Global momentum towards a climate resilient, low-carbon economy is building quickly. We have reached a tipping point, where it has become clear that transitioning to a low-carbon energy system is good for both the economy and the planet.

China, India, the US, the EU, and many other governments have announced ambitious plans to reduce carbon emissions and increase climate investment. Leaders from thirteen of the largest American businesses also recently pledged to cut emissions and invest at least $140 billion in renewable energy. And investors of all sizes are opting to divest from fossil fuel assets and invest in assets that boost a low-carbon future along with their bottom lines.

However, because the global economy has been built on high-carbon growth until now, current policies and business models – which were developed to meet the needs of fossil fuel generation – are inefficient for large scale deployment of renewable energy. They are ill-suited to take full advantage of the financial opportunities that the transition could provide.

For the past few years, Climate Policy Initiative’s Energy Finance program has been exploring new and better ways to maximize the financial benefits of transitioning to a low-carbon energy system, while minimizing the cost to public budgets and private balance sheets. We’ve worked with key actors around the world to evaluate and improve policy, and to design new financial vehicles that can lower costs and increase returns from low-carbon energy.

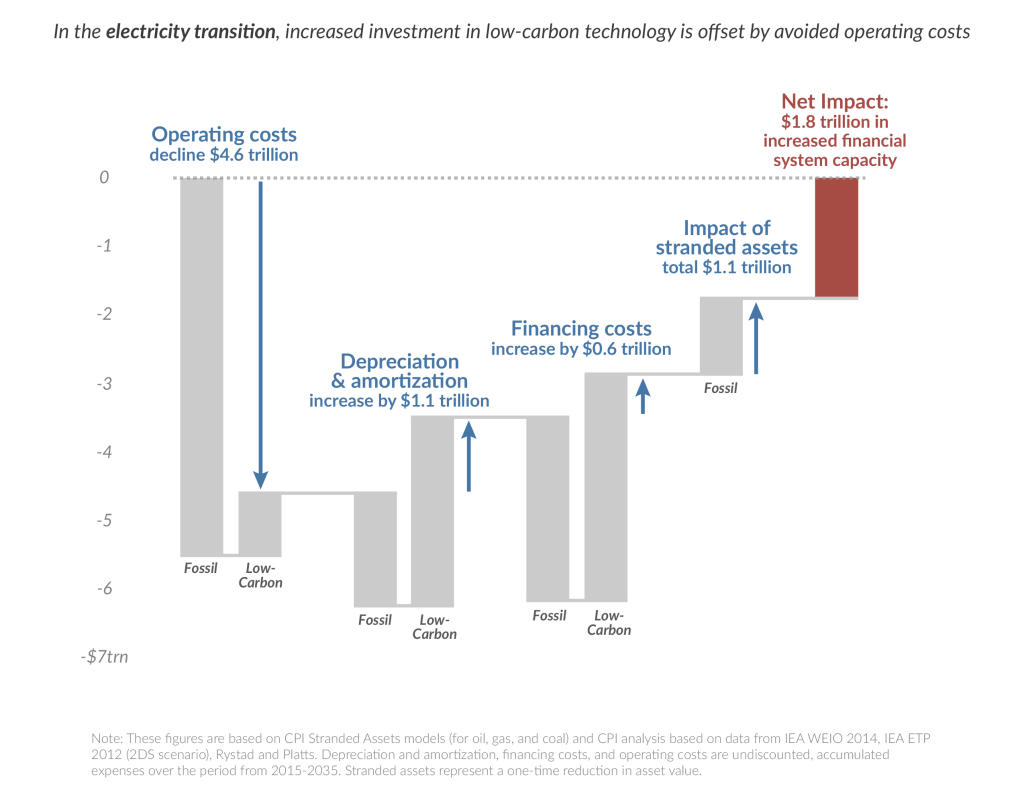

For example, we’ve demonstrated that, through the right policies, governments can reduce the risk of stranded assets and generate trillions in global savings through the transition to low-carbon energy. Utilities can pioneer new utility business models which can attract more investment and lower the cost of renewable energy by up to 20%. And financial service providers can create new financial vehicles which could unlock green investment from institutional investors. As more and more governments and financial leaders are looking to take advantage of the financial opportunities of a low-carbon economy, the demand is growing for analysis and tools which can lower the costs and accelerate the benefits of transitioning. CPI’s Energy Finance team has been busy at the center of this, working on several important projects for key actors, including: Unlocking investment for renewable energy in Germany, Spain, Italy, the UK, and Nordic nations,through deep dive analyses for the European Climate Foundation and the New Climate Economy program, which highlight potential investors whose risk-return profiles are aligned with renewable energy assets, and identify new financing mechanisms that may attract investment from these sources. Accelerating states’ transition to a clean grid in the US,through advising regulators in New York, Colorado, and other states on how to reduce the carbon intensity of the power sector while minimizing economic losses, and how to incentivize utility-scale renewable energy. Managing the risk of stranded assets in developing countries,by supporting the European Bank for Reconstruction and Development on how to assess and estimate the financial impact of climate change policies on national budgets and what options are available to manage risks and benefit from opportunities, and by exploring financial levers to curb fossil fuel investments in China. Lowering the cost of capital for renewable energy projects,by working with institutional investors to develop new financial vehicles for clean energy infrastructure investment, and by analyzing the opportunities and limitations of YieldCos and other emerging financial vehicles for renewable energy. Increasing the availability of finance at attractive terms for renewable energy in India,by evaluating the cost-effectiveness of different government subsidy mechanisms, and determining the potential of investment in renewable energy from key sets of investors, including institutional investors and foreign investors. Countries, businesses, and individuals around the world are choosing to chart a better, cleaner course to economic growth. CPI’s Energy Finance team is with them at the helm, working together to find new ways to transition to a low-carbon economy most cost-effectively. To meet the increased demand for our services, we are currently looking to expand our team of analysts in San Francisco, Delhi, and London, to continue identifying ways in which finance can catalyze the global transition to low-carbon energy. Visit our hiring page for more information.