Executive Summary

The global climate finance landscape has changed significantly since the establishment of the Climate Investment Funds (CIF) in 2008. New institutions have come to the fore, countries’ economic circumstances and investment needs have evolved, and climate-related risks have become clearer. Given this evolved landscape, and in light of the request put forward by the CIF governing body, this study examines the role of the CIF in the changed context in which it now operates and in relation to other providers of concessional climate finance. This is a particularly timely and important task because a “sunset clause” conceived at CIF’s establishment requires the fund to conclude its operations once a new financial architecture – now embodied by the Green Climate Fund (GCF) – is effective.

This study’s primary aim is to identify if and where the CIF business model adds value in the landscape of climate finance and whether the CIF holds a comparative advantage in supporting climate-relevant investment needs compared to other multilateral climate funds. This report also examines the role of concessional climate finance, characterizes its main providers, and discusses where and how concessional resources are most needed to address climate investment gaps in priority sectors. It concludes with recommendations for the CIF going forward.

Our findings provide insights for those considering the delivery of international climate finance both in the short and the medium to long-term. They are based on the views and opinions of the CIF, the GCF, and other climate finance stakeholders, and a review of relevant literature and climate finance data. Further in-depth portfolio- and country-level analyses would help to provide more detail and further substantiate some of our findings.

Current and future investment needs and gaps

Investments in clean and efficient energy systems, urban infrastructure, climate-smart land-use and water management need to scale up significantly in the next 15 years to enable low-carbon, climate-resilient development consistent with limiting global temperature rise to below 2 °C. The Intended Nationally Determined Contributions (INDCs) of developing countries highlight these sectors as key investment priorities. Achieving the INDCs’ goals will require large-scale support and the engagement of multiple stakeholders from both the public and private sectors. These stakeholders’ actions need to be coordinated under a common strategic framework.

Barriers to climate investment in priority sectors in developing countries remain significant. The lack of adequate access to capital, particularly patient capital, and the presence of both real and perceived risks (sovereign risks, technology risks, financing risks and first-mover risks) are holding back investors. Sustained access to concessional sources of finance to overcome these barriers will be critical to support countries in meeting their goals. In this regard, Multilateral Development Banks (MDBs) have a role to play in helping to narrow investment gaps, and will likely require additional injections of external concessional finance to do so.

The role of the CIF in tackling investment needs

The CIF has provided more multilateral concessional climate finance more quickly than any other climate fund:

- It is the largest source of external concessional climate finance for the six MDBs that act as its implementing agencies, providing about 45% of the external concessional finance managed by MDBs in 2013-2014

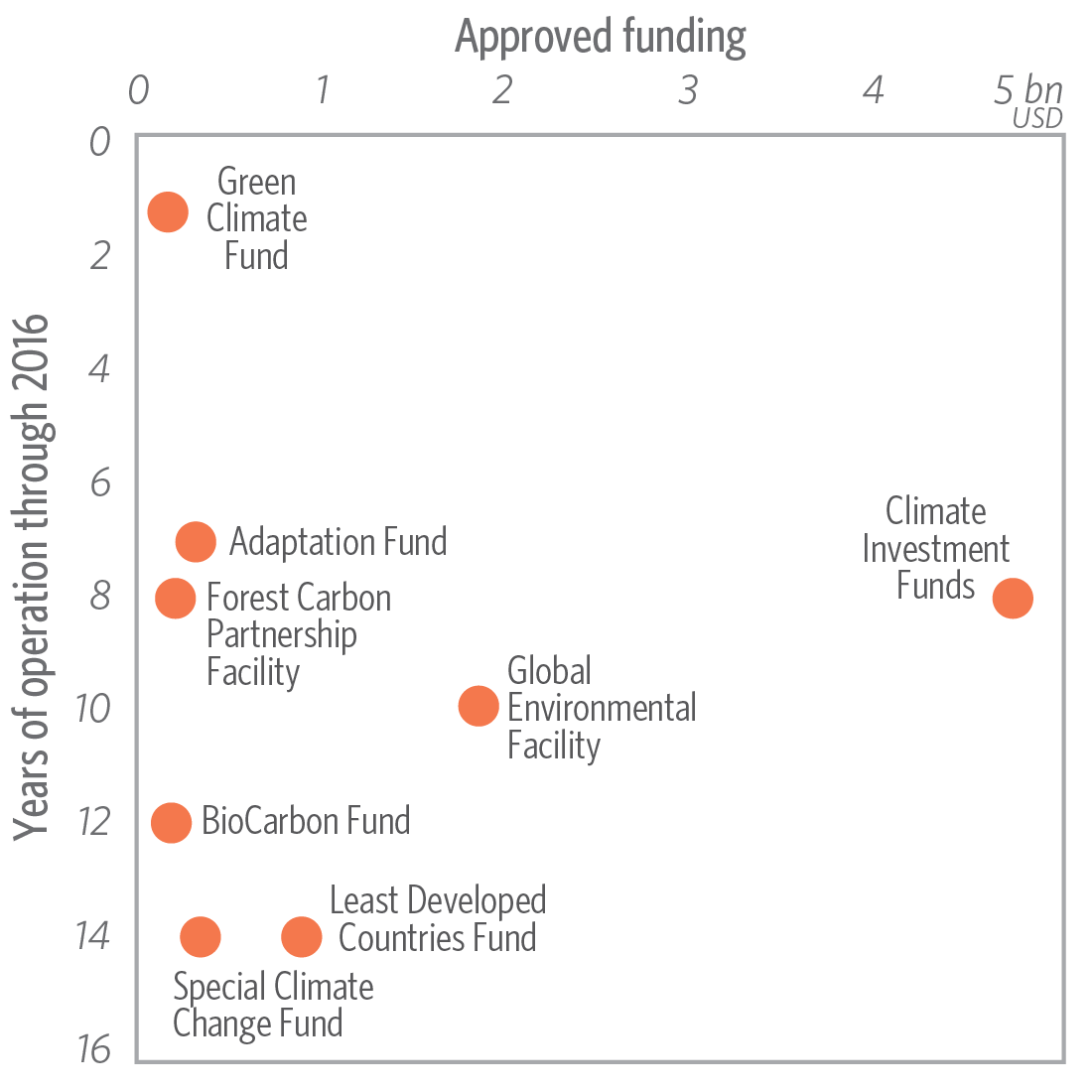

- Over the past ten years, it approved around 60% of the total finance committed by eight multilateral climate funds (Figure ES 1).

Other sources of multilateral concessional climate finance such as the GCF and the Global Environment Facility (GEF) have also played an important role in addressing barriers to investment or are expected to do so in the future.

The CIF is well-suited to support some of the most urgent climate investment needs going forward. Advancing climate action calls for, among other things, private sector engagement at scale, significant deployment of novel technologies to drive down costs, risk-taking and flexibility to pilot-test new approaches in challenging investment environments. Furthermore, translating INDCs into concrete investments will likely require the mobilization of multiple stakeholders under coherent strategic investment plans and supportive policy frameworks. Given the distinctive features of the CIF’s business model compared to other multilateral climate funds’ and future investment needs, from our analyses emerge that the CIF appears well-suited to play a role in these areas, particularly in the short to medium-term while the GCF gets up to speed. More specifically:

- The CIF’s programmatic approach offers a predictable and strategic framework within which to develop and structure investments. The CIF is the only climate fund to date to prioritize a programmatic national investment planning process. The GEF offers a programmatic approach to supplement its project-based approach, but this has not been the primary focus of GEF funding to date. The GCF is currently undertaking a competitive project-by-project approval process, but may choose to adopt a more programmatic approach in the future.This national investment planning process requires the CIF to involve multiple stakeholders in the development and implementation of policy reforms and investments aligned with countries’ climate strategies. It starts with countries being informed of the indicative amount of resources they are eligible for, followed by the development and endorsement of the investment plans and finally approval of projects. This approach has provided a certain level of predictability to both the recipients and implementing partners. Consultations with MDB representatives highlighted that a predictable funding stream is particularly relevant to the development of, for instance, first-of-a-kind projects that require substantial preparation (e.g. climate-resilient infrastructure projects). The competitive project-by-project approval approach followed by some climate funds does not provide the same level of certainty and this can hamper the development of individual projects and markets more broadly. Indeed, almost all respondents to a survey of CIF and GCF recipient countries indicated that predictability of finance flows, along with scale, is of critical importance.

- The CIF partnership with MDBs has allowed recipient countries to benefit from these banks’ different areas of expertise and work with them in a more coordinated manner under a common investment framework. This MDB partnership has allowed recipient countries to draw from these institutions’ varied skillsets, including their ability to attract and coordinate financing on the ground, provide broader policy support, and deliver resources at scale to given markets and technologies. The CIF has also enabled MDBs to experiment with new financing approaches, mainstream climate in their operations, and generate significant institutional learning. The CIF has created a collaborative platform among MDBs both at the program management and at the operational level, resulting in enhanced on-the-ground and intra-bank coordination.

- MDB stakeholders and recipient countries consulted in this study value the range of financial instruments available through the CIF. Interviewees noted that this range differentiates the CIF from other sources of concessional finance. The flexibility with which instruments are provided was particularly noted in the context of the Clean Technology Fund (CTF)’s Dedicated Private Sector Program (DPSP) and means that interviewees found this fund particularly well-suited to fostering the piloting of first-of-a-kind approaches and business models.The CIF is also the only climate fund that has provided reimbursable finance (e.g., concessional loans) for adaptation measures and the only one to develop a dedicated grant mechanism for indigenous people to tackle the drivers of deforestation. Beyond grants and loans, the CIF also offers its resources in the form of equity, subordinated or mezzanine debt structures, guarantees, local currency, as well as currency hedging tools in support of local currency operations. It is important to note, however, that some of these financial and risk instruments have yet to be fully utilized.

- Representatives of MDBs and recipient countries value the CIF’s risk appetite. This appetite is reflected by the types of risk-taking instruments the CIF provides and also noticeable at the portfolio-level. For instance, the CIF has allocated about 36% of its approved funding to unproven or risky technologies (e.g. geothermal and Concentrated Solar Power) in low- and middle income countries, and has provided up to 55% of international public finance currently flowing to the earliest, riskiest stages of geothermal projects.

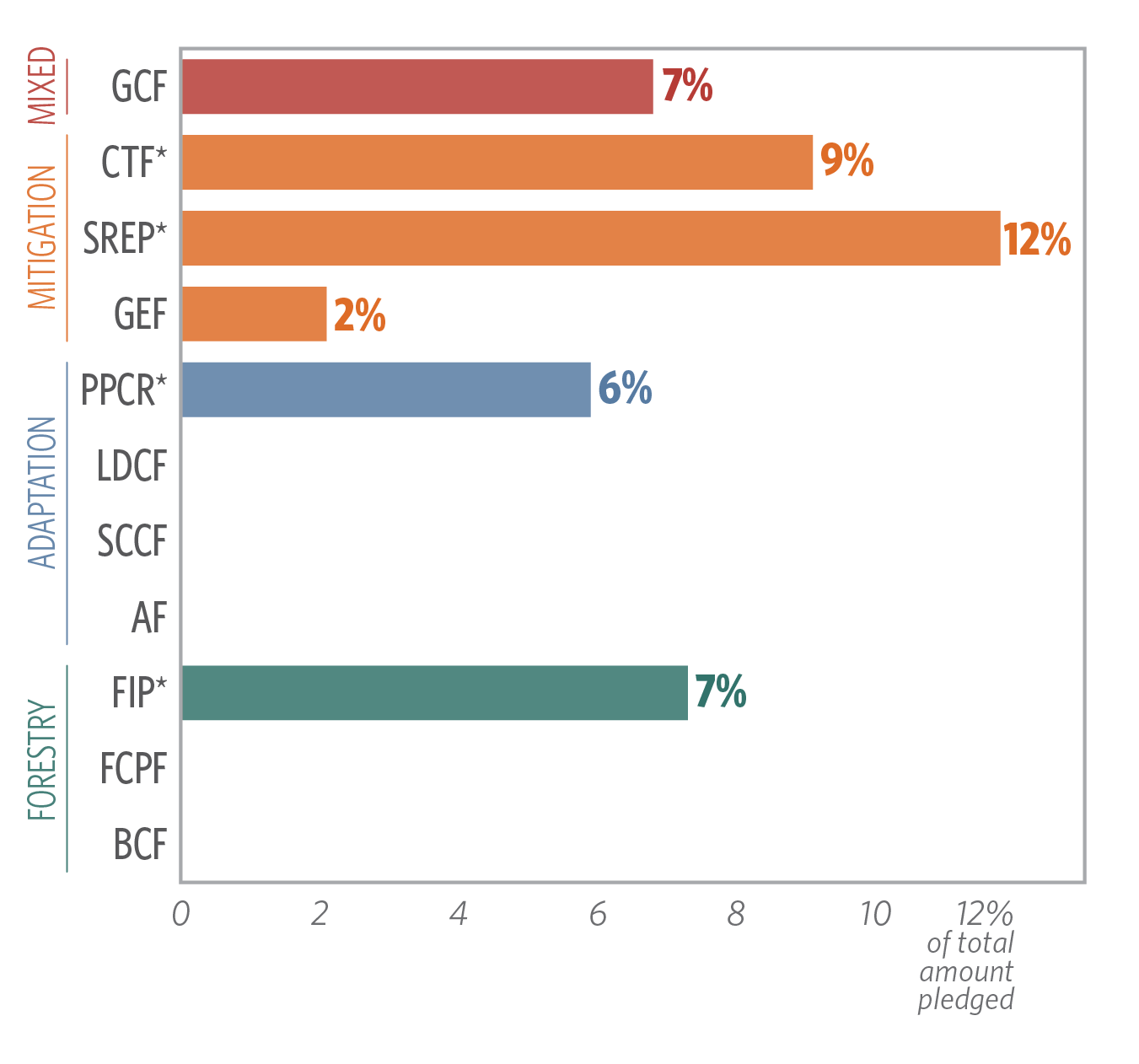

- The CIF has allocated more finance to driving private sector investment in mitigation, forestry and adaptation than any other multilateral climate fund. Overall, the CIF has allocated 28% of its financing (or USD 2.3 billion) to private sector investments to help cover the viability, knowledge, and risk gaps that can affect private actors’ ability and incentive to invest. This is more private sector funding than any other multilateral climate fund to date both in absolute dollar terms and as a share of each funds’ total financial resources. Nevertheless, despite noteworthy pioneering investments, the CIF and its implementing entities have struggled to attract private investment in key areas, particularly forestry and adaptation, as well as in the less developed countries in which the CIF operates. The geographic restrictions on use of the set-aside funds and the weaknesses of these countries’ policy frameworks have made attracting private investment challenging. The GCF also places a strong emphasis on private sector engagement, but it is too early to evaluate how this will take shape.

Recommendations

Grounded in the above findings, we recommend the following to the CIF Administrative Unit, CIF stakeholders, and the broader climate finance community:

- Keep the CIF in operation to maintain momentum on climate finance and climate action, bearing in mind investment needs and the additional gaps that may arise in a “no-CIF” scenario. The CIF has experience and a functional structure in place which can help to maintain momentum and bridge major climate investment gaps. Other climate funds have notable strengths, but do not necessarily offer the same capabilities as the CIF does right now, such as the provision of the programmatic and predictable support needed to deploy relatively less mature technologies or certain climate-resilient investment. While the establishment of the GCF — a new and critical institution within the climate finance landscape — is intended to fill investment gaps, questions remain regarding the extent to which the fund will be able to deliver the scale and type of support recipient countries need in the short to medium-term as it gets up to speed. In fact, the recently released World Bank Group’s Climate Change Action Plan highlights that “[…] uncertainties exist around how this [GCF] process will move forward […] There remains a risk of a global shortage of access to leveraged ‘climate finance’ for transformative activities in the critical period from Paris through 2020” (WBG, 2016). The Intergovernmental Group of Twenty-Four (G-24) countries, which coordinates the position of developing countries on development issues, also recently called for “[…] the urgent replenishment of the Climate Investments Funds” (IMF, 2016).

- Focus on maintaining and strengthening those unique characteristics of the CIF business model that are valued by CIF recipients, contributors, and MDBs, and are relevant for filling gaps in the climate finance landscape. These include the CIF’s programmatic approach, partnership model with MDBs, private sector focus, flexibility, adaptive learning, innovation, and risk-taking capacity. The CIF’s programmatic approach and its resulting predictability could be a model for the implementation of the INDCs through the development and financing of investment plans, particularly when considering the broader institutional and regulatory challenges countries would need to overcome.

- Pursue concrete opportunities to work with the GCF in a complementary manner. The CIF does not currently have sufficient resources to finance either the projects in its pipeline or those of new pilot countries. These resource constraints are creating uncertainties for both recipient countries and MDBs. To advance action while maintaining the CIF programmatic implementation approach, CIF pilot countries and MDBs could request funds from the GCF (or other sources) for project and program concepts that have been developed under CIF investment plans. This could create a win-win scenario by both providing funding for the CIF pipeline and helping the GCF build off the CIF’s robust investment portfolio to achieve its ambitious USD 2.5 billion per annum programming goal. Such an arrangement would also foster coordination and complementarity across sources of climate finance, a need emphasized in the Paris Agreement. Some synergies across the two funds have already emerged: the GCF recently provided USD 20 million in the form of a guarantee for an Energy Efficiency Green Bond Facility that had previously received USD 19 million from the CIF’s Clean Technology Fund. In addition, some CIF recipient countries, in partnership with their MDB counterparts, have or are planning to take projects they are developing under the CIF investment plans to the GCF for funding. Possible areas for further complementarity and synergic action could be explored in future work.

- Continue to engage with private actors, pursuing ways to enhance their involvement in forestry and adaptation. All MDB stakeholders interviewed highlighted the achievements of the Clean Technology Fund’s (CTF) DPSP in driving private investment, in particular its flexibility in providing instruments well-suited for private investments and its thematic focus on specific sectors and technologies. While the CIF should continue its efforts to scale up private investment in energy systems through the DPSP, there is room for making its private sector engagement in forestry and adaptation more effective. Some interviewees noted that this could be achieved by: 1) removing the private sector set asides’ tight time restrictions placed on the project proposal development period; 2) allowing MDBs to collaboratively identify private sector investment opportunities under thematic areas (as in the DPSP model); and 3) focusing resources on strengthening the policy and business frameworks in low or/least developed countries where the formal private sector is small in size and investment environment challenging. The MDBs’ public and private sector arms can work in cooperation to pursue this aim. Further, the CIF can help support the piloting and testing of private sector adaptation or forestry approaches in middle-income countries with relatively stronger private sector and business environments to develop viable business models that can then be replicated in lower-income countries.

- Generate and share knowledge on how to optimize the use of concessional finance in public sector operations to increase the efficiency of scarce resources. All providers of concessional finance should consider working together to identify appropriate terms and conditions for public sector projects in ways that better target specific investment barriers. This would allow for scarce public resources to be used more efficiently. The portfolios of MDBs’ renewable energy sector projects could offer opportunities for further analysis and an appropriate testing ground.