India is the world’s third-largest carbon emitter, with emissions expected to rise as the economy grows. While this economic growth is important for advancing development objectives, it also poses a challenge: 600 million people in India are at risk from the impacts of climate change such as floods, wildfires, and heat waves.[1]

Additionally, inaction on this threat could shave USD 1.12 trillion off India’s GDP by 2050,[2] eroding progress on sustainable development and poverty alleviation in a country that already struggles to meet basic needs.

To address these challenges, India has committed to reduce its emissions intensity by a third by 2030 (from 2005 levels), primarily by way of increasing renewable energy capacity in the country to 50% of installed power capacity. [3] This would require over USD 200 billion of investment every year.[4]

At this level of annual investment, private capital must play a majority role. However, India’s mitigation and adaptation sectors are not yet mature enough to attract this level of private sector investment in the relatively short time required. Blended finance—the strategic use of development and other concessional finance to mobilise commercial finance for sustainable development—could play more of a role in scaling climate finance in India, as well as overall sustainable development, but s yet to realize even a small fraction of the potential that it presents for climate investments in India.

In this article, we describe how a select set of equity and debt blended finance instruments could be structured to make catalytic investments in India’s climate change sectors, attracting commercial capital towards projects that contribute to sustainable development, while providing financial returns to investors. We also discuss a few implementation models for each of these instruments and the potential sources of capital that could sponsor the associated vehicles to crowd-in investors.

Blended Equity

The nature of impact investments in India is quite close to that of commercial financial investments, with a focus on later-stage investing and an expectation of significant impact returns from these late-stage projects. In addition, most impact funds are focused on a wide range of investments, including financial inclusion and healthcare, which imposes limitations on their ability to make catalytic investments specifically in the climate change space. With support from blended equity, an opportunity exists to finance smaller and emerging companies in niche climate change segments that have potential to scale over the next few years.

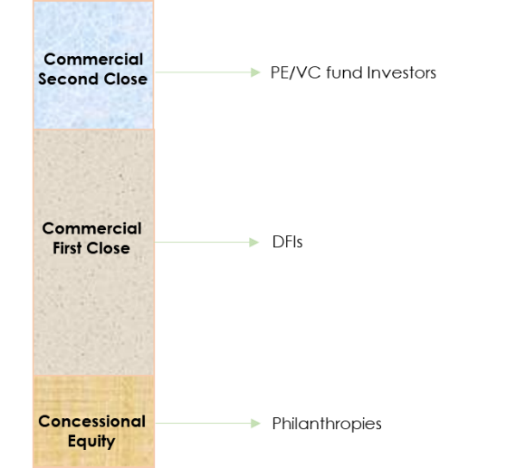

Each category of investor is driven by a typical risk, return, and impact profile; thus, capital needs to be mixed from a range of investors while providing differentiated risk-return for a given impact. Therefore, there is a need to pool investors and structure innovative financial instruments that allow different risk, return, and impact requirements to be met with different classes of shares. One way to structure such instruments is with three equity classes, as illustrated below.

Concessional equity will increase the risk-adjusted return rate for private investors, allowing the fund to invest in climate change businesses with a high economic rate of return and relatively lower internal rate of return, in which private sector financial investors would not have invested independently. This concessional contribution could be like a first loss catalytic contribution (junior equity), or a capped return structure.

Table 1. How blended finance can be used for equity investments.

| Instrument (EQUITY) | Structure I (Capped Upside Return) | Structure II (Junior Equity) |

| Anchor Foundations’ contribution | Investment with a capped return, thereby passing the potential upside to other investors. | Contribution as catalytic first-loss capital, thereby providing downside protection to other investors. It is also termed as the junior equity structure. |

| INVESTORS’ Return | Possible returns will be high. Upside incentive for investors. | Returns would be lower as the upside is shared proportionately with foundations’ contribution. |

| Capital Protection | Investments from anchor foundations and other investors will be exposed equally to any downside risk (capital erosion). | Investors’ capital would be protected at least to an extent of anchor foundations’ contribution by way of first-loss protection. |

Building a case for a Climate Investment Blended Fund for India

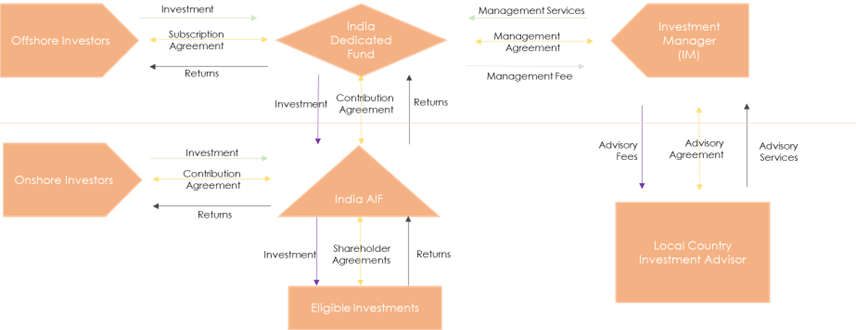

A blended catalytic equity fund with moderate return expectations at the fund level, while satisfying the return expectations of a variety of participating investors, could be structured as follows:

The investment manager, along with the local country investment advisor, could work with philanthropies (anchor concessional equity investors) to develop and design the blended catalytic equity fund and also support the management of the investment process after crowding the desired range of commercially-driven institutional investors into the proposed fund structure. This could be created as Alternative Investment Fund – AIF Cat I or Cat II under Indian AIF laws.

Blended Debt

Growing ventures in the climate change sectors in India require a balanced combination of equity and debt financing to successfully transition from early-stage (prototype) to late-stage (market-ready). The perceived risk of early-stage technologies acts as a major barrier to accessing affordable debt financing from traditional lenders. There is a necessity for blended finance instruments to facilitate debt financing at affordable interest rates. This would complement the existing equity instruments and diversify the financing support available, helping ventures to transcend the ‘commercialization valley of death’.

Table 2. Concessional debt can be provided with the following mechanisms.

| Instrument (DEBT) | Structure I (Inverted SubORDINATE Debt) | Structure II (FLDG/PCG)[5] |

| Anchor Foundations’ contribution AS DEBT | Subordinate to Senior Loans but priced lower than Senior Loans. Gets 2nd charge on assets. | Contribution as catalytic first-loss capital, thereby providing downside protection to other lenders. |

| Commercial LendeR | Usual risk-priced interest rates. | Usual risk-priced loans, but interest rates are likely to be lower. |

| Capital Protection | On default recovery, waterfall pays off senior debt first and commercial lenders have the first charge on collateral. | Commercial lenders’ capital is protected to the extent of the default guarantee. (For India we found that FLDG does not work so just PCG is better.) |

Some possible structures are given below:

Structure I

An inverted/subordinated debt can be structured as an on-lending facility, also known as financial intermediary lending. This can increase the availability of local debt, improve access to local financing, and help build local lending capacity. Many DFIs leverage their high credit ratings and market access to borrow debt at low rates and on-lend them via credit lines to a local financial institution (LFI). The LFIs blend this with their own higher cost of funds to provide loans to end-users that are lower than what those end-users could have otherwise secured. The concessional lender can also provide a technical assistance facility that the LFI may access for consultancy services and training to develop feasible projects, thus building capacity, experience, and a track record.

Structure II

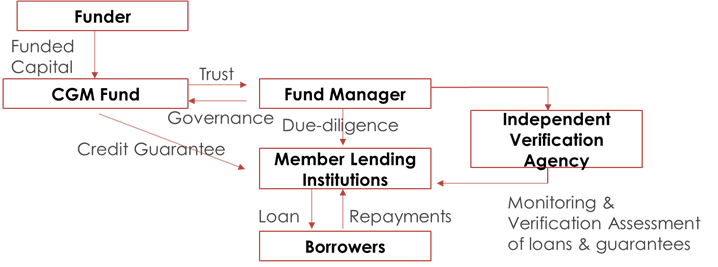

An FLDG/PCG can be structured as a Credit Guarantee Mechanism (CGM). This would work as a bilateral loss-sharing agreement between the credit guarantee fund and lending institutions (Banks/FIs), supporting the lending institutions in case of delay in debt servicing and also reimbursing them for a portion of any losses incurred due to payment default.

The most plausible CGM structure is a trust fund managed by a Fund Manager.

Philanthropies could provide concessional capital to the CGM Fund. The Fund Manager would conduct required due diligence for guaranteed applications, issue guarantees, and process claims and disbursals for eligible cases. It would also conduct periodic monitoring and evaluation of the guaranteed portfolios of Member Lending Institutions (MLIs), through an independent agency, if required. It would charge a Guarantee Fee to cover its operating costs.

MLIs are the empaneled lenders, who would avail guarantees for their loan portfolios. Borrowers would be drawn from a host of businesses.They would avail loans from MLIs, covered by the CGM Fund, and utilize them for the intended purposes.

An Independent Verification Agency could also be included to verify the claims submitted by the MLIs and certify the validity of the same to the Fund Manager, as well as evaluate the overall impact of the CGM.

Conclusion

There is tremendous opportunity for blended finance in India, but several barriers must be addressed to reach its potential. For example, there is an increasing volume of commercial capital seeking to get ‘blended,’ but less awareness and uptake on concessional equity and debt. Part of our goal for this blog was increasing awareness about the significant investment opportunities—and their impact—such instruments can provide.

The good news is that these barriers are not difficult to overcome. As we’ve shown above, there are many innovative approaches to developing layered structures of capital—stacked up to meet the desired impact and return objectives—needed to mobilize the level of investment required for India’s growing climate change sectors. Careful structuring and planning are also required to help ensure success.

Some areas to pay particular attention include:

- Deal sourcing: Conducting adequate market research and opportunity assessment to better understand the opportunities and gaps, and facilitating development of the investment pipeline by supporting the sourcing, screening, and appraising of new investment opportunities.

- Investment appraisal: Ensuring adequate resources are in place to cover various aspects of investment analysis, including due diligence, intensive financial modelling, preparation of investment committee documents, and commercial negotiation with shortlisted companies.

- Investment closure and documentation: Establishing processes and service providers to prepare the investment agreement documents (such as subscription agreement, shareholders agreement, etc).

- Portfolio management: Quarterly monitoring and reporting of investee companies, providing strategic advice and operational guidance, and identifying exit opportunities.

CPI has extensive experience in supporting projects in their capital requirement across the capital stack. Leveraging this experience, CPI can collaborate with philanthropies looking to provide the catalytic/concessional capital layer, as well as identify an investment manager for any of the above, or similar, blended finance instruments for investing into the climate space in India. If you are interested in learning more or furthering the discussion around blended finance opportunities in India, please contact us: Kushagra.Gautam@cpiglobal.org; Dhruba.Purkayastha@cpiglobal.org.

[1] World Bank Research: https://openknowledge.worldbank.org/bitstream/handle/10986/28723/9781464811555.pdf?sequence=5&isAllowedy

[2] https://www.worldbank.org/en/news/press-release/2018/06/28/climate-change-depress-living-standards-india-says-new-world-bank-report

[3] https://www.nrdc.org/sites/default/files/road-from-paris-202009.pdf

[4] https://economictimes.indiatimes.com/industry/adaptations-by-india-towards-climate-change-likely-to-cost-as-much-as-360-billion-a-year-by-2030/articleshow/49990031.cms

[5] FLDG – First Loss Default Guarantee; PCG – Partial Credit Guarantee