Key takeaways

- Climate-aligned investment from Indonesia’s financial sector, comprising public finance institutions (FIs) and private FIs, makes up 15% of the country’s climate finance to meet its net zero goals. This number needs to scale by at least 4.5x during the remainder of this decade.

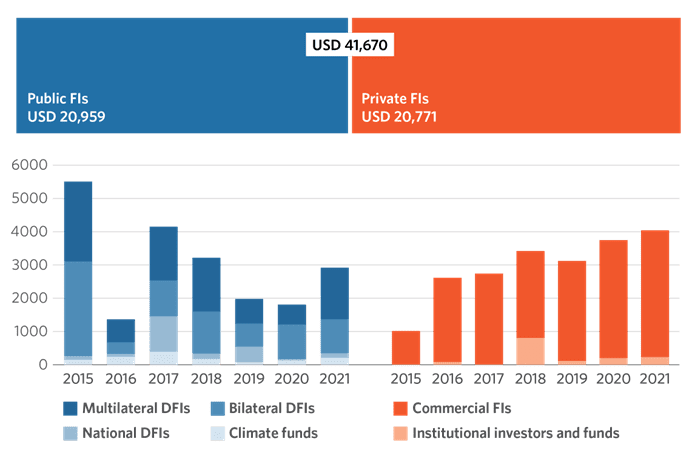

- Public FIs and Private FIs contribute almost equal shares of climate finance. Public FIs allocate an annual average of USD 3.5 billion in climate-aligned investment. Meanwhile, private FIs contribute an annual average of USD 3.4 billion, which represents only 3% of their total investments.

- Dominated by Development Finance Institutions (DFIs), Public FIs mainly target renewable energy and dual-benefit projects. Climate-aligned investments by private FIs, driven by commercial FIs, are largely concentrated on the AFOLU sector, consisting mainly of investments into certified sustainable palm oil.

Indonesia’s climate targets and financing gap

Indonesia has set various climate targets, including through its 2022 Enhanced NDC to reduce up to 43.2% emissions by 2030, with an optimistic scenario of reaching net zero emissions (NZE) by 2060 or earlier. The Indonesia Just Energy Transition Partnership (JETP) sets out even more ambitious conditional targets for power sector decarbonization of meeting 34% renewable energy (RE) mix by 2030 and NZE by 2050.

The commitment to rolling back high-emissions business activities is less clear. For instance, fossil fuel subsidies account for 9% of total state expenditure, while climate spending – based on climate budget tagging – accounts for only 6% on average over the past 5 years (CPI, 2021). To reach the 2030 climate targets, an estimated investment of USD 285 billion is required. As the government’s budget can only cover 34%[1] of the investment need, this leaves a gap of around USD 145 billion in climate finance to close.

Climate-aligned investment: sources of finance and targeted sectors

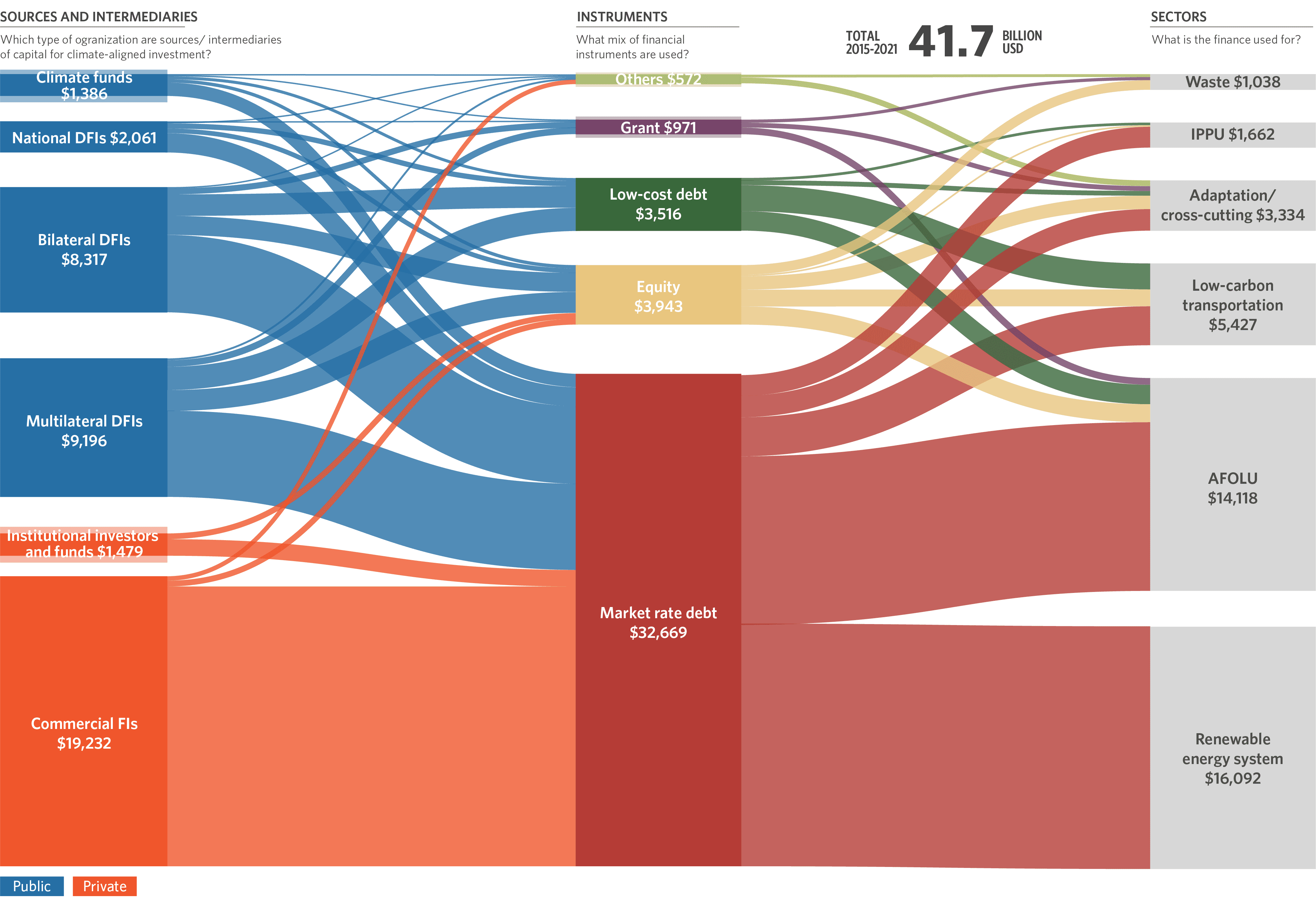

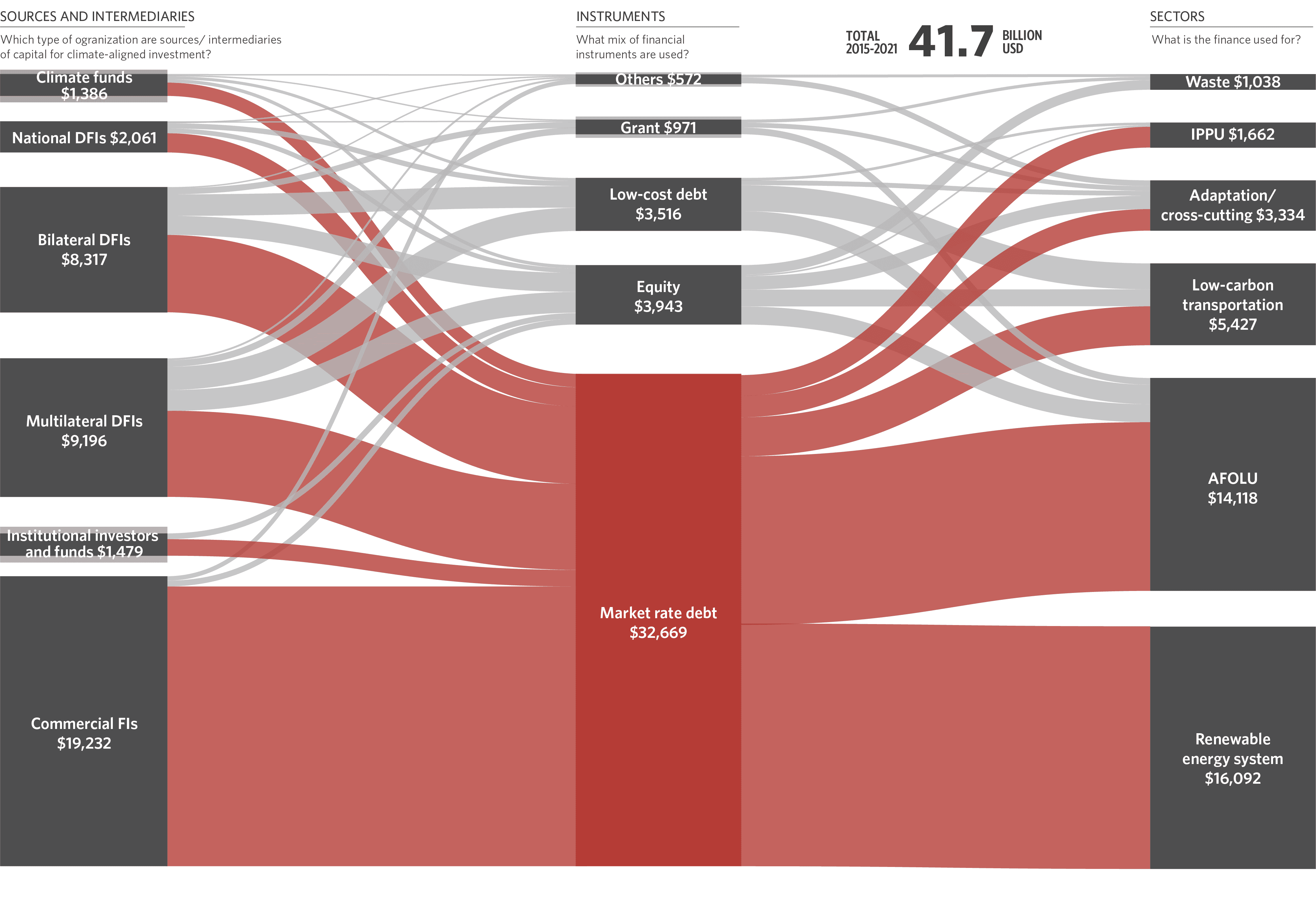

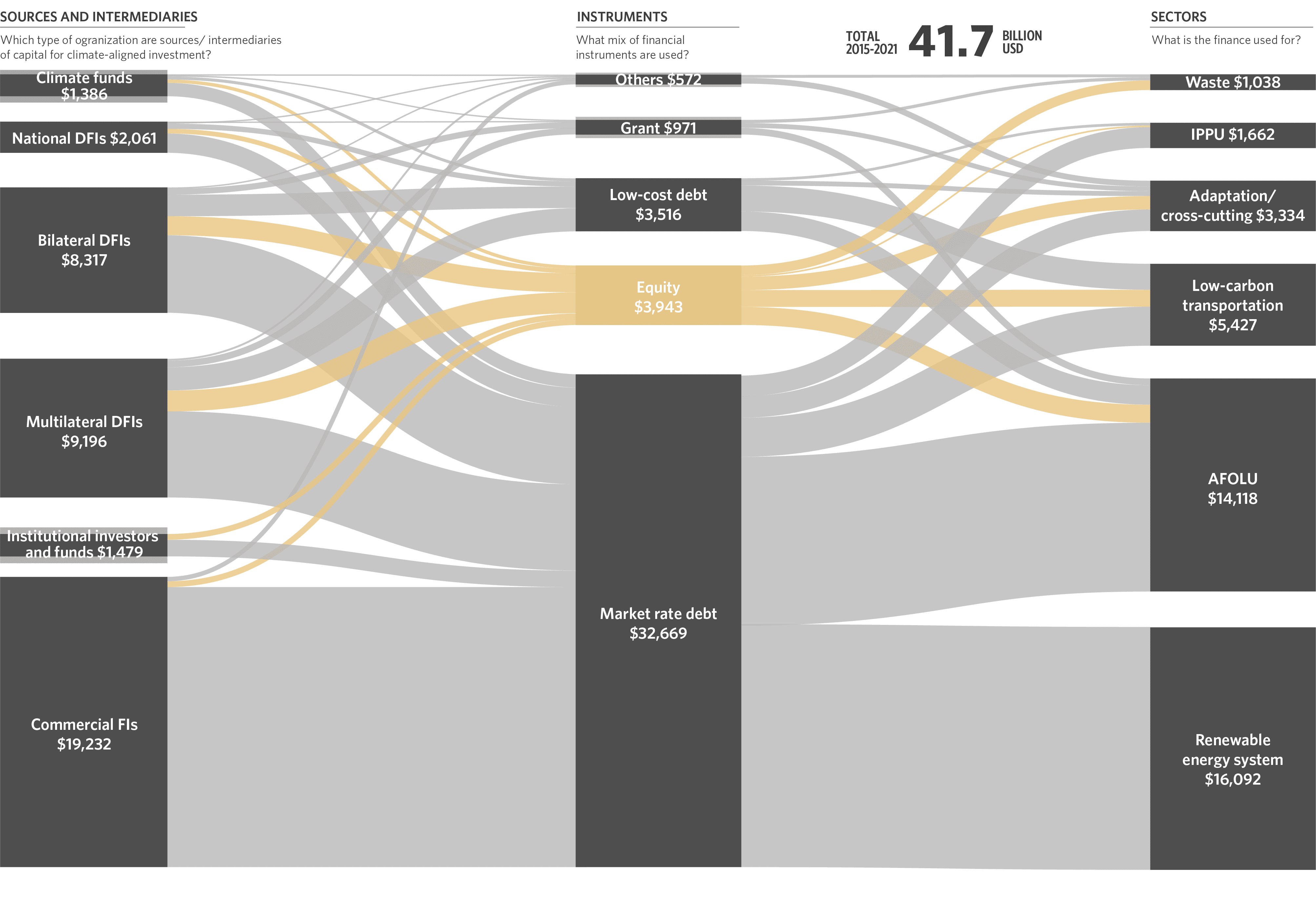

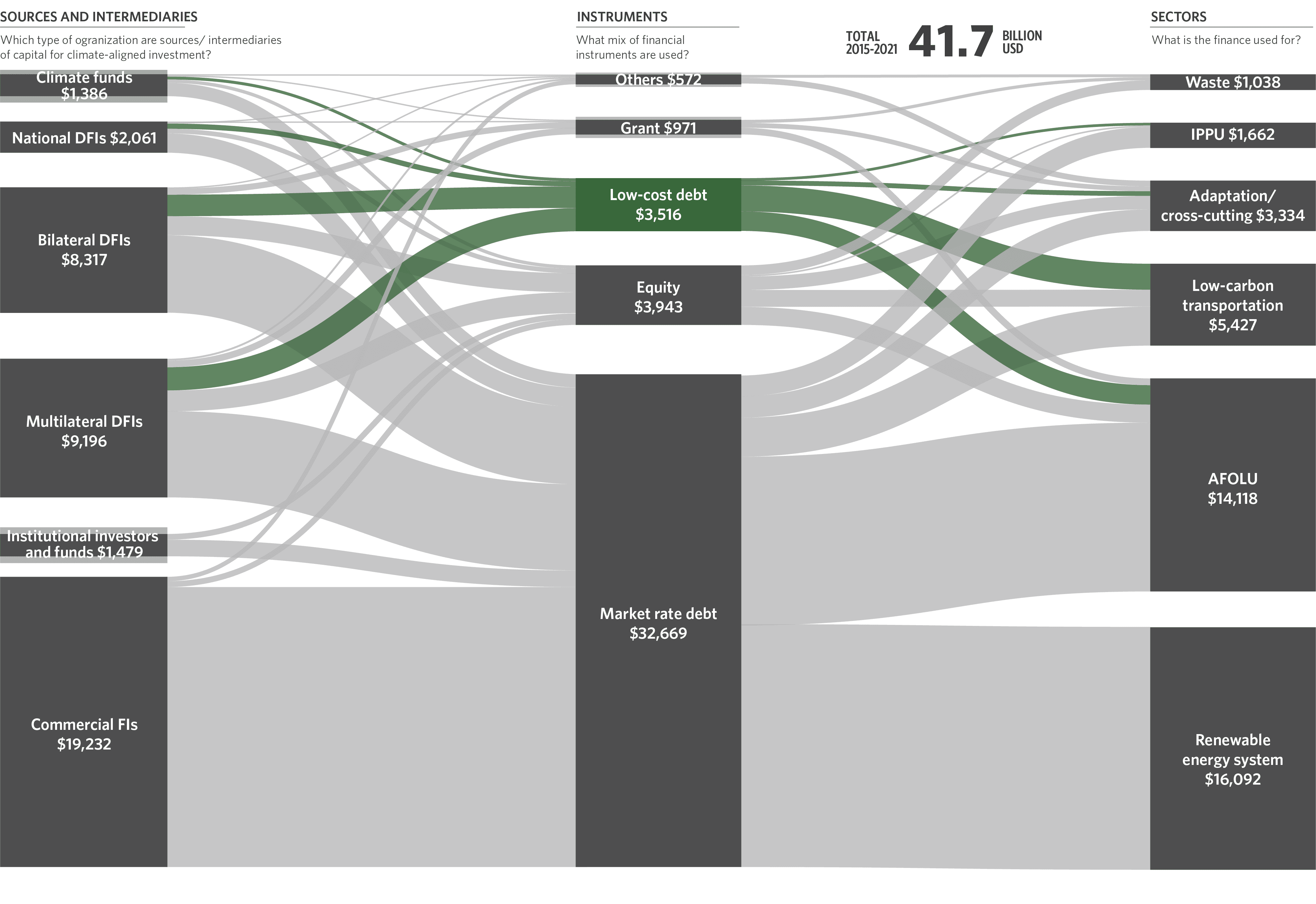

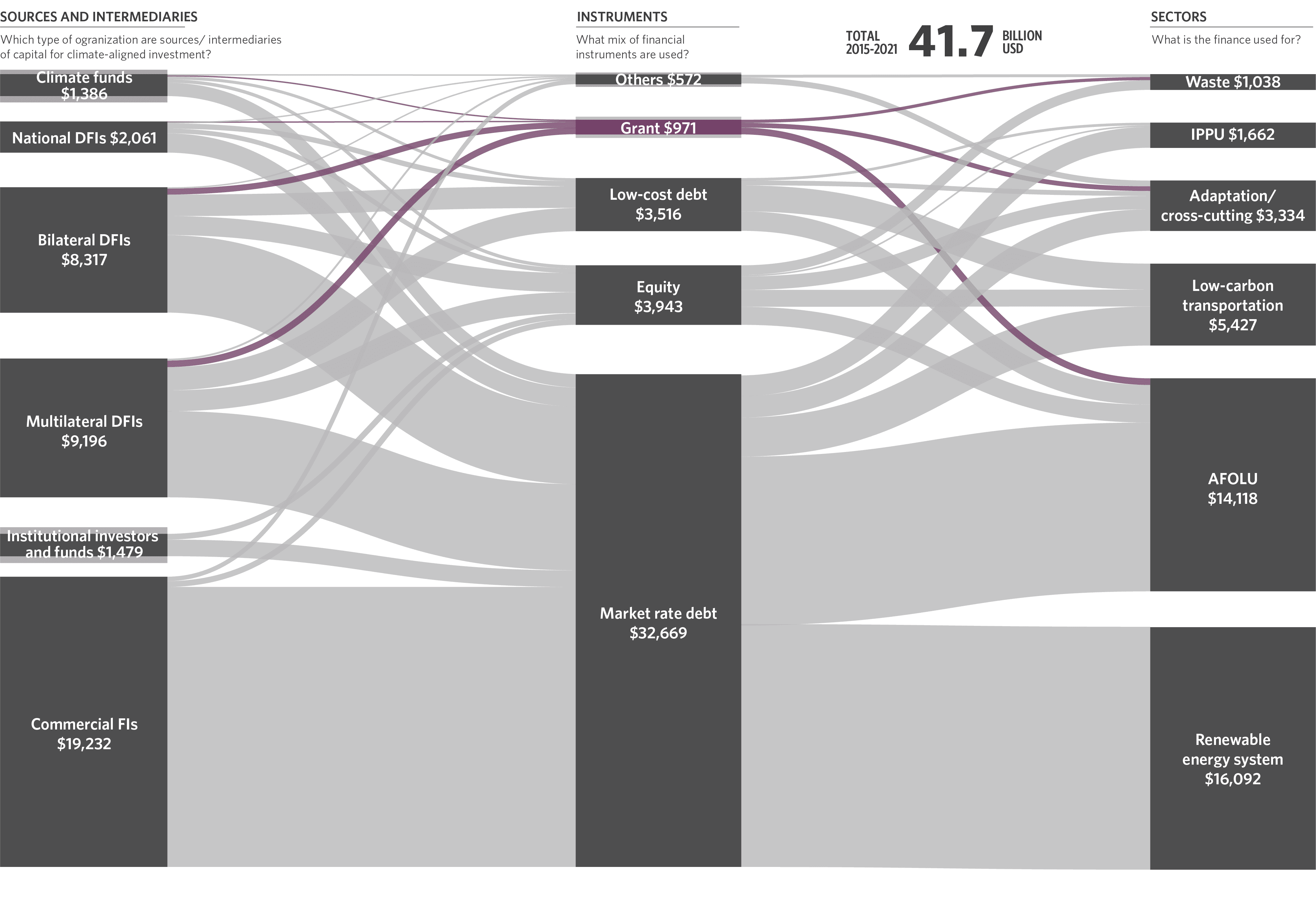

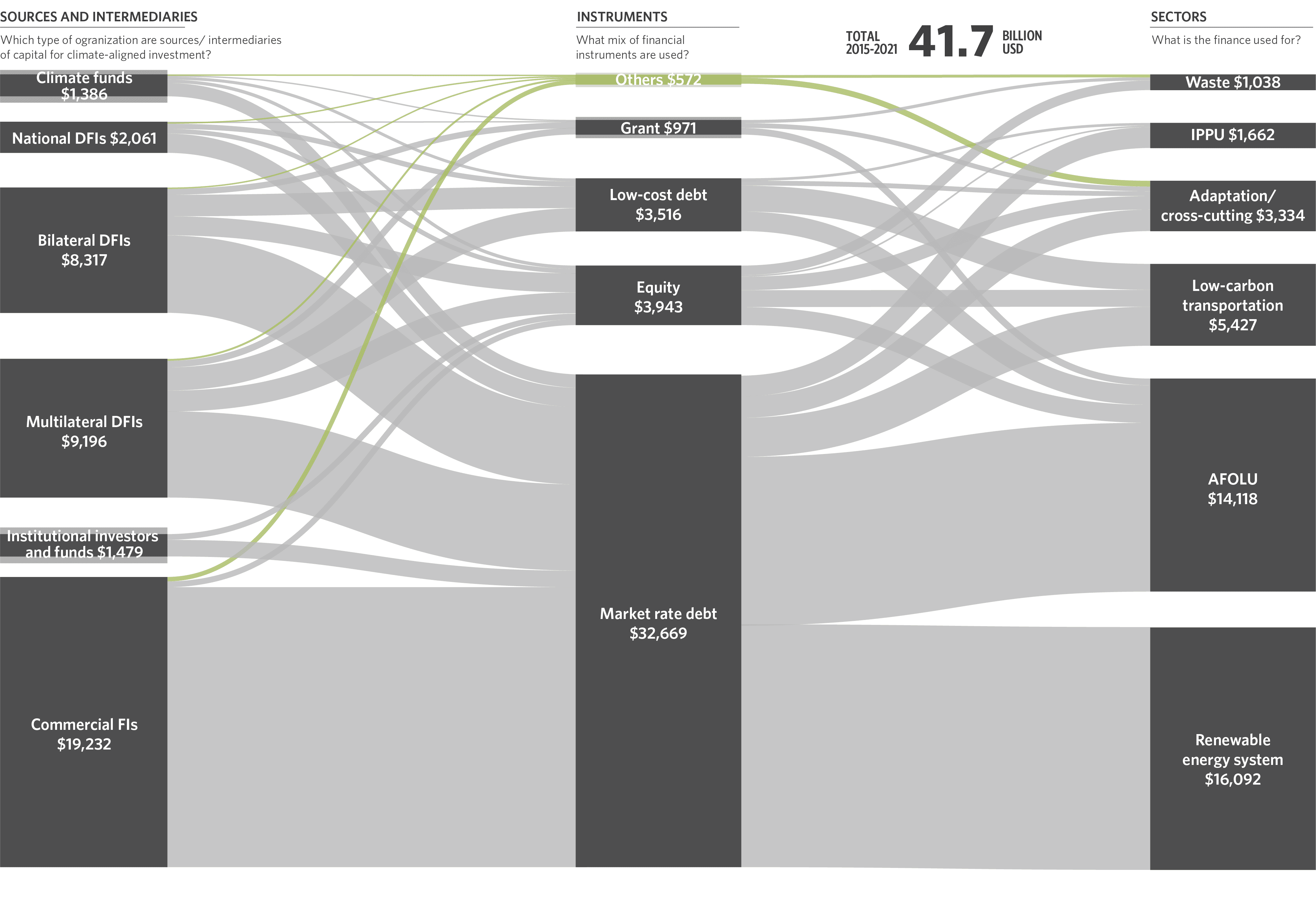

Based on CPI’s latest tracking of climate finance in Indonesia’s financial sector[2], a total of USD 41.7 billion was committed from 2015 to 2021. This constitutes 15% of the country’s climate finance needs, with public and private financial institutions (FIs) contributing almost equal shares of annual climate-aligned investments[3] (Figure 1)

Figure 1. Financial sector’s climate-aligned investment, 2015-2021, USD million, by actor

Public finance dominated by DFIs and targeting RE

Public finance actors[4] committed an annual average of USD 3.5 billion in climate-aligned investment. Multilateral and bilateral development finance institutions (DFIs) continued to provide the majority of public finance, targeting primarily renewable energy (RE), contributing up to USD 2.9 billion annually. Their finance flows hiked in the period of 2017 – 2018, almost double the previous year, and are expected to continue increasing as they raise their climate ambition. MDBs and DFIs (e.g., members of International Development Finance Club) are committed to providing more than 50% of their financing for domestic and international climate-aligned investment by 2025 (MDBs, 2021; IDCF, 2020). National DFIs have provided relatively stable climate finance flow for the past 6 years, averaging USD 344.5 million annually, indicating Indonesia’s continuous commitment to achieving NDC targets since its first pledge to the Paris Agreement. Climate funds[5] then contributed an annual finance flow of USD 231.1 million, mostly allocated for AFOLU projects with dual mitigation and adaptation benefits.

Vast potential for greater private finance contribution

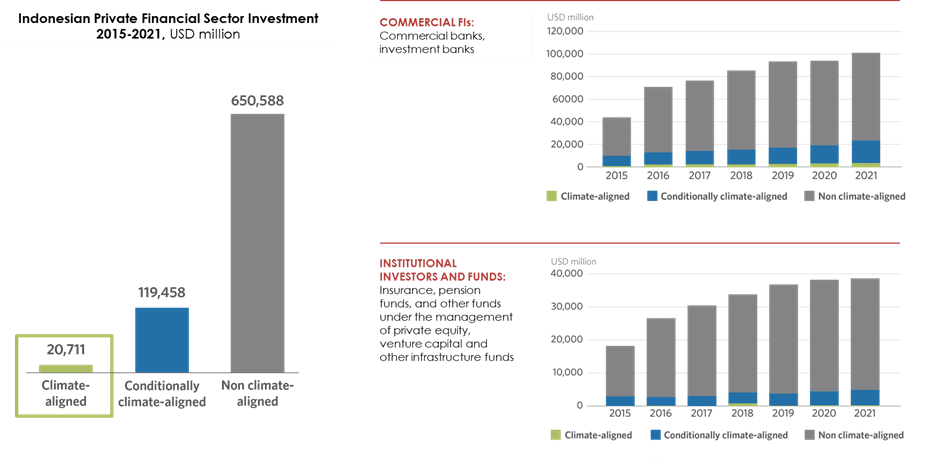

Private finance actors[6] contributed annual average of USD 3.4 billion of climate-aligned investment. This represents only 3% of total investments by private actors (Figure 2). Most of private sector climate finance is sourced from commercial FIs,mainly driven by the requirements imposed by regulators to invest in climate-aligned and supporting MSMEs activities.[7] Recent update in financial sector regulation – OJK Regulation POJK 18/ 2023 – sends clearer signals for private financiers to mainstream sustainability within their investment coverage, as well as social and sustainability aspects. As indicated by CPI’s focus group survey in 2022, Indonesian commercial FIs are investing mainly in AFOLU due to sector familiarity, followed by renewable energy and low-carbon transportation. Despite their huge potential, finance flows from institutional investors and funds[8] in Indonesia capital markets contributed only 7% of the private FIs’ climate-aligned investment at USD 20.7 billion from 2015 to 2021.

The potential for greater private finance contribution is huge as there is higher growth in private capital. Total stock market capitalization value at the end of 2022 was at IDR 9,5 quadrillion (USD 600 billion), experiencing 15.1% increase while bank loans grew 11.2% year on year representing IDR 6 quadrillion (USD 385 billion) in cash flow. A fraction of these is sufficient to close the USD 145 billion climate financing gap if diverted into climate-aligned activities.

Figure 2. Indonesia’s Private Financial Sector Investment, 2015-2021, USD million

Snapshot of sectoral finance: Indonesia’s power sector

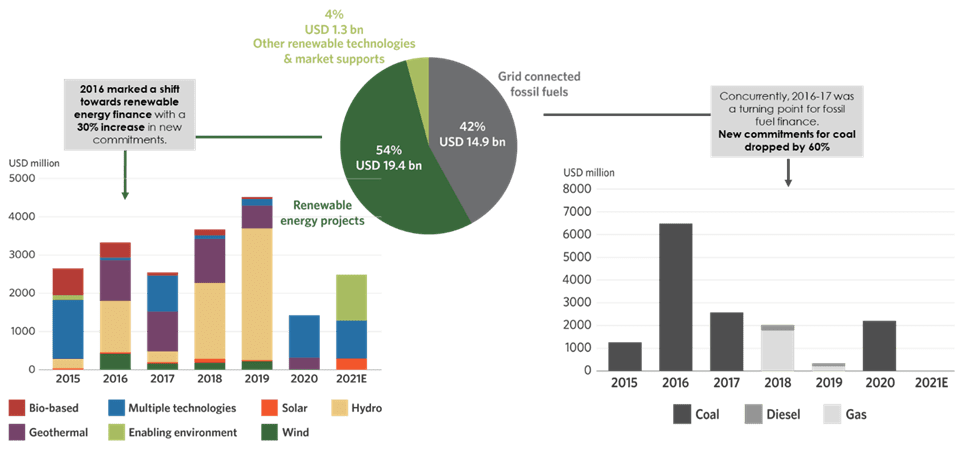

Power as a major sector in Indonesia’s energy transition has undergone a steady shift away from coal, although the size is not yet sufficient to meet renewable energy investment needs. Based on CPI’s Indonesia power sector tracking, more than half or around 67% of USD 35.6 billion total investment over the past six years went to renewable energy, mostly to geothermal and hydropower. Since 2016, investments in new fossil fuel generation have been on the decline (Figure 3). The shift in market preferences, commercial FIs’ net zero pledges, moratorium on coal-fired power, and regulatory signals — POJK 51/2017 on Sustainable Finance Implementation, POJK 18/ 2023 on Sustainability Bond and Linked Products, MEMR Regulation 4/2020 on Renewable Power Generation, and Energy Transition Mechanism Initiative in 2021 — contributed to the realignment of investment strategies to decarbonize this sector.

Figure 3. Indonesia’s power sector finance snapshot, finance commitment from 2015 to 2021E, USD million, by technology

The next trend in power sector financing will likely follow government’s policy signals, as our tracking data shows that the financial sector reacts in step with regulatory enactments. Recently, the Government of Indonesia has started to make significant progress with selected policy reforms to narrow the climate investment gap, including the iteration of Green Taxonomy 1.0 to a Taxonomy for Sustainable Finance under OJK, the relaxation of Local Content Requirement (LCR) for solar panel and solar PV system[9], and establishment of an Indonesian National Energy Transition Taskforce[10]. Furthermore, OJK regulation POJK 14/ 2023, regarding the carbon market, facilitates the first mandatory Emission Trading System (ETS) that places an emissions cap initially covering 99 coal-fired power plants (CFPPs), accounting for 81.4 % of national power generation capacity.

Indonesia’s carbon finance initiative is timely and aligned with global carbon credit initiatives, for instance, the Coal-to-Clean Credit Initiative (CCCI) that potentially incentivizes coal plant owners to change course and invest in RE, while generating funding to support the transition of impacted communities, and the Energy Transition Accelerator (ETA) that seeks to mobilize new finance commitment from the private sector for phasing out coal. In parallel, Indonesia’s ETM Country Platform aims to catalyze energy transition finance and the USD 20 billion JETP seeks to attract finance for not only the ETM’s coal retirement and renewable energy goals, but also for grid development and low-carbon transportation supply chains.

Upstream of power supply chain: Domestic mining sector

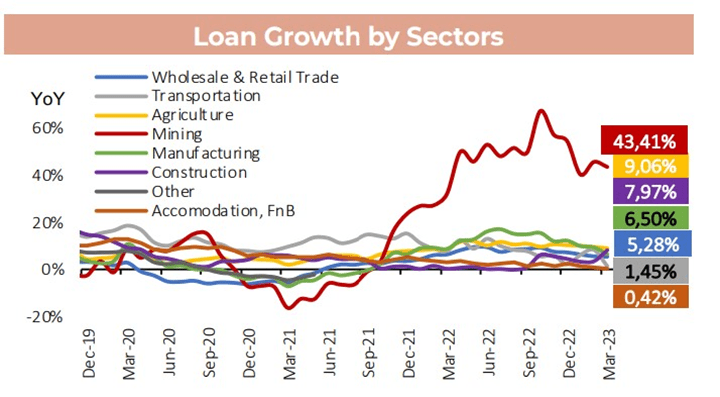

Based on OJK’s 2023 report on Indonesia financial development, by far the highest growth in investment loans went to mining sector, spiking 43% in 2022 which dwarfed all other sectors. This is consistent with GoI’s plans and actions in boosting the domestic mining sector including downstream activities that involves processing of raw materials into value-added goods, hence increasing the selling value of mining products from Indonesia. The growth of the mining sector is also in line with the trend of commodity export and has benefited from higher commodity prices in 2022.[11] As of 2022, Indonesia stands as the world’s largest nickel producer and third-largest coal producer.

Figure 4. Indonesia’s Banking Industry – Loan Growth by Sectors, (%)

Next Step

As the outlook of climate-aligned investment responds well to government policy signals (including JETP, ETM, and power sector ETS), as well as global initiatives (such as the ETA and CCCI), streamlining financial and sectoral policies — as well as tailoring the necessary fiscal support — is of paramount importance to mobilize the necessary scale of finance for transitioning to a low carbon economy.

Upcoming CPI work will share more detailed analysis of relevant policy signals to mainstream the principles of sustainability into the Indonesia financial sector and further support climate-aligned investment.

[1] Based on Indonesia’s Climate Budget Tagging data (Indonesia MoF, 2021)

[2] Indonesia’s financial sector is defined as a whole set of actors that provide financial services to commercial and retail customers, including investment funds, banks, and insurance companies (MoF – Fiscal Policy Agency, 2021)

[3] Climate-aligned finance: Activities that directly contribute to reducing GHG emissions and improving climate resilience, aligned with Indonesia’s climate goals and the categorization of green and/ or sustainable sectors under the regulations of Financial Sector Authority/ Otoritas Jasa Keuangan as well as CPI’s Global Landscape of Climate Finance and Net Zero Finance Tracker

[4] Public financial institutions in this report include Multinational Development Finance Institutions (DFIs), Bilateral DFIs, National DFIs, and Climate Funds

[5] Climate funds include multilateral climate funds such as The Green Climate Fund (GCF) and Adaptation Fund (AF)

[6] Private financial institutions in this report include Commercial Financial Institutions and Institutional Investors and Funds

[7] OJK regulation POJK 51/2017

[8] Institutional investors and funds include insurance, pension funds, and other funds under the management of private equity, venture capital and other infrastructure funds

[9] Ministry of Industry Regulation No. 23 Year 2023 stipulates a minimum requirement for 60% LCR for solar panels has been postponed until January 1st, 2025; Import of solar panels is allowed for solar PV systems with minimum capacity of 50MW specifically for the new capital and whose projects will need to commission at the latest by Dec 2024.

[10] Decree of Coordinating Ministry for Maritime and Investment Affairs No. 144 Year 2023 officially enacted the GoI’s special task force to guard the Indonesian energy transition process involving high-level officials across relevant ministries and government agencies.

[11] Bank Indonesia. 2023. Strengthening Policy Synergy to Maintain Stability while Advancing the Economy amid Escalating Uncertainty and Declining Global Growth. Available at: https://www.bi.go.id/en/iru/presentation/Documents/Republic%20of%20Indonesia%20Presentation%20Book%20-%20May%202023.pdf