This publication is CPI’s analysis of Blockchain Climate Risk Crop Insurance, an innovative climate finance instrument endorsed by the Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

In developing countries, only 20% of smallholder farmers have access to agricultural insurance coverage, and in sub-Saharan Africa this falls further to just 3%.

At the same time, climate vulnerability of crops is increasing and smallholders have not yet fully developed the capacity to adapt to the increasing effects such as floods and droughts. Accessible and affordable crop insurance is crucial for smallholder farmers to increase their resilience to the effects of climate change, but unfortunately, traditional insurance isn’t working for them. Insurance can be expensive, and there is little trust in traditional insurers due to histories of delayed or absent payouts.

Blockchain Climate Risk Crop Insurance offers a different kind of crop insurance that’s both affordable and accessible to smallholder farmers at scale. Blockchain Climate Risk Crop Insurance is a digital platform for standardized crop insurance for smallholder farmers in Africa, which increases their resilience to climate change by enabling transparent, timely, and fair payouts in extreme weather events.

INNOVATION

Blockchain Climate Risk Crop Insurance is a digital platform wherein crop insurance policies are plugged into smart contracts on a blockchain and indexed to local weather. During an extreme weather event, the policies are automatically triggered, which facilitates fair, transparent and timely payouts.

For farmers, the instrument reduces transaction costs during the processing of claims. The Lab estimates that in the long-term, an integrated insurance platform model can reduce the costs required to issue a policy by up to 41%, enabling a premium reduction of up to 30%. Reduced claim cycles, from 3 months to 1 week, and increased transparency also build trust amongst stakeholders.

On the supply side, by creating templates for blockchain-based insurance products, the platform gives third parties (insurers and beyond) the tools to create their own customized insurance product, enabling them to offer weather-indexed crop insurance at scale.

IMPACT

The instrument was proposed to the Lab by Sprout Insure, who is leading its development in partnership with ACRE Africa, a recognized intermediary for index insurance across sub-Saharan Africa, and Etherisc, a smart contract developer for different types of index insurance products.

The planned pilot will take place over two to four years, starting from April 2020, and will aim to insure 1.2 mn farmers in Kenya, who will be able to pay the insurance premiums in small installments as low as 50 cents.

At scale, the instrument can potentially mobilize up to US$ 6 to 10 billion in annual premiums. Sub-Saharan Africa provides the best opportunities for replication, especially Burkina Faso, Senegal, and Mali in West Africa and Kenya, Uganda, and Rwanda in East Africa. There is also significant potential in South Asia (India, Bangladesh, and Nepal) and Southeast Asia (Cambodia, Thailand, and the Philippines).

DESIGN

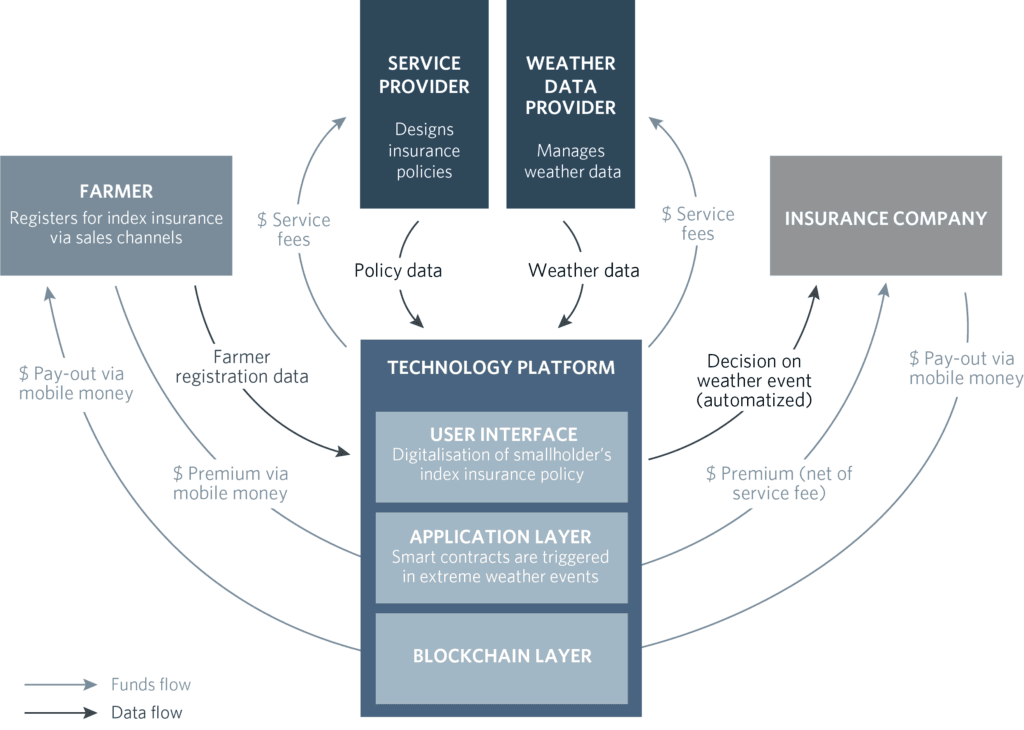

In the pilot phase, the aim is to plug a blockchain-based technology platform into an existing index insurance infrastructure to prove the concept of timely and transparent pay-outs. The key elements are:

- An insurance service and data provider, ACRE Africa designs the insurance product, processes the premium payments, and manages the commercialization of the product and customer care. It also collects and manages the weather data.

- A user interface, designed and managed by Sprout Insure, registers the insurance policies as smart contracts on a private blockchain. This will harmonize payment processing, farmer data, and policy information ultimately reducing transaction costs.

- An application layer, developed by Etherisc, provides the smart contract infrastructure on the blockchain layer where the user interface is built.

The farmer registers for insurance through a scratch-card attached to a bag of seeds by paying a premium via mobile money. Once an extreme weather event occurs the smart contract is triggered. The technology platform will pay out the smallholders using a duplicate risk pool, created to prove the concept of faster payouts. An insurance company will reimburse these payments thereafter.