This blog post was originally published in Environmental Finance, July 2020.

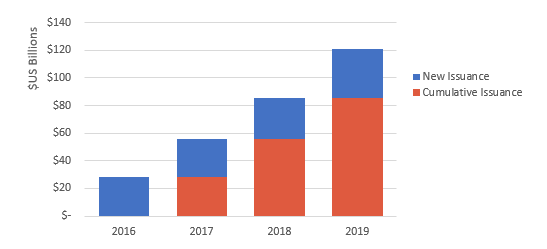

The Chinese green bond market expanded rapidly from 2016-2019, becoming the second largest green bond market globally with USD 120 billion of cumulative issuance. The rapid growth indicates great potential for mobilizing capital at the scale needed to meet China’s climate investment needs, estimated at around RMB 3-4 trillion (USD 420-560 billion) per year.

Figure 1: Cumulative Issuance in China’s domestic green bond market

How these green bond funds are used are not always clear, however. Multiple regulatory authorities oversee different bond types, with inconsistent reporting and verification requirements, which leads to varying levels of transparency across bond types. Moreover, Chinese regulations allow “clean coal” and other fossil-fuel projects to be eligible for green bond funding, and up to 50% of proceeds may be allocated to general working capital purposes for enterprise bonds. According to Climate Bonds Initiative’s analysis, nearly USD 3.7 billion of issuance in China did not meet international standards in 2019.

China is taking significant steps to improve the quality of its green bonds. A new draft of guidelines for the catalogue of eligible China green bond projects, released in May 2020, aims to remove “clean coal” and other fossil-fuel related projects from the eligibility list. The draft plan was jointly issued by the People’s Bank of China, China Securities Regulatory Commission, and National Development and Reform Commission, signaling greater coordination among the bond markets’ key regulatory authorities.

A deeper understanding of China’s green bond market is important for expanding the domestic and international investor base for China green bonds. Moving closer to international green bond standards also widens the potential foreign investor base of the Chinese green bond market. Foreign investors are currently largely underrepresented in Chinese bond markets, at around 1.6% of the total value of bonds outstanding in China.

To better understand China’s green bond market, Climate Policy Initiative (CPI) and the International Institute of Green Finance (IIGF) conducted extensive primary data research to track bond issuances, their use of proceeds and their environmental and climate impacts. Our report—including new data that has never been published before—explores China’s green bond market from an economic and regulatory perspective and provides recommendations on how policymakers can support the market to continue its growth.

Investment Trends

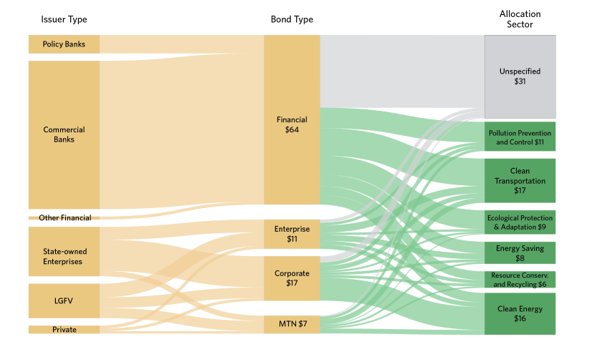

Of the nearly USD 100 billion green bonds issued in China from January 2016 to April 2019, almost a third of total proceeds, USD 31 billion, were unspecified or pending allocation. Clean transportation and clean energy received the next largest share of proceeds, with USD 17 billion and USD 16 billion respectively.

Within the clean energy sector, hydropower accounted for the largest share at USD 7 billion. Within clean transportation, urban rail transit contributed the largest share at USD 5.7 billion. Projects for “clean utilization of coal” accounted for around USD 380 million of proceeds.

Figure 2: Allocation of proceeds, from issuers to allocation sector (January 2016- April 2019)

As the tracking graphic above shows, green bonds issued by financial institutions contributed the largest share of unspecified allocations; largely due to proceeds that

were still pending allocation. Furthermore, because financial institutions act as intermediaries and provide capital to end-users who are not always identified, it’s not always possible to verify the final allocation of proceeds beyond the sectoral-level.

Project-level details specifying whether proceeds went towards new or existing projects are often not available, although this is not unique to Chinese issuers. Among the US $67 billion of proceeds whose allocation sector was identified, 28% was reported as going to new projects and 10% towards debt refinancing or for existing projects. A further 11% was allocated to working capital, while details for the remaining 51% of proceeds were unknown.

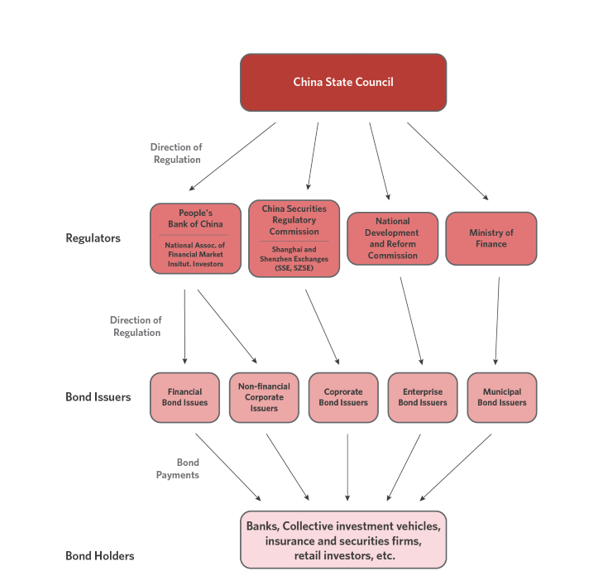

Regulatory Framework

China’s green bond market has multiple regulatory authorities providing oversight over different parts of the market as illustrated below.

Figure 3: China’s bond regulatory framework

Each regulator provides its own guidelines for green bond issuance and regulates different types of bonds. The resulting segmentation poses several consequences for the market, such as inconsistent standards and different expectations for reporting, which can decrease efficiency and increase cost.

Impact & Additionality

China’s green bond market attracted 160 new issuers, supporting projects that reduced 52.6 million tons of CO2e and added 11.2 GW of installed clean energy capacity.

Our research reviewed 114 green bond issuances with publicly available environmental impact reporting. According to the issuer’s reports, the cumulative impacts are 52.6 million tons of CO2e reduced and 11.2 GW of installed clean energy capacity. A significant share of green bond investment has been directed to clean transport including more than 3000 km of rail/subway line constructed.

In terms of additionality, we used the number of entrants to the green bond market since 2016 as a proxy. Nearly 160 new issuers entered the market following the central bank’s launch of green bond guidelines and endorsed project catalogue in December 2015. Proceeds from these bonds have reported substantial environmental impacts as noted above.

Recommendations

Despite the recent economic downturn spawned by the global coronavirus pandemic, the Chinese green bond market is expected to continue to expand in the years ahead. However, there are opportunities for policymakers and investors to increase the rate of growth, broaden both the issuer and investor base, and increase the effectiveness of the market.

Continue growing the market through clear guidelines and incentives

The market segmentation created by different authorities and regulatory frameworks impacts the efficiency of the market, creates unnecessary burdens on issuers, and decreases transparency. Authorities can work to address market segmentation by seeking approaches to consolidate requirements and clarify guidelines.

Diversify the issuer and investor base

Current regulations favor large issuances with AA or AAA ratings. Easing credit rules may help increase the participation of entities that have less access to credit but are still creditworthy.

To meet the needs of smaller projects and borrowers, authorities and issuers can work to develop the green asset-backed securities (ABS) market. The transaction costs of bond issuances favor large issuances that do not meet the needs of many types of projects. Using ABS, smaller projects can be aggregated and transaction costs reduced.

Strengthen the monitoring, reporting and verification (MRV) system

A major challenge to understanding the green bond market in China is the difficulty in collecting the data from available reporting. Our analysis also faced limitations due to the lack of project-level data on green bonds that was either difficult to find or incomplete.

Establishing a centralized depository of green bond financial and environmental data that is easily accessible would alleviate many of these problems. Another measure could be to introduce a standardized framework for environmental impact reporting that provides common methodologies and metrics for issuers to track and report on the impact of their green bonds. This would allow the market to better understand and communicate the benefits of green bonds and draw additional investors.

Learn More

We encourage readers to download and read the full report, as it provides a deeper look and additional data for each of the categories in this blog post. Green Bonds in China.

CPI and IIGF conducted a webinar on these findings, available here: Webinar: Green Bonds in China.

We also plan to produce additional information on the Green Bond market in China, so encourage you to subscribe to our newsletter or follow us on social media (Twitter or LinkedIn) for notification of future releases.