India has set ambitious targets to increase the share of renewable energy (RE) in its energy mix. The Government of India (GoI) plans to install 175 GW of renewable energy projects by 2022 and 450 GW by 2030. To put that in perspective, total installed energy capacity in India at the end of 2020 was 379 GW, or which 93 GW (25%) was RE.

To date, the government’s primary focus of RE expansion has been on large grid-scale solar. However, achieving India’s ambitious RE targets will also require an increase in distributed renewable energy (DRE) projects. If a more favorable regulatory and policy environment is created, such DRE projects, though smaller in size, have greater scalability potential. They also avoid the long lead times and execution bottlenecks associated with public-sector offtake procurement projects.

In this CPI report, we outline the benefits and market potential of India’s DRE sector, examine the current policy and institutional landscape, and provide tailored recommendations for the different stakeholders.

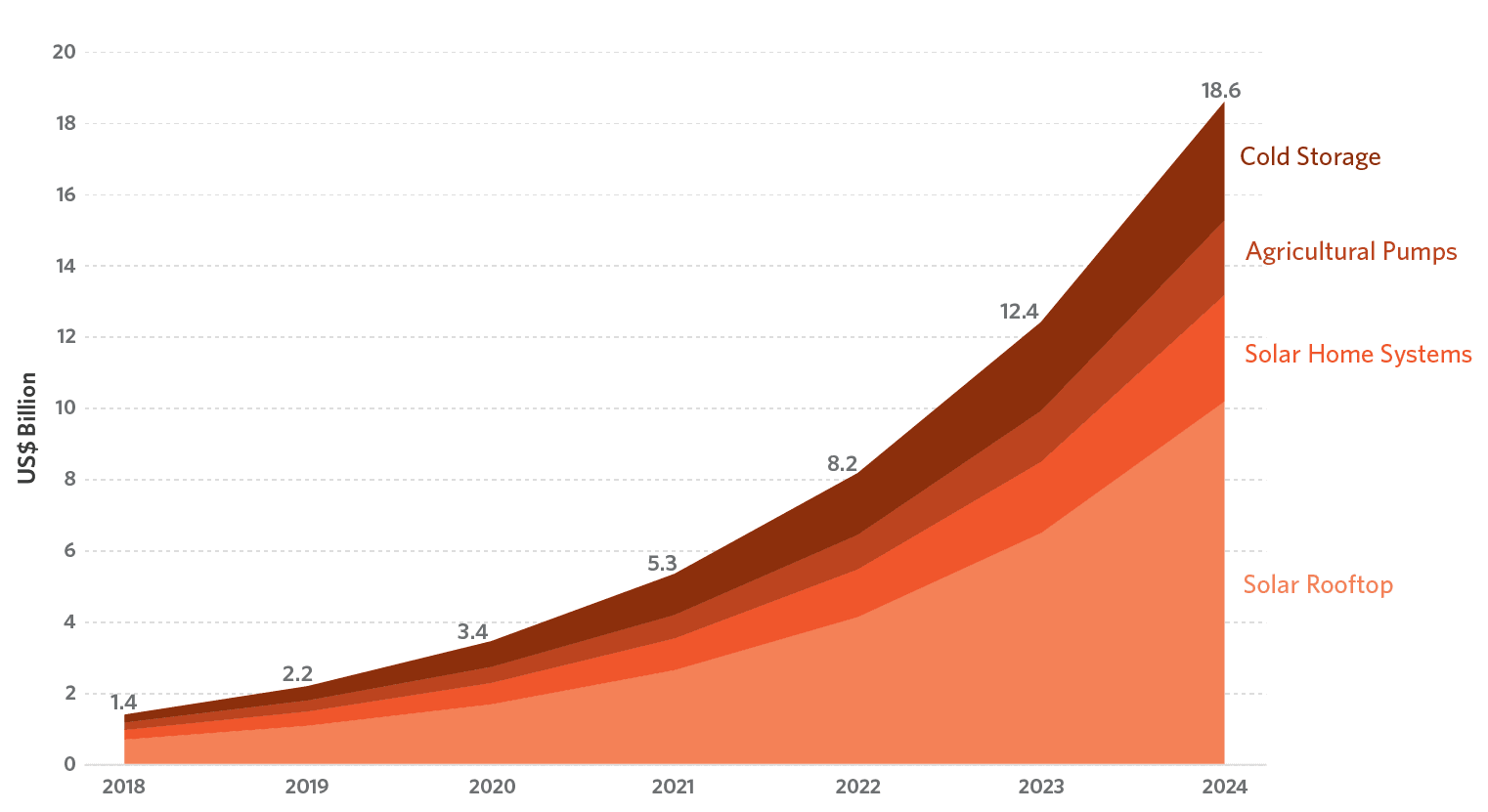

To meet its sustainable energy targets, India will require annual DRE investment of USD 18 billion by 2024, a 10x increase from current levels.

The 2022 target of 175 GW of RE includes 100 GW of solar capacity, out of which 40 GW is earmarked for rooftop solar (RTS) and off-grid solar (OGS). There are multiple market opportunities for RTS and OGS. The government previously introduced policy frameworks for multiple downstream off-grid solar (OGS) applications, such as agricultural pumps, cold storage, and home systems, and multiple other DRE downstream applications are emerging, such as energy storage, EV charging, and rural non-farm productive use appliances.

All of these opportunities mean that DRE can, and should, play a vital role in achieving India’s sustainable energy targets in the coming decade. However, to achieve these targets we estimate that India will require a significant increase in annual investments, from USD 2 billion in 2019 to USD 18 billion by 2024. That level of investment increase will not be possible without significant changes to India’s existing DRE policy framework.

Backed by central government incentives, states had initially created a favorable policy environment for DRE. However, in recent years, a number of these incentives have been rolled back. For example, due to RTS subsidy rollbacks, state electricity distribution companies (DISCOMs) are turning hostile towards RTS as they foresee a loss in revenue, an increase in costs, and the longer-term threat of disintermediation. In addition, the COVID-19 outbreak has had a severe financial impact on all stakeholders, leading to a conservative outlook on demand, profitability, and cash flows.

In these circumstances, it is imperative that the GoI re-evaluates its approach towards DRE and considers a rejuvenated policy framework that would both develop the private market for multiple downstream applications and maintain a meaningful role and revenue stream for DISCOMs.

Policy Gaps and Opportunities

In addition to its current focus on large grid-scale projects, to meet its sustainable energy goals India needs a shift in policy focus towards creating a robust private market for the DRE sector.

A stable policy environment with incentives for all stakeholders is required to accelerate growth and would help direct more public and private financing, from domestic and international sources, into the DRE sector. Specific examples developed further in this report include:

- Rooftop Solar: A more holistic demand aggregation model integrated into the GoI’s Phase II grid-connected RTS scheme would allow DISCOMs to get both a transaction fee for facilitating the installation as well as monthly fee for Operation & Maintenance (O&M), such that billing/collection would better allow them to stay relevant and eliminate the threat of disintermediation.

- Distributed Storage: Distributed energy-storage policy should be integrated with the Phase II RTS scheme. Instead of promoting a capital-subsidy based model, the government should create a more favorable environment for operational models with the involvement of DISCOMs.

- Smart Energy Management: Creating incentives forInternet of Things (IoT) based energy efficiency retrofits, that can attach to existing home circuits, will accelerate energy consumption optimization in households and small commercial establishments. This would not only help reduce energy bills and carbon footprint, but could strengthen overall grid resilience. For example, DISCOMs could move more quickly towards Time-of-Day billing as a part of their demand-side management.

- Electric Vehicle Charging Infrastructure: India’s EV-charging infrastructure should be treated as a public good. Policy should support a decentralized approach, with DISCOMs being the implementing agency for a franchise-based model. Allowing commercial establishments that produce excess solar power from RTS to set up retail charging points would be another step in the right direction.

- Solar Agricultural Pumps: The GoI’s KUSUM scheme currently has a centralized tendering process. Allowing state DISCOMs to partner with private installers at a local level should be considered. DISCOMs could facilitate commercial partnerships with solar pump installers and local farmer co-operatives. The DISCOM, through the installer, could pool the excess power generated from solar pumps into a single point of injection into the grid and pay power purchase costs, net of service fees, to farmer co-operatives.

- Solar Cold Storage: The GoI currently offers a 30% subsidy on solar cold storage installation under its broader rural livelihood subsidy scheme. However, considering the importance of cold storage in the agriculture supply chain, it is vital to create a separate solar cold storage program to bring down capital costs.

- Productive Use Appliances: It is imperative to shift the focus of grants from subsidizing product purchases to providing project development support to entrepreneurs developing the products. Equipment subsidies limit grant usage to the number of assets that it can fund, whereas project development support allows entrepreneurs to both defray technical assessment costs associated with commercial capital raising as well as develop commercially scalable business models that reduce the cost of products for end-users.

Financing Gaps and Opportunities

The RTS and OGS markets are small and fragmented, largely reliant on philanthropy or subsidized private funding. There is currently limited interest from private commercial capital. Supported by stronger financial-sector policy and strategic public investment, the public, private, development and philanthropic sectors have a tremendous opportunity to work in coordination to open significant new DRE market opportunities for India.

DRE and its downstream applications offer an opportunity to not only meet India’s climate and renewable energy targets but also provide attractive returns to financial investors.

Over the last few years an increasing number of smaller RTS and OGS companies have been able to better develop their business models and are now in need of growth-stage funding. However, many smaller RTS and OGS developers still lack the required capabilities to navigate the entire credit appraisal process of lenders. This lack of expertise also reduces their probability of reaching financial close. For such developers, there is increasing demand and need for additional rounds of early-stage capital, technical assistance, and strategic advice to move towards commercialization and to attract growth equity.

Information asymmetry, due to lack of project preparation and targeted transaction advisory, is also a significant cause of lack of access to capital for smaller DRE developers. Government and philanthropic support should be channeled to quickly address these gaps, allowing the DRE sector to scale more rapidly.

On the private capital side, though impact investors have scaled up their DRE operations over the last decade, participation among private capital owners such as family offices, high net-worth individuals, and corporates remains limited. With competing demands for capital from mainstream business models, such investors view DRE as less financially attractive. Blended finance instruments can potentially help to bridge this gap.

Even with the positive intent of impact investors, currently impact investors, along with commercial financial investors active in the space, tend to favor mature-stage companies and projects. An opportunity exists to create incentives and expand investment focus to finance smaller and emerging companies in niche segments that have the potential to scale over the next few years.

DRE and its downstream applications offer an opportunity to not only meet India’s climate and renewable energy targets, but also provide attractive returns to financial investors. DRE also paves the way for India to reduce import-dependence on crude oil, in turn accelerating economic growth and jobs in the long run. Addressing the existing policy and financing gaps identified in this report through a combination of policy advocacy, knowledge dissemination, and catalytic finance would not only allow for better targeting and risk-hedging of government spending programs, but would also allow capital to be recycled efficiently, thereby enhancing both the duration and magnitude of the impact.