Leaders will soon commemorate five years of the signing of the Paris Climate Agreement for global climate action, wherein nations agreed to keep temperature rise well below 2°C and pursue even more effort to limit it to 1.5°C. Article 2.1c of the Agreement calls for “finance flows [to be made] consistent with a pathway towards low greenhouse gas [GHG] emissions and climate-resilient development,” which would require all financial actors (financial institutions, corporations and governments) to align their practices, investments, and portfolios with climate goals, mitigate all risks related to climate change, and seize opportunities for growth through climate-smart investment.

Complying with the Paris Agreement and net-zero emissions targets means adjusting decision frameworks to account for climate change risks, including physical, transition, and liability risks. Much of this effort will need to be within power, transport, and other sectors with high-emissions intensities driven by the existing asset fleet. We also need to understand how activities across individual institutions and diverse sectors of the economy ‘add up’ to achieve necessary levels of sector, country, regional, and global decarbonization.

Since 2010, Climate Policy Initiative’s Climate Finance team has been a leader in tracking sustainable investment annually in its Global Landscape of Climate Finance. Now, CPI builds on this work to provide first-of-its-kind insight into high-emissions finance and investment 1 alignment in a series of three papers:

- Improving Tracking of High-GHG Finance in the Power Sector investigates methods and available data for tracking high GHG emissions finance at the project level. It brings together the best of these to present, for the first-time, granular information on financing sources, instruments, destinations, and technology uses for high-emissions power plant projects for the years 2017/18.

- A Proposed Method for Measuring Paris Alignment of New Investment outlines a science-based methodology for understanding how new investment tracks to IEA global warming scenarios and emissions budgets. This methodology attempts to arm policymakers and investors with a new methodology for understanding whether new investment is contributing sufficiently to 2030 targets under the Paris Agreement, within specific sectoral/geographical contexts.

- Paris Misaligned: An Assessment of Global Power Sector Investment presents the results from applying this methodology to best available data for the global power and U.S. transport sectors for the year 2018; discusses the implications of these results for the power sector; and outlines possible solutions to be undertaken by public and private financial actors, as well as regulators and service providers.

We stress the importance of the new methodology itself. If integrated into investor and public institutions’ decision-making processes, where it could draw on much more granular data, our approach would allow those actors to understand and improve the alignment of their investment practices with Paris goals. While this operational value is subject to further discussion and testing of the methodology, these papers offer several broad findings from a first test of our approach:

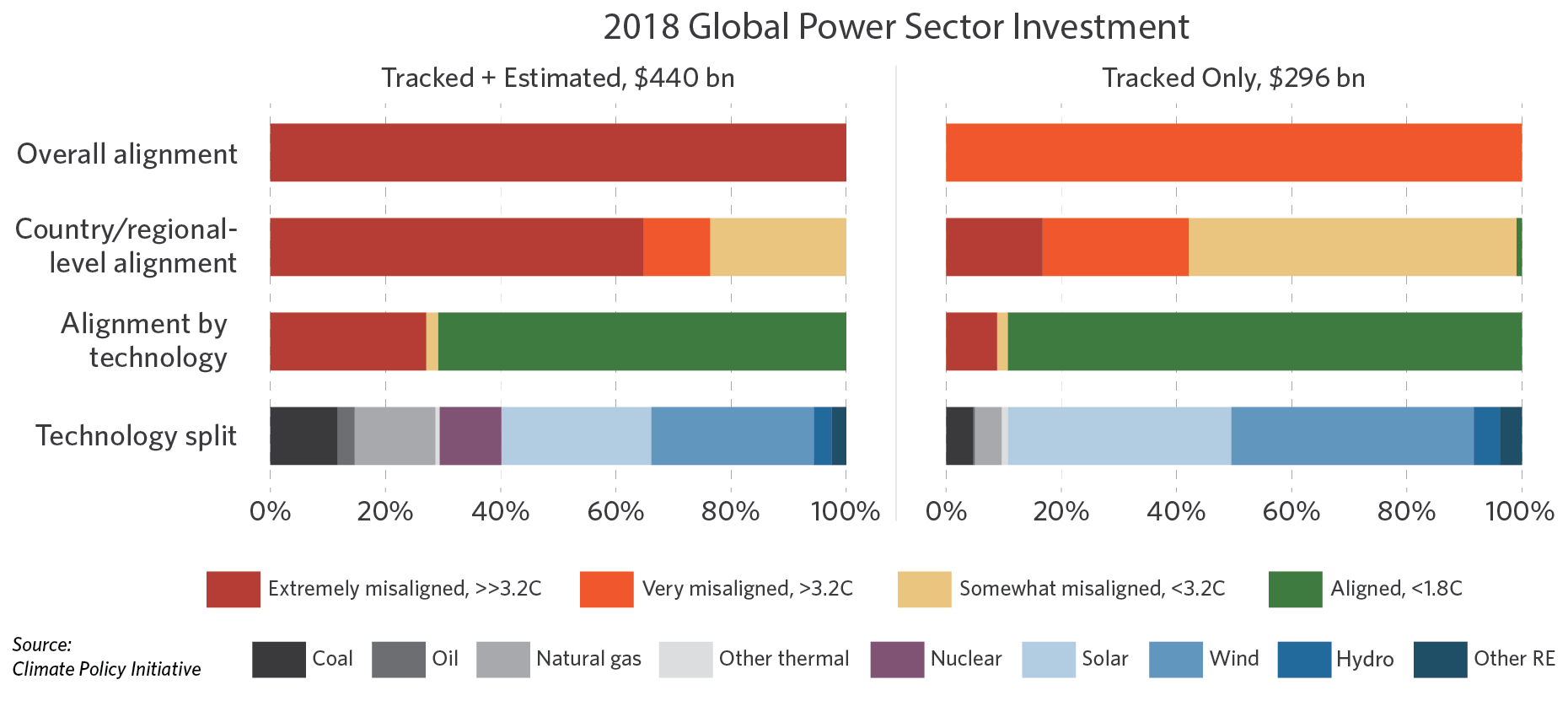

- Globally, 29% of new power investment in 2018, or approximately USD 129 billion, was invested in fossil fuel power, resulting in 109 GW of new fossil generating capacity2 and putting the world on a temperature trajectory of over 3.2°C – more than double the level targeted in the Paris Agreement. Despite strong investment in renewable energy, continued fossil fuel investments across multiple geographies and existing fossil fuel plants that lock in high-emissions capacity are driving misalignment with Paris goals. To meet Paris-aligned targets in 2030 and stay within implied carbon intensity budgets across regions3, all new finance for power should fund development of zero-carbon generation and decommissioning of fossil fuel plants should take place at an accelerated pace. However, zero-carbon global power sector investment currently falls well short of this target, at 71% of the total.

New power sector investment by technology and related alignment, and resulting contribution to temperature pathways at the country-level and at the global level – 2018, global investments (% of investment, USD bn investment)

- No major country or region is currently decarbonizing its power sector at the required pace to meet Paris goals, with fossil fuel finance driving misalignment across a wide range of markets in 2018. While renewable capacity is growing rapidly in almost all geographies, new investment in fossil fuel generation that will remain operational for years to come continues to hold back progress toward Paris-aligned pathways. As a result, finance to most regions was extremely misaligned in 2018, and average emissions rates were higher than even the targets for the IEA’s least aggressive Current Policies Scenario, which represents a pathway to well over 3.2°C of warming. Trends have been particularly worrying in Brazil, China, India, and Japan, as despite their emissions-intensive existing assets, these major economies are still investing in high-emissions power, locking in further emissions increases even as sharp decreases are required to achieve Paris alignment.

Degree of alignment and implied temperature pathways of new power investment in major countries and regions

- No major investor category is fully aligned with CPI’s calculated Paris-aligned emissions intensity targets for power-sector finance. Institutional investors, with 43% of direct investments aligned with regional targets, and multilateral development banks, at 28%, are marginally more on track with their investment portfolios relative to other investor types, none of which exceed 20% when assessing alignment of finance aggregated by region.

- Investment flows from commercial finance institutions were found to be “Very misaligned;” commercial FIs were the leading sources of tracked fossil fuel power investment at USD 13 billion. Commercial banks, along with export credit agencies and state-owned banks, invested heavily in fossil fuel power plants, at USD 13 billion, USD 9 billion, and USD 5 billion per year respectively in 2017/18. Overall, public and private institutions provided similar amounts of tracked project finance for fossil fuel power, at USD 22 billion and USD 19 billion per year respectively.

Discussion of findings

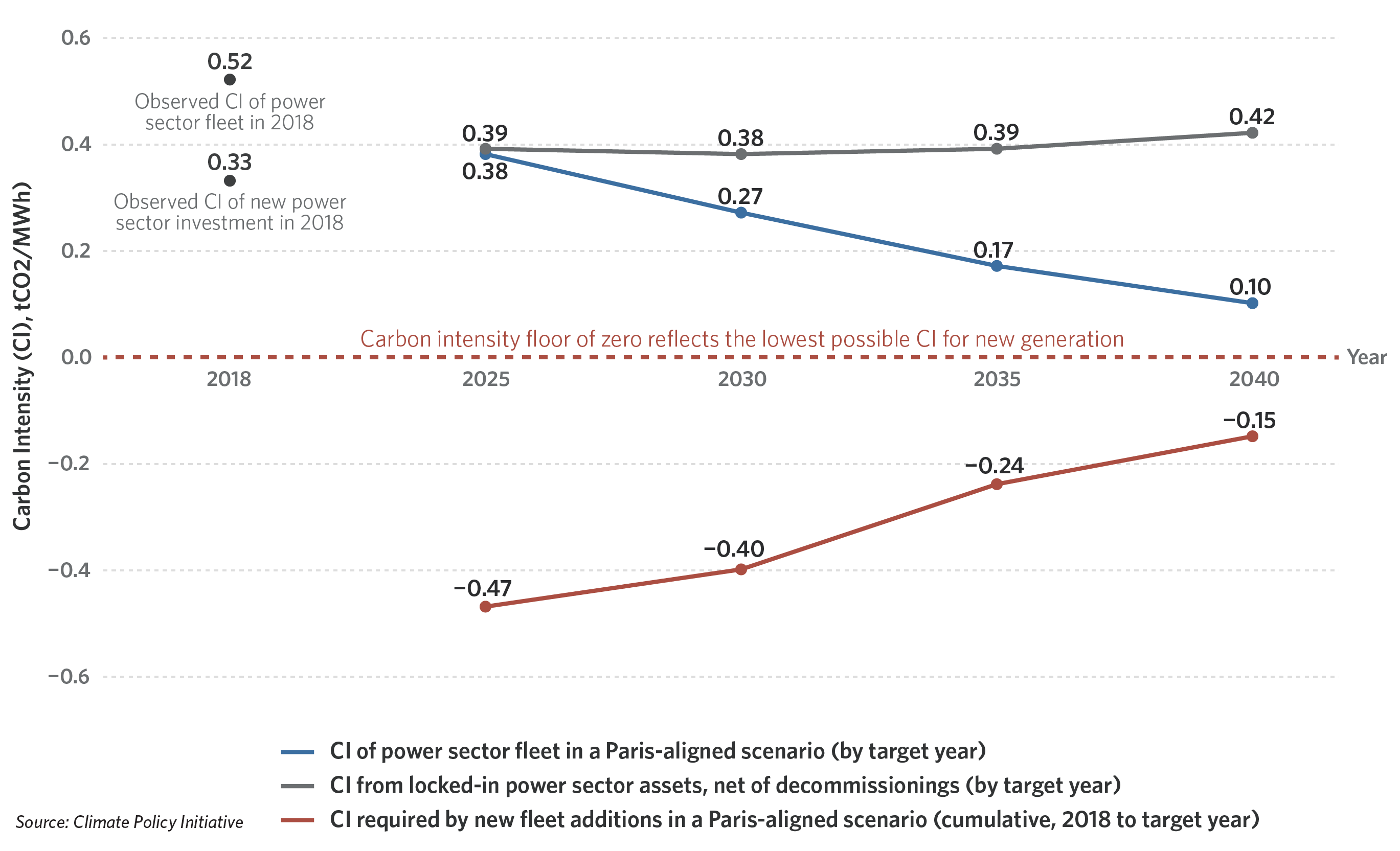

The primary barrier to making power investment compatible with Paris-aligned 2030 emissions pathways arises from the locked-in emissions of existing fossil fuel generation. Even if all new generating capacity were to be zero-carbon, additional power sector emissions cuts are necessary, including activities to prevent or capture emissions from existing high-carbon assets, including accelerated decommissioning of coal, oil, and natural gas generation as well as investment in carbon capture, energy efficiency, and carbon storage technologies.

Global carbon intensities (CI) of 2018 power finance vs. future year alignment targets

This challenge is further complicated by the difficulty of tracing primary investment to source institutions or countries. Investments for which information on the type of investor is not available – which we estimate and categorize as “unknown” in the paper – are expected to largely comprise transactions taking place on corporate balance sheets rather than at project level. This applies to both private and state-owned enterprises, highlighting the need for increased disclosure and regulation of these financing arrangements. Under current investment disclosure rules, which incentivize firms to “hide” dirty activities by financing them through balance sheet borrowing, asset-level transaction data were available for just 23% of the high-emissions power finance tracked in 2018. In the absence of more comprehensive transaction-level datasets detailing the types and identities of firms financing high-carbon activities and assets, full assessment of the alignment status of both broad types of financial actors (e.g. corporates, national Development Finance Institutions) and specific firms or institutions is almost impossible.

Recommendations

The past decade, and in particular the past three years, have brought significant growth in sustainable finance, especially in the power sector as renewable energy deployment has exploded. However, the ratio of dirty to clean power investment remains far too high. Even in 2018, when investment in zero-carbon energy grew to represent 60% of total power finance, new fossil fuel investment raised the overall carbon intensity of new generation to levels incompatible with a Paris-aligned decarbonization scenario.

While continuing to invest in zero-carbon generation is important, the primary challenge in attaining Paris alignment in the power sector remains emissions from fossil fuel generation. We have identified solutions to both of these challenges, which broadly target the following goals:

- Halt new carbon-intensive investments

- Accelerate retirement of fossil-fuel plants

- Continue to scale up low-carbon investments including in renewable energy, energy efficiency, grid infrastructure, carbon capture and storage, as well carbon offsets

In the table below, we outline recommendations by actor category and emphasize that public and private actors should act in cross-collaboration to deliver the Paris Agreement.

[1] In line with CPI’s Global Landscape of Climate Finance, this paper defines “investment” as primary financial commitments into productive assets at the project level – excluding secondary transactions that involve money changing hands but no physical impact, and also research and development spending assumed to be recovered through the sale of resulting products. Financial commitments provided by certain instruments such as guarantees, insurance, government revenue support schemes and fiscal incentives, or “intermediate output” investments in manufacturing or equipment sales, are not counted due to data limitations and the potential for double-counting.

[2] However, CPI was only able to obtain asset-level transaction data for USD 32 billion of this amount, less than a quarter of the value of the total. This asset-level tracking gap highlights the difficulty of linking corporate balance sheet financing to specific high-emissions power projects.

[3] Paris-aligned and Paris-misaligned carbon intensity targets were developed by CPI based on scenarios from the International Energy Agency (IEA) World Energy Outlook 2019. Available at: https://www.iea.org/reports/world-energy-outlook-2019