This publication is CPI’s analysis of The Green Guarantee Company (GGC), an innovative climate finance instrument endorsed by The Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

ABOUT

Green bond issuance is expected to range between USD 500 billion to 1 trillion in 2022, however, less than 10% will flow to emerging markets outside China. Lack of access is driven primarily by perceptions of the risks associated with climate investments in developing economies.

Outside global capital markets, large climate infrastructure projects struggle to raise patient debt capital required at scale other than via limited public finance. Emerging capital markets are underdeveloped, with green bonds delivering little benefit in terms of scale or horizon.

Without solutions to unlock private climate capital, emerging markets cannot mobilize the capital required to deliver on climate change mitigation obligations under the Paris Agreement and build resilience domestically against physical climate risks.

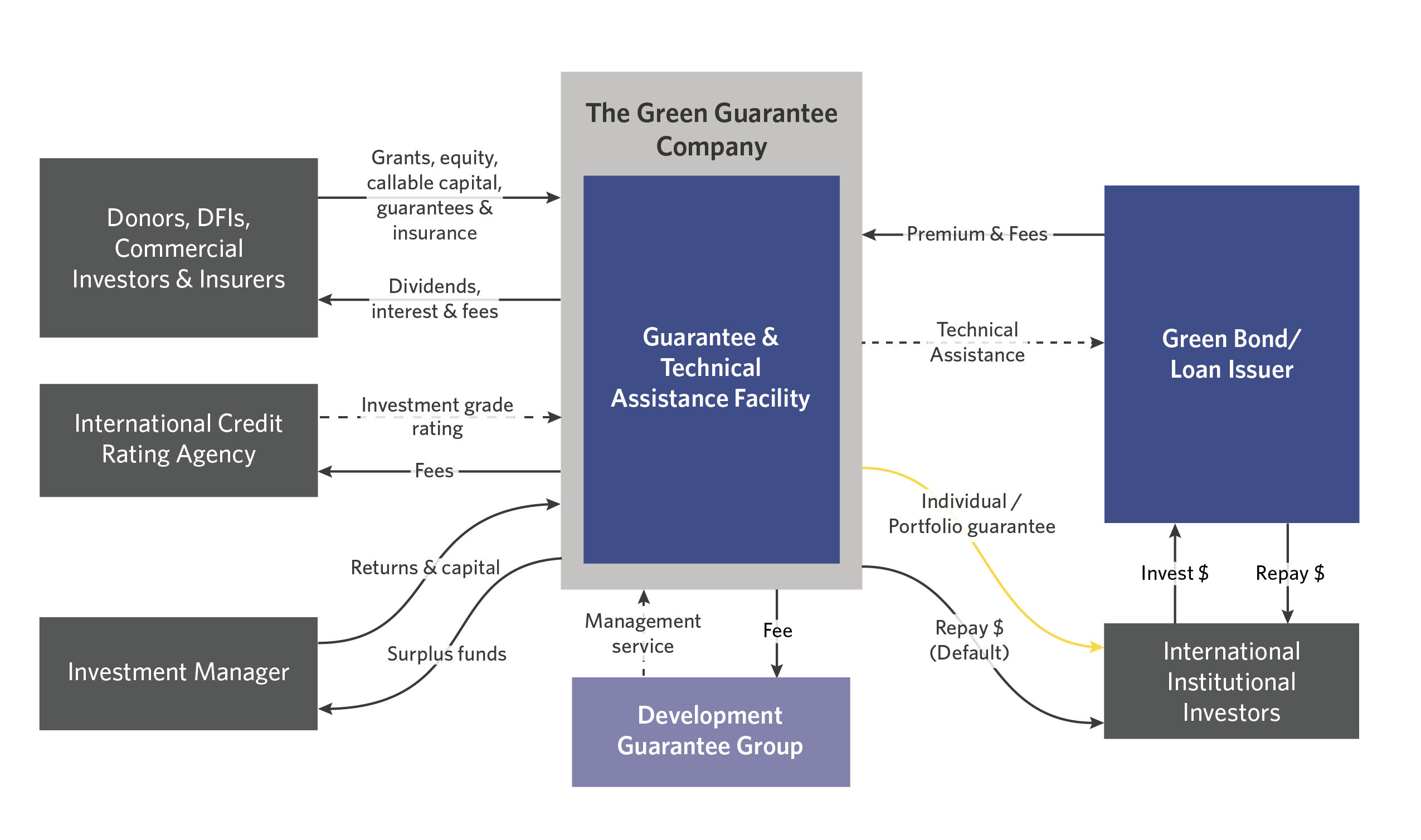

The Green Guarantee Company is the first specialist guarantor for emerging market climate adaptation and mitigation projects, unlocking access to global investors by de-risking green bonds and loans.

INNOVATION

The Green Guarantee Company (GGC) is unique in institutionalizing credit enhancement to attract global green bond investors into quality climate projects across the Global South, spanning a wide range of infrastructure sectors and transaction structures, resolving information asymmetries over time.

GGC provides credible borrowers with a full guarantee anchored in hard currency and aligned with the international Climate Bond Standard to support bonds and loans of up to 20 years.

A linked technical assistance facility addresses barriers to uptake of green bonds and loans in emerging markets through raising market awareness, building issuer capabilities, and preparing pipeline for certification and financial close.

IMPACT

GGC is expected to unlock access to USD 10 billion in climate capital over ten years, accelerating sustainable infrastructure development. As a guarantee facility, the GGC does not make direct project investments, but rather enables such projects. Many of these projects would otherwise have been delayed or even cancelled due to lack of financing.

Initial estimates suggest that GGC guarantees have the capacity to avoid approximately 75 Mt carbon dioxide equivalent over the lifecycle of projects supported during the pilot phase. Whilst mitigation projects are expected to comprise the bulk of GGC’s portfolio, it is targeting a minimum of 20% adaptation investment.

DESIGN

The GGC is capitalized by paid-in equity and callable capital facilities arranged in advance of new business to ensure adequate capital provisioning. Surplus capital will be invested by an investment manager in low to moderate risk strategies targeting capital preservation and generating additional income.

This set of institutional arrangements will ensure the GGC has an investment grade rating from a highly regarded rating agency from day one, leveraging an initial capitalization of USD 100 million in equity from public investors.

Separately, the TA facility will be capitalized with USD 10 million of grant funding from donors. The TA facility accelerates market readiness through building local knowledge and capabilities while developing a pipeline through offering borrowers structuring and certification support

Drawing on considerable experience, the Development Guarantee Group (DGG) – the manager of the GGC – will work with defaulting borrowers to restructure non-performing debt, eventually recovering a large portion