Climate Policy Initiative has released an update to India’s first-ever effort to track green investment flows.

According to the new report, titled ‘Landscape of Green Finance in India’, tracked green finance in 2019-2020 was INR 309 thousand crores (~USD 44 billion) per annum, which is less than a fourth of India’s green finance needs.

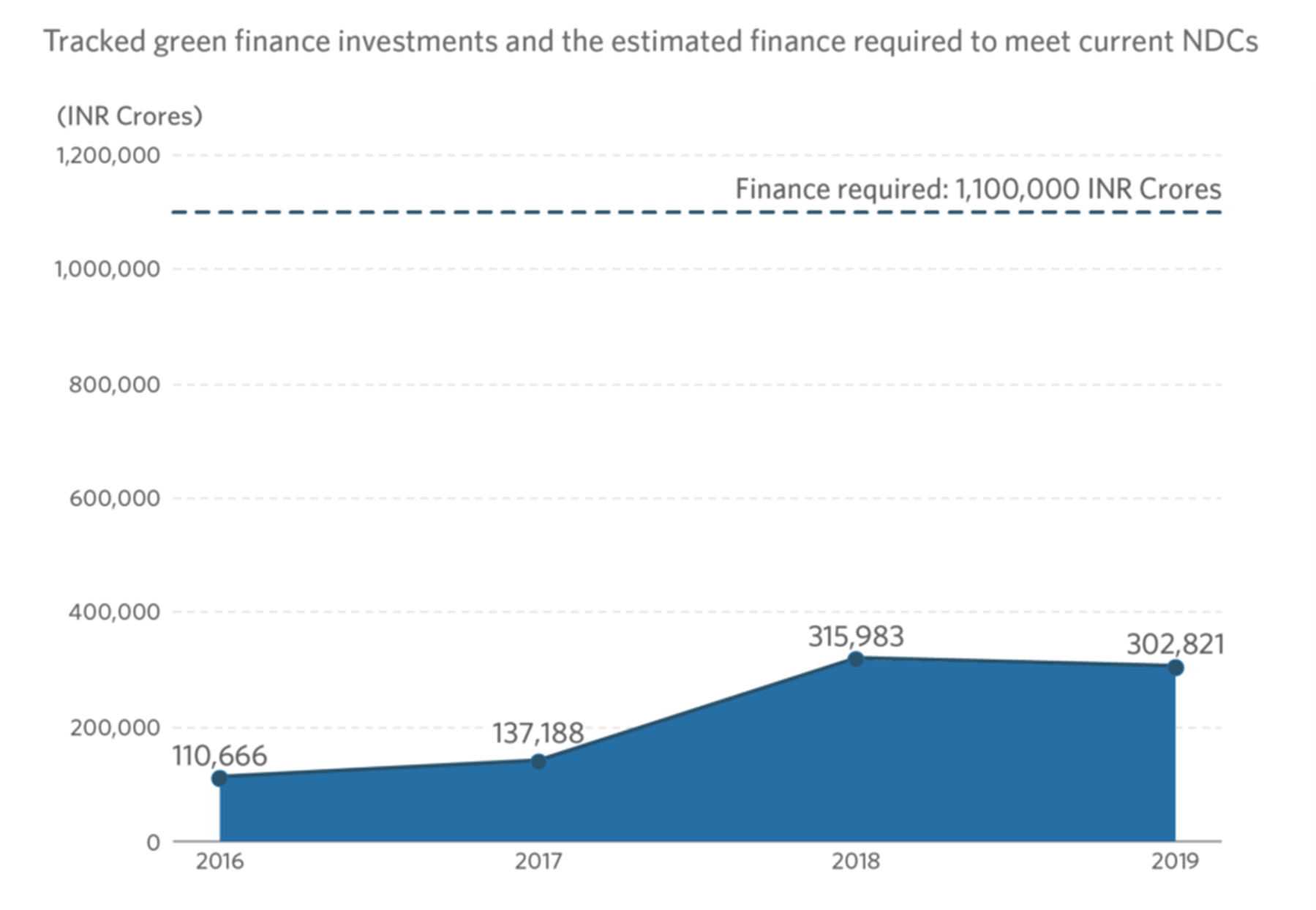

The report estimates that for India to achieve its Nationally Determined Contributions (NDCs) under the Paris Agreement, the country requires an approximate INR 162.5 lakh crores (USD 2.5 trillion) from 2015 to 2030 or roughly INR 11 lakh crores (USD 170 billion) per year.

The evaluation of green finance flows focuses on three key real economy sectors: clean energy, clean transport, and energy efficiency. The study tracks both public and private sources of capital—domestic and international—and builds a framework to track finance flows to the end beneficiaries with an emphasis on bottom-up approaches based on actual investments rather than commitments, providing the most accurate analysis to date of where India’s climate finance stands, the finance gaps it faces, and the opportunities that lie ahead.

The report also provides a first-of-its kind evaluation of Adaptation financing for select sectors.

“The report shows increased flows to renewable energy sectors, reflecting the positive role policy support has had in mobilizing investment. We hope to see a similar role being played in other sub-sectors like distributed renewable energy and clean mobility.”

– Neha Khanna, Project Manager and Lead Author, Climate Policy Initiative

Green finance gaps reveal significant investment opportunities

In 2021, India put forth enhanced ambitions on climate action and announced the Panchamrit targets, which include adding 500 GW of non-fossil fuel-based energy capacity and meeting 50% of its energy requirements through renewable sources. Such enhanced ambition requires mobilization of green finance at a much faster pace.

In the two years since CPI’s initial report, green finance flows increased by 150%. In the overall increase, public sector flows increased by 179% and private sector flows by 130%. This shows increased commitment from public sources – both domestic and international.

However, domestic sources continue to account for the majority of green finance, with 87% and 83% in FY2019 and FY2020, respectively. Of these domestic sources, the private sector

contributed about 59%–INR 156.9 thousand crores (USD 22 billion). The share of international sources increased from 13% in FY 2019 to 17% in FY 2020, but it is still a far cry from Prime Minister Modi’s demand of a trillion dollars of climate finance at COP26 in Glasgow, to help meet India’s 2030 and net-zero goals.

“Proving comprehensive information of actual finance flows helps provide a baseline from which policymakers and investors can act, to improve energy access, energy security, and resilience. And we need to act urgently due to India’s high climate vulnerability.”

– Dhruba Purkayastha, India Director

Adaptation finance is critically low

India is one of the most vulnerable countries to climate change, and there is a pressing

need for funds to flow into the Adaptation sector. Tracked finance for the sector stood

at INR 37 thousand crores (USD 5 billion) in FY 2020, which was severely short of the

required needs. The major source of Adaptation funding was domestic (94%), and it was fully funded by Central and State government budgets. Collaboration and planning are key to increasing finance flows to the sector, as is the development of Adaptation investment plans at the State level.

The complete report can be accessed, here.

Contact:

Angel Jacob – angel.jacob@cpiglobal.org

Gunjan Jain – gunjan.jain@gsccnetwork.org

About CPI

CPI is an analysis and advisory organization with deep expertise in finance and policy. Our mission is to help governments, businesses, and financial institutions drive economic growth while addressing climate change. CPI has six offices around the world in Brazil, India, Indonesia, the United Kingdom, and the United States.