term. While actors may deliver tangible results at the project level, the market level works to incubate, accelerate and aggregate climate solutions, with a view to influencing the broader system over the long term. In turn, the system itself enables, shapes and guides – if not results from – action at the lower levels. As such, change is both cumulative and highly circular between the conceptual levels, exhibiting feedback loops within and between levels (see Figure ES2). While individual contributions to market- and system-level change may (and must) happen in the immediate, near-term (e.g. enacting a policy or regulatory reform) the full realization of outcomes from those actions take time to transpire. In short, transformational climate finance is, by definition, high-quality climate finance.

Transformational climate finance is finance that works to deliver positive and sustained change at the market and broader system levels.

CPI identifies ten key dimensions for moving public climate finance along this gradient toward delivering transformational change. Moving beyond the project level toward transformational change at the market and system levels is both an imperative and an opportunity for public climate finance providers. Taking into account the perspectives of both providers and beneficiaries, Table ES1 outlines ten key dimensions that are relevant for assessing the transformational potential of public climate finance based on extensive literature review and institutional knowledge (gathered from multiple engagements in high-level climate finance discussions and assignments (G20 IHLEG, 2024)). Focusing on – and responding to – these dimensions is a key means by which public climate finance providers can yield market- and system-level changes, thereby delivering transformational climate finance. For example, programmatic approaches that constitute coherent, multi-year and scalable funding envelopes are a key means by which public climate finance providers can move away from one-off, project-by-project interventions, towards catalyzing positive and sustained changes at the market- and system-level, within which the program is implemented.

In addition to proposing definitions for climate finance quality and transformational climate finance, this paper spotlights related measurement approaches currently used by public climate finance providers. At the project level, this entails core climate results indicators, sector-specific indicators and development goal tagging. At the market level, it includes emerging approaches to assessing market outcomes. At the system level, it involves applying a paradigm shift lens, tracking macro-level outcomes, and operationalizing scoring approaches that assess transformational potential. While there is some convergence in measurement approaches at the project level, with certain actors developing relatively sophisticated methods for assessing transformational potential, the public climate finance providers reviewed exhibited more limited approaches or scope for indicators assessing market-level outcomes (see Section 3.4).

This study seeks to establish a shared understanding of, and common language concerning, climate finance quality in the context of public climate finance. There is scope for socializing this framework so that it can be integrated into upstream project or program appraisal and design, offering a theory-of-change template for ensuring high-quality public climate finance that yields transformational change on the ground toward low-emission, climate-resilient and equitable economies. The next step is for CPI to empirically apply this framework to sectoral or thematic contexts, using real-world data, to better understand how it can be operationalized. We note that this is subject to data availability and will be an iterative process. Application in practice will help refine the overall conceptual framework for understanding the quality of climate finance. There is scope to draw upon both quantitative and qualitative data in the next phase of work, to illustrate how climate finance quality may be tracked at the project, market, and system level, using a mix of explanatory approaches (quantitative indicators, qualitative-based scores, and case studies, among others). In particular, the next phase of work will aim to inform efforts for standardizing climate finance quality metrics or indicators across multiple public climate finance providers, building on the existing work of certain coalitions or harnessing collaborative initiatives (for example, the Joint MDB Common Approach to Measuring Climate Results; the Harmonized Indicators for Private Sector Operations (HIPSO); and the ongoing work of the Coalition of Finance Ministers for Climate Action (CFMAC)).

More broadly, this work contributes to the global discourse on climate finance quality with the aim of fostering consensus and convergence in measurement approaches among public climate finance providers. In the same way that various public actors have taken up tracking the quantity of climate finance over time, this convergence will require flexibility in shared approaches, allowing them to cater to different institutional priorities and capacities while fostering consensus for longer-term harmonization. The study is conducted in the context of the New Collective Quantified Goal (NCQG) on Climate Finance and the emerging Baku-to-Belem Roadmap, offering insights that may inform discussions among Parties to the UNFCCC related to articulating and improving the quality of their climate finance.