China’s climate action in the coming decade will play a decisive role in whether the world can limit global warming to 1.5 degrees Celsius. As the world’s largest source of CO2 emissions, China accounts for nearly a third of the global total. Based on its current trajectory, China’s emissions are expected to increase further by 7%-15% by 2030 above 2015 levels, which would more than offset the global decreasing trend. To ensure that China meets its own goals for advancing an ecological society, as well as its stated commitments to the Paris Agreement, climate and green finance needs to mobilize at an unprecedented scale.

This report provides an overview of the potential for climate finance, green finance and innovative finance to accelerate China’s decarbonization and support its transition to a green economy. As one of the first countries to emerge from the COVID-19 pandemic lockdown and start on a path towards recovery, coupled with the 14th Five-Year Plan to be released in March 2021, China faces a historic opportunity to outline a path for sustainable growth that also highlights the role of innovative green and climate finance.

The report addresses the following specific questions:

- Who are the key actors involved in China’s green/climate finance landscape?

- What is the policy and regulatory framework enabling and/or hindering green/climate finance in China? How could the policy framework be improved?

- What are the common financial instruments and sectors of green/climate investment? How might these be leveraged to scale up green/climate investments?

- What are some of the key barriers to innovative green/climate finance? How could these barriers be addressed?

Key findings

China’s green financial reform made great progress during the 13th Five-Year Plan. Key factors such as high-level political support, central bank leadership, green taxonomies, and substantial incentives, all contributed to this success. Green credit and green bonds emerged as particular success stories, mobilizing RMB trillions for green projects in the past five years.

Overall green finance in China was an annual average of RMB 2.1 trillion (USD 320 billion) during 2017/2018. It will need to scale up by at least four times to meet estimated green investment needs. As much as USD 1.4 trillion in annual investment is needed over the next decade to meet the climate targets and environmental protection standards that China established in 2015. Investment needs might be even higher, considering China’s emission targets are based on carbon intensity and not on absolute reductions.

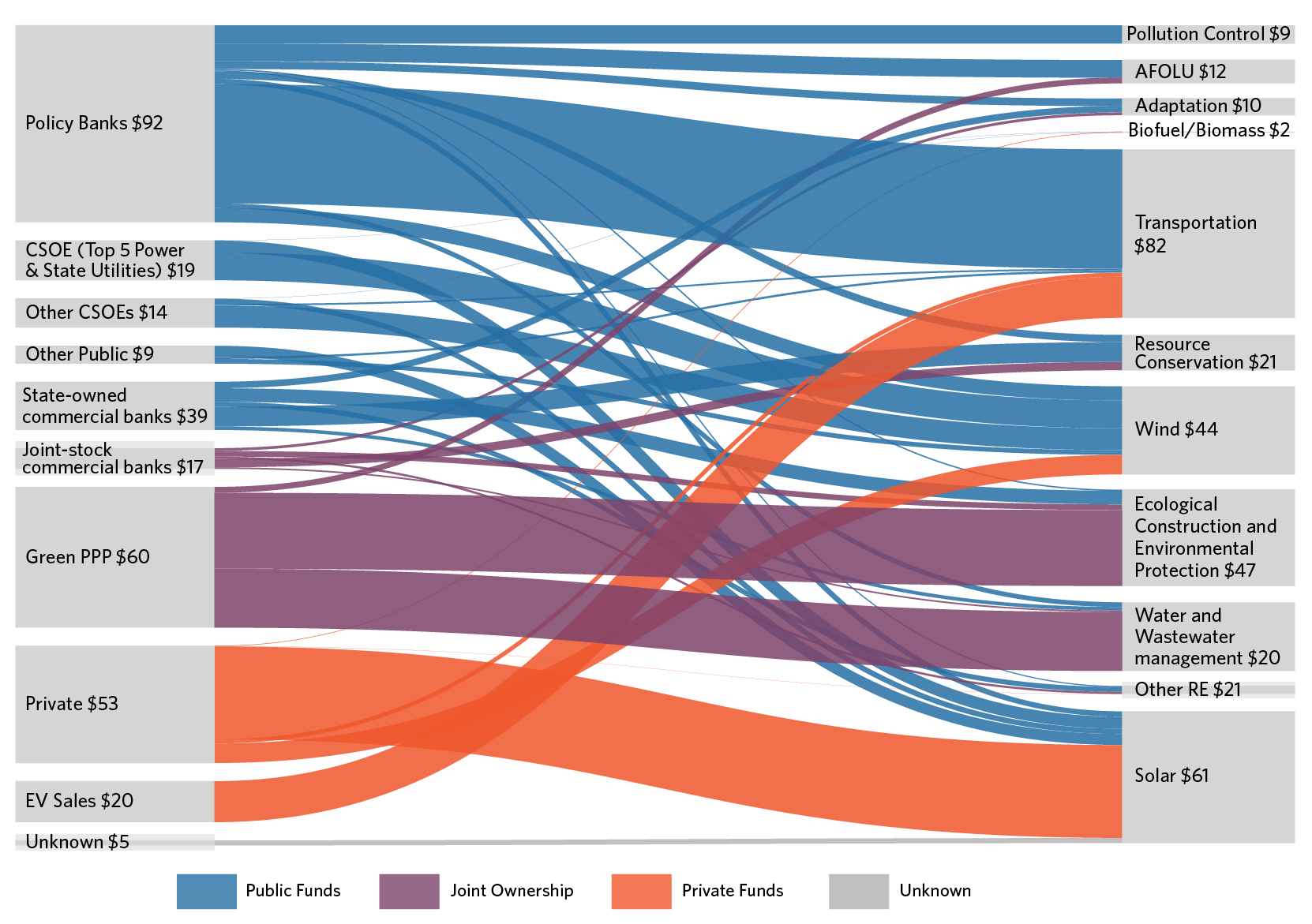

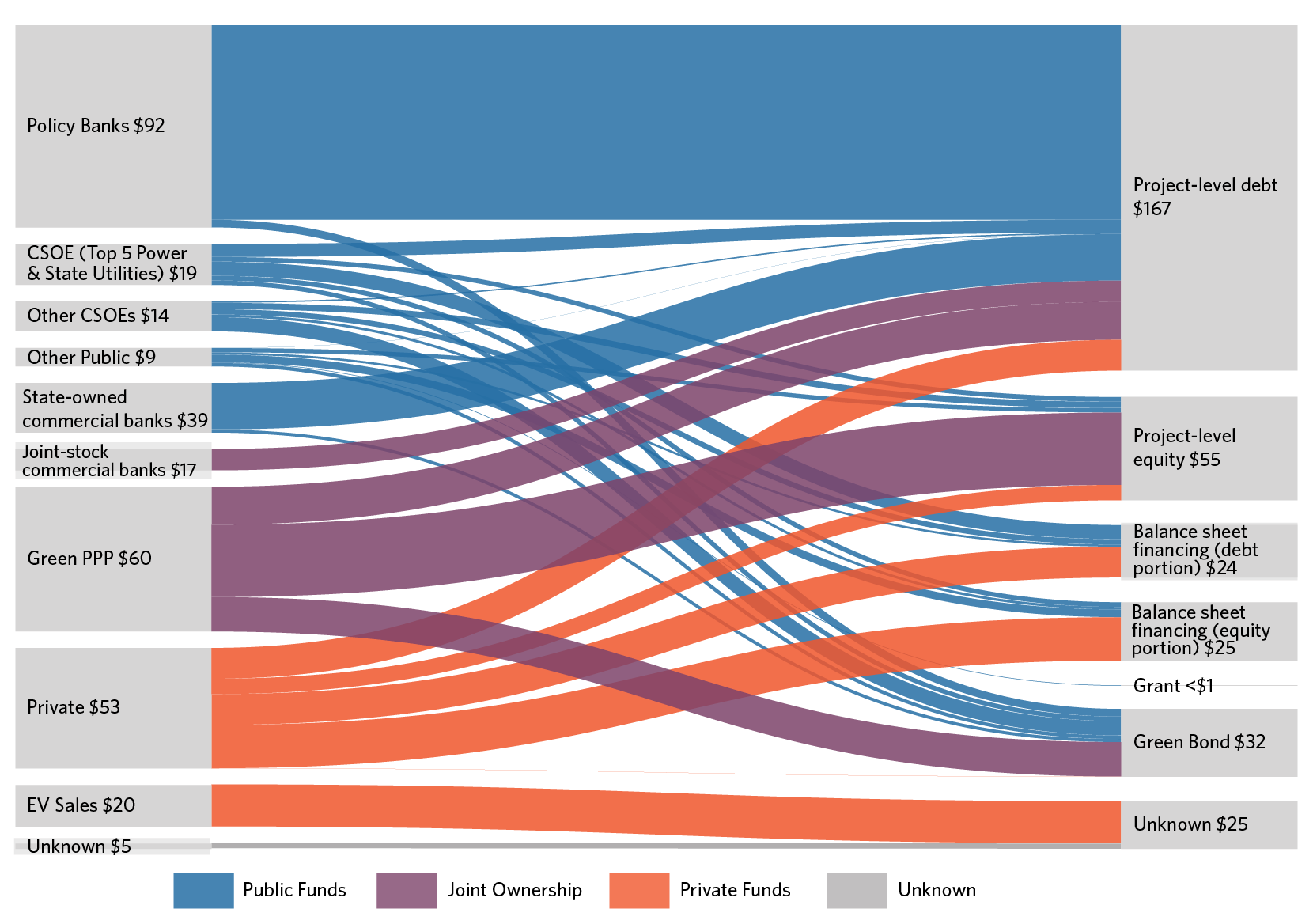

The public sector plays an outsized role. Public sources accounted for at least 51% of total green finance, with nearly 95% of that amount attributable to Central State Owned Enterprises (CSOEs), policy banks and other major state-owned banks. Green PPP projects provided a fifth of climate finance, but it remains largely subsidized by government budgets and has few incentives for private actors to participate. The private sector’s contribution to climate finance was concentrated in the solar sector.

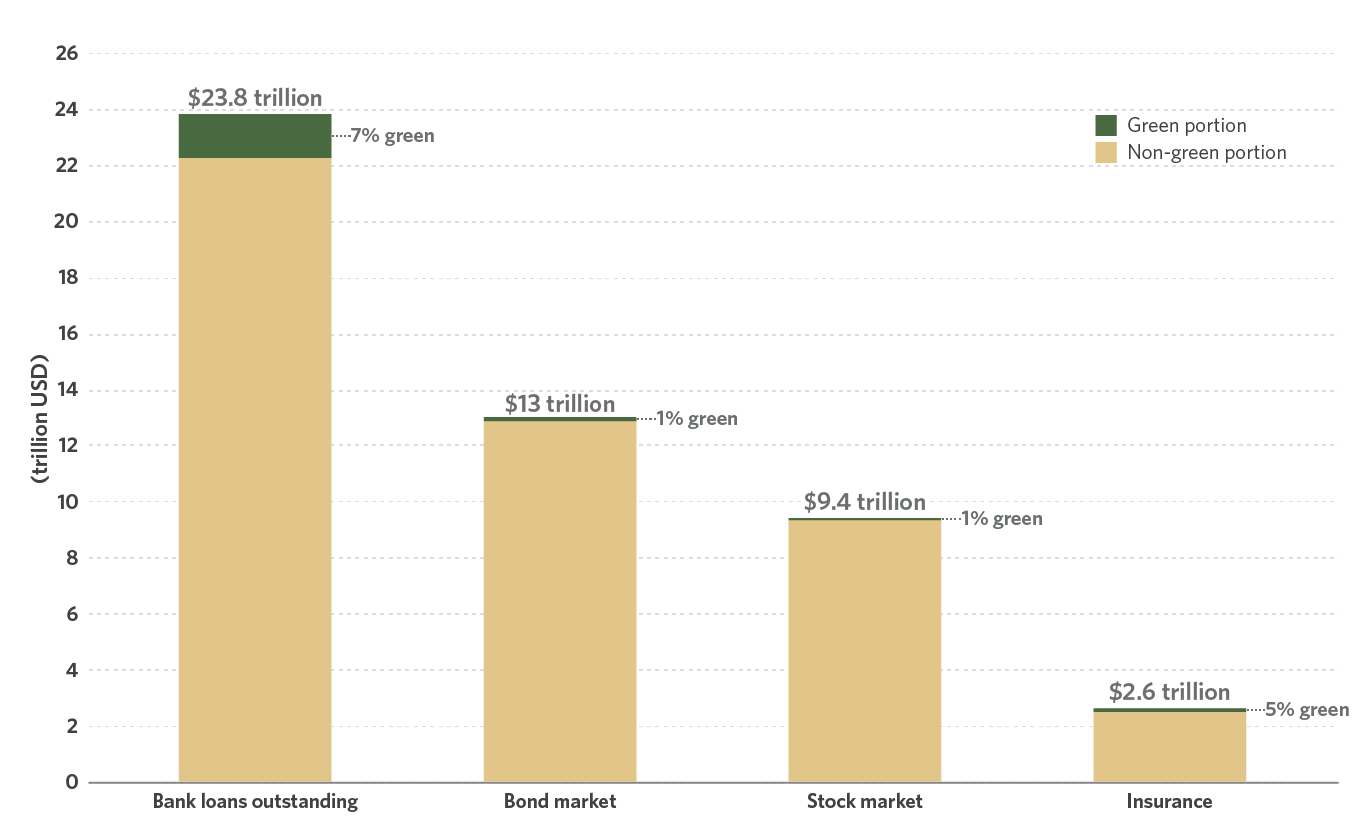

There is tremendous potential for climate finance to grow. The current ‘green penetration’ in China’s financial system is around 4%. As China’s capital market continues to evolve and actors become familiar with green financial instruments, uptake in the market will grow. China has been increasing financial support for SMEs, new sources of concessional capital are in development, and there is growing interest in exploring innovative structures. Mobile payment and online banking systems offer new financing channels for retail consumers and investors. Finally, there are growing opportunities for foreign private capital to collaborate with domestic actors through funds and joint ventures.

Regional distribution

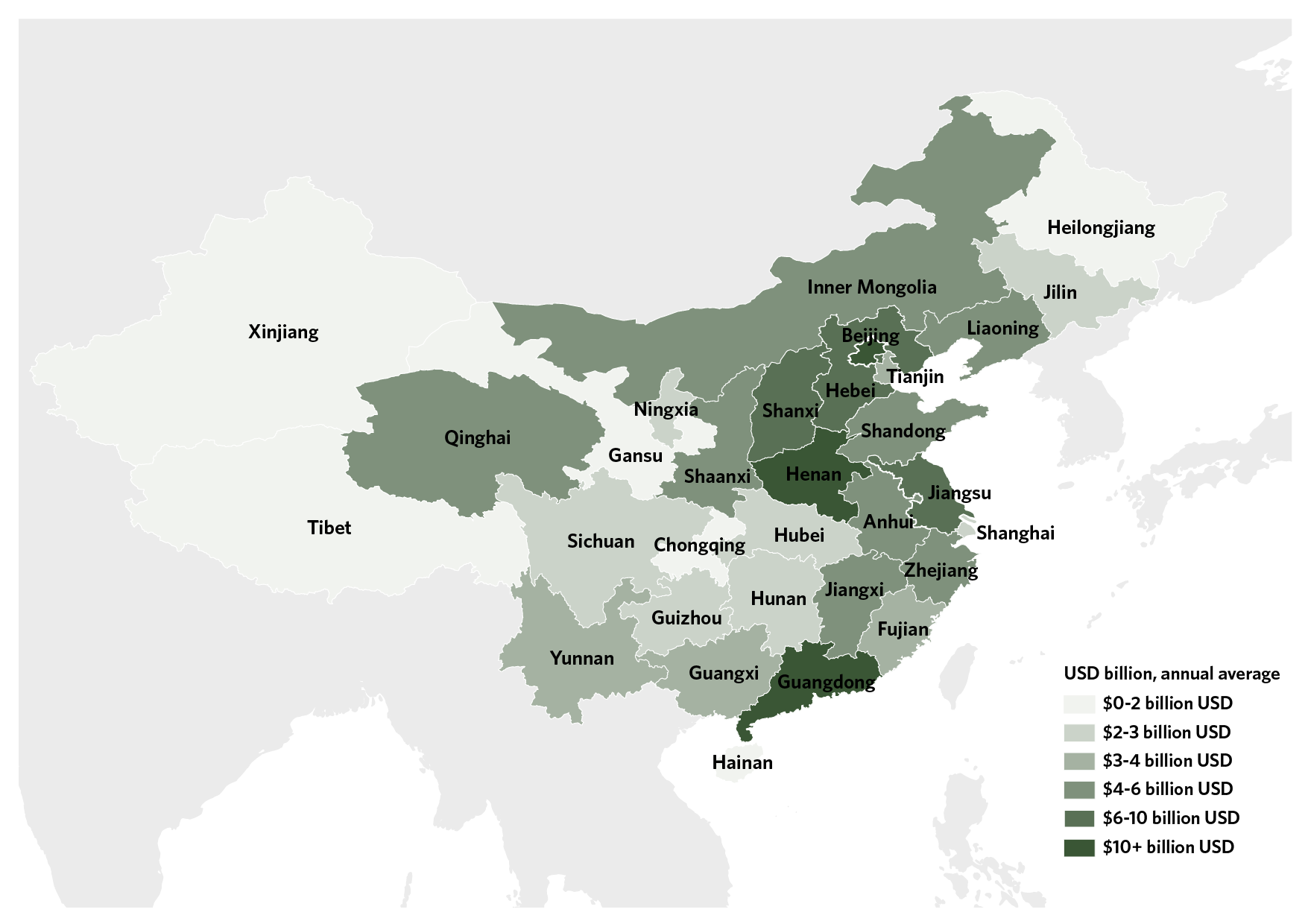

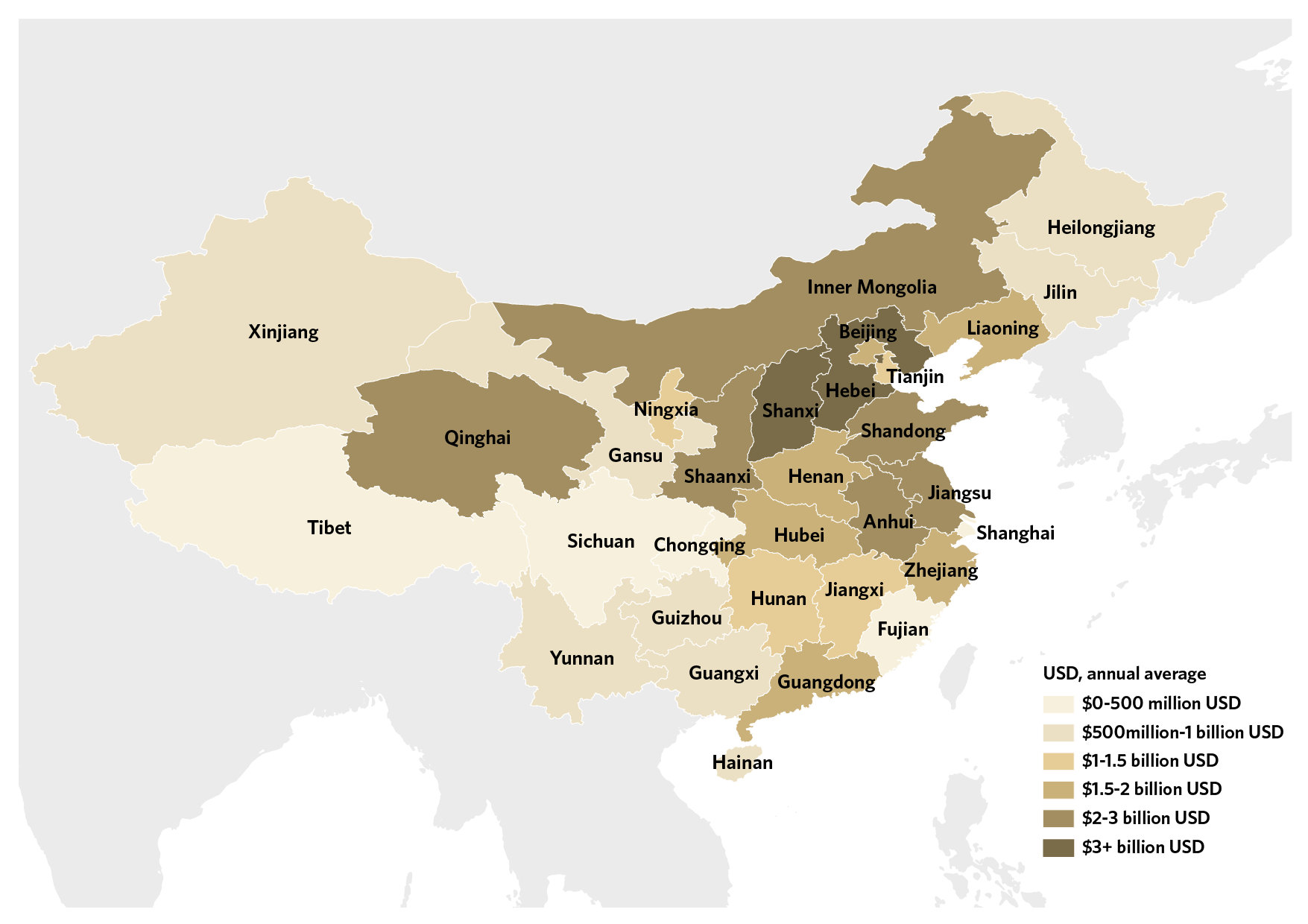

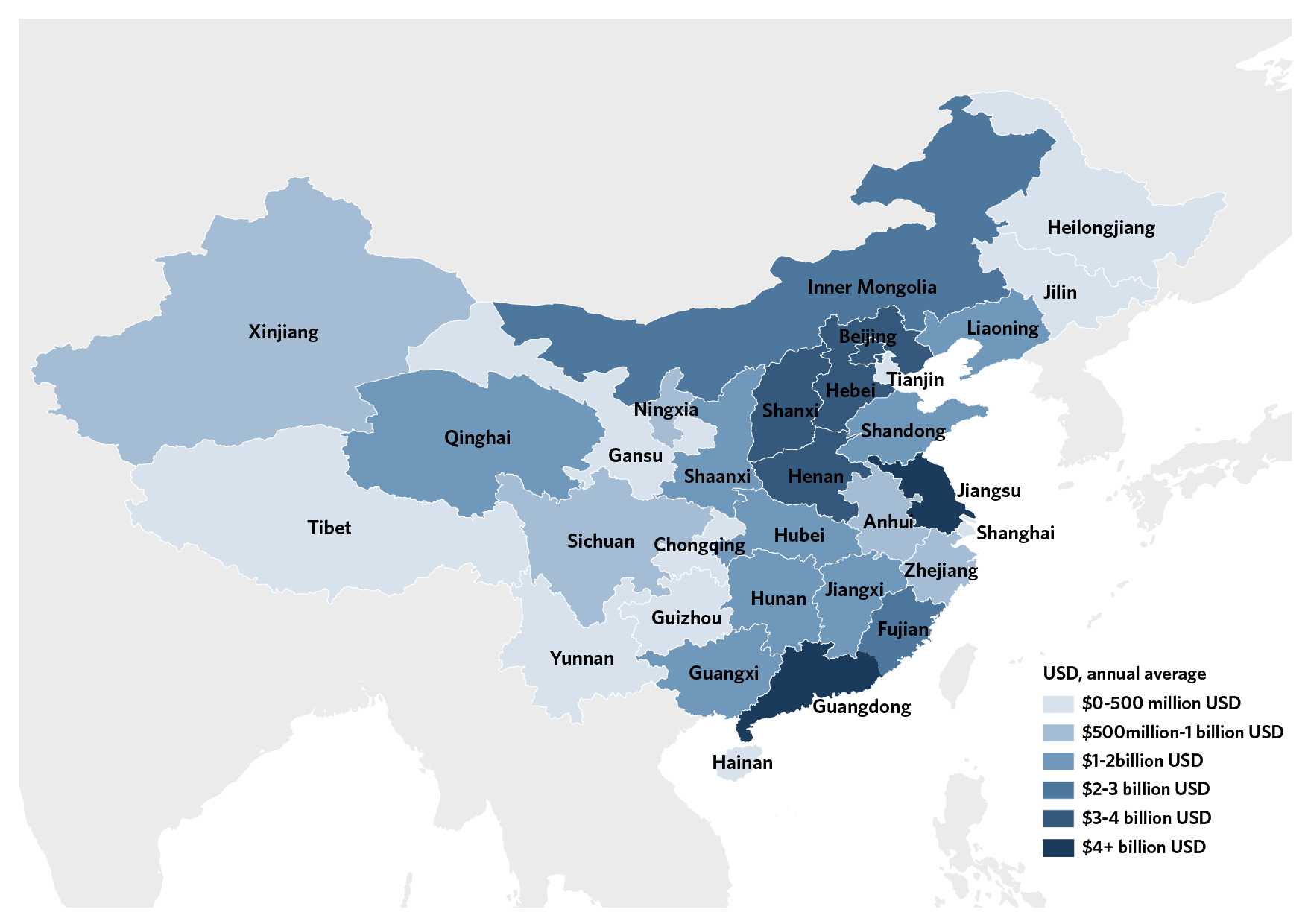

Investments were concentrated north and southeast, especially along the coastal provinces. Solar dominated in the northeastern provinces, led by Hebei, Shanxi, Shaanxi, and Inner Mongolia. Wind was prominent in the southeast, led by Jiangsu, Guangdong, and Henan. The green finance pilot zones selected by the State Council in 201743 are well distributed across the country to reflect the different development contexts and natural resource conditions in each. These include Zhejiang in the east, Jiangxi, Guangdong, Guizhou in the south, and Xinjiang and Gansu in the west. The cities in these provinces were selected to establish local green finance policies and establish innovative market mechanisms for mobilizing green finance.

Barriers and opportunities

China faces several key barriers for scaling up private climate finance. While the top-down approach to implementing green finance reform has led to the mobilization of large pools of green capital, access remains concentrated among public actors. Private capital will be essential for meeting investment targets, but private actors are not benefiting from the increasing pools of available green capital. It remains unclear how private actors can access the funds. For private companies and investors interested in climate impact, there are high ‘search costs’ and their access to formal financing channels and investment pipelines are limited.

There are important opportunities for greening China’s outbound finance. China’s outbound investment reached over USD 2 trillion from 2013-2019, of which USD 739 billion, or 37%, went to Belt and Road Initiative (BRI) partner countries. Energy-related investments to BRI countries over the same period was around USD 292 billion, half of which went to fossil fuels. Initiatives are underway to embed green standards in BRI investments. While such initiatives are promising, green requirements must be ambitious, clearly articulated, and adopted in project screening and investment decision making processes.

Recommendations

Scaling climate finance in China will require clear policy signals and incentives, utilization of all financial tools in the system, participation from a diverse base of financing actors, and a robust framework for accountability.

The report details specific recommendations for improving the quality and scaling up innovative climate finance in China, including:

- Continue raising the ambition of high-level targets and green standards

- Incentivize experimentation with innovative financing structures

- Build and increase visibility on the pipeline of green projects for private actors

- Track and monitor finance flows for ultimate allocation and impact

- Introduce mandatory exclusion lists and negative incentives for high-emission sectors

The report includes a foreward by Ma Jun, President of the Beijing Institute of Finance and Sustainability, and Tom Heller, Chairman of the Board and Senior Strategic Advisor, Climate Policy Initiative.