This report is also available for download in Portuguese (view annex) and Spanish (view annex).

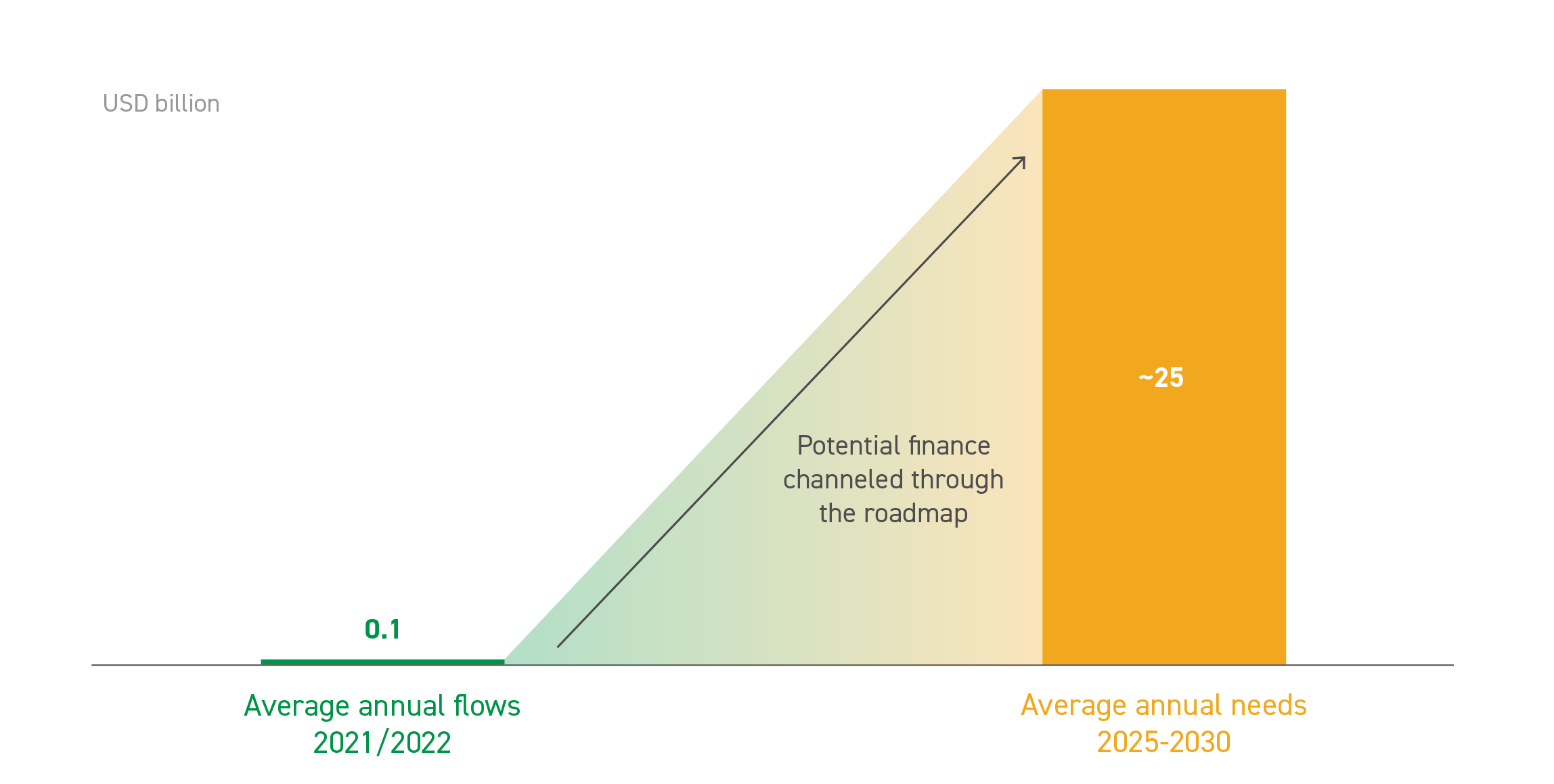

Sustainable livestock systems require actionable climate finance roadmaps to enable more actors to invest effectively and at a greater scale, particularly in emerging markets. The ClimateShot Investor Coalition (CLIC) estimates that less than USD 240 million in climate finance goes to global livestock systems, resulting in a USD 181 billion funding gap. The underfunding of livestock systems, which comprise <0.01% of total funding for agrifood systems, is outsized even in the context of the trillion-dollar funding gap to agrifood systems. Agrifood systems received short of USD 100 billion in climate finance in 2021/22, less than 10% of the USD 1.1 trillion required annually until 2030 to reduce emissions and build resilience (CLIC 2025).

This roadmap focuses on livestock systems in Latin America and the Caribbean (LAC) and aims to leverage this sector’s outsized potential for climate mitigation and resilience. Despite being responsible for both millions of rural livelihoods and over half of greenhouse gas (GHG) emissions in the region, LAC livestock systems receive little to no climate investment, presenting untapped opportunities for action. Sustainable practices can strengthen resilience both at the producer level, by reducing exposure to climate shocks and market volatility, and at the system level, by improving nature outcomes more widely.

Realizing the mitigation and adaptation potential of the livestock sector in LAC will help sustain it as a key source of livelihoods and food security. The region hosts 28% of global animal production, producing 23% of the world’s beef and 21% of its poultry (FAO 2024). In response to expected growth in both global population and income, food production is projected to rise by almost a third by 2050, with some emerging markets and developing economies (EMDEs) expected to double their food production (USDA 2025). By the end of the decade, demand for animal protein is forecasted to increase by 20% from 2020 levels. As meat consumption is unlikely to fall, at least in the near term, measures to reduce emissions in the sector must be deployed.

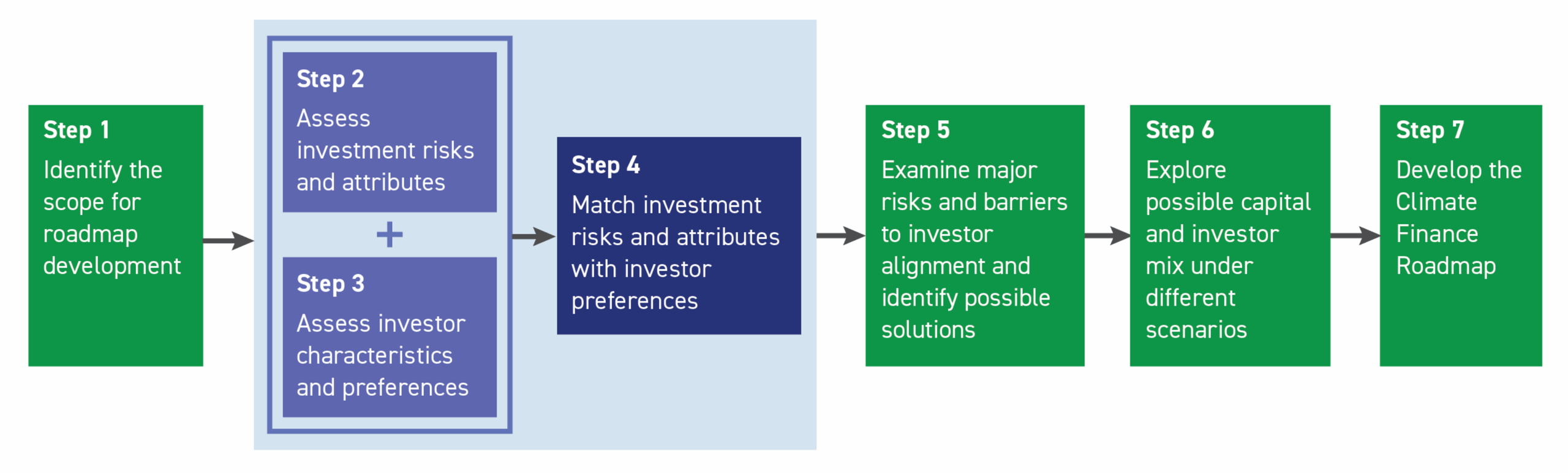

CLIC has used CPI’s new Climate Finance Roadmaps framework, released in 2024, to chart a path to scaling sustainable investment for livestock systems in LAC. This first pilot of the framework sheds light on factors that create misalignment between investor preferences and climate investment needs. The roadmap exercise then identifies opportunities for strategic intervention, indicating where policy and financial tools could be used most effectively to unlock further investment. It also explores the roles that private and public actors can play to address these barriers, including through enabling activities and capacity building.

Key Findings

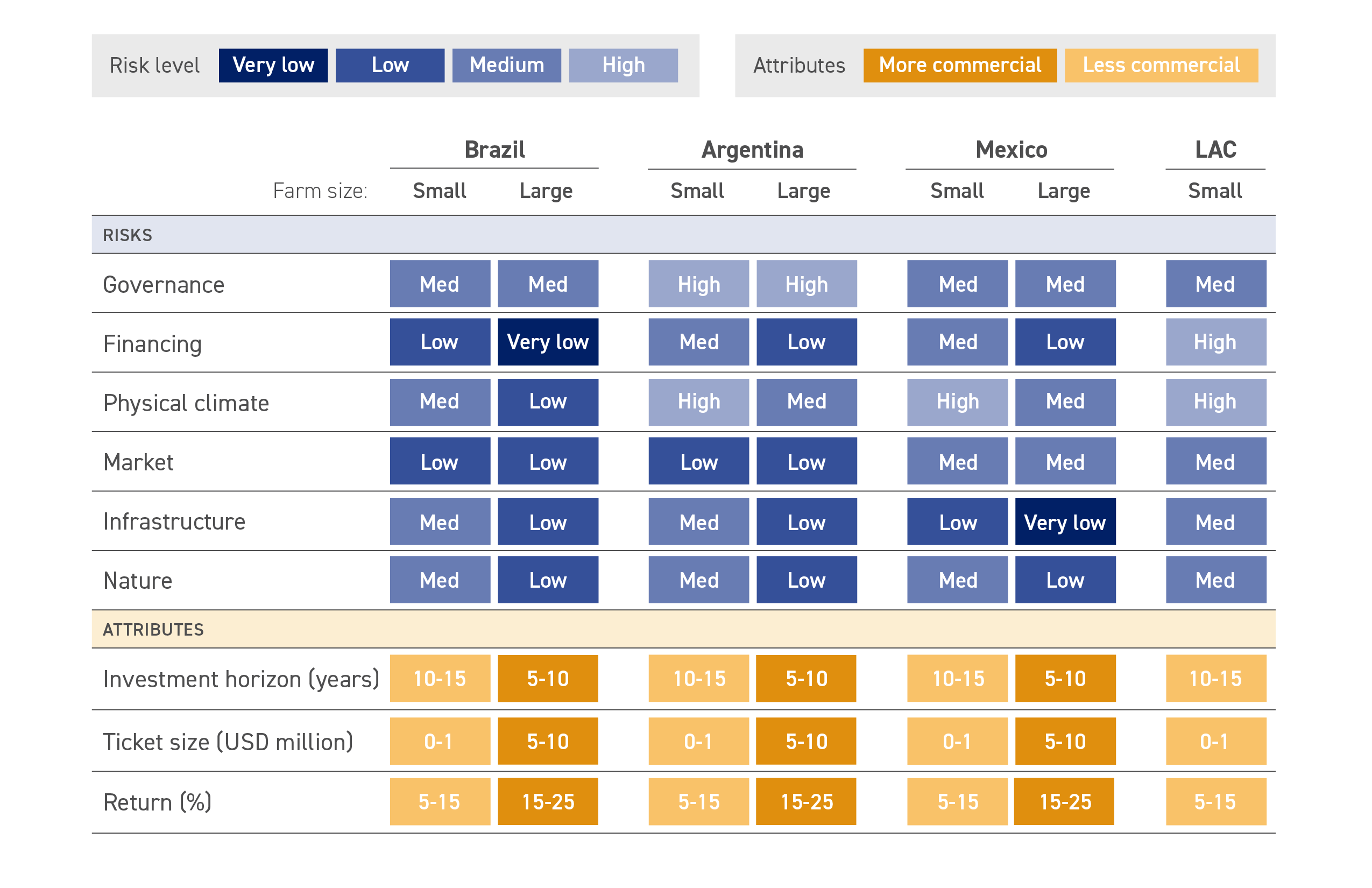

Public investors are currently best suited to make climate investments across livestock systems in all LAC markets, given their higher risk tolerance and development focus. Given the limited availability of public climate funding, especially amid recent significant decreases in public development finance, barriers need to be addressed to enable more private investors to enter the market. The public sector must both help derisk investments and create an enabling environment that facilitates the deployment of capital towards climate- and nature-positive practices for smallholder farmers.

Barriers related to governance and physical climate risks are particularly acute, with a general mismatch in risk-return profiles in LAC climate livestock investments, especially in small farms. Private funders are better placed to invest in large farms in Brazil and Mexico, which generally have lower physical climate, infrastructure, and governance policy risks, and optimal ticket sizes. Barriers to investment observed across the LAC region included increasing frequency of physical climate risks intensified by El Niño; macroeconomic instability, currency fluctuations, and financing risks; and geopolitical headwinds heightening market risks.

Targeted financial tools, such as the use of guarantees in blended finance structures, can reduce governance and financing risks, especially for large farms in Brazil and Argentina. However, even with such interventions, small farms in all examined markets remain reliant on public funding, highlighting the need for policy and institutional reforms to address structural risks, rather than solely relying on concessional capital to catalyze private investment. While localized solutions can create lasting change, instruments should be designed with both the flexibility to adapt to local circumstances and be grounded in replicable frameworks. Furthermore, pairing targeted policy solutions, such as the mainstreaming of extension and technical assistance, with improved financial instrument design can further reduce risks and strengthen investor alignment, particularly for small farms.