The Adaptation Gap

Over he past decade, the impacts of climate change on human and natural systems are being felt with severity across the world.<1> The imperative to build climate resilience – the capacity of communities and economies to cope and adapt to ongoing and likely future changes—is greater than ever before. In 2015, the 21st Conference of Parties (CoP) agreed to the Paris Agreement, which was designed to limit global warming to well below 2°C, in order to avoid dangerous climate change.<2> However, while global measures to mitigate climate change have accelerated over the past decade, scientists believe that “ven if GHG emissions were to stop immediately, the average temperature will continue to rise, as the life of carbon dioxide in the atmosphere is more than 100 years.”<3> Therefore, as critical as mitigation is, equal if not more priority and attention needs to be focused on building resilience.

While, historically, developed countries have been responsible for a bulk of the emissions that have led to climate change, developing countries such as India with limited adaptive capacities are most vulnerable to climate impacts. The ‘need for adaptation’ has been defined by the United Nations Environment Programme (UNEP) as “the difference between actually implemented adaptation and a societal set goal, determined largely by preferences related to tolerated climate change impacts, and reflecting resource limitations and competing priorities.” Resilience and adaptive capacity are shaped by access to finance, technology and knowledge.<4>

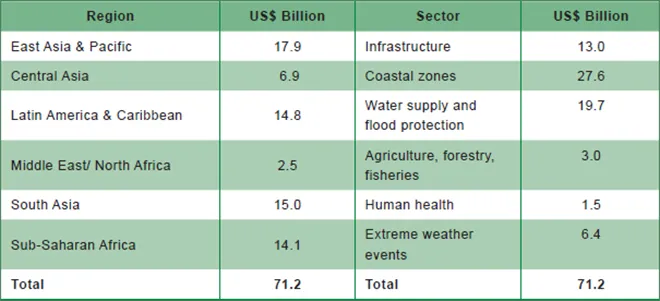

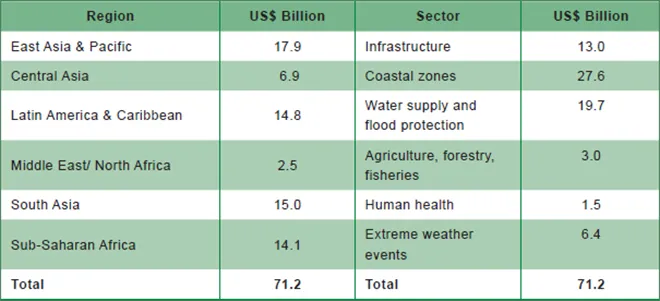

Global annual cost estimates (USD Billion) for developing country regions and sectors 2010-2050

Source: UNEP, 2014<6>

Source: UNEP, 2014<6>

To provide the financial resources required to support both mitigation and adaptation in developing countries, it was reaffirmed by the developed world at the Paris Agreement that they would honour the commitments made in the 2009 Copenhagen Accord to mobilise US$100 billion annually by 2020. However, estimates suggest that this amount would be inadequate to support the developing world’s transition to low-carbon, resilient economies. The costs involved in building the resilience of socio-economic systems to climate change in the developing world alone, is projected to range between US$140 to 300 billion by 2030, and between US$280 and 500 billion by 2050.<5>

The gap in adaptation finance requires the mobilisation of new sources of financing from both the public and private sectors. The UNFCCC climate finance meetings held in 2018 highlighted the need for a greater understanding of adaptation finance and exploring potential avenues to ‘scale up’ said finance.<7> However, so far, the flow of climate finance to adaptation has remained particularly weak.

The annual ‘2017 Global Landscape of Climate Finance’ report by the Climate Policy Initiative (CPI), in its most comprehensive estimates of international climate finance, assessed that while total global climate finance reached a record high of US$437 billion in 2015, only 16 percent of it was dedicated to adaptation.<8> In terms of climate finance flow from developed to developing countries, out of the total US$86 billion public climate-specific finance flows between 2011-2014, 63 percent targeted mitigation, 16 percent to adaptation, and 21 percent went to crosscutting or other activities.<9>

In terms of the climate finance directed to adaptation in developing countries, the public sector – both bilaterally and multilaterally - has been the major contributor, with a significant increase in the amount over past years, although estimates vary.<10> <11> Nearly 80 percent (US$11.8 billion) of the financing for adaptation comes from bilateral climate-related flows, out of which 45 percent is allocated to least developed countries.<12> The global public climate finance flows for adaptation was US$25 billion in 2013. Of the combined commitment of US$15.1 billion of international public adaptation finance for developing countries by OECD DAC and Multilateral Development Banks, US$10 billion is dedicated towards adaptation, while US$5.1 billion of it is towards activities designed to address both adaptation and mitigation.<13>

Public investments in adaptation are necessary considering some adaptation measures directly concern areas of government activities—public storm shelters, dams, or flood-resistant infrastructure, to name a few. However, for sectors where private activities are affected by climate change—large commercial infrastructure or real estate, for example—financing should increasingly come from commercial or private sources. A growing body of literature<14> highlights private investments in mitigation, but, despite the need, the experience with private sector engagement in adaptation in developing countries has been poor. Private finance accounted for 16 percent of total developed country adaptation finance budgets between 2013-2014, yet, the actual contribution made towards adaptation was only 10 percent.<15> Despite this lack of involvement, it is in the interest of the private sector to engage substantially in adaptation to protect their existing and future investments from the effects of climate change. Climate resilience and adaptation can also provide new, previously unexplored business opportunities.<16> <17>

The reason for businesses to be traditionally more interested in investing in activities that focus on mitigation over adaptation is to secure more immediate, reasonable and predictable returns at acceptable risks.<18> Adaptation projects tend to lack such incentives. Moreover, Developing and Least Developed Countries (LDCs) systematically rank low in the World Bank’s ‘Doing Business’ and the World Economic Forum’s ‘Global Competitiveness Index’—suggesting that these countries, often do not offer enabling environments for secure investments.<19>

Paradoxically, Pauw & Pegels argue that the engagement of the private sector in adaptation is “inevitable and potentially significant.”<20> First, “private-sector investments constitute 86% of global investment and financial flows<21> and 90% of the population in developing countries depend on the private sector for their income.”<22> Second, as evidence suggests, mobilising private investments in adaptation is imperative considering the high costs of adaptation. There is an established, general agreement that current international public finance flows for resilience are insufficient to meet needs. Unless additional finance from a variety of sources is secured, the gap is likely to broaden over the coming years.<23> Adapting to climate change is also important for the private sector to safeguard business, ensure their continuity and profits, and take advantage of new market opportunities. Yet, a number of barriers currently hinder the private sector’s motivation, ability, and perspective on investing in adaptation action.<24>

At the same time, it is difficult for developing countries themselves to access available private finance for adaptation. Different types of financing and funding have different objectives and requirements, thereby making it complicated for the developing countries to navigate the array of sources. These issues include, insufficient awareness of the need for adaptation and the potential sources of funding that is available; difficulty in understanding international investment procedures; lack of capacity to develop and implement projects in partnership with the private sector; and a lack of coherent policies and regulatory frameworks. Moreover, developing countries tend to not have clear sets of priorities when it comes to adaptation and development.<25>

Challenges for Private Investment in Climate Resilience

The effects of climate change pose risks to the operations, competitiveness and profitability of businesses, both directly and indirectly, as well as the value of tangible and intangible assets. The uncertainties related to future climate change impacts, intangibility of adaptation interventions, long-term payback period, as well as political, institutional and legal bottlenecks have constrained the willingness of private investors to channel funds to resilience projects.

Policy and regulatory barriers

Coherent legal and regulatory frameworks that ensure policy stability and good governance are the enablers of attracting investments from both public and private sectors.<26> Deficient domestic market regulations and policy frameworks that are not designed to stimulate adaptation (such as, infrastructure codes and environmental/social impact assessment laws, or lack of economic incentives for investment in climate resilience) can constrain private responses to climate change risks and opportunities.<27> While middle-income developing counties have been able, to a certain extent, to attract private finance, low-income developing countries or LIDCs have received its lowest share and continue to rely on Official Development Assistance (ODA) as the main external source of climate finance.<29>

For enabling an efficient and cost-effective shift to climate-resilient and low-carbon economies, it is imperative to ensure coherence in policy, legal and regulatory frameworks, which is often limited.29 Addressing misalignments between various climate policies such as regulatory regimes for infrastructure that inadvertently deter investment in resilience and poorly designed insurance mechanisms that discourage risk reduction investment, would help in attracting investments in resilience activities.

Lack of knowledge and information

The private sector needs to understand climate vulnerability to integrate climate change risks and opportunities into their investment and decision-making processes. They often face knowledge gaps in availability of investment-relevant data and tools that can inform their decision—lacking the integration of long-term climate trends, as well as the capacity and expertise to identify climate-resilient investment.<31> Moreover, the private sector has a tendency to apply short-term investment horizons, and this impacts their business appetite to invest in climate resilience.

Similarly, developing countries often face challenges in acquiring relevant data on climate and reliable estimates of historical climate phenomena. There are significant uncertainties in the available projections of the magnitude and direction of climate change impacts that are available, as the countries often lack the technical expertise to interpret data and develop climate models. The history of success and failure in achieving expected adaptation and development targets are limited.31 This can further inhibit the countries’ attempts to access private climate finance.

Lack of awareness

While adaptation activities have found increased relevance in the policy discourses of developing countries at the national level,<32> the knowledge of potential options is highly limited among local authorities and non-state actors.<33> There is a lack of knowledge among these actors regarding the availability of finance, the means of access, and whether it meets the needs of the most vulnerable. While impacts from climate change would be borne by the vulnerable communities in each country, no strong adaptation actions at the local level have been formulated to date.<34> The information on resilience finance is mostly available across a variety of international databases, making it difficult for local governments and the private sector to obtain. The actors are unable to identify the most relevant sources for their countries<35> and the shaping of relative adaptation action.<36>

Difficulty in accessing finance

Developing countries face the particular challenge of understanding and meeting the complicated procedures and standards that are involved with seeking access to climate finance. Multilateral climate funds are structurally designed to deliver finance through large public sector organisations (such as the National Bank for Agriculture and Rural Development in India) or Non-Banking Financial Companies (NBFCs) as they do not have the mandate or staff to finance transactions directly. Consequently, they have small institutional footprints, affecting their access to these funds. Since multilateral international entities perform project pipeline development, facilitation and management functions, they in turn require strong national institutions that can meet the complex processes and robust fiduciary and environmental standards, to access their funds.<37> In order to tap into these financial sources for climate change resilience projects, developing countries need to formulate stronger national climate strategies and in-country institutional structures that can meet the required staffing, expertise, experience and internal controls to be an ‘Implementing Entity’ (IE) for Adaptation Funds (AF) as well as ensuring the necessary standards and safeguards.<38>

Capacity constraints

Developing countries lack the technical capacity to design and develop project proposals; this impedes their access to climate finance. Private sector investors need a robust and achievable rate of return in the project proposals.<39> Resilience measures, for the most part, are not revenue-generating and not considered a part of conventional business practice. Since it is difficult to calculate project costs over the long term owing to changing climate, it is difficult to clearly monetise resilience.<40> While there are support programmes to aid in improving required capacities in developing countries<41> offering complete sets of information, outlining inputs, activities, outputs, outcomes and impacts of a project that aligns with a fund’s “logical framework,” remains limited.<42>

Furthermore, a strong monitoring and evaluation mechanism is critical for meeting reporting requirements while accessing international climate finance. However, a key methodological challenge is to gaze the long-term horizons and take uncertainty of climate change into consideration for adaptation measures.<43>

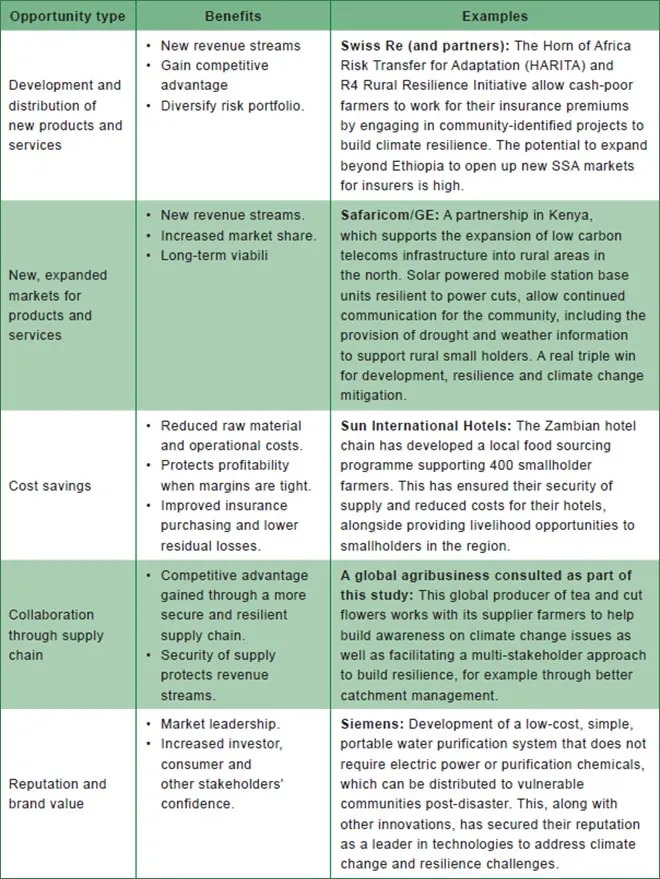

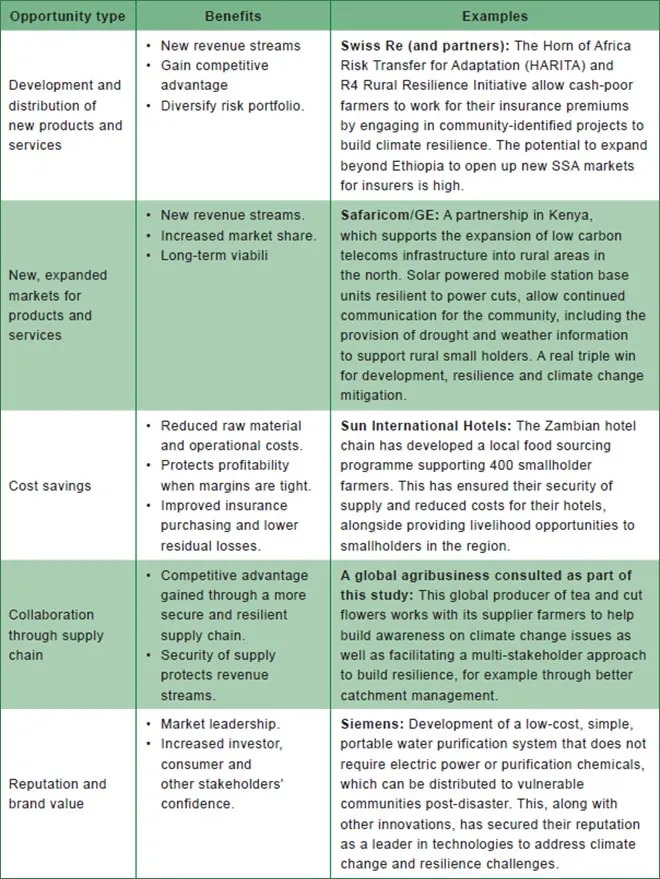

Motivations for the private sector to engage in resilience

Climate change is likely to increase the risks for businesses by impacting their climate-sensitive assets in social and economic sectors such as, agriculture, water and energy-related infrastructure.<44> The projected threats of climate change include the disrupting of supply chains, reducing productivity and revenues, and destroying livelihoods – all of which are likely to weaken the creditworthiness of companies,<45> thereby also increasing the financial risks for financial institutions.<46> The private sector must therefore engage substantially in building resilience to avoid such risks and respond to new market conditions.<47> Moreover, the private sector has the potential to make significant contributions to enhance adaptation by developing new climate-resilient products, technologies and services and accelerate the replication of climate-resilient approaches.

Scholars have categorised private sector motivation for engagement in adaptation under ‘climate risk management’ and ‘new markets and business opportunities.’ Climate risk management can be defined as “mainstreaming adaptation in business practice to protect revenues and to prevent future costs from changing climatic conditions.”<48> The apprehended risks could be from either direct sources, such as a business’s local exposure to climate impacts (including heat stress, water scarcity, and extreme weather events) that cause damage to physical assets, production and health. They could also be from indirect risks, including the broader effects of climate impacts, such as disruption of infrastructure or supply chains and impacts on communities or workforce. However, financing climate risk management projects remains a challenge. While 83 percent of respondents in the ‘Caring for Climate’ survey recognise the risk from climate change impacts to their products or services, identifying additional costs of rising insurance policies, disruption of supply chains, or regulatory risk as adaptation becomes particularly difficult.<49>

On the other hand, new markets and business opportunities could arise due to changing demands in sectors such as agriculture, communication, technology and information services, and water management. They could also come from publicly funded adaptation projects that require implementation by specialised private-sector companies that mainstream climate risks during large infrastructure project design and implementation—climate-resilient roads and flood protection barriers, for example.<50>

Business drivers for adaptation and disaster resilience action

Source: DFID, 2013<51>

Source: DFID, 2013<51>

Where does the opportunity lie in India?

The impacts of climate change and vulnerabilities in key sectors such as agriculture, infrastructure, energy and health continue to be poorly understood, given both the inherent uncertainty of climate data and the complexity of the systems that will be impacted. The capacity to anticipate future impacts and investment needs in these sectors under conditions of uncertainty, complexity and ambiguity would require fundamentally different research and policy approaches.

Agriculture

Climate change will largely have a negative impact on crop production, although some exception could be made in certain high- altitude regions where rising temperatures could positively affect agriculture production and yields. Proceedings of the National Academy of Sciences 2017<52> suggest that increased temperatures from climate change are expected to reduce yields of the four crops humans depend on most—wheat, rice, corn and soybeans — by 6 percent, 3.2 percent, 7.4 percent, and 3.1 percent, respectively.<53> Moreover, climate change-induced extreme events such as droughts, floods, and storms destroy, among other things, crops and agro-infrastructure.

The estimated rise in temperature by 1-3°C by 2050 and resultant extreme precipitation are likely to intensify stress, causing soil erosion and significant loss of topsoil.<54> Besides the decline in agriculture production and yield, climate change impacts are also likely to slow the growth and life-cycle of livestock. The global demand for food is expected to increase anywhere between 59 percent to 98 percent by 2050.<55> This is likely to cause additional pressures on farmers and put them at risk of financial destitution. A rise in temperature over a long period of time would lead to melting of glaciers and the raising of sea levels, which would affect water supply and the livelihood of coastal societies and low lands. The collective impacts would exacerbate the risks of hunger and undernutrition.<56>

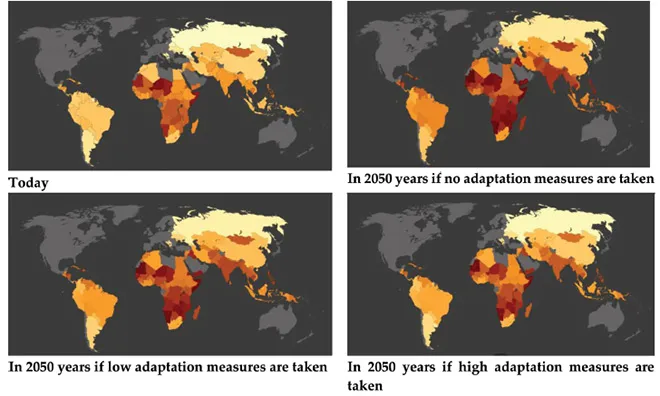

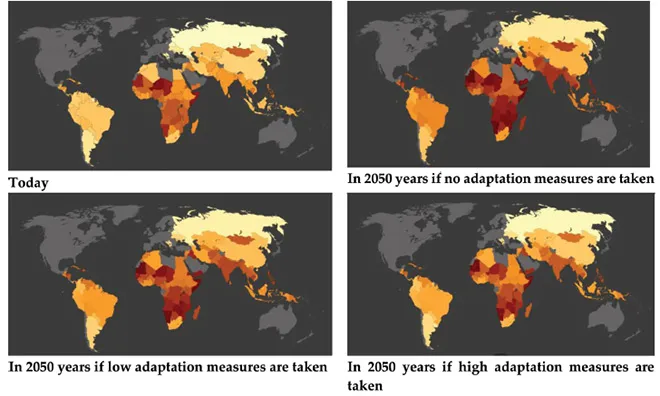

Figure: Food Insecurity and Climate Change Vulnerability Map

Source: World Bank compilation from UK Met Office, Food Insecurities and Climate Change Data<58>

Source: World Bank compilation from UK Met Office, Food Insecurities and Climate Change Data<58>

The Food Insecurity and Climate Change Vulnerability map by the UN World Food Programme (WFP) and the Met Office Hadley Centre, illustrates the hunger and vulnerability to food insecurity scenarios under different levels of adaptation efforts.<57>

Despite this, there is a growing commercial potential for agri-resilience investments. One of the key and growing agri-resilience sub sectors where there is scope for private and public sector investment is water infrastructure. Another key area where the private sector can invest and largely contribute to is the agri value chain. The small sub-sectors under the value chain requires training farmers and providing them with technical assistance, to ensure better access to finance and knowledge. Private sector investment in farmer advisories would also contribute to sustainability of agri-resilience investment for small and medium enterprises in developing economies.<59> Another area where private capital flows can be diverted include investments in climate smart agriculture, which is the type of high-value add, non-traditional agricultural asset that investors tend to be attracted to.<60> Additionally, successful models pioneered by agricultural banks such as NABARD<61> and micro-financing initiatives such as Kiva<62> have shown that private capital can be directed to loans and investments for small farm-holds as well.

Energy

Energy systems are largely viewed as mitigation projects as they are major emitters and thereby significant contributors to climate change. Indeed, energy production, particularly from fossil thermal energy such as coal, oil, gas that are primary production sources for developing countries, contribute to 25 percent of global greenhouse gas (GHG) emissions.<63> However, energy systems are equally vulnerable to the climate change impacts. For instance, thermal power plants need cool water as hotter-than-normal water intakes in plants makes them less effective. Extreme weather can prevent coal and petroleum supply delivery, thereby disrupting both fossil-fuel inputs. This is also true in the case of renewable energy systems.<64> Variability in the degree of rainfall reduces the power generating ability of hydropower plants that are usually dependent on regular rainfall. At the same time, extreme precipitation can also affect solar photovoltaic (PV) systems, and intense storms can damage wind turbines. Moreover, weather events along with high temperatures can damage power transmission systems, impacting electricity output and shutting down the power grid, forcing business owners and others to rely on diesel generators that are expensive and inefficient.<65>

The United Nations General Assembly 2016 estimates that 1.1 billion people lack access to reliable source of power.<66> A projected increase in population, with the majority of growth expected in the developing countries of Asia and Africa, means there will be an increase in demand for energy. Moreover, energy need is often highest at daytime due to heating and cooling requirements, as well as industrial demands. Peak demand produces additional stress on energy grids, providing another factor that increases the risk of system failure.<67>

Despite this, private-sector investments in advanced technologies for distributed power generation, smart grids, energy-efficient buildings and alternative energy for transport could contribute to improved efficiency and availability. Additionally, if emerging and developing nations embrace the privatisation of transmission and distribution networks, the resilience of power transmission systems can be drastically improved – either through regulation demanding the upgrade of the systems by governments during the sale process or through the foresight of the acquiring firms. In certain countries, the acquisitions will come from large conglomerates, but other countries might not have such domestic alternatives and will therefore have to attract private equity firms and institutional investors through policy and regulatory changes.

Health

By 2030, climate change is projected to have irreversible negative impacts on health that could largely undo global poverty reduction strategies, thereby pushing more than 100 million people back to extreme poverty.<68> Climate change will exacerbate cardiovascular diseases and respiratory illnesses, linked to air pollution.<69> Higher frequency of extreme weather events, rising sea levels, rising temperatures, and changing patterns of precipitation are all linked to negative health outcomes.

It is expected that climate change will increase health risks associated with extreme weather events that are more frequent, intense, of longer duration and with greater spatial extent. Increased UV radiation, air pollution, contamination, and re-emergence of rodent and vector-borne infectious diseases would increase health challenges faced by vulnerable populations, especially across the developing world.<70>

In addition to these direct effects to the health of people, increased extreme weather events would damage hospital buildings, cause power or water outages and disrupt delivery of health care at the frontlines.<71> Road blocks may limit the accessibility of supplies and essential services needed for running health facilities, such as energy and water supply and obstruct patients’ accessibility to health facilities.<72> There is a huge need for private-sector investment in making healthcare facilities and systems climate resilient.

However, the burden of upgrading healthcare facilities and systems, does not have to be fully borne by the private entities or governments that own them. Using blended financing instruments that are available through multilateral development banks can allow both the public and private sector to access bank debt at significantly lower interest rates, thereby lowering the total cost of upgrading the facilities. Additionally, the holding companies of the healthcare systems can issue bonds that are specifically earmarked toward making the facilities climate resilient. These bond issuances will, in all probability, generate significant interest from socially responsible investors – from institutional investors all the way down to day traders.

Transport

Like energy systems, transport is considered a key sector in the mitigation of climate change. Worldwide, transportation consumes 64 percent of global oil and 27 percent of energy and contributes to one-quarter of total GHG emissions.<73> Transport is also a vital driver of a well- functioning economy. By enabling people-to-people connectivity, access to essential services such as healthcare and jobs, the transportation sector allows the flow of goods and services, knowledge transfer, competition and opportunities, thereby fostering long-term growth.<74>

This sector, like many others is just as vulnerable to climate change stressors. Extreme events such as heat waves can damage transport infrastructure by making roads and rail unstable. Heavy rainfall, floods and landslides can wash away roads and rail connections. Storm surges may damage ports and block water channels. These could cause severe disruptions and block access for long periods of time, thereby isolating communities, impacting markets and economies.<75>

Transport systems are generally designed based on historical local conditions that do not predict future risk of delays, disruptions and damage. There is a need for well-conceived sustainable transport infrastructure that is resilient to climate and natural hazards.<76> This requires investment in large scale. In low-income countries, an estimated population of one billion still lacks access to all-weather roads.<77> High mobility costs impacts the poor, who often lack reliable and affordable public transportation. Asia alone requires US$40 trillion for infrastructure development, including transport, before 2030.<78> Opportunities for building climate resilience are greatest when integrated into the initial design and construction of new infrastructure rather than retrofitting. The sector undoubtedly provides various market opportunities for investing in its resilience.

Conclusion

A critical challenge for private-sector participation in projects that build the resilience of communities, businesses and the economy is the lack of knowledge and awareness of both the needs and opportunities for climate action. Here the research and knowledge community have a critical role to play, not only to provide research-based knowledge on likely climate risks to businesses, the infrastructure and economies they depend on, but also to change mindsets, build capacities and break the silos within which the research and practice communities working on climate adaptation and finance work operate. The adaptation research community is often focused on grassroots research, examining how households and communities (particularly those that are especially vulnerable due to their social conditions) are likely to be impacted by changing climate. Many of the challenges and actions this research identifies are typically considered to be the domain of the public sector. Within the finance community, environment concerns have typically been seen as a ‘cost’ to businesses - cause for delays in approvals of projects or draw down on profits and reduction in rates of return. Neither of these positions are defensible as climate impacts become ubiquitous and impact all aspects of economies, and indeed life. More interdisciplinary research and dialogue across the epistemic communities is needed to engage and draw private capital into building resilience of economies and countries to climate impacts.

This essay originally appeared in Financing Green Transitions

Endnotes

<1> Change, Climate. “Impacts, vulnerabilities and adaptation in developing countries.” Climate Change Secretariat (UNFCCC)(2007).

<2> Rogelj, Joeri, Michel Den Elzen, Niklas Höhne, Taryn Fransen, Hanna Fekete, Harald Winkler, Roberto Schaeffer, Fu Sha, Keywan Riahi, and Malte Meinshausen. “Paris Agreement climate proposals need a boost to keep warming well below 2 C.” Nature 534, no. 7609 (2016): 631.

<3> Divya Sharma and Sanjay Tomar. “Mainstreaming climate change adaptation in Indian cities.” Environment and Urbanization 22, no. 2,2010, 451-465.

<4> UNEP 2014. The Adaptation Gap Report 2014. United Nations Environment Programme (UNEP), Nairobi

<5> UNEP 2016. The Adaptation Finance Gap Report 2016. United Nations Environment Programme (UNEP), Nairobi

<6> UNEP 2014. The Adaptation Gap Report 2014. United Nations Environment Programme (UNEP), Nairobi

<7> UNFCCC, 2018. Standing Committee on Finance. Biennial Assessment and Overview of Climate Finance Flows Technical Report

<8> Barbara Buchner, Padraig Oliver, Xueying Wang, Cameron Carswell, Chavi Meattle and Federico Mazza. “Global Landscape of Climate Finance 2017.” Climate Policy Initiative (2017).

<9> UNEP 2016. The Adaptation Finance Gap Report 2016. United Nations Environment Programme (UNEP), Nairobi

<10> OECD DAC Statistics Aid to Climate Change Adaptation, 2014

<11> Peterson Carvalho, Annaka, and Pieter Terpstra. “Tracking adaptation finance: an approach for civil society organizations to improve accountability for climate change adaptation.” 2015

<12> OECD DAC. “Climate-related development finance in 2013.” 2015

<13> OECD. “Toolkit to Enhance Adaptation Finance. For developing countries that are vulnerable to adverse effects of climate change, including LIDCs, SIDS and African states.” Report to the G20 Climate Finance Study Group prepared by the Organisation for Economic Co-operation and Development (OECD) in collaboration with the Global Environment Facility (GEF). 2015

<14> Briner, G., T. Kato, S. Konrad, and C. Hood, “Taking Stock of the UNFCCC Process and its Interlinkages”, OECD/IEA Climate Change Expert Group Papers, No. 2014/04, OECD Publishing, Paris

<15> OECD DAC. “Climate-related development finance in 2013.” 2015

<16> ATKearney. “Adapting to the inevitable. A.T.Kearney’s foresight series, Thinkforward. 2013

<17> PwC. Business leadership on climate change adaptation. Encouraging engagement and action. 2010 London: Author

<18> Pauw, W. P. “Not a panacea: private-sector engagement in adaptation and adaptation finance in developing countries.” Climate Policy 15, no. 5, 2015: 583-603.

<19> ibid

<20> Pauw, Pieter, and Anna Pegels. “Private sector engagement in climate change adaptation in least developed countries: an exploration.” Climate and Development 5, no. 4 (2013): 257-267.

<21> UNFCCC, Investment. “Investment and financial flows to address climate change.” Bonn: UNFCCC (2007).

<22> Pauw, W. P. “Not a panacea: private-sector engagement in adaptation and adaptation finance in developing countries.” Climate Policy 15, no. 5, 2015: 583-603

<23> CICERO & CPI. “Background Report on Long-term Climate Finance. Prepared for the German G7 Presidency.”2015. CICERO and Climate Policy Initiative.

<24> Agrawala, Shardul, Maëlis Carraro, Nicholas Kingsmill, Elisa Lanzi, Michael Mullan, and Guillaume Prudent-Richard. “Private sector engagement in adaptation to climate change: approaches to managing climate risks.” 2011.

<25> OECD. “Toolkit to Enhance Adaptation Finance. For developing countries that are vulnerable to adverse effects of climate change, including LIDCs, SIDS and African states.” Report to the G20 Climate Finance Study Group prepared by the Organisation for Economic Co-operation and Development (OECD) in collaboration with the Global Environment Facility (GEF). 2015

<26> Mathur, VIkrom, and Aparajit Pandey, “Great Walls: Addressing Domestic Barriers to Climate Action Projects in India”, Observer Research Foundation, 2017

<27> Trabacchi, C and F Mazza. “Emerging solutions to drive private investment in climate resilience. A Climate Policy Initiative Working Paper. 2015

<28> OECD. “Toolkit to Enhance Adaptation Finance. For developing countries that are vulnerable to adverse effects of climate change, including LIDCs, SIDS and African states.” Report to the G20 Climate Finance Study Group prepared by the Organisation for Economic Co-operation and Development (OECD) in collaboration with the Global Environment Facility (GEF). 2015

<29> OECD 2015, Aligning Policies for a Low-carbon Economy, OECD Publishing, Paris

<30> Peterson Carvalho, Annaka, and Pieter Terpstra. “Tracking adaptation finance: an approach for civil society organizations to improve accountability for climate change adaptation.” 2015.

<31> OECD 2014, Climate Resilience in Development Planning: Experiences in Colombia and Ethiopia, OECD Publishing, Paris

<32> UNFCCC 2015, “Report on the 27th meeting of the Least Developed Countries Expert Group”, FCCC/SBI/2015/7, The United Nations Framework Convention on Climate Change, Bonn.

<33> Wilkinson, E., et al. 2014. “Going in the right direction? Tracking adaptation finance at the subnational level”, ODI Working Papers, Overseas Development Institute, London

<34> ibid

<35> Peterson Carvalho, Annaka, and Pieter Terpstra. “Tracking adaptation finance: an approach for civil society organizations to improve accountability for climate change adaptation.” 2015.

<36> Wilkinson, E., et al. 2014. “Going in the right direction? Tracking adaptation finance at the subnational level”, ODI Working Papers, Overseas Development Institute, London

<37> Briner, G., T. Kato, S. Konrad, and C. Hood, “Taking Stock of the UNFCCC Process and its Interlinkages”, OECD/IEA Climate Change Expert Group Papers, No. 2014/04, OECD Publishing, Paris

<38> GEF 2014, Programming Strategy on Adaptation to Climate Change - Least Developed Countries Fund Special Climate Change Fund, the Global Environment Facility, Washington D.C

<39> Vandeweerd, Veerle, Y. Glemarec, and S. Billett. “Readiness for Climate Finance: A framework for understanding what it means to be ready to use climate finance.” New York: United Nations Development Programme 2012.

<40> Briner, G., T. Kato, S. Konrad, and C. Hood, “Taking Stock of the UNFCCC Process and its Interlinkages”, OECD/IEA Climate Change Expert Group Papers, No. 2014/04, OECD Publishing, Paris

<41> UNFCCC 2014, “Information paper on experiences, good practices, lessons learned, gaps and needs in the process to formulate and implement national adaptation plans”, FCCC/SBI/2014/INF.14, The United Nations Framework Convention on Climate Change, Bonn

<42> Christiansen, L., et al.1999 “Accessing International Funding for Climate Change Adaptation – A Guidebook for Developing Countries.” UNEP Risø Centre on Energy, Climate and Sustainable Development, Roskilde, Denmark

<43> OECD 2015. National Climate Change Adaptation: Emerging Practices in Monitoring and Evaluation, OECD Publishing, Paris

<44> IPCC 2014. “Summary for policymakers” in Climate Change 2014: Impacts, Adaptation, and Vulnerability. Part A: Global and Sectoral Aspects, Contribution of Working Group II to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change , Cambridge University Press, Cambridge (the United Kingdom) and New York, pp. 1-32.

<45> Crawford, Meg, and Stephen Seidel. “Weathering the storm: Building business resilience to climate change.” Centre for Climate and Energy Solutions (2013): 112.

<46> IFC (2012), Enabling Environment for Private Sector Adaptation, the International Finance Corporation (IFC), Washington D.C.

<47> Pauw, W. P., Richard JT Klein, P. Vellinga, and F. Biermann. “Private finance for adaptation: do private realities meet public ambitions?.” Climatic Change 134, no. 4 (2016): 489-503.

<48> Pauw, W. P. “Not a panacea: private-sector engagement in adaptation and adaptation finance in developing countries.” Climate Policy 15, no. 5 (2015): 583-603.

<49> UN Global Compact, UNEP, Oxfam & WRI. (2011). Adapting for a green economy: Companies, communities and climate change (A caring for climate report). New York, NY: UN Global Impact.

<50> Intellecap. (2010). Opportunities for private sector engagement in urban climate change resilience building. Hyderabad:Intellecap.

<51> Department for International Development, Simulating Private Sector Engagement and Investment in Building Disaster Resilience and Climate Change Adaptation, December 2013

<52> Zhao, Chuang, Bing Liu, Shilong Piao, Xuhui Wang, David B. Lobell, Yao Huang, Mengtian Huang et al. “Temperature increase reduces global yields of major crops in four independent estimates.” Proceedings of the National Academy of Sciences 114, no. 35 (2017): 9326-9331.

<53> Jeff McMahon, “Climate Change Already Impacting Wheat, Rice, Corn, Soybean Yields Worldwide,” Forbes, September 1, 2017.

<54> U.S. Global Change Research Program “National Climate Assessment: Agriculture”.

<55> Valin, Hugo, Ronald D. Sands, Dominique van der Mensbrugghe, Gerald C. Nelson, Helal Ahammad, Elodie Blanc, Benjamin Bodirsky et al. “The future of food demand: understanding differences in global economic models.” Agricultural Economics 45, no. 1 (2014): 51-67.

<56> Ibid

<57> UK Met Office Hadley Centre and World Food Programme, Data on Food Insecurity and Climate Change.

<58> Tordo, Silvana, Gianni Lorenzato, Jing Zhao, Kyle McEneaney, and Sebastian Phillip Sarmiento-Saher. “Options for Increased Private Sector Participation in Resilience Investment: Focus on Agriculture.” (2017).

<59> Ibid

<60> Branca, Giacomo, Timm Tennigkeit, Wendy Mann, and Leslie Lipper. Identifying opportunities for climate-smart agriculture investment in Africa. Rome, Italy: Food and Agriculture Organization of the United Nations, 2012.

<61> Vinson Kurien, ‘Nabard’s growth has few parallels among peers,’ Hindu Business Line, published July 17.

<62> Kiva

<63> United States Environmental Protection Agency, Global Greenhouse Gas Emissions Data.

<64> U.S. Global Change Research Program “Energy Supply and Use Report”.

<65> U.S. Environmental Protection Agency (EPA), “Understanding the Link Between Climate Change and Extreme Weather” Obama Administration Archive 2017.

<66> International Energy Agency, Energy Access Database.

<67> Ibid

<68> The World Bank, Climate Change Overview.

<69> D’Amato, Gennaro, Lorenzo Cecchi, Mariella D’Amato, and Isabella Annesi-Maesano. “Climate change and respiratory diseases.” (2014): 161-169.

<70> Wu, Xiaoxu, Yongmei Lu, Sen Zhou, Lifan Chen, and Bing Xu. “Impact of climate change on human infectious diseases: Empirical evidence and human adaptation.” Environment international 86 (2016): 14-23.

<71> The Canadian Coalition for Green Health Care and the Nova Scotia Department of Environment and Health Canada, “Health Care Facility Climate Change Resiliency Toolkit,” 2016.

<72> World Health Organisation. “Risk reduction and emergency preparedness. WHO six-year strategy for the health sector and community capacity development” 2007.

<73> Tordo, Silvana, Gianni Lorenzato, Jing Zhao, Kyle McEneaney, and Sebastian Phillip Sarmiento-Saher. “Options for Increased Private Sector Participation in Resilience Investment: Focus on Agriculture.” (2017).

<74> The Economic Times, ‘Why transport infrastructure is most important for country’s progress,’ February 2016.

<75> Michael Meyer et al., “Climate Change, Extreme Weather Events and the Highway System: A Practitioner’s Guide,” National Cooperative Highway Research Program.

<76> Pregnolato, Maria, Alistair Ford, Sean M. Wilkinson, and Richard J. Dawson. “The impact of flooding on road transport: A depth-disruption function.” Transportation research part D: transport and environment 55 (2017): 67-81.

<77> The World Bank, Transport Overview.

<78> Asian Infrastructure Investment Bank, Annual Meeting of the Board of Governors, Summary of Proceedings. 2018.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: UNEP, 2014

Source: UNEP, 2014 Source: DFID, 2013

Source: DFID, 2013 Source: World Bank compilation from UK Met Office, Food Insecurities and Climate Change Data

Source: World Bank compilation from UK Met Office, Food Insecurities and Climate Change Data PREV

PREV