As of November 2016, 271 cities in developing countries had committed to developing climate mitigation and adaptation plans. They currently have limited access to the capital necessary to implement these plans. Less than 20% of developing countries cities have access to local capital markets, through for example issuing bonds to investors, and only 4% are deemed creditworthy enough to access international capital markets.

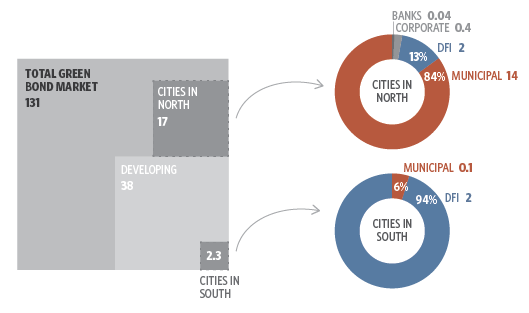

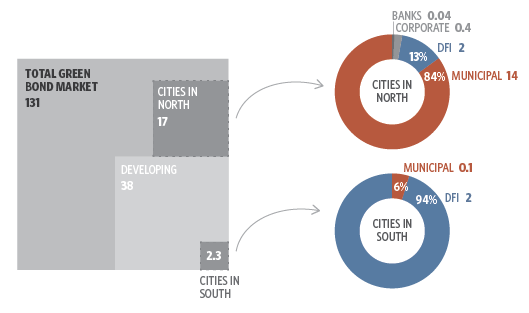

This report offers a strategic guide for cities in developing countries to access green bond market flows, a potential source of finance for cities in developing countries looking to secure investment in low-carbon, climate-resilient infrastructure to meet the water, energy, housing and transportation needs of their expanding urban populations. Since 2007, USD 131 billion in green bonds have been sold to institutional and retail investors attracted by their link to green projects, goods and services. The last three years has seen an exponential 13-fold increase in the value of annual bonds issued, from USD 3.2 billion in 2012 to USD 44 billion in 2015. This is projected to reach USD 75 billion by the end of 2016.

There would seem to be considerable room for these cities to access increased finance from the green bonds market. CPI analysis of the projects underlying green bonds currently in the market shows USD 2.3 billion in value is linked with city-based projects in developing countries, including urban mass transit systems, district heating and water distribution networks. To put this in context, this represents:

- 1.7% of total green bond market flows since 2007.

- 6% of all flows to developing countries: A total of USD 38 billion of the proceeds from green bonds issued by development finance institutions (DFIs), commercial banks, and corporations has been directed toward projects in developing countries.

- 11% of flows to all city-based projects worldwide: USD 17 billion has been raised by cities in developed countries such as the US, France, and Sweden.

Breakdown of green bond market flows from total issuance 2007-mid-2016

Choosing a strategy to access finance from green bonds

Developing country cities’ own creditworthiness is the key constraint limiting their ability to issue bonds themselves. As of November 2016, the USD 137 million bond from Johannesburg in South Africa is the only municipal green bond issued by a developing country city. Most finance that flowed to developing country city-based projects did so indirectly. 94% from green bonds issued by DFIs such as the World Bank and Asian Development Bank.

The subsequent sections of this report help cities to decide on the most appropriate short and long-term strategies based on their current creditworthiness, regulatory context and financing goals. There are a number of ways that cities in developing countries can address their creditworthiness in order to access the green bond markets directly. There are also opportunities for cities to access the green bond markets indirectly regardless of their creditworthiness.

- Cities or affiliated entities able to issue green bonds can explore options to enhance their creditworthiness through structuring, guarantee instruments or securing a cornerstone buyer such as a DFI.

- Cities or affiliated entities unable to issue green bonds can align their investment plans with the green bond performance and reporting criteria of other issuers that participate in city infrastructure projects such as national or multilateral DFIs, private sector corporations or commercial banks.

Both approaches can increase the visibility of cities’ green infrastructure plans and policies among international and domestic investor communities helping to make it easier to raise finance in the longer term. They can also make investment more attractive through improved reporting on green performance metrics. For investors seeking additional environmental and social impacts, bonds linked to sustainable urbanization plans have significant co-benefits in the form of improved health, air quality and social conditions that may fit with their investment mandates.

As well as raising finance, developing a bond market strategy can provide additional benefits:

- Linking green projects to loans or bonds can help support transparency and build internal administration procedures as part of efforts to improve overall sound financial management.

- Aligning city-based projects with the green bond frameworks of issuers can ensure urban infrastructure follows national or international green performance requirements.