Innovative Sovereign Bond Structures for Financing a Sustainable Recovery

This paper assesses the potential for Recovery Bonds to help sovereigns raise capital to fund a sustainable and climate-resilient post-COVID recovery. As climate impacts become more severe, countries need targeted approaches to capital borrowing and deployment that is designed to decrease emissions, increase renewable energy distribution and other climate mitigation and adaptation solutions, and create long-lasting green jobs for a secure economy.

Recovery Bonds link a country’s borrowing to the targeted deployment of capital, designed to facilitate a low-carbon sustainable recovery that can bring economic, social, and climate priorities together. This paper lays out a prospective blueprint to facilitate the issuance of Recovery Bonds, focusing on two potential use cases: sovereign green bonds as part of issuances financing recovery, and bonds linked to fossil fuel subsidy reform (FFSR).

Sovereign green recovery bonds and FFSR bonds differ in their contractual development, but both produce a climate-beneficial outcome. While green bonds focus on the use of the proceeds that are reserved for qualified projects, a bond linked to the reduction of fossil fuel subsidies focuses instead on how bondholders could be repaid.

Opportunities and Challenges of Sovereign Green Bonds

Sovereign green recovery bonds are similar to traditional green bonds, where the use of proceeds are earmarked for eligible projects with environmental or climate benefits, but issued by national or sub-national governments to finance a sustainable recovery.

Previous sovereign green bonds have financed projects such as solar power plants, waterways maintenance, landscape conservation, and waste management. Since 2016, 20 sovereign green bonds worth USD 89.7 billion have been issued to considerable investor demand. Sovereign green recovery bonds could be a suitable financial tool for both developed and developing economies to support a green recovery, as well as an opportunity to demonstrate their commitment to sustainable development and climate resilience.

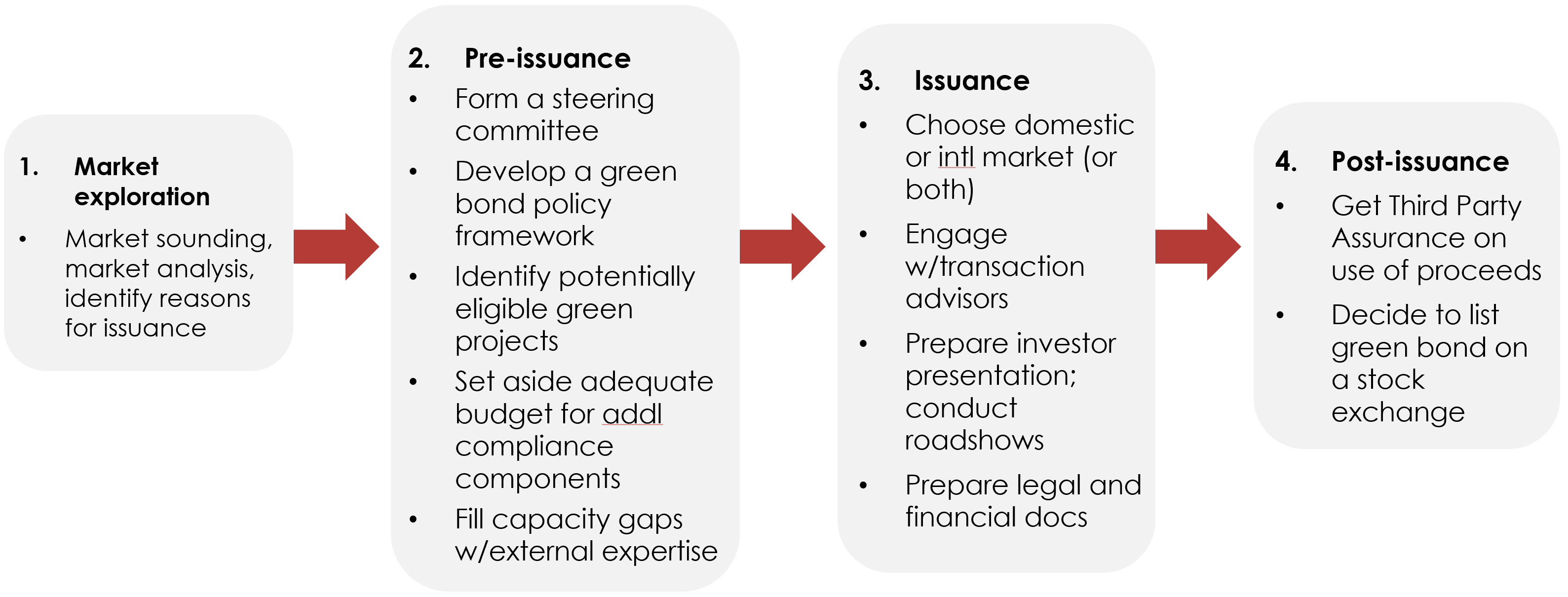

As sovereign green bonds focus on the development of environmentally-friendly impacts and outcomes, they require both the use of a green bond policy framework and third-party assurance for the environmental benefits of project outcomes. This blueprint provides a detailed outline of the steps necessary to issue such bonds. A case study is also included on combining a sovereign green recovery bond with performance-based Incentives to accelerate retirement of mid-age coal power plants in India.

Opportunities and Challenges of Fossil Fuel Subsidy Reform Bonds

The International Energy Agency (IEA) estimates that the world spends USD 320 billion annually on fossil fuel subsidies (FFS). By eliminating or reducing FFS, developing economies can use potential future savings from planned FFSR as the notional basis to repay a bond issued today. The FFSR bond is essentially a sovereign bond targeted towards green or SDG-oriented investors with an accompanying narrative of commitment to climate action, as reducing subsidies will reduce fossil fuel use and subsequent emissions.

To date, no country has issued an FFSR bond. Known challenges to FFSR bonds include estimating the right energy prices and subsidies, managing the impact of reforms on current and future energy prices as experienced by consumers, and building political and social support. This blueprint lays out a roadmap for how a country could issue an FFSR bond. Much like a green bond, there is a strong opportunity to invest in green jobs and sustainable infrastructure with an FFSR bond, although it is not a requirement of the bond contract. The removal of FFS is designed to create direct benefits, such as a more level playing field for renewables and clean technologies, while also decreasing the country’s exposure to stranded assets.

Conclusion

Both sovereign green bonds and FFSR bonds offer a promising framework to deliver sustainable recovery finance. There are significant opportunities for investment in key sectors like renewable energy, clean water supply, and waste management, as well as the potential to reduce reliance on fossil fuels. These sectors are particularly important to a post-COVID-19 economic recovery and will require trillions of dollars of investment over the coming decades. Both bonds have the potential to fund a sustainable recovery with a focus on climate adaptation and mitigation, create long-term jobs in the green energy sphere, and lower country emissions.