This publication is CPI’s analysis of Sub-national Climate Finance Initiative, an innovative climate finance instrument endorsed by the Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

Over two-thirds of the global population is expected to live in cities by 2050. Urban infrastructure built over the next 30 years to accommodate this growth will largely determine whether the world locks in a high-emissions, non-resilient future or reaches global sustainability goals.

Engagement at the sub-national level is critical. Approximately 6,000 state and municipal governments are already committed to reducing emissions. Despite this, a tremendous amount of investment is needed. With public budgets increasingly under strain, private sector investment is crucial to meeting this need, yet private investment barriers include high risk, low returns, and small investment size.

SnCF is expected to be the first private equity fund to feature a Technical Assistance Facility that provides local government capacity building and certifies all projects for SDG impact prior to investment.

INNOVATION

SnCF seeks to remove barriers to the sourcing, financing and sustainability certification of mid-sized sub-national infrastructure projects by:

• De-risking projects through concessional finance and technical assistance, while offering larger investable opportunities through the fund format

• Sourcing deals through a Technical Assistance Facility (TAF) which will also ensure standard governance, reporting, and local government capacity building to strengthen local regulations and enforcement of contracts

• Certifying all projects prior to first close using internationally recognized Gold Standard methodologies for environmental and social impact

IMPACT

The Initiative targets emerging market urban areas and has already procured No-Objection Letters from 42 countries across Asia, Latin America, Africa, Central Europe and the Middle East. The projects targeted have to be aligned with host countries’ NDCs, need to have a commercially viable business model, a clear climate mitigation component and contribute positively to at least two other SDGs.

The Consortium estimates that the SnCF concessional tranche could mobilize 4x private finance at the fund level and up to 24x at the project level. With a target fund goal of USD 750 million, the initiative could generate up to 1.8 GWh of renewable energy per year, create 20,000 direct jobs, avoid 3.8 million tonnes of CO2 annually and, over its lifetime, improve urban living conditions for 17 million city dwellers.

DESIGN

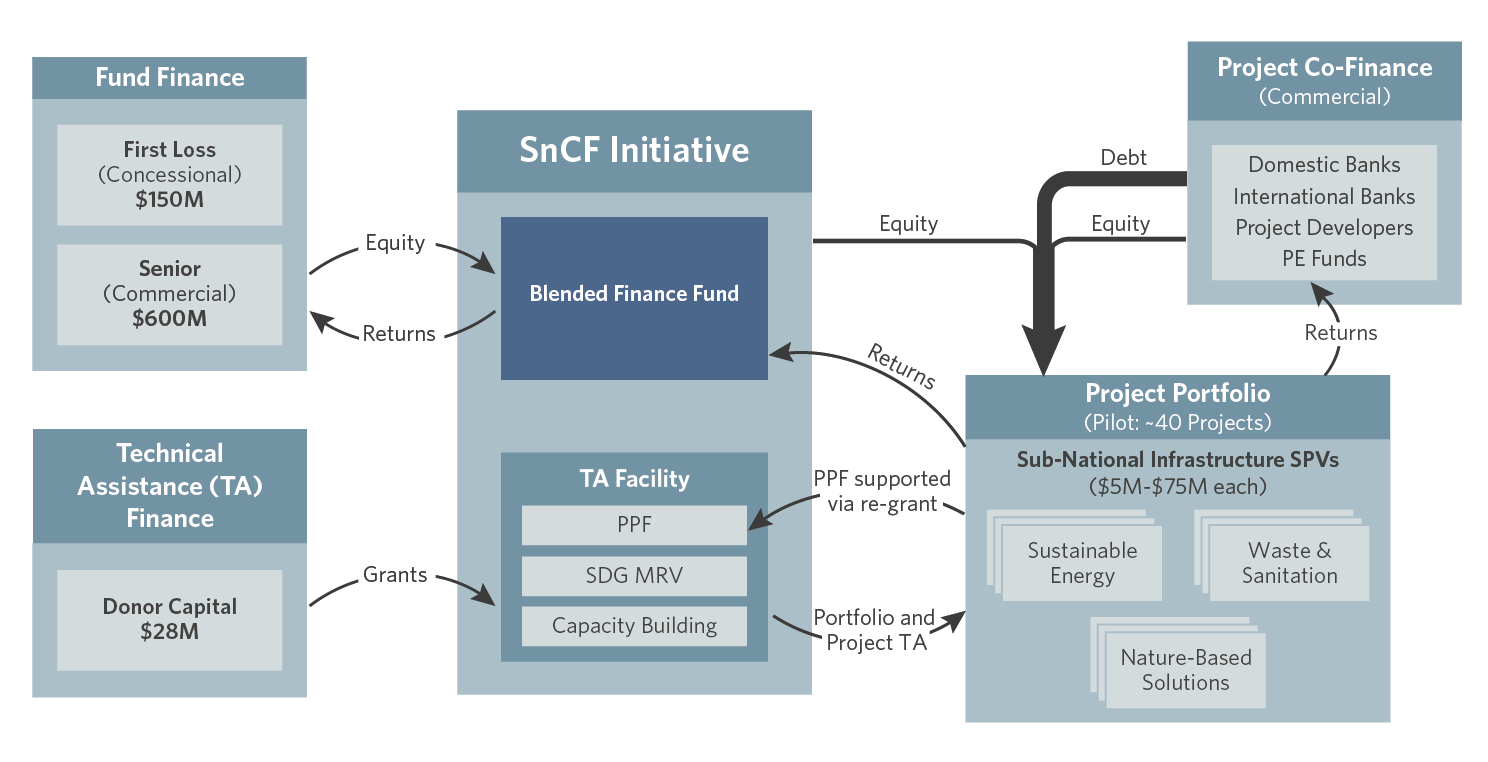

The SnCF uses a blended investment vehicle and adds several new features that make mid-size infrastructure projects more attractive for investment.

A Technical Assistance Facility (TAF) will be implemented in tandem with, yet financially and operationally separate from, the Fund. The TAF carries out three sleeves of activities: 1) project preparation; 2) impact monitoring and certification; and 3) local government capacity building.

To finance individual projects in the portfolio, SnCF will provide blended equity, while sourcing commercial debt and equity financing from international and domestic investors. The Fund anticipates this capital will be invested in a portfolio of around 40 sub-national infrastructure projects – including sustainable energy, waste & sanitation, and nature-based solutions – in up to 20 countries, with a target project size ranging from USD 5 to 75 million.