The 2015 Paris climate agreement is built on a central trade-off. All countries will pony up plans to cut their carbon footprint—but only if rich countries, which bear the most responsibility for causing the crisis, pony up cash for their poorer neighbors, the ones that bear the brunt. But as the volume of climate finance lags behind, analysts say rich countries are failing to grasp their own economic interests in protecting poor ones.

The target usually cited for climate finance transfers is $100 billion per year, which rich countries committed in 2009 to raise by 2020. Not only has that target been missed—the most recent official estimate is $79.6 billion—but it falls far short of what is really needed.

Are rich countries contributing enough?

A new analysis on Oct. 18 by Climate Policy Initiative (a nonprofit research group funded by European governments and others) attempts to capture the full amount of public and private spending on climate adaptation and mitigation measures globally. It found that tracked climate finance—including what poor countries pay out of their own pockets, what rich countries spend within their own borders, and what corporations spend for their own benefit—reached $632 billion in 2019-20, up from $547 billion in 2017-18.

While this sum may seem impressive compared to the $100 billion target, we actually need a total of at least $4.13 trillion by 2030 for the world to be on track for the Paris Agreement goal to limit warming to 1.5 C. Rich countries must contribute far more.

One key reason rich countries aren’t doing more is that they still view and process climate finance as a form of charity or aid, says Sara Jane Ahmed, finance advisor to the Vulnerable 20 Group, a coalition of low-income countries in Africa, Asia, and Latin America that tend to work as a bloc in climate negotiations. That view is myopic, she says.

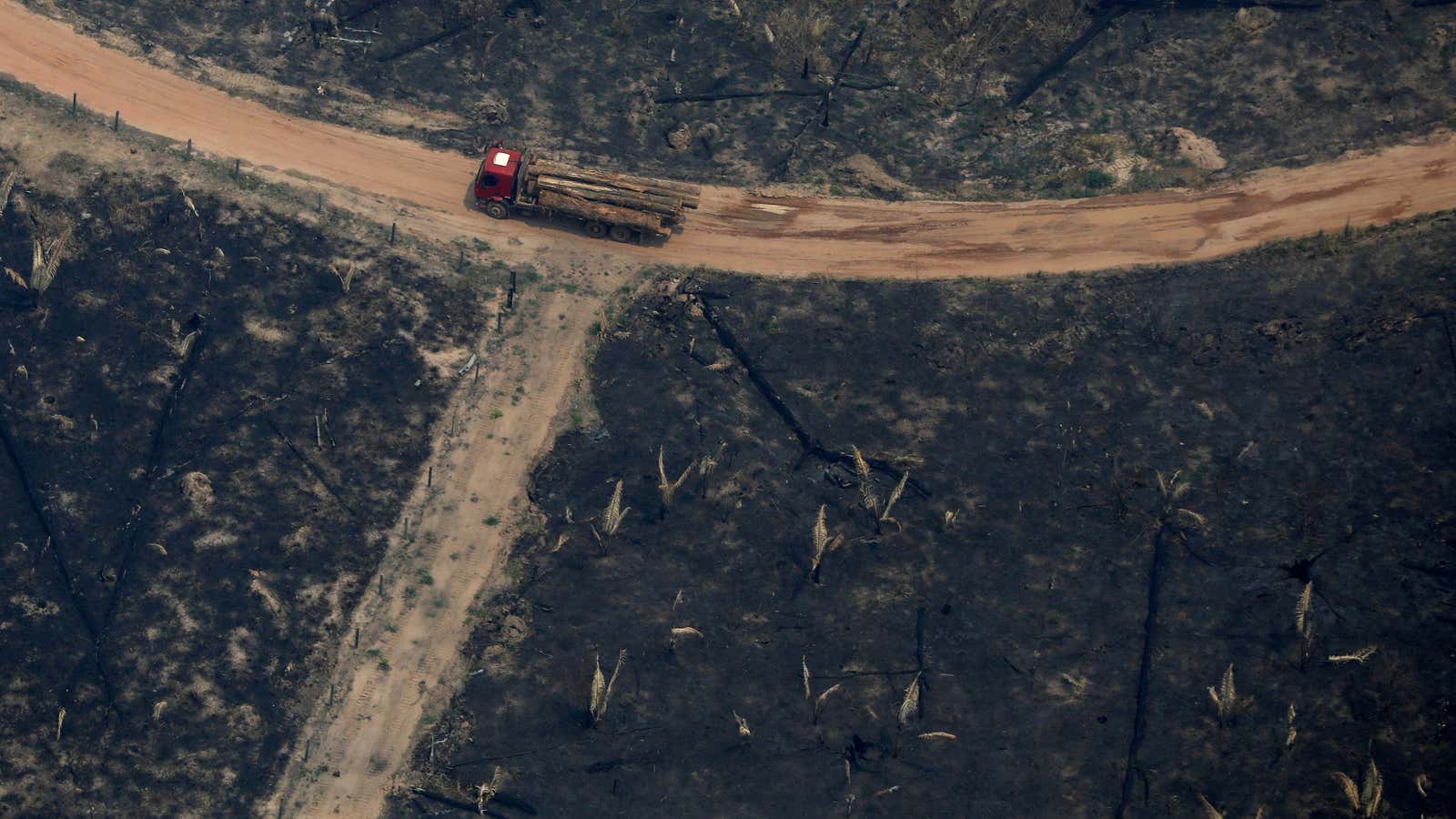

Instead, she argues, climate finance is really a strategic investment in protecting the roots of global supply chains. For food, natural resources, textiles, consumer electronics, and other key ingredients of global trade, these roots often originate in climate-vulnerable countries.

When the roots suffer—when a hurricane destroys a factory, or a drought destroys a harvest—rich countries pay more for everything from restaurant bills to semiconductor chips. Paying to storm-proof the factory or facilitate access to climate-resilient agriculture is a way to mitigate that risk.

“It’s still perceived as a handout,” Ahmed says. “But if we look at the impact to supply chains, with weather costing hundreds of billions of dollars, why are we not reaching the $100 billion target already?”

The three big problems with climate finance

Climate finance will be a key topic at the upcoming COP26 summit in Glasgow. If the US and other rich countries don’t announce major new rounds of funding, middle-income major emitters like Brazil and India have threatened to withhold further emissions cuts.

This week, a multilateral working group led by Canada and Germany is due to publish an updated strategy for how rich countries will reach the $100 billion goal and press beyond it. The strategy will likely focus on the three big problems with how climate finance is administered today:

- There’s not enough of it. Among other reasons, the pandemic recession sapped enthusiasm and budgets for climate finance from rich countries.

- Too much of it goes toward mitigation, not adaptation. Investments aimed at reducing carbon emissions (“mitigation,” in climate jargon) are well and good, but they do nothing to stem the impacts of climate change that are already here. A mere 7% of climate finance targets adaptation measures, of which nearly all is sourced from the public sector, said Baysa Naran, a senior analyst at CPI and lead author of the report. The main reason is that while mitigation investments—a solar farm, say—tend to present a clear business case, adaptation is unlikely to generate direct profit for investors.

- Climate finance comes with too many strings attached. 60% of climate finance comes in the form of a loan, CPI reports, as opposed to grants or equity. While loans from development banks are typically offered at below-market interest rates, they still create a new debt burden for countries that were already struggling before the pandemic. And, some analysts argue, loans shouldn’t be counted as climate assistance finance at all since they eventually get repaid to lenders.

Ultimately, the solution to all three problems is the same: It’s up to the public sector to pick up the slack—which, again, can ultimately benefit consumers in rich countries by mitigating supply chain price shocks.

How climate finance gets spent

Although the vast majority of international public climate finance by dollar volume goes toward mitigation projects, agriculture and other sectors that feed into global supply chains are also common, according to an OECD database.

The list also prominently features support for renewable energy, which could represent a market opportunity for clean-tech manufacturers in rich countries. Plus, there are a few projects with a more tenuous link to fighting climate change, including funding for counter-narcotics operations, teacher training, and even two coal-fired power plants in Bangladesh sponsored by the Japanese International Co-operation Agency.

Parsing this database by funding volume—i.e., which specific projects attract the most funding—is tricky, because individuals loans or grants often cover multiple development objectives and may not go entirely to climate-related activity, says Jan Kowalzig, a climate finance analyst at Oxfam Germany. Individual projects may also include a mix of public and private funding.

The upshot is that if the volume of climate finance for adaptation is increased, it’s already poised to flow into projects with benefits that reach beyond the borders of the recipient country.

But altruism and supply chains aren’t the only consideration for rich countries’ climate finance, says Billy Pizer, vice president for research at Resources for the Future, a nonprofit think tank in Washington. Adaptation funding can also help stem national security risks in developing countries, and limit cross-border migration. As more public climate finance becomes available, it should take all these factors into account, he says.

“When you’re thinking about security and migration, it definitely makes sense to think about the poorest countries,” Pizer says. “When you think about supply chain vulnerability, it’s not as clear where it leads you. It might lead you to more middle-income countries. Given the limited amount of foreign assistance, so it still makes sense to focus on the poorest countries that are most vulnerable.”