This discussion brief provides an overview of the development of green banking practices in China, identifying major policies and practices, performance to date, as well as barriers to further expansion. It also explores green banking practices within one of China’s largest banks—the Industrial and Commercial Bank of China (ICBC)—providing practical development and management examples of green banking practices. Through this work, policymakers can better understand green banking’s successes to date, and what barriers need to be addressed to further scale green banking in China.

Green financial reform is especially important considering the scale of Chinese banks. China’s four largest state-owned commercial banks, the “Big Four,” are also the largest banks in the world, with combined total assets of RMB 103.6 trillion (USD 14.8 trillion). Considering China is the largest source of CO2 emissions globally, accounting for nearly one third of the global total, and that up to RMB 95.45 trillion (USD 14 trillion) will be needed over the next decade to support China’s green transition, accelerating green practices within China’s banking ecosystem is essential to meeting decarbonization targets.

The impact of China’s banking system goes beyond China’s borders. Together the Big Four contributed USD 240 billion to the fossil fuel industry from 2016 to 2019. 44% of this contribution, or USD 106 billion, went towards coal mining and coal power, making the Big Four the top four financiers of coal globally. China is also expected to finance in excess of USD 1 trillion for foreign infrastructure over the next ten years through its Belt and Road Initiative.

This report also provides a first look at the performance of green credit portfolios of China’s major banks. Our analysis indicates that green portfolios, to date, perform better than a benchmark of traditional portfolios in terms of non-performing loans. Although just one indicator, it suggests that expanding green banking in China could improve risk management. Taken together, the findings of this report show that a solid foundation for green banking is now established. Although the impact of green banking has been relatively small to date, there is significant potential to scale, which would have major impacts on the availability of financing for sustainable infrastructure around the world.

DEVELOPMENT OF GREEN FINANCING IN CHINA

Green finance has developed rapidly in China in recent years. Just like other elements of Chinese policymaking, the development has been top-down, with high-level directives guiding market development. Once there was high-level political buy-in, the market response was fast.

After the launch of the Guidelines for Establishing the Green Financial System in 2016, green credit policies proliferated across several ministries and regulators, including direct financial incentives provided to banks that expanded their green credit portfolios.

For example, the People’s Bank of China (PBoC) created green incentives in two ways under its re-lending policy. Green loans are now accepted as part of the standing lending facility (SLF), and green bonds at AA rating are accepted as collateral in its medium-term lending facility (MLF), both of which deliver favorable capitalization and interest rate benefits. In addition, the evaluation of banks’ green performance is now included in PBoC’s macroprudential assessment (MPA) framework, giving banks additional incentive to expand and report on their green portfolios.

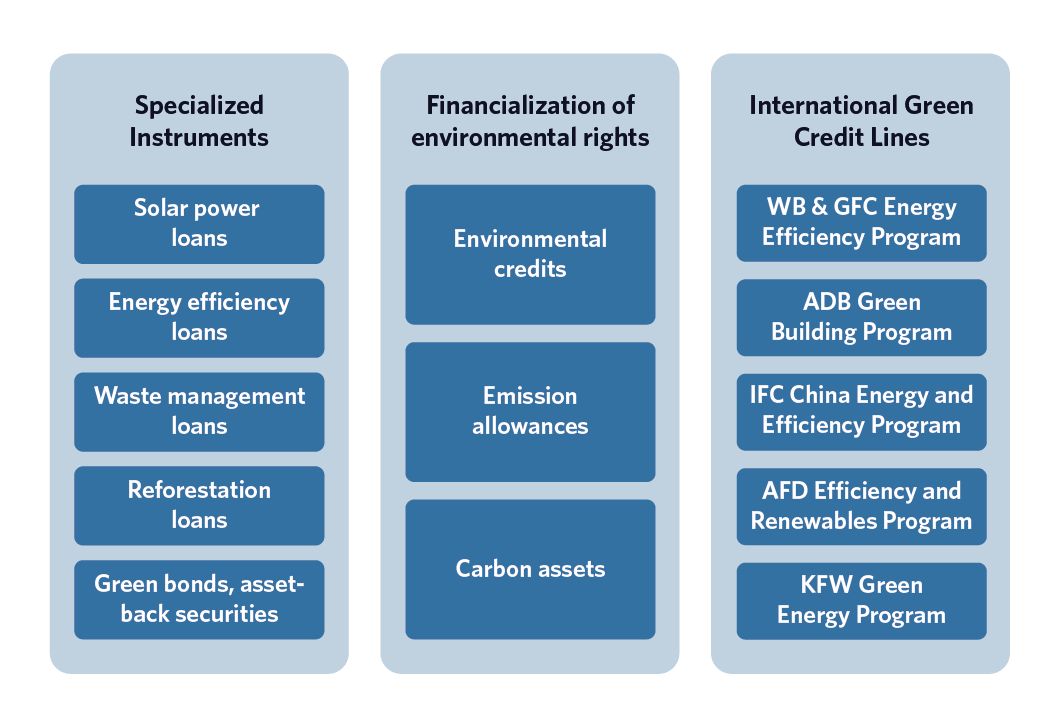

These changes also expanded the range of green instruments used by Chinese banks, showing increasing diversity across specialized tools, collateral methods, asset-backed securities, and international green credit lines, as shown in Figure 1 below. The most important instruments are green loans and green bonds, but the market is broader and includes mechanisms of international green finance cooperation.

Figure ES1: Overview of the different types and examples of green credit tools

KEY STATISTICS

The total balance of green loans is growing as a share of the overall credit balance, expanding from 8.8% in 2013 to 10.4% at the end of 2019, to reach a cumulative total of over RMB 10.6 trillion (USD 1.5 trillion). The vast majority went to clean transport and

clean energy, which made up 45% and 24% of green finance in 2019 respectively.

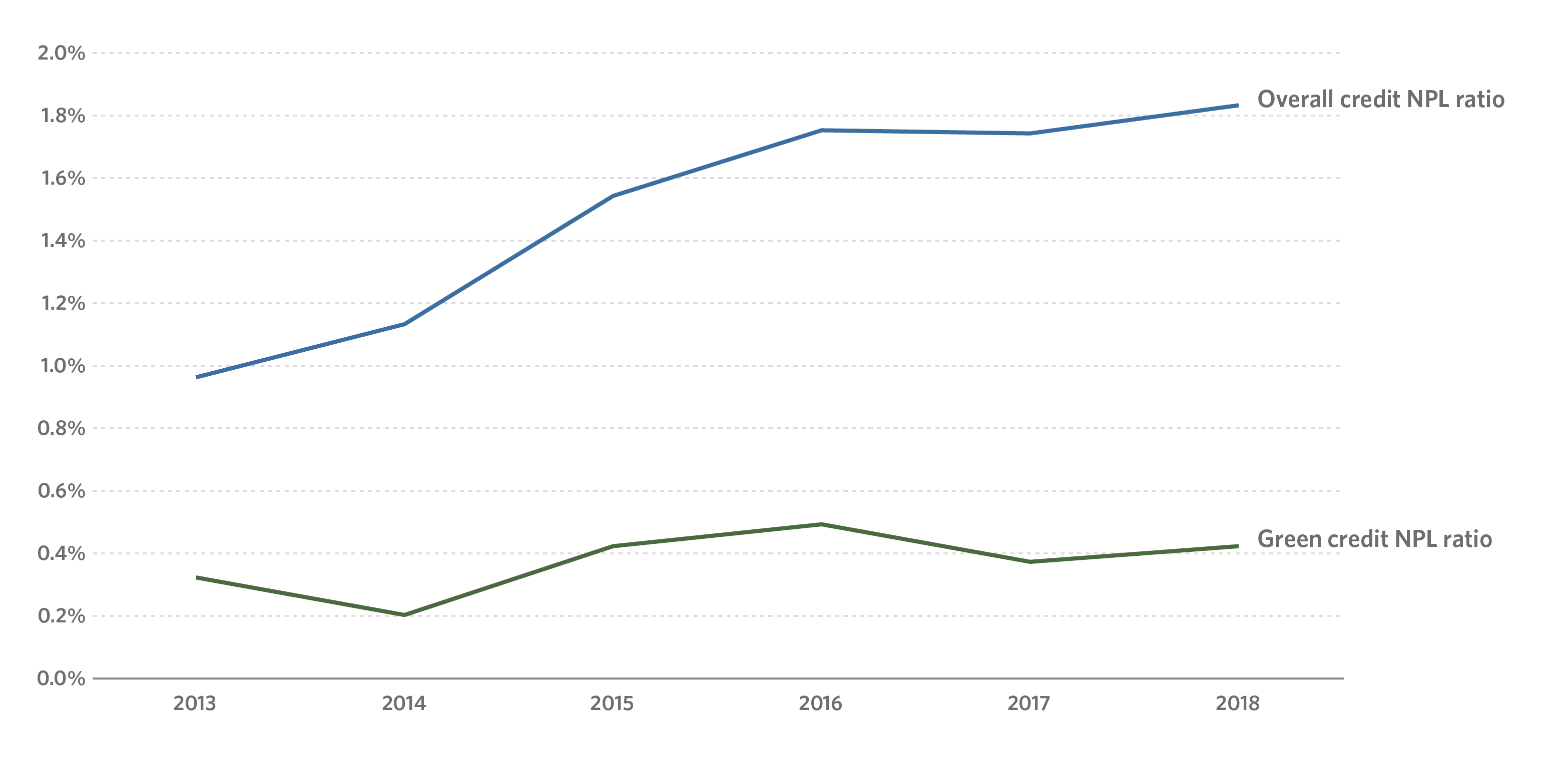

Green loans in China have performed better than conventional loans. As shown in Figure 2 below, at the end of 2018, the non-performing Loan (NPL) ratio for green loans stood at 0.42%, while the overall credit NPL ratio stood at 1.83%. This is significant, as it indicates that green loans are less risky and such evidence can be used to justify including green factors for financial system governance by regulators. However, it should be noted that factors other than “greenness” may be influencing the trend as well, such as the fact that many green loans are for infrastructure projects, which are already considered a relatively stable asset class.

Figure ES2: Non-performing loan proportions of green and non-green loans

IMPACTS ON THE FINANCIAL SYSTEM

The development of green bonds and green credit is starting to change the lending behavior and capitalization of Chinese banks. Due to regulatory pressure to increase financing for green activities, and the increasing understanding of the financial risks of high-carbon portfolios, banks are integrating green criteria into their lending decisions and credit risk analyses. Moreover, the decreasing size of customer deposits in China has driven banks to increasingly rely on capital markets, raising capital through bond issuance in international and Chinese interbank markets and by listing on stock markets.

The removal of the 75% loan-to-deposit ratio (LDR) requirement by the PBoC in 2015 paved the way for banks to issue more bonds, leading to a clear increase in LDRs across the banking sector. The average LDR of major banks reached 82% in 2018. This, however, adds pressure on banks as funding costs for deposits are approximately 1%, compared to bond issuance at 2.5% in the domestic interbank, and 3% in international capital markets.

The top green lenders by proportion are state-owned commercial banks such as Bank of China, China Construction Bank, and Agricultural Bank of China. Two banks out of the 21 main banks in China are developing into banks specialized in green finance, namely Industrial Bank and Shanghai Pudong Development Bank. Both were amongst China’s first green bond issuers

and have some of the highest green loan proportions.

There is also significant potential for China’s three policy banks—China Development Bank (CDB), China Export Import Bank (EXIM Bank), and the China Agricultural Development Bank (CADB)—to take a greater role in green finance. Given their size, for example CDB’s USD 2.4 trillion in assets compared to the World Bank’s USD 600 billion, they are large enough to substantially impact green credit markets. However, currently these three banks rank among the lowest in green credit scores.

TRENDS AND BARRIERS

All indications suggest the positive trends of green finance in China will continue. Fundamentally, the overarching policy direction of green finance is favorable and supported by both China’s State Council and the Communist Party.

Despite recent pressures on the Chinese financial system, such as a lower GDP growth rate, a trade dispute with the US, and pressure to deleverage, green finance has continued to expand.

However, there are important barriers and limitations to further growth. These include:

Governance

- Insufficient risk modeling and management. As the Chinese banking system does not yet have a clear responsibility mechanism for environmental accidents and liabilities, banks are not yet including such concerns. Furthermore, most banks are not comprehensively conducting environmental stress testing.

Policy

- Weakness of current direct financial incentives. Despite the innovative nature of current approaches, financial incentives we reviewed are not strong enough to send a clear signal to banks.

- Deleveraging pressure. Chinese companies are currently under regulatory pressure to deleverage, making it difficult for banks to simultaneously increase the use of credit tools that could drive green transitions.

- Too few high-emissions penalizing factors. As reducing the profitability of high emission, or “dirty,” projects directly increases the profitability of green projects in comparison, high-emissions penalizing factors are currently too limited to incentivize green credit.

Economic Environment

- Perception of trade-offs between investing in green and making a profit. With green projects often having high investment costs, long cycles, and low interest rates, banks perceive that they can make greater profits in the short term from traditional sectors of the economy, even though analysis demonstrates that those traditional sectors harbor increasing risk and lower overall returns.

Addressing these issues in the short term would foster the next phase of greening China’s financial system.

SPOTLIGHT ON THE INDUSTRIAL AND COMMERCIAL BANK OF CHINA (ICBC)

ICBC is a major contributor of green financing in China. Its portfolio of green loans was worth an estimated USD 199 billion in 2019, reaching 8% of its total portfolio. ICBC is also a leading issuer and underwriter of green bonds, raising USD 9.8 billion across five offshore issuances since 2017. The majority of ICBC’s green bond proceeds were earmarked for Belt and Road projects, successfully attracting a diverse base of foreign investors. The bank is also actively involved in domestic and international green finance initiatives, working in close partnership with China’s Green Finance Committee and UNEP to advance the green finance agenda globally.

The environmental impact achieved by ICBC’s green credit portfolio is measured through a range of indicators as recommended by China’s banking regulatory commission. The self-reported emissions reductions achieved by its portfolio was nearly 90 million tons of CO2 as of 2018.

The impact of green financing activities on ICBCs balance sheet has been small considering its relative size, but steadily growing. Given ICBC’s early participation in green lending practices, its green credit balance has reached 15.8% of its corporate loan balance, or 8.5% of its total loan balance. This accounts for 13% of the total green credit balance in China, RMB 10.6 trillion, as of end 2019. As for green bond issuances, which remain only on ICBC’s offshore issuances, these account for 6.5% of total debt.

CONCLUSIONS

Chinese banks hold tremendous potential to contribute to domestic and global decarbonization. China’s Big Four state-owned banks are also the world’s four largest banks, representing combined assets of USD 14.8 trillion, greater than the combined assets of the 11 largest banks in the US. Simultaneously, the Big Four are some of the largest contributors of both green and fossil fuel finance in the world. A green transition for Chinese banks would be enormously consequential.

Policymakers in China are at the forefront of innovation on green banking policies. After the launch of the Guidelines for Establishing the Green Financial System in 2016, innovation expanded rapidly, but there is potential for more. The positive performance indicators summarized in this report suggest that accelerating green banking could serve the dual purpose of addressing climate targets and mitigating some of the expected near-term economic pressures on the Chinese economy.

The ICBC case study shows how some financial institutions in China have embraced green finance, both in response to regulatory pressures and to seek new financial opportunities. The overall size of the green finance business of banks is still small but expected to continue growing.

Supported by continued policy reform, banks that embrace the growing trend of green finance in China will be rewarded with a new customer base, new sources of capital, potential benefits in terms of reducing risks from non-performing loans, and the monetary incentives provided by the PBoC. We expect these factors to continue driving growth in the sector. The turning point, however, will be when Chinese banks’ financing for green displaces financing for high-emissions activities, as China continues to pursue its goal for constructing an ecological civilization and leads global banking practices towards net-zero emissions goals.