How catalytic equity can unlock the clean energy transition where it’s needed most

Meeting global climate and development goals will require a rapid scale-up of clean energy infrastructure investment in emerging markets and developing economies (EMDEs). However, while the magnitude of the financing gap is widely recognized, the discussion has largely focused on aggregate figures that lack guidance for practical action.

This report, prepared by Climate Policy Initiative and the Glasgow Financial Alliance for Net Zero, with support from Allied Climate Partners and Three Cairns Group, and analytical support from Wood Mackenzie, highlights equity as a critical but often overlooked component of capital formation.

Equity is essential for scaling projects and companies. By committing early and taking on risk, equity investors lead transactions and create a foundation for financial leverage. This support helps businesses move through the development phase, growing the pipeline of bankable projects.

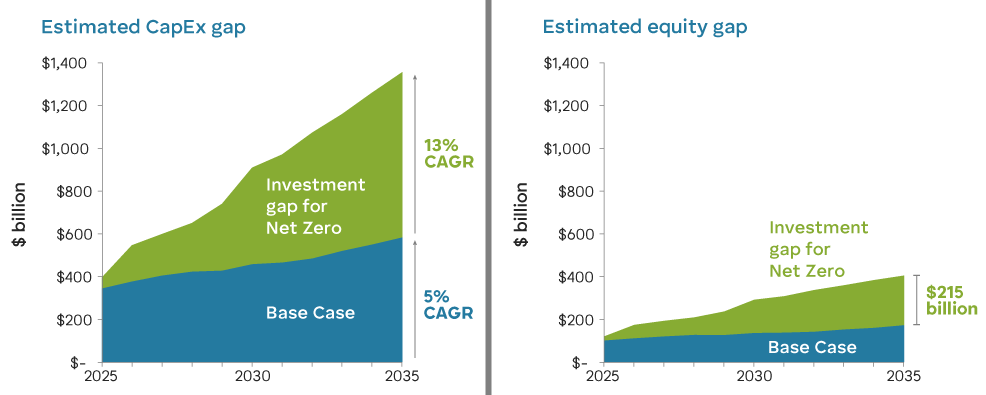

However, EMDEs are likely to fall far short of the equity investment needed to reach net zero. Between 2025 and 2035, equity investment in EMDEs is expected to grow at only 5.4% annually in a Base Case scenario, reaching about USD 160 billion per year. To align with a net zero pathway, equity investment must grow at 13.1% annually—more than double that rate—to reach USD 375 billion each year.

This leaves a USD 215 billion annual equity gap that must be filled to put EMDEs on track for a low-carbon transition.

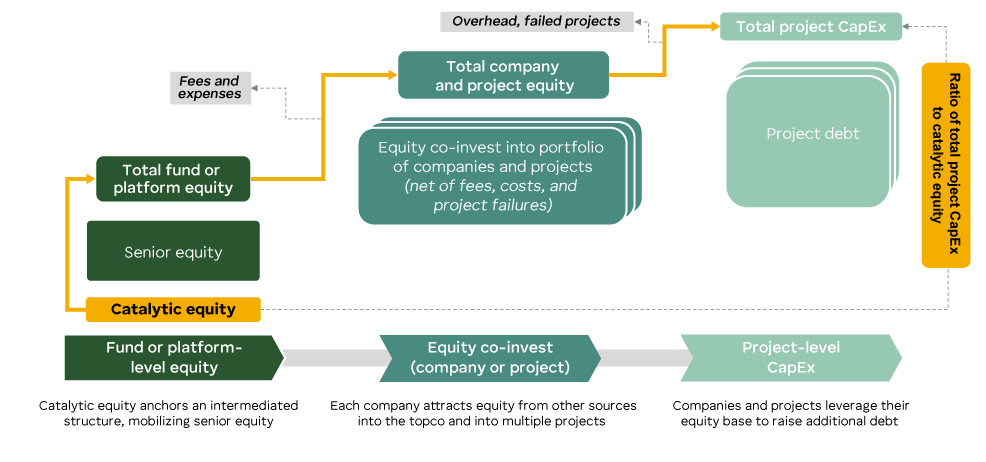

Catalytic equity—equity invested on sub-market terms to mobilize additional capital—offers a powerful, efficient solution. Early evidence suggests that one dollar of catalytic equity could unlock up to USD 30 in total project investment by reducing risk and enhancing returns for other investors. The report estimates that just USD 12–25 billion in catalytic equity annually by 2035 could help bridge the equity gap, if well-targeted and supported by enabling policy and institutional action.

As official development assistance declines and public finance providers face increasing pressure to “do more with less,” the report offers practical recommendations for the climate and development finance community: mobilize more equity to accelerate and scale capital deployment for climate, significantly increase the amount of catalytic equity in the system, and strengthen the knowledge base to ensure catalytic equity is well targeted.

By identifying where equity, and catalytic equity in particular, can make the most difference, this work aims to help development finance institutions, their shareholders, and philanthropies use their capital to unlock much larger volumes of private investment for climate and development on commercial terms.

Key findings

Equity is an underutilized but critical component of capital formation.

- Climate and development actors have historically focused on debt financing.

- Equity leads transactions by taking early risk and providing the foundation for leverage – leading to larger total investment volumes.

EMDEs will likely fall far short of the equity investment needed to reach net zero.

- Equity investment from 2025-2035 is expected to grow at a 5.4% CAGR in a Base Case scenario. To align with net zero, equity investment must rise at a 13.1% CAGR—more than double the Base Case rate.

- Annual equity investment in a Base Case is projected at USD160 billion. A net zero scenario requires USD 375 billion annually, revealing a USD 215 billion annual equity gap.

Early evidence suggests that catalytic equity could be powerful tool to mobilize capital.

- Catalytic equity mobilizes external capital by reducing risk or enhancing returns for other investors.

- One dollar of catalytic capital could unlock USD 4 in intermediated equity, USD 9 at the project level, and USD 30 in total project CapEx.

The mobilization power of catalytic equity implies only modest volumes could help reduce the equity gap.

- We estimate USD 12–25 billion in catalytic equity annually by 2035 could help address the USD 215 billion equity gap in EMDEs. To fully close the gap, additional measures, including policy action, are required.

Recommendations to the climate and development finance community:

- Mobilize more equity to accelerate and scale capital deployment for climate.

- Significantly increase the amount of catalytic equity in the system.

- Develop the insights and learnings needed to ensure that catalytic equity is well targeted.