One of the major themes coming out of Doha at the UNFCCC Conference of Parties last week was the role of climate finance. Basically, if we want to reduce emissions and scale up renewable energy and energy saving measures, we need to figure out where the money to do these things will come from.

With public budgets strapped, this challenge increasingly becomes about how we can direct limited public funds to unlock private investment in a targeted, effective way.

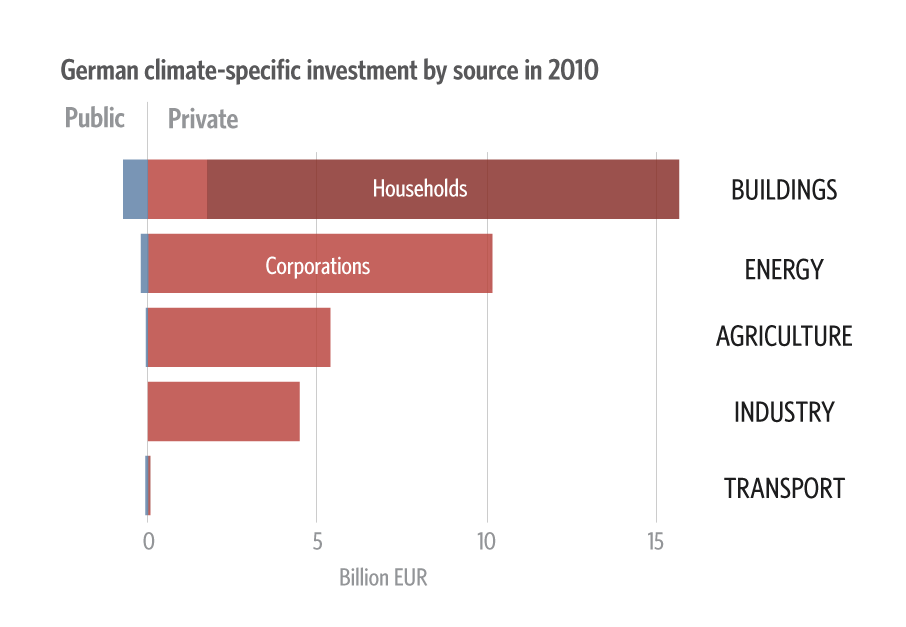

In Germany, a recent CPI study showed that 1.5% of GDP, or 37 billion Euros, is invested in climate-related activities like renewable energy and energy efficiency. More than 95% of that investment comes from businesses and households. This small share of government spending is striking. However, it would be wrong to conclude that the government plays no role.