Over the past decade, California has become a national leader in addressing climate change. This includes passing laws that require carbon neutrality and an 85% reduction in carbon emissions by 2045, phasing out internal combustion engine passenger vehicles by 2035, and increasing the state’s resilience to severe heat and drought.

To support California in meeting its climate goals and using its budget most effectively, CPI created this first-of-its-kind landscape of climate finance in California, building on our flagship Global Landscape of Climate Finance methodology. In doing so, we aim to fill a gap in comprehensive data on both past spending and future investment needs in the state. This analysis will help policymakers and private sector actors identify opportunities, establish priorities, measure progress, and develop coordinated plans to meet the scale of the climate challenge, including for budgets, regulations, tapping into federal funding, and investment plans.

This landscape is a beta version that covers public and private and private investments by county across several sectors, including energy and transport, from 2019 to 2022. CPI started with a beta version to demonstrate potential value and use cases of a complete landscape, particularly for data that covers all public and private financial flows across multiple sectors.

Finance needs to meet California’s climate policy goals

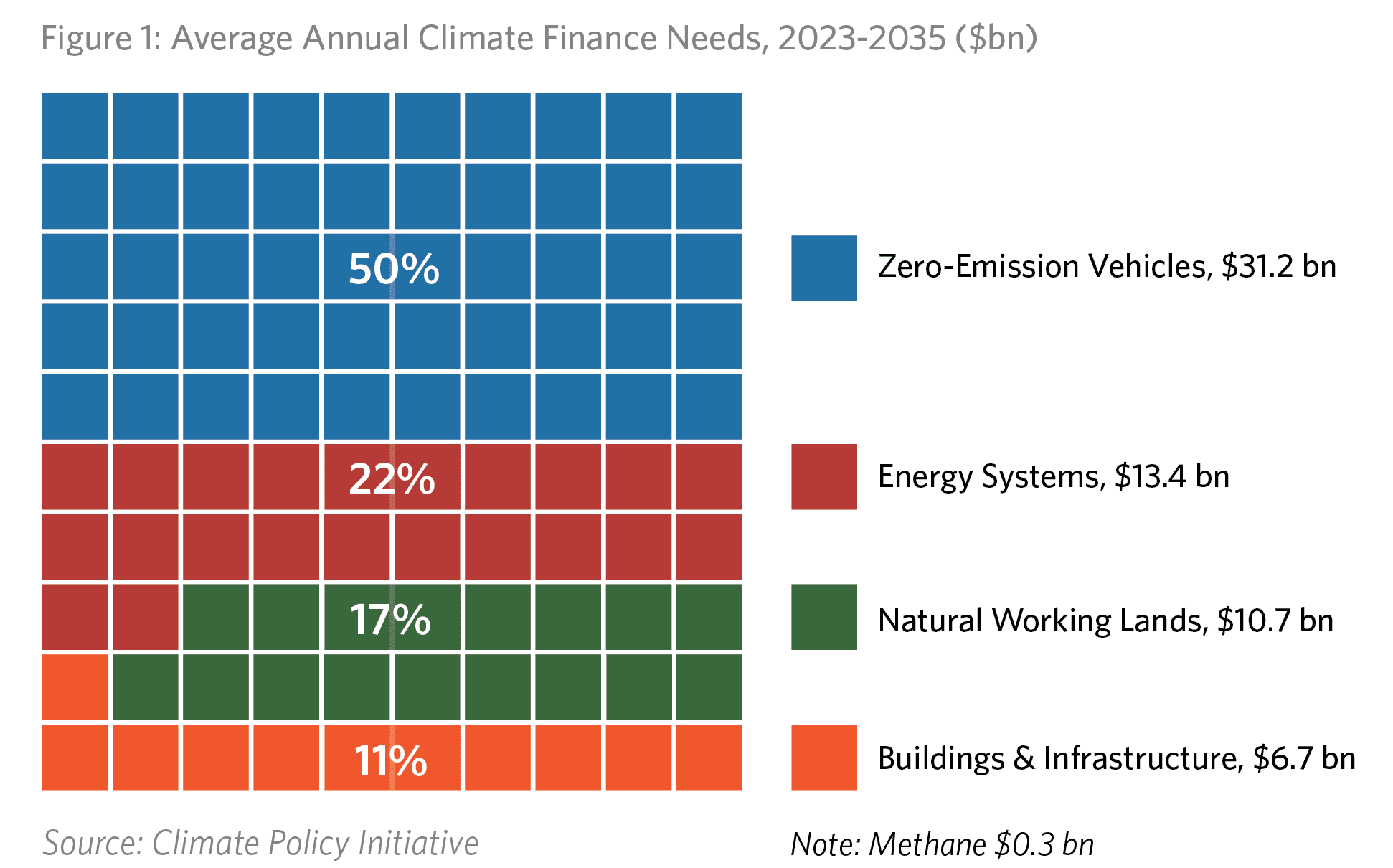

To put current spending in context, CPI developed an estimate of investment needed in different sectors to meet California’s climate goals through 2045. This needs assessment will help policymakers set the appropriate level of ambition and identify the types of investments where scarce public funds can have the greatest catalytic effect to reduce emissions and increase resiliency. To conduct this analysis, we built on CPI’s methodology for climate finance needs assessment and incorporated estimates from decarbonization models and state regulators.

CPI estimates that California will need an annual average of USD 62 billion from 2023 to 2035 to stay on track for its climate goals. Half of these investments will be for zero-emission vehicles, followed by energy systems, agriculture and land use, and buildings and infrastructure. These needs expand after 2035 to an annual average need of USD 79 billion, almost entirely from a higher uptake of zero-emission vehicles.

For this beta version, CPI prioritized the largest sources of climate finance in California, including private spending in energy and zero-emission passenger vehicles, federal government grants and loans, state spending through the cap-and-trade program and certain grant programs, and local government bond proceeds for public transit and energy conservation improvements.

CPI tracked USD 39 billion of climate finance spending in 2022, which represents 63% of California’s annual needs through 2035. The annual growth rate of climate finance from 2019 to 2022 was 26%, with most of the growth coming from the private sector. The growth of private sector spending is encouraging and demonstrates a sustainable model, but further mobilization of private sector investment is critical to close the investment needs gap, especially considering relatively scarce state public funds.

For both the public and private tracked sources of finance, transport is by far the largest destination sector.

Climate finance is distributed relatively evenly per capita by county, as shown in the interactive map. However, climate finance is not currently being channeled at a higher rate to those areas with worse current and historical pollution metrics, as measured by comparing per capita climate finance with a comparison of average county-level CalEnviroScreen scores.

Recommendations and next steps

Given our findings on the growth and distribution of climate finance in California, policymakers, civil society, and the private sector can build on the state’s progress, including by:

- Developing a comprehensive roadmap to close the climate investment gap in each sector, and implement policies to incentivize the transition to net zero and remove any remaining investment barriers.

- Tracking the impact of new policies on climate finance trends, and adjust interventions accordingly.

- Identifying opportunities where public and concessional funds can have the biggest impact on increasing overall climate finance, including through pre-development, project preparation, and de-risking, especially for sectors or populations which are currently viewed as commercially unviable by the private sector.

Given relatively scare public dollars, the state should continue to prioritize spending on programs that catalyze investment from the private sector and federal government to meet climate finance needs, and that meet socioeconomic policy priorities.

This can include funding for:

- Pre-development to build capacity and develop projects to a stage where they can access private sector or federal government funding, especially in less commercially viable sectors.

- Bottleneck technologies with relatively low overall needs compared to their benefits, such as charging for electric vehicles (USD 44 million per year through 2035) and transmission for renewable energy (USD 1.1 billion per year).

- Disadvantaged communities which may not have the resources to make the energy transition on their own and are disproportionately impacted by current emissions.

The barrier to expanding finance is not always more money, as factors such as permitting, electric grid interconnections, coordination between different actors, and the existence of medium-term goals and plans can change the overall cost and risk profile of investments.

A full landscape of California climate finance would build on this beta version to facilitate improved decision-making and prioritization for state policymakers, development banks, and philanthropies. Additional topics CPI could cover in a full landscape include:

- Climate finance tracking: Adding additional sectors and actors, such as private investment in building decarbonization and agriculture, climate finance through local budgets, and all state agencies and expenditures.

- Needs assessment: Identifying which actors are likely to play a role in each sector; adding sectors without clear decarbonization pathways; analyzing impacts of incorporating equity and economic priorities on climate finance needs.

- Capacity building: Identifying funds that can be used for matching federal funds, building local capacity through technical assistance, and facilitating project development.

- Level of analysis: Adding regional and sub-county climate finance tracking and needs assessment, including for specific disadvantaged and tribal communities.