Currently, 185 million people in East Africa are without access to electricity, relying on high-cost and carbon intensive diesel generators or hazardous kerosene lamps. Off-grid solar home systems offer a clean, reliable, and affordable energy solution for homes in East Africa.

However, as most of these systems are financed to customers, sales rely on the solar developers’ ability to leverage their own balance sheets. This ability is constrained by the substantial collateral required by the few commercial and concessional funding sources available.

Solar Securitization for Rwanda is an initiative that pools loans from multiple solar developers into a tradable, asset-backed security, freeing up capital for expanding the solar home system market.

INNOVATION

Solar Securitization for Rwanda presents a critical opportunity to meet these challenges. By pooling solar home system loans into a tradable asset-backed security and providing solar developers access to more liquid capital markets, it will increase the developers’ ability to leverage and allow for a rapid expansion of the solar market, meeting the clean energy access needs of African households.

Increasing clean energy access can not only decrease harmful emissions, but also improve health, employment, economic development, gender equality, safety, and education.At scale, Solar Securitization for Rwanda can reach US$ 100 million in size in Rwanda alone, expanding energy access to 2 million households.

IMPACT

The instrument is under development by both Access to Finance Rwanda and the Development Bank of Rwanda (BRD), an institution with more than 15 years’ experience in energy finance and a very strong regional presence. The instrument will first be deployed in Rwanda, where the proponent has a considerable market and institutional influence, and a country where only 34% of the population has access to on-grid energy, but that posts high economic growth rates and a positive regulatory and political environment.

The first issuance will be sized at US$ 9 million and will enable the deployment of solar home systems for 175,000 households. At scale, the instrument can reach US$ 100 million in size in Rwanda alone, targeting 2 million households, and later be expanded to other East African countries with similar energy access and economic/institutional conditions.

DESIGN

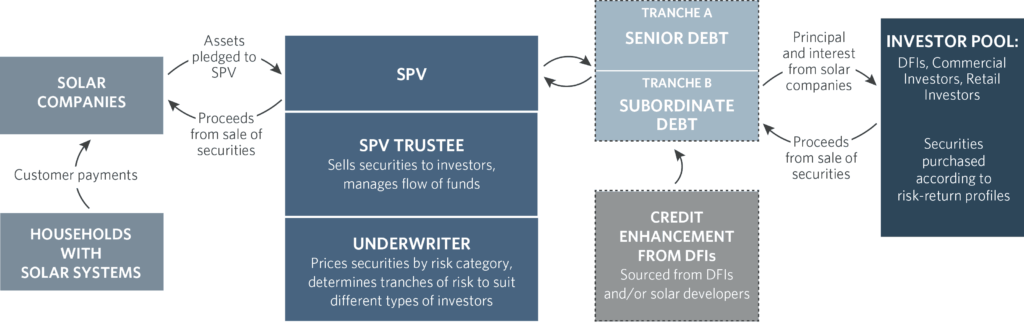

Eligible loans from the solar home companies are pooled into a special purpose vehicle (SPV), overseen by the Trustee. Loans are then underwritten, priced, and divided into tranches. The instrument will be split into two tranches, with Tranche 1 being sold to investors, and Tranche 2 serving as a subordinated, first loss facility to provide downside protection to the senior tranche.

While development finance institutions (DFIs) will be needed to provide funding for design-stage capital and the first loss credit enhancement (subordinate tranche), commercial and retail investors will most likely be the buyers of the senior tranche. Finally, the Trustee will oversee the flow of funds from the sale of the security to the solar developers, as well as the funds from repayment of the solar loans to the investors.

Flickr photo credit: United Nations Photo