This publication is CPI’s analysis of Financing Steel Decarbonization, an innovative climate finance instrument endorsed by The Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

ABOUT

Steel is a highly emission-intensive sector responsible for around 10% of energy emissions in India, the world’s second-largest steel producer. Alignment with the Paris Agreement and India’s target to achieve net zero by 2070 will therefore require the sector to transition to low-carbon pathways immediately.

Steel decarbonization entails many new and innovative technologies like green hydrogen and carbon capture, which have not fully reached the market. In India, even commercially available technologies remain under-utilized, resulting in a much higher emission intensity than the global average.

The adoption of these technologies requires around USD 200 billion globally, per year, until 2050, plus USD 2 trillion in necessary infrastructure. Such large-scale investments need a robust enabling ecosystem comprising the right policy and market conditions and financial and non-financial de-risking measures.

Financing Steel Decarbonization combines technical assistance, low-cost patient capital, and implementation stage support to prepare, invest in, and de-risk decarbonization technology projects for low-carbon steel production, while supporting the development of the wider industrial ecosystem.

INNOVATION

Financing Steel Decarbonization (FSD) is the first instrument to target the mobilization of private finance into commercially available, but sparsely adopted, and new pre-commercial stage low-carbon technologies for decarbonizing steel, a hard-to-abate sector. While there are already several investment vehicles supporting technology start-ups to commercialize technologies such as green hydrogen and carbon capture, FSD will also be the first to focus directly on financing technology adopters and providing steel companies and other private industry players with early-stage technical assistance and implementation support.

“Industry response to climate transition involves addressing finance, business, technology, and humanity questions to empower a comprehensive Just First approach and deliver Just transition while maintaining industry viability. Creating the proposed financial instrument in collaboration with The Lab will complete the framework to decarbonize hard-to-abate steel industry and enable a climate-resilient economy in line with the UN Sustainable Development Goals in employment, health, equity, and innovation” – Abhijit Basu, Keeper of the Purpose, Smartex

IMPACT

Over its five-year investment period, FSD would deploy nearly USD 1 billion, and mobilize an additional USD 3.4 billion in private investments for low-carbon steel production. This would lead to a reduction in the emission intensity of steel production by an average 25% of about 20 MTPA capacity. Over the lifetime production of steel from this capacity, this would result in a cumulative emission savings of 250 MtCO2. FSD could mitigate 0.25 tCO2 for every USD invested and 0.47 tCO2 for every USD of concessional public finance. The FSD mechanism can be replicated in other hard-to-abate sectors like cement, fertilizers, and chemicals and in different geographies, including countries in eastern Europe and southeast Asia.

DESIGN

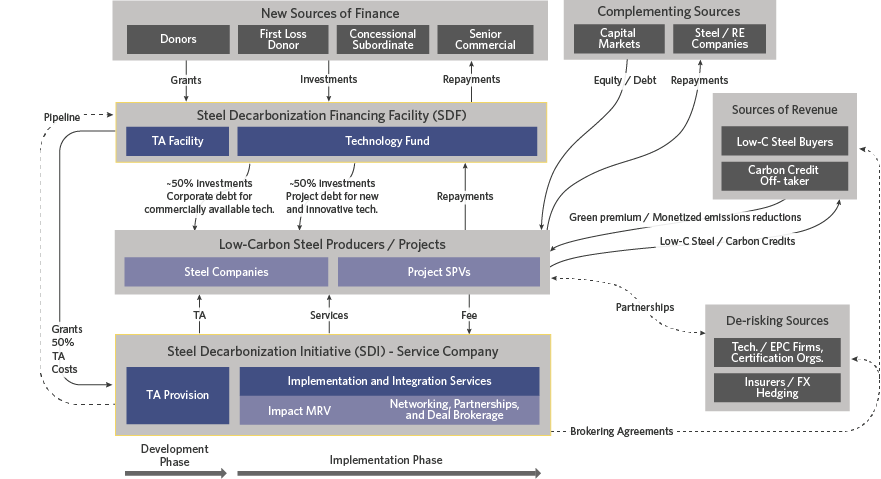

The FSD mechanism consists of two financially and legally separate entities – the Steel Decarbonization Financing Facility (SDF), and the Steel Decarbonization Initiative (SDI).

SDF consists of a blended debt Technology Fund, capitalized equally by concessional and commercial finance, that will invest nearly USD 1 billion over five years into both commercially available, and new and innovative technologies, and a complementing technical assistance facility that will provide early-stage support for project preparation to steel companies through grants and, in turn, create a pipeline of bankable projects for the fund.

SDI will be a one-stop service provider to steel companies for developing and implementing decarbonization projects. Depending on the needs and the development stage of the project, the services provided by SDI will include (1) technical assistance; (2) impact monitoring, verification, and reporting to investors and stakeholders; (3) facilitation of off-take agreements for steel companies with customers of value products like green steel, carbon credits and captured CO2; (4) a platform for networking and partnering with wider ecosystem players. These essential bespoke services by SDI will be bundled to mitigate investment risks and promote stakeholder transparency.