Climate change poses a threat to water resources, particularly for poor communities who are more vulnerable to extreme weather events. To meet 2030 Sustainable Development Goals, annual investment in water supply and sanitation in developing countries needs to increase threefold to USD 114 billion.

Private finance will need to fund a significant portion of these investments. The water sector, however, is not traditionally favored by private investors due to uncertainties in revenues and potential for political interference, particularly in developing countries.

Any scaled-up finance flows need to result in low carbon, climate resilient infrastructure and utilities, not only for the benefit of water access but also to ensure any private investment is secure and viable.

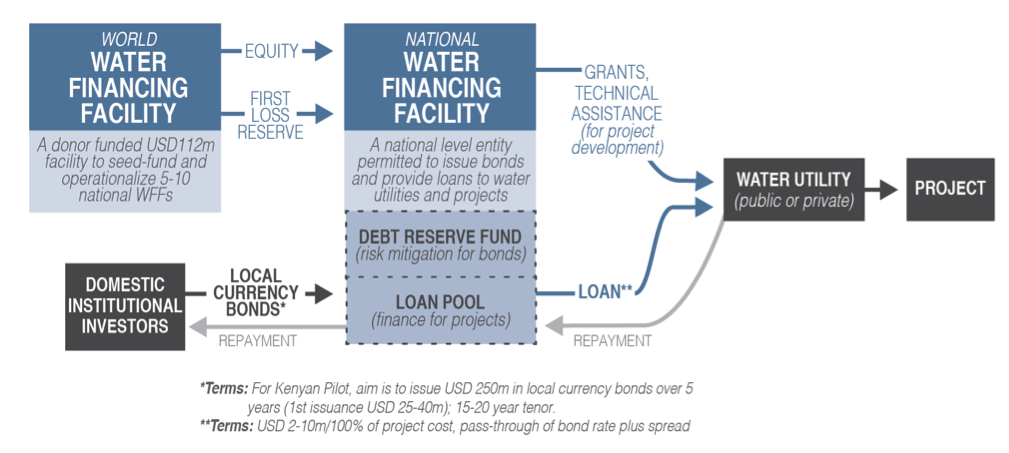

The Water Financing Facility mobilizes domestic investment into climate compatible water sector projects through the local bond market.

The Water Financing Facility (WFF) mobilizes large-scale domestic private investment from institutional investors such as pension funds and insurance companies in support of countries’ national priority actions on adaptation and mitigation in the water sector, thereby also contributing to ensure availability and sustainable management of water and sanitation for all. It seeks to coordinate this finance with public funding and international impact investment to help bridge the investment, infrastructure, and sustainability gaps countries are facing.

The types of projects financed will have a clear linkage to climate vulnerabilities in the water sector and will be assessed against priority actions as identified in Nationally Determined Contributions for climate change.

Funded by donors and impact investors with up to USD 112 million in public finance, the World WFF aims to centralize knowledge, expertise, and budgets to replicate and scale up eight national-level facilities.

For a given project, WFF financing can improve debt service coverage by 71% and allow cost-reflective tariffs set by utilities to be stable over time.

About

Climate change poses a threat to water resources, particularly for poor communities who are more vulnerable to extreme weather events. To meet 2030 Sustainable Development Goals, annual investment in water supply and sanitation in developing countries needs to increase threefold to USD 114 billion.

Private finance will need to fund a significant portion of these investments. The water sector, however, is not traditionally favored by private investors due to uncertainties in revenues and potential for political interference, particularly in developing countries.

Any scaled-up finance flows need to result in low carbon, climate resilient infrastructure and utilities, not only for the benefit of water access but also to ensure any private investment is secure and viable.The Water Financing Facility mobilizes domestic investment into climate compatible water sector projects through the local bond market.https://www.youtube.com/embed/6fka_ggMauQ?feature=oembed

The Water Financing Facility (WFF) mobilizes large-scale domestic private investment from institutional investors such as pension funds and insurance companies in support of countries’ national priority actions on adaptation and mitigation in the water sector, thereby also contributing to ensure availability and sustainable management of water and sanitation for all. It seeks to coordinate this finance with public funding and international impact investment to help bridge the investment, infrastructure, and sustainability gaps countries are facing.

The types of projects financed will have a clear linkage to climate vulnerabilities in the water sector and will be assessed against priority actions as identified in Nationally Determined Contributions for climate change.

Funded by donors and impact investors with up to USD 112 million in public finance, the World WFF aims to centralize knowledge, expertise, and budgets to replicate and scale up eight national-level facilities.For a given project, WFF financing can improve debt service coverage by 71% and allow cost-reflective tariffs set by utilities to be stable over time.

WFF would provide an initial public-private finance leverage ratio of 1:1.4 to 1:3.4 that would be increased over time as more private capital is mobilized.

In seven potential pilot countries identified, USD 1.23 billion per year in private finance may be mobilized out to 2030 if national WFFs capture a 25% share of the investment needs.

In addition to the positive impacts on costs of capital and resource mobilization for sustainable water infrastructure financing, the approach facilitates a number of additional environmental and socially beneficial outcomes, including improved access to safe and affordable water, health, socio-economic development, and resilience to ecosystem risks.

Implementation at the national level could require two to three years to establish from a standing start, provided there is adequate data on water utilities’ creditworthiness, and adequate and consistent project pipeline, and domestic investors are entitled to invest in non-government bonds.

A pilot in Kenya was established in early 2017. The national-level facility in Kenya has set a target to periodically issue bonds for water and sanitation projects, with a first to be realized by the end of this year. In addition, in April 2017, the Netherlands Ministry of Foreign Affairs announced EUR 10 million to support the World Water Facility’s launch. There are also plans for expansion to two more countries, contingent on raising an additional EUR 21 million in donor funds.

A pilot in Kenya is progressing. The World Water Facility has also received additional funding support from the Netherlands government.

DESIGN

A World Water Financing Facility (WWFF) would be established as a limited liability company that facilitates the creation of eight national-level facilities and provides financial engineering, transaction advice, and financial management support.

The national-level facilities would be established in developing countries and would provide long-term, lower cost loans to public or private water utilities that have little or no access to commercial finance or at poor terms. The loans would be backed by the utility but linked with specific water infrastructure investments, appropriately screened and designed to enhance the adaptive capacity of the utility and sector against identified climate vulnerabilities.

The National WFF would then leverage its blended finance capital structure to issue local currency, investment-grade bonds to domestic institutional investors (such as pension funds and insurance companies). Incomes generated by water utilities would be ring-fenced to provide additional creditworthiness beyond the strength of utilities own balance sheet. National governments may also provide a revenue pledge to the facilities’ debt reserve fund to mitigate credit risk.

In order to address the climate compatibility challenges of the water sector, the WFF integrates climate considerations at all levels – from country selection, project selection, project design, optimization, reporting, and impact assessment.