This publication is CPI’s analysis of Rural Prosperity Bond, an innovative climate finance instrument endorsed by the Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

As the climate crisis worsens, 65% of Africa’s land is affected by degradation. Should no action be taken, this would lead to an estimated loss of PPP USD 4.6 trillion1. From the loss of 280 million tons of cereal crops each year. 4.6 trillion Purchasing Power Parity (PPP) USD are equivalent to 1.9 trillion constant 2011 USD over 15 years up to 2030. Rural small and medium enterprises working on sustainable agriculture and forestry are crucial to land restoration and the rural economy.

However, because these enterprises are too small for commercial banks and too large for microfinance, they have relatively few sources of finance available to them. Consequently, they frequently lack the capital needed to grow their businesses and serve more farmers. These rural communities are already highly vulnerable to climate change and food insecurity, the latter being exacerbated by the current COVID-19 crisis.

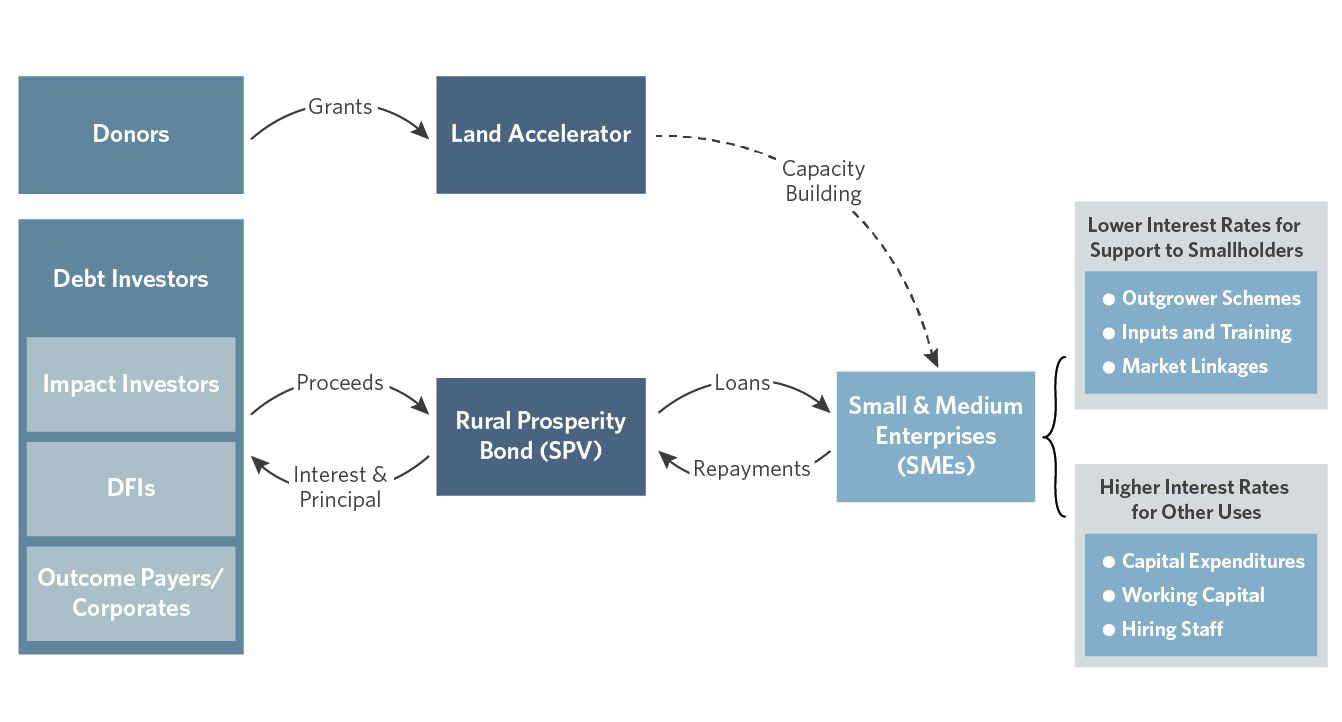

The Rural Prosperity Bond (RPB) will provide loans to SMEs working in land restoration in Africa, South Asia and Latin America.

INNOVATION

The RPB will benefit from a unique partnership with World Resources Institute’s Land Accelerator. This is an entrepreneurship program that provides tailored capacity- building to restoration enterprises. Upon graduation from the accelerator, these SMEs will be able to apply for credit from the bond.

One key element is the use of discounted interest rates to incentivize SMEs to boost their social and environmental impact by working closely with smallholders. They will avail the discounted rate, by, for example, using the capital to connect farmers to markets, selling them agricultural inputs, or by purchasing produce from them.

IMPACT

In just six years, the Rural Prosperity Bond could mobilize around USD 70 million to supply almost 400 small-size loans to restoration SMEs operating in Africa, South Asia and Latin America. Through the restoration of about 100,000 hectares of land, the Bond has the potential to sequester 850,000t CO2.

This is achievable because the instrument could connect SMEs to more than 800,000 farmers, the majority of whom are women. With the COVID-19 pandemic, farmers are facing greater food insecurity, and rural unemployment is ramping up. By improving the yields of most farmers by at least 40%, and by supporting 18,000 rural jobs, the RPB can contribute to a green recovery.

DESIGN

The Land Accelerator was launched in 2018 by WRI and provides a four-month training program to selected SMEs active in sustainable agriculture and forestry. The curriculum is designed to build entrepreneurs’ technical and business capacity, as well as improve the management of their farmer network. This helps to reduce business risks and increase their bankability.

As SMEs graduate from the Land Accelerator, the Rural Prosperity Bond management team will evaluate each of them based on funding needs and expected risk. Those that qualify will be offered loans at interest rates that depend on the country and the use of loans. For example, enterprises committing to dedicate more than 50% of the loan for uses that directly support smallholders will benefit from a 2% discount in the interest rate compared to other SMEs in the same country.